- France

- /

- Entertainment

- /

- ENXTPA:VIV

3 Stocks That May Be Trading Below Their Estimated Value In November 2024

Reviewed by Simply Wall St

As global markets experience broad-based gains with U.S. indexes approaching record highs, investor sentiment is buoyed by a strong labor market and positive home sales reports, despite ongoing geopolitical tensions and economic uncertainties. In this context of mixed signals and cautious optimism, identifying stocks that may be trading below their estimated value can offer opportunities for investors looking to capitalize on potential market inefficiencies.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Victory Capital Holdings (NasdaqGS:VCTR) | US$72.24 | US$144.03 | 49.8% |

| NBT Bancorp (NasdaqGS:NBTB) | US$50.12 | US$99.93 | 49.8% |

| Synovus Financial (NYSE:SNV) | US$57.97 | US$115.67 | 49.9% |

| CS Wind (KOSE:A112610) | ₩42100.00 | ₩83493.57 | 49.6% |

| Tongqinglou Catering (SHSE:605108) | CN¥21.71 | CN¥43.37 | 49.9% |

| Intermedical Care and Lab Hospital (SET:IMH) | THB4.94 | THB9.85 | 49.8% |

| EuroGroup Laminations (BIT:EGLA) | €2.728 | €5.42 | 49.7% |

| Nidaros Sparebank (OB:NISB) | NOK100.00 | NOK198.62 | 49.7% |

| Nutanix (NasdaqGS:NTNX) | US$72.35 | US$143.99 | 49.8% |

| VerticalScope Holdings (TSX:FORA) | CA$9.01 | CA$18.01 | 50% |

Here's a peek at a few of the choices from the screener.

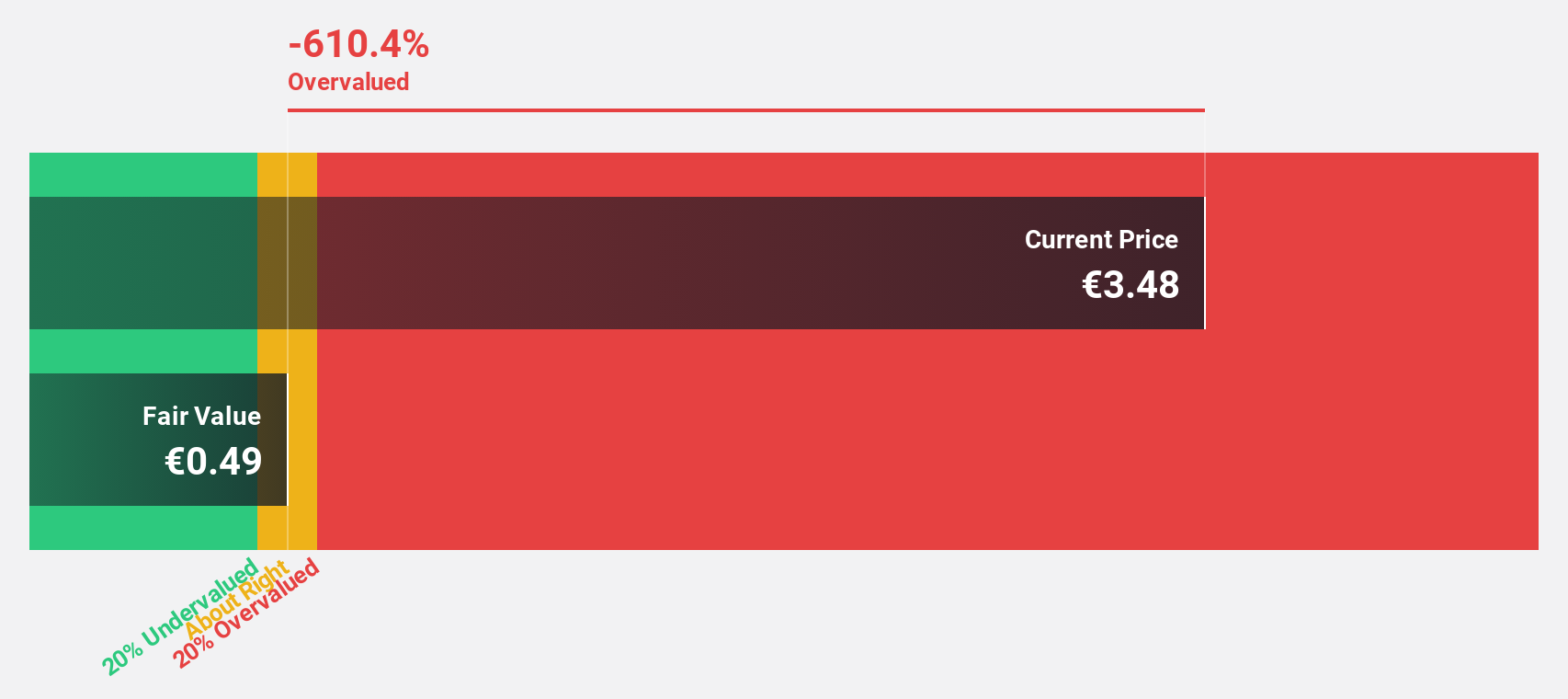

Vivendi (ENXTPA:VIV)

Overview: Vivendi SE is a global entertainment, media, and communication company with operations across Europe, the Americas, Asia/Oceania, and Africa, and has a market cap of approximately €8.90 billion.

Operations: The company's revenue segments include Canal+ Group (€6.20 billion), Havas Group (€2.92 billion), Gameloft (€304 million), Prisma Media (€303 million), Vivendi Village (€151 million), and New Initiatives (€176 million).

Estimated Discount To Fair Value: 48.2%

Vivendi's recent financial performance and forecasts suggest it is undervalued based on cash flows. The company's revenues surged to €4.75 billion in Q3 2024, largely due to Lagardère's consolidation, while earnings are expected to grow significantly at 31.1% annually, outpacing the French market. Trading at approximately 48% below its estimated fair value of €17.04 per share, Vivendi presents potential for appreciation despite a low forecasted return on equity and an unstable dividend track record.

- Insights from our recent growth report point to a promising forecast for Vivendi's business outlook.

- Navigate through the intricacies of Vivendi with our comprehensive financial health report here.

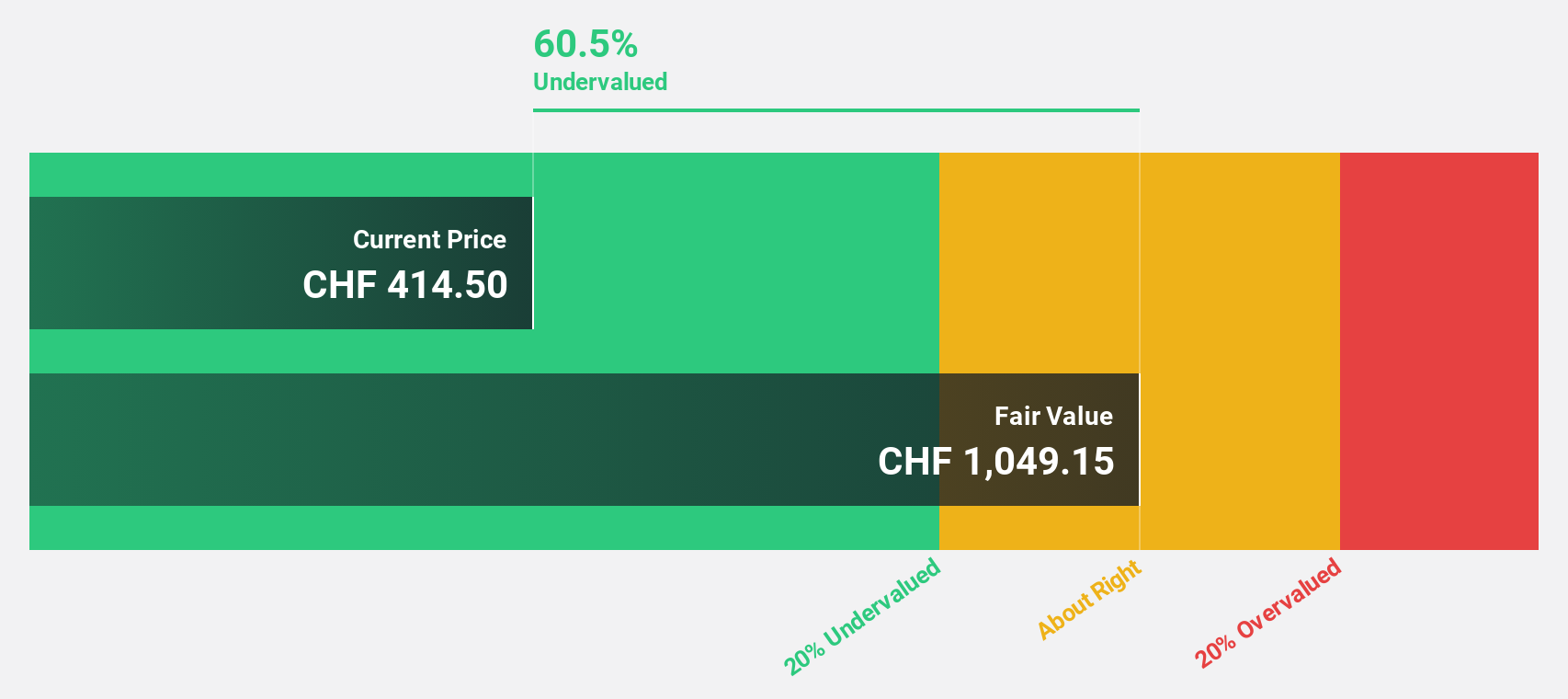

Ypsomed Holding (SWX:YPSN)

Overview: Ypsomed Holding AG, with a market cap of CHF4.87 billion, develops, manufactures, and sells injection and infusion systems for pharmaceutical and biotechnology companies through its subsidiaries.

Operations: The company's revenue segments include Ypsomed Diabetes Care, generating CHF176.61 million, and Ypsomed Delivery Systems, contributing CHF428.94 million.

Estimated Discount To Fair Value: 32%

Ypsomed Holding appears undervalued based on cash flows, trading at CHF356.5, well below its estimated fair value of CHF524.2. Despite a volatile share price and high debt levels, earnings are projected to grow significantly at 41.13% annually, surpassing the Swiss market's growth rate. Recent earnings showed a decline in net income compared to last year; however, product approvals like the mylife YpsoPump in Canada could boost future revenue streams.

- The growth report we've compiled suggests that Ypsomed Holding's future prospects could be on the up.

- Delve into the full analysis health report here for a deeper understanding of Ypsomed Holding.

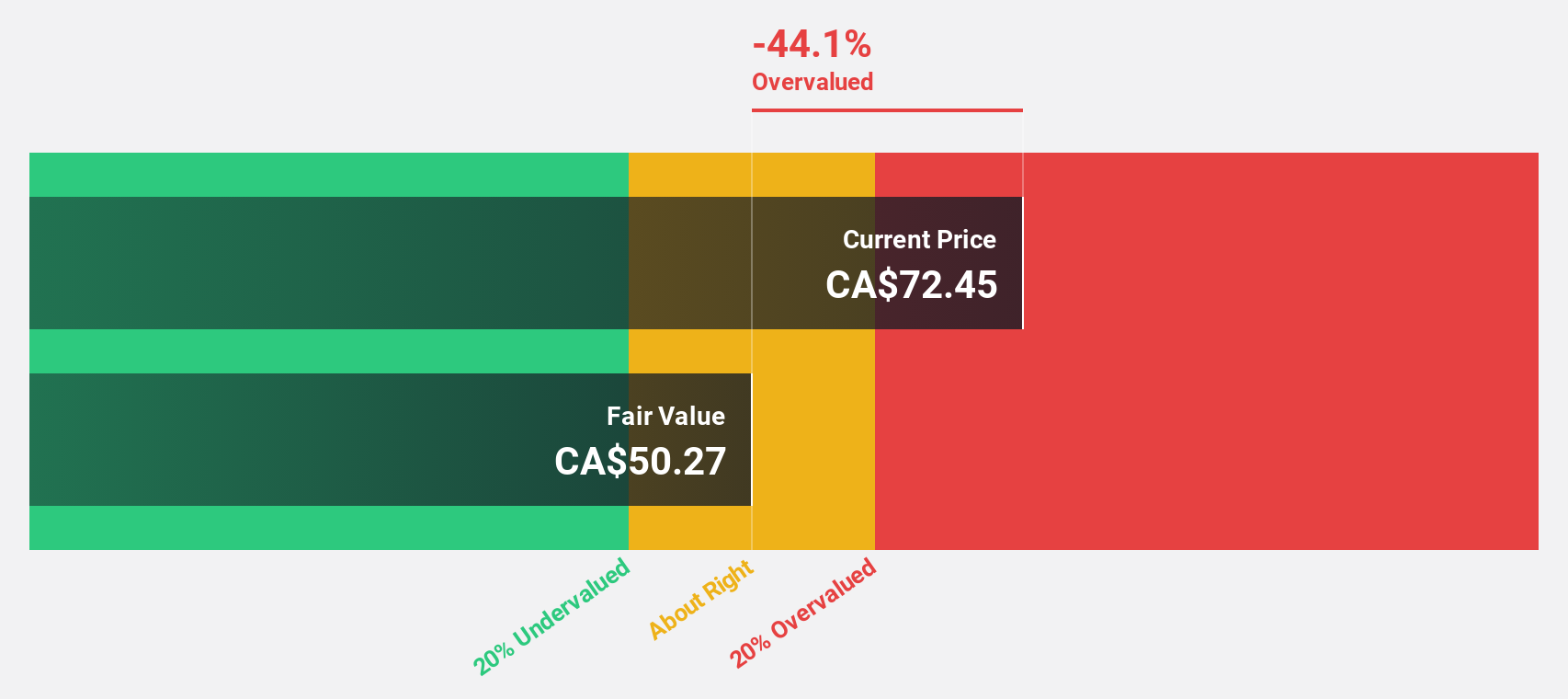

Lundin Gold (TSX:LUG)

Overview: Lundin Gold Inc. is a Canadian mining company with a market capitalization of CA$7.63 billion.

Operations: The company generates revenue from its Fruta Del Norte segment, amounting to $1.04 billion.

Estimated Discount To Fair Value: 45.4%

Lundin Gold shows potential as an undervalued stock based on cash flows, trading at CA$32.24, significantly below its estimated fair value of CA$59.04. Recent earnings reveal strong performance with a net income increase to US$135.72 million for Q3 2024 from US$53.78 million the previous year. Despite insider selling, ongoing high-grade drilling results at Fruta del Norte could bolster future resource estimates and potentially enhance cash flows further.

- In light of our recent growth report, it seems possible that Lundin Gold's financial performance will exceed current levels.

- Click here and access our complete balance sheet health report to understand the dynamics of Lundin Gold.

Summing It All Up

- Embark on your investment journey to our 916 Undervalued Stocks Based On Cash Flows selection here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:VIV

Vivendi

Operates in the content, media, and entertainment industries in France, rest of Europe, the Americas, Asia/Oceania, and Africa.

Moderate growth potential with worrying balance sheet.

Similar Companies

Market Insights

Community Narratives