- Canada

- /

- Oil and Gas

- /

- TSX:KEI

TSX Stocks That May Be Trading Below Their Estimated Value

Reviewed by Simply Wall St

As the Canadian market navigates ongoing tariff uncertainties, recent trends have shown resilience, with the TSX experiencing a notable rise in May alongside its U.S. counterpart. In this environment of cautious optimism and potential economic adjustments, identifying stocks that may be trading below their estimated value can present intriguing opportunities for investors seeking to capitalize on market inefficiencies.

Top 10 Undervalued Stocks Based On Cash Flows In Canada

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| OceanaGold (TSX:OGC) | CA$6.38 | CA$10.30 | 38.1% |

| K92 Mining (TSX:KNT) | CA$14.77 | CA$22.14 | 33.3% |

| Docebo (TSX:DCBO) | CA$36.83 | CA$57.88 | 36.4% |

| Groupe Dynamite (TSX:GRGD) | CA$16.23 | CA$27.91 | 41.8% |

| Aritzia (TSX:ATZ) | CA$66.66 | CA$117.10 | 43.1% |

| VersaBank (TSX:VBNK) | CA$15.42 | CA$29.15 | 47.1% |

| Lithium Royalty (TSX:LIRC) | CA$5.38 | CA$8.42 | 36.1% |

| Kolibri Global Energy (TSX:KEI) | CA$9.86 | CA$19.58 | 49.7% |

| TerraVest Industries (TSX:TVK) | CA$170.02 | CA$300.73 | 43.5% |

| Journey Energy (TSX:JOY) | CA$1.71 | CA$2.87 | 40.3% |

We're going to check out a few of the best picks from our screener tool.

Kolibri Global Energy (TSX:KEI)

Overview: Kolibri Global Energy Inc. is involved in the exploration and exploitation of oil, gas, and clean energy reserves in the United States, with a market cap of CA$356.66 million.

Operations: The company generates revenue of $60.74 million from its oil and gas exploration and production activities in the United States.

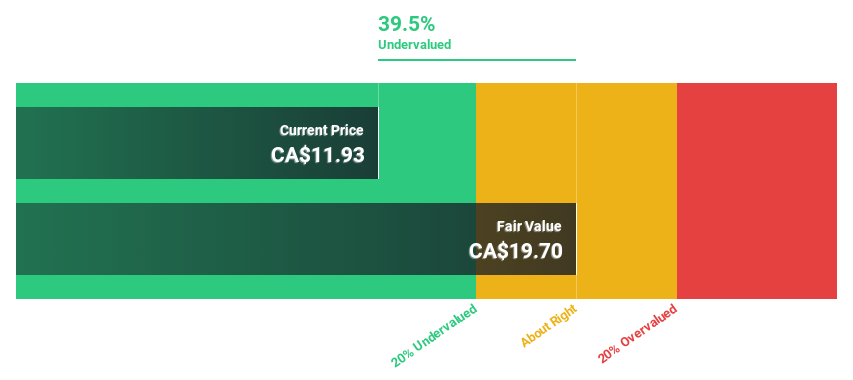

Estimated Discount To Fair Value: 49.7%

Kolibri Global Energy is trading at CA$9.86, significantly below its estimated fair value of CA$19.58, indicating it is undervalued based on discounted cash flow analysis. Recent earnings results show strong growth, with Q1 2025 revenue rising to US$16.37 million from US$14.29 million a year earlier and net income increasing to US$5.77 million from US$3.35 million, driven by a 23% production boost from new wells drilled in 2024.

- Our comprehensive growth report raises the possibility that Kolibri Global Energy is poised for substantial financial growth.

- Get an in-depth perspective on Kolibri Global Energy's balance sheet by reading our health report here.

K92 Mining (TSX:KNT)

Overview: K92 Mining Inc. is involved in the exploration and development of mineral deposits in Papua New Guinea, with a market cap of CA$3.43 billion.

Operations: The company's revenue is primarily derived from the Kainantu Project, which generated $435.43 million.

Estimated Discount To Fair Value: 33.3%

K92 Mining is trading at CA$14.77, below its estimated fair value of CA$22.14, highlighting undervaluation based on discounted cash flow analysis. The company reported robust Q1 2025 earnings with sales of US$144.6 million and net income soaring to US$70.24 million from US$3.07 million a year ago, driven by increased production at the Kainantu Gold Mine in Papua New Guinea despite recent insider selling activities and leadership changes.

- In light of our recent growth report, it seems possible that K92 Mining's financial performance will exceed current levels.

- Click to explore a detailed breakdown of our findings in K92 Mining's balance sheet health report.

OceanaGold (TSX:OGC)

Overview: OceanaGold Corporation is a gold and copper producer involved in the exploration, development, and operation of mineral properties in the United States, the Philippines, and New Zealand, with a market cap of CA$4.27 billion.

Operations: OceanaGold generates revenue from its mineral operations with contributions of $591.70 million from Haile, $161.20 million from Waihi, $330.10 million from Didipio, and $300.60 million from Macraes.

Estimated Discount To Fair Value: 38.1%

OceanaGold, trading at CA$6.38, is undervalued with a fair value estimate of CA$10.3 based on discounted cash flow analysis. Recent Q1 2025 results showed strong performance with sales of US$359.9 million and net income of US$99.7 million, reversing last year's loss. Despite significant insider selling, the company continues to repurchase shares and declared a dividend for June 2025, while ongoing exploration in New Zealand shows promising high-grade mineralization potential.

- Insights from our recent growth report point to a promising forecast for OceanaGold's business outlook.

- Navigate through the intricacies of OceanaGold with our comprehensive financial health report here.

Next Steps

- Gain an insight into the universe of 24 Undervalued TSX Stocks Based On Cash Flows by clicking here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Kolibri Global Energy might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:KEI

Kolibri Global Energy

Engages in the exploration and exploitation of oil, gas, and clean and sustainable energy reserves in the United States.

Reasonable growth potential with adequate balance sheet.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

Deep Value Multi Bagger Opportunity

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)