- Canada

- /

- Metals and Mining

- /

- TSX:ARIS

3 TSX Stocks Estimated To Be 27.4% To 47.6% Below Intrinsic Value

Reviewed by Simply Wall St

Despite experiencing a rollercoaster first half of the year marked by policy uncertainties and trade tensions, the Canadian stock market has managed to reach all-time highs, with the TSX showing resilience amid global economic shifts. In this environment of volatility and potential opportunities, identifying undervalued stocks becomes crucial for investors seeking to capitalize on discrepancies between market prices and intrinsic values.

Top 10 Undervalued Stocks Based On Cash Flows In Canada

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Trisura Group (TSX:TSU) | CA$44.09 | CA$85.65 | 48.5% |

| Triple Flag Precious Metals (TSX:TFPM) | CA$32.20 | CA$47.47 | 32.2% |

| Timbercreek Financial (TSX:TF) | CA$7.61 | CA$11.08 | 31.3% |

| TerraVest Industries (TSX:TVK) | CA$169.40 | CA$314.27 | 46.1% |

| Teck Resources (TSX:TECK.B) | CA$52.61 | CA$89.70 | 41.3% |

| Sandstorm Gold (TSX:SSL) | CA$13.51 | CA$19.41 | 30.4% |

| Magna Mining (TSXV:NICU) | CA$1.79 | CA$3.41 | 47.6% |

| Lithium Royalty (TSX:LIRC) | CA$5.42 | CA$8.78 | 38.3% |

| K92 Mining (TSX:KNT) | CA$14.95 | CA$22.02 | 32.1% |

| High Tide (TSXV:HITI) | CA$3.21 | CA$4.56 | 29.6% |

Let's review some notable picks from our screened stocks.

Aris Mining (TSX:ARIS)

Overview: Aris Mining Corporation, with a market cap of CA$1.68 billion, is involved in the acquisition, exploration, development, and operation of gold properties in Canada, Colombia, and Guyana.

Operations: The company's revenue primarily comes from its Marmato segment, contributing $62.76 million, and its Segovia segment, generating $497.75 million.

Estimated Discount To Fair Value: 27.4%

Aris Mining appears undervalued, trading at CA$9.55, below its estimated fair value of CA$13.15. The company recently increased Segovia's processing capacity by 50%, which could boost gold production in the second half of 2025. Earnings grew by 62.5% last year and are expected to grow significantly over the next three years, outpacing the Canadian market's growth rate. Revenue is forecast to rise at 21.5% annually, indicating robust cash flow potential.

- The analysis detailed in our Aris Mining growth report hints at robust future financial performance.

- Get an in-depth perspective on Aris Mining's balance sheet by reading our health report here.

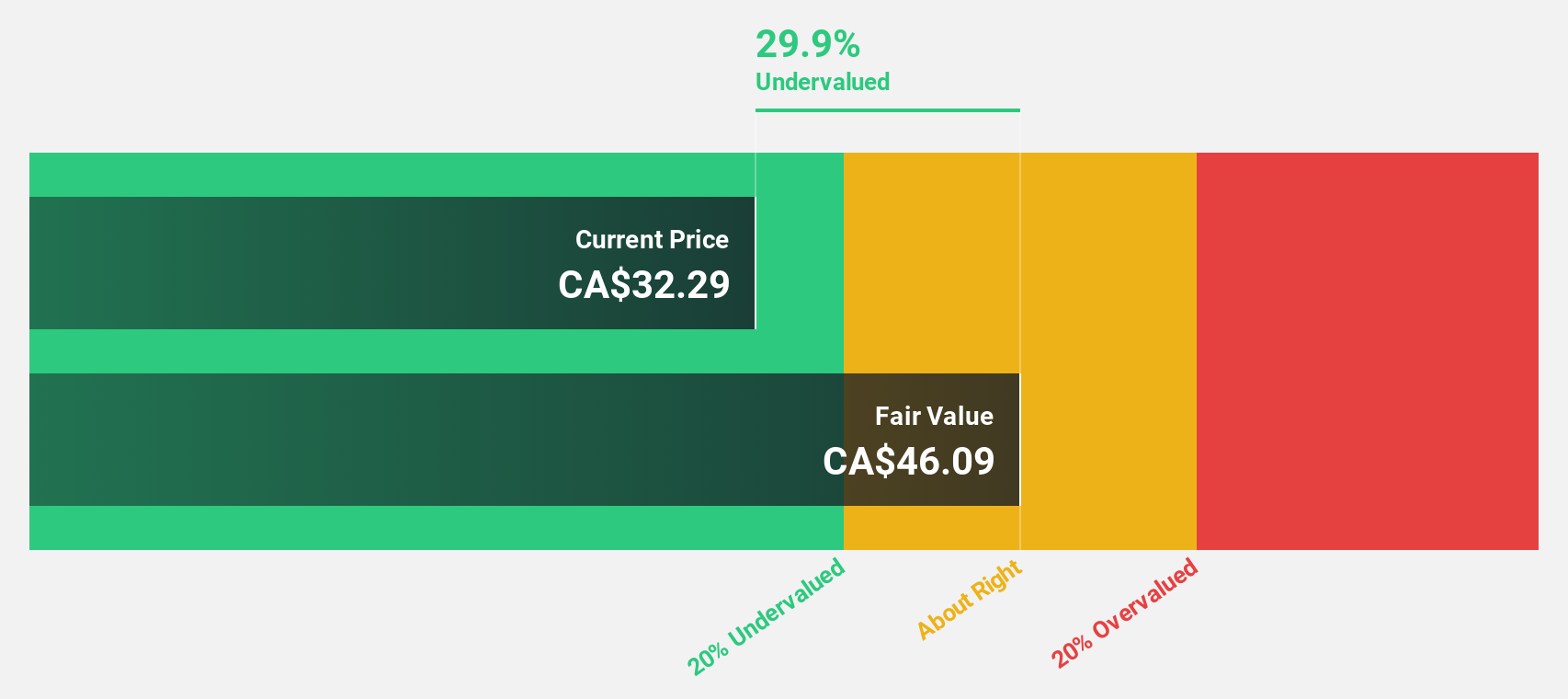

Triple Flag Precious Metals (TSX:TFPM)

Overview: Triple Flag Precious Metals Corp. is a streaming and royalty company focused on acquiring and managing precious metals interests across various countries, with a market cap of CA$6.33 billion.

Operations: The company's revenue is primarily derived from its metals and mining segment, specifically gold and other precious metals, totaling $293.71 million.

Estimated Discount To Fair Value: 32.2%

Triple Flag Precious Metals is trading at CA$32.2, significantly below its fair value estimate of CA$47.47, indicating potential undervaluation based on discounted cash flows. Recent record quarterly revenue of US$94.1 million and reaffirmed 2025 sales guidance support a positive outlook for cash flow generation. Despite forecasted earnings growth outpacing the Canadian market at 50.7% annually, profit margins have decreased from last year’s figures, and insider selling has been significant recently.

- In light of our recent growth report, it seems possible that Triple Flag Precious Metals' financial performance will exceed current levels.

- Click to explore a detailed breakdown of our findings in Triple Flag Precious Metals' balance sheet health report.

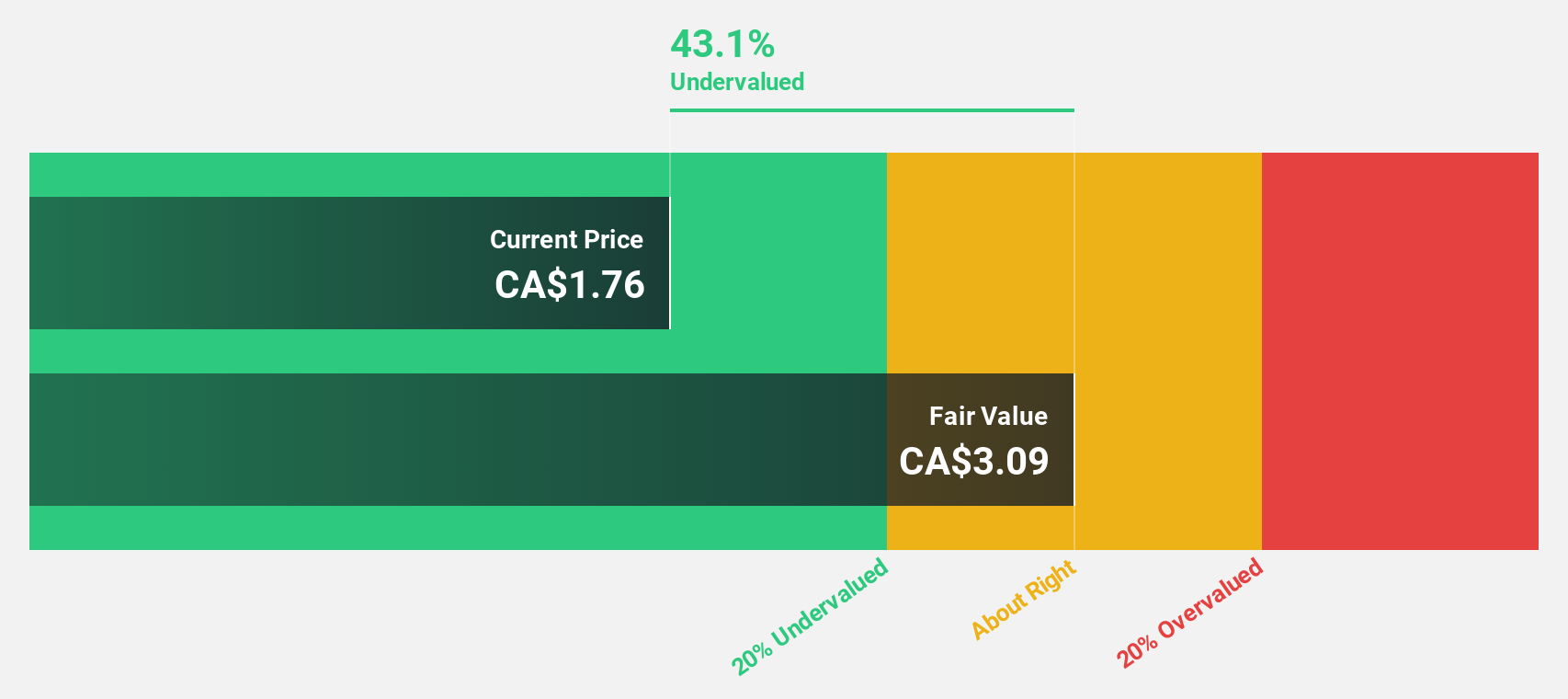

Magna Mining (TSXV:NICU)

Overview: Magna Mining Inc. is involved in the acquisition, exploration, and development of mineral properties in Canada with a market cap of CA$353.61 million.

Operations: The company focuses on acquiring, exploring, and developing mineral properties across Canada.

Estimated Discount To Fair Value: 47.6%

Magna Mining is trading at CA$1.79, well below its fair value estimate of CA$3.41, highlighting potential undervaluation based on cash flows. Recent exploration updates from the Levack Mine indicate promising copper-nickel-PGE mineralization, which could enhance future cash flow prospects. However, revenue remains modest at CA$4 million despite becoming profitable this year with a net income of CA$29.1 million for Q1 2025. Earnings are forecast to grow significantly over the next three years.

- The growth report we've compiled suggests that Magna Mining's future prospects could be on the up.

- Take a closer look at Magna Mining's balance sheet health here in our report.

Key Takeaways

- Unlock more gems! Our Undervalued TSX Stocks Based On Cash Flows screener has unearthed 22 more companies for you to explore.Click here to unveil our expertly curated list of 25 Undervalued TSX Stocks Based On Cash Flows.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:ARIS

Aris Mining

Engages in the acquisition, exploration, development, and operation of gold properties in Canada, Colombia, and Guyana.

Exceptional growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives