- Canada

- /

- Metals and Mining

- /

- TSX:NGD

New Gold (TSX:NGD) Valuation: Is There More Upside After a 153% Year-to-Date Surge?

Reviewed by Kshitija Bhandaru

New Gold (TSX:NGD) shares have caught some attention recently, especially as the stock has delivered a strong 54% gain over the past 3 months. Investors are starting to ask whether this momentum reflects improved fundamentals or is a result of shifting market sentiment.

See our latest analysis for New Gold.

New Gold’s share price momentum has been especially strong in 2024, building on a series of operational improvements and a surging gold price environment. With a current share price of $9.58, the stock has climbed rapidly, boasting a year-to-date share price return of 153% and a remarkable 145% total shareholder return over the past year. This signals that positive sentiment and growth expectations are on the rise.

If you’re keen to identify what other fast-moving opportunities are out there, now is a great time to broaden your search and discover fast growing stocks with high insider ownership

The key question now is whether New Gold’s stellar run means it remains undervalued, or if the market has already priced in its future growth. Could there still be a buying opportunity here, or is everything already factored in?

Most Popular Narrative: 17.4% Undervalued

New Gold's most popular valuation narrative signals that the share price is trading well below its estimated fair value, even after this year’s rally. With analysts projecting a notably higher target, the focus now turns to the bold assumptions powering that outlook.

Ramp-up of higher-grade ore production at both Rainy River (open pit and underground) and New Afton (C-Zone block cave), supported by strong operational execution and milestones achieved, is expected to drive increased gold and copper output at lower unit costs. This would directly improve revenue and net margins over the next 2 to 3 years.

Want to peek behind the curtain at what’s fueling this valuation? The narrative is built on explosive growth assumptions in both top-line and profit margins, plus a future profit multiple not often seen in this sector. Analysts appear to be betting on a transformation that could rewrite New Gold’s financial story. Find out what’s got them so confident—what key financial leaps are they banking on?

Result: Fair Value of $11.60 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing reliance on just two core mines and the potential for rising costs could still threaten New Gold's impressive growth outlook.

Find out about the key risks to this New Gold narrative.

Another View: Multiples Tell a Different Story

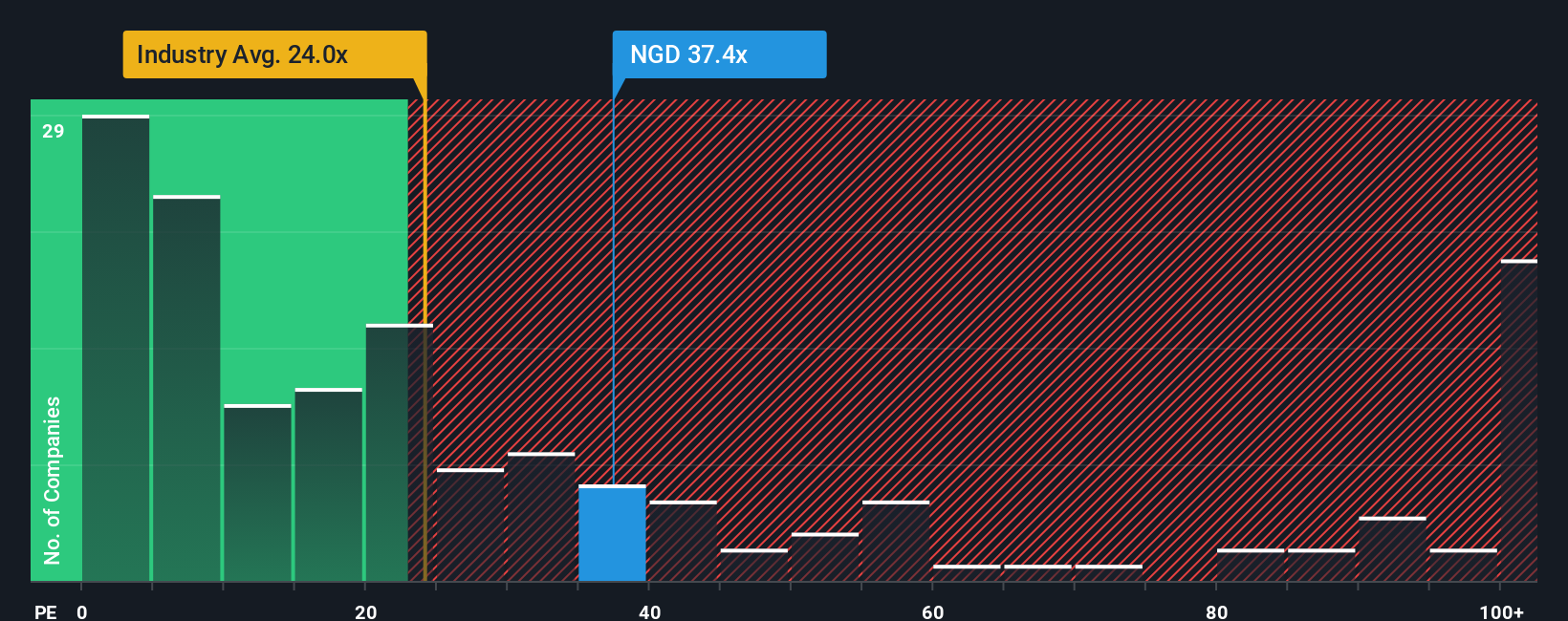

While the fair value estimate paints New Gold as markedly undervalued, looking at its price-to-earnings ratio offers a less optimistic angle. The current ratio of 37.4x is higher than both the Canadian Metals and Mining industry (24x) and its peers (21.2x). Compared to the fair ratio of 33.8x, shares are not cheap on this measure, suggesting heightened valuation risk if earnings do not accelerate fast enough. Could this premium signal market confidence or caution?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own New Gold Narrative

If you think there’s another story unfolding, or want to dive into the numbers and chart your own course, it’s simple to build a narrative in just a few minutes: Do it your way

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding New Gold.

Looking for more investment ideas?

Take your investing game up a notch. Smart moves start with the right search tools. Don’t settle for less when you can access so much more on Simply Wall St.

- Boost your portfolio’s innovation edge by spotting breakout potential among these 24 AI penny stocks shaping tomorrow’s artificial intelligence landscape.

- Tap into stable rewards with these 19 dividend stocks with yields > 3% for reliable income streams beyond just capital gains and market hype.

- Jump ahead of the curve with these 26 quantum computing stocks where pioneering quantum technologies promise to disrupt entire industries in the years ahead.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if New Gold might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:NGD

New Gold

An intermediate gold mining company, engages in the development and operation of mineral properties in Canada.

High growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives