- Canada

- /

- Metals and Mining

- /

- TSX:NEXT

We're Interested To See How NextSource Materials (TSE:NEXT) Uses Its Cash Hoard To Grow

Just because a business does not make any money, does not mean that the stock will go down. By way of example, NextSource Materials (TSE:NEXT) has seen its share price rise 788% over the last year, delighting many shareholders. Having said that, unprofitable companies are risky because they could potentially burn through all their cash and become distressed.

In light of its strong share price run, we think now is a good time to investigate how risky NextSource Materials' cash burn is. For the purpose of this article, we'll define cash burn as the amount of cash the company is spending each year to fund its growth (also called its negative free cash flow). Let's start with an examination of the business' cash, relative to its cash burn.

Check out our latest analysis for NextSource Materials

Does NextSource Materials Have A Long Cash Runway?

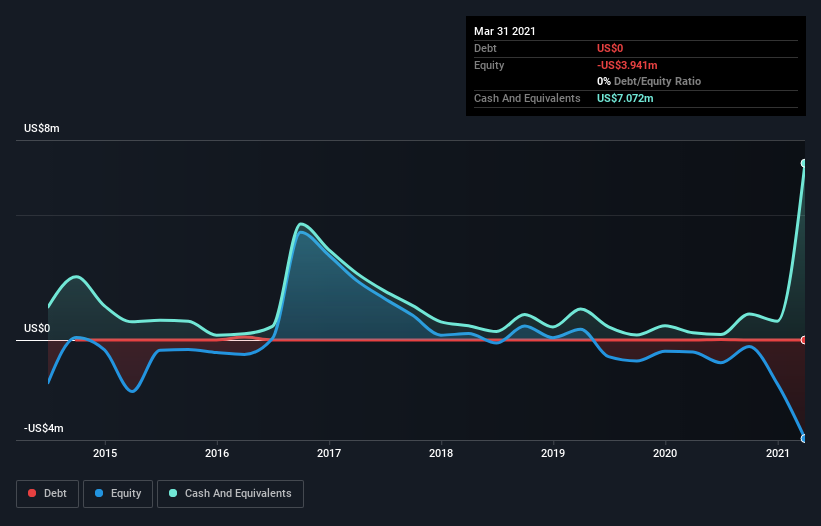

A company's cash runway is calculated by dividing its cash hoard by its cash burn. When NextSource Materials last reported its balance sheet in March 2021, it had zero debt and cash worth US$7.1m. Looking at the last year, the company burnt through US$1.5m. That means it had a cash runway of about 4.8 years as of March 2021. There's no doubt that this is a reassuringly long runway. The image below shows how its cash balance has been changing over the last few years.

How Is NextSource Materials' Cash Burn Changing Over Time?

NextSource Materials didn't record any revenue over the last year, indicating that it's an early stage company still developing its business. So while we can't look to sales to understand growth, we can look at how the cash burn is changing to understand how expenditure is trending over time. Even though it doesn't get us excited, the 24% reduction in cash burn year on year does suggest the company can continue operating for quite some time. Admittedly, we're a bit cautious of NextSource Materials due to its lack of significant operating revenues. So we'd generally prefer stocks from this list of stocks that have analysts forecasting growth.

Can NextSource Materials Raise More Cash Easily?

While NextSource Materials is showing a solid reduction in its cash burn, it's still worth considering how easily it could raise more cash, even just to fuel faster growth. Generally speaking, a listed business can raise new cash through issuing shares or taking on debt. One of the main advantages held by publicly listed companies is that they can sell shares to investors to raise cash and fund growth. We can compare a company's cash burn to its market capitalisation to get a sense for how many new shares a company would have to issue to fund one year's operations.

Since it has a market capitalisation of US$216m, NextSource Materials' US$1.5m in cash burn equates to about 0.7% of its market value. That means it could easily issue a few shares to fund more growth, and might well be in a position to borrow cheaply.

Is NextSource Materials' Cash Burn A Worry?

It may already be apparent to you that we're relatively comfortable with the way NextSource Materials is burning through its cash. In particular, we think its cash runway stands out as evidence that the company is well on top of its spending. Its cash burn reduction wasn't quite as good, but was still rather encouraging! Taking all the factors in this report into account, we're not at all worried about its cash burn, as the business appears well capitalized to spend as needs be. On another note, we conducted an in-depth investigation of the company, and identified 4 warning signs for NextSource Materials (2 don't sit too well with us!) that you should be aware of before investing here.

If you would prefer to check out another company with better fundamentals, then do not miss this free list of interesting companies, that have HIGH return on equity and low debt or this list of stocks which are all forecast to grow.

If you're looking for stocks to buy, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if NextSource Materials might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TSX:NEXT

NextSource Materials

Explores for, develops, and evaluates mineral properties in Madagascar and Canada.

Limited growth with imperfect balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Butler National (Buks) outperforms.

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)