- Canada

- /

- Metals and Mining

- /

- TSX:TXG

Torex Gold Resources (TSX:TXG): Assessing Valuation After Strong Q3 Output and Media Luna Ramp-Up Success

Reviewed by Kshitija Bhandaru

Torex Gold Resources (TSX:TXG) is capturing attention after releasing its Q3 results, which showed gold production above expectations and impressive ramp-up progress at the Media Luna mine. Operational updates signal potential for further resource growth.

See our latest analysis for Torex Gold Resources.

Torex Gold’s stellar Q3 results and the accelerated Media Luna ramp-up have fueled impressive momentum, with a 41.6% 3-month share price return and a 1-year total shareholder return of 113%. Both figures handily outpace the broader market. Fresh discoveries at ELG Underground and sustained operational progress continue to reinforce investor confidence, suggesting its growth story is far from over.

If Torex’s breakout has you wondering what else might be taking off, now’s the perfect time to discover fast growing stocks with high insider ownership

With Torex Gold’s ongoing production beat and impressive resource discoveries, the big question now is whether its strong future growth is already priced in or if there is still a buying opportunity for investors.

Most Popular Narrative: 5.5% Undervalued

With Torex Gold closing at CA$62.11, the most popular fair value estimate puts its shares at CA$65.70, slightly above the market price. This narrative draws attention to upgraded growth forecasts and improving profitability, setting up the main catalyst for further discussion.

Expansion projects and infrastructure investments are poised to boost production, extend mine life, and stabilize long-term revenue and cash flow. Strategic acquisitions and operational efficiency efforts diversify assets, reduce risk, and support margin and earnings growth despite ongoing sector volatility.

Want to know what’s fueling this new price target? This narrative hints at a sharp profit rebound and ambitious growth projections, plus a bold margin reset that could surprise many investors. Don’t miss the full breakdown behind these bullish assumptions.

Result: Fair Value of $65.70 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent rises in production costs or delays in ramping up Media Luna could quickly shift Torex Gold’s growth story in a less favorable direction.

Find out about the key risks to this Torex Gold Resources narrative.

Another View: DCF Model Sends a Stronger Signal

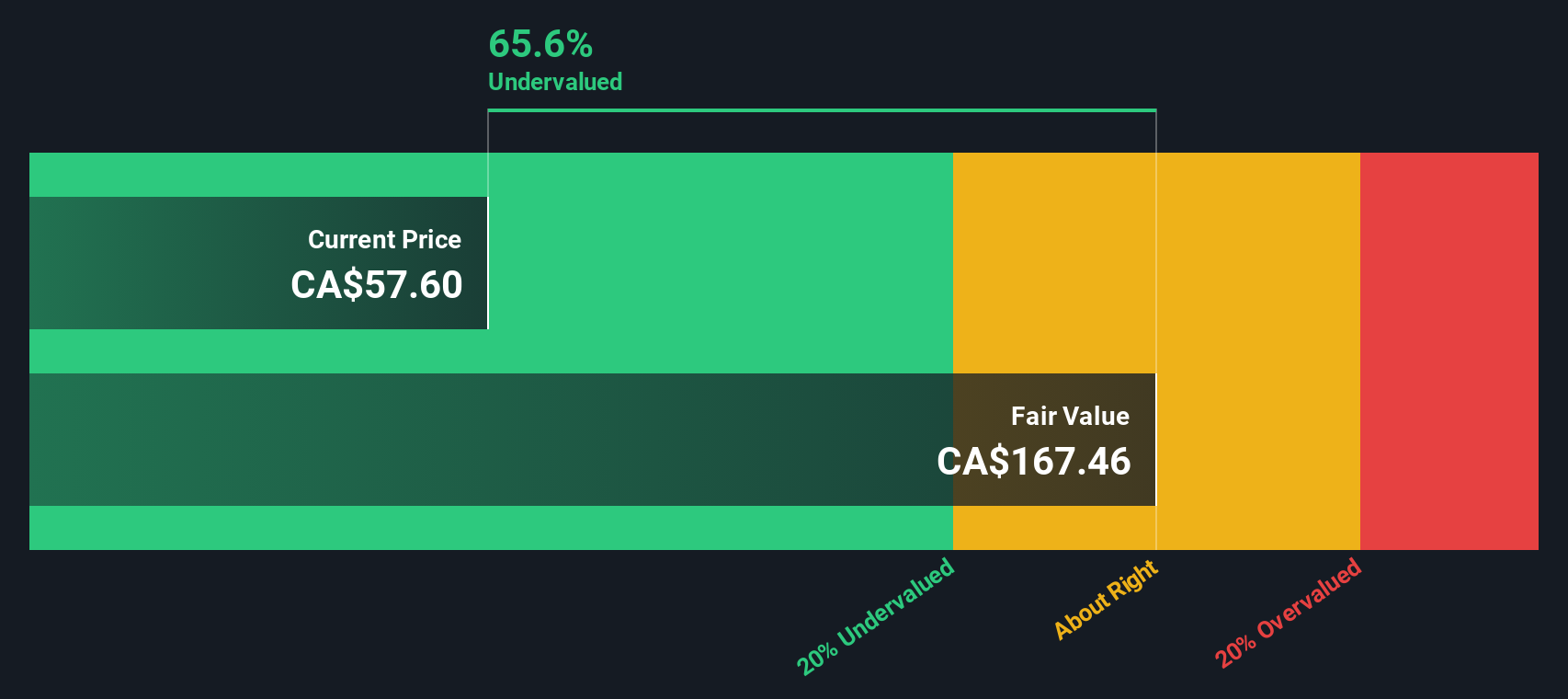

While many investors lean on earnings multiples to judge value, the SWS DCF model tells a different story for Torex Gold Resources. According to our DCF, TXG is trading at a steep 63.6% discount to its fair value. This suggests there could be much more potential than the market currently reflects. But is this discount justified, or do risks outweigh the upside?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Torex Gold Resources Narrative

Prefer digging through the numbers yourself? If you’re inclined to chart your own course, you can develop a custom narrative in minutes. Do it your way

A great starting point for your Torex Gold Resources research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Don’t settle for a single opportunity when you can access a world of smart picks. Use Simply Wall Street’s screeners to discover what others might miss.

- Unlock high yields for your portfolio by checking out these 19 dividend stocks with yields > 3%, offering reliable returns and robust income potential in today's market.

- Uncover future stars before the crowd by hunting through these 3578 penny stocks with strong financials, built on strong financials and potential for dynamic gains.

- Capitalize on the next wave in artificial intelligence by exploring these 24 AI penny stocks, which are shaping tomorrow’s most innovative solutions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Torex Gold Resources might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:TXG

Exceptional growth potential with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives