Stock Analysis

- Canada

- /

- Consumer Finance

- /

- TSX:GSY

Boyd Group Services And Two More TSX Stocks Seemingly Priced Below Intrinsic Value Estimates

Reviewed by Simply Wall St

As the first half of 2024 concludes, Canadian markets have shown resilience with a solid performance, particularly benefiting from sectors like technology and utilities. This positive momentum, coupled with favorable economic indicators and potential central bank rate cuts, sets an optimistic stage for investors looking at the remainder of the year. In such a market environment, identifying stocks that appear undervalued relative to their intrinsic value could be particularly compelling.

Top 10 Undervalued Stocks Based On Cash Flows In Canada

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| goeasy (TSX:GSY) | CA$197.12 | CA$313.13 | 37% |

| Trisura Group (TSX:TSU) | CA$41.38 | CA$80.18 | 48.4% |

| Kinaxis (TSX:KXS) | CA$157.76 | CA$265.37 | 40.6% |

| Viemed Healthcare (TSX:VMD) | CA$10.45 | CA$20.08 | 48% |

| Green Thumb Industries (CNSX:GTII) | CA$16.50 | CA$28.27 | 41.6% |

| Constellation Software (TSX:CSU) | CA$3941.88 | CA$5643.24 | 30.1% |

| Jamieson Wellness (TSX:JWEL) | CA$29.01 | CA$49.82 | 41.8% |

| Opsens (TSX:OPS) | CA$2.90 | CA$4.64 | 37.5% |

| Kits Eyecare (TSX:KITS) | CA$8.57 | CA$15.41 | 44.4% |

| Capstone Copper (TSX:CS) | CA$9.70 | CA$17.65 | 45.1% |

Let's uncover some gems from our specialized screener

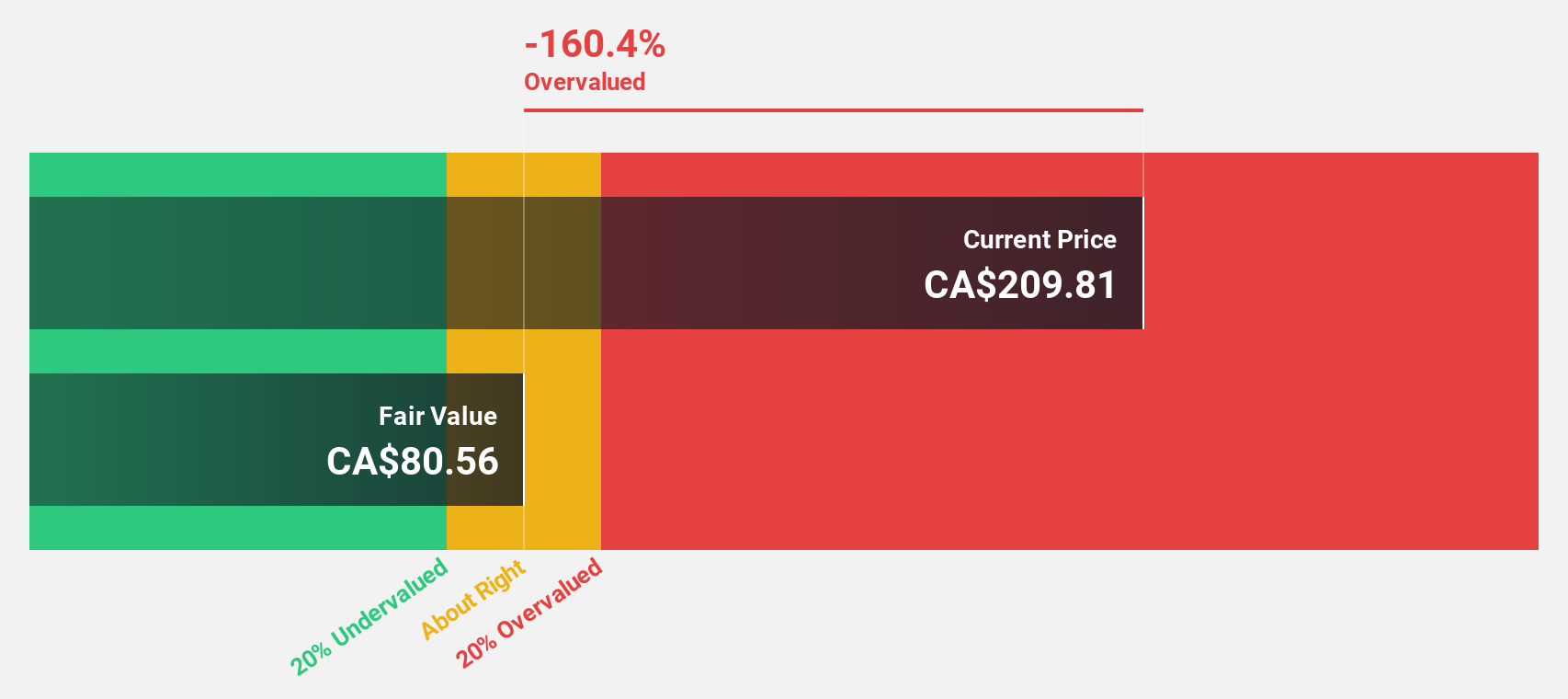

Boyd Group Services (TSX:BYD)

Overview: Boyd Group Services Inc. operates a network of non-franchised collision repair centers across North America, with a market capitalization of approximately CA$5.52 billion.

Operations: The company generates CA$3.02 billion from automotive collision repair and related services.

Estimated Discount To Fair Value: 30.1%

Boyd Group Services Inc., with a trading price of CA$256.97, is considered undervalued by more than 30%, positioned below the estimated fair value of CA$367.65. Despite recent earnings showing a decrease to US$8.38 million from US$20.82 million, forecasts suggest an aggressive rebound with expected annual earnings growth at 37.6% and revenue growth at 10.4% per year—both outpacing average market projections in Canada. However, its ability to cover interest payments with earnings appears weak, indicating potential financial stress.

- Insights from our recent growth report point to a promising forecast for Boyd Group Services' business outlook.

- Navigate through the intricacies of Boyd Group Services with our comprehensive financial health report here.

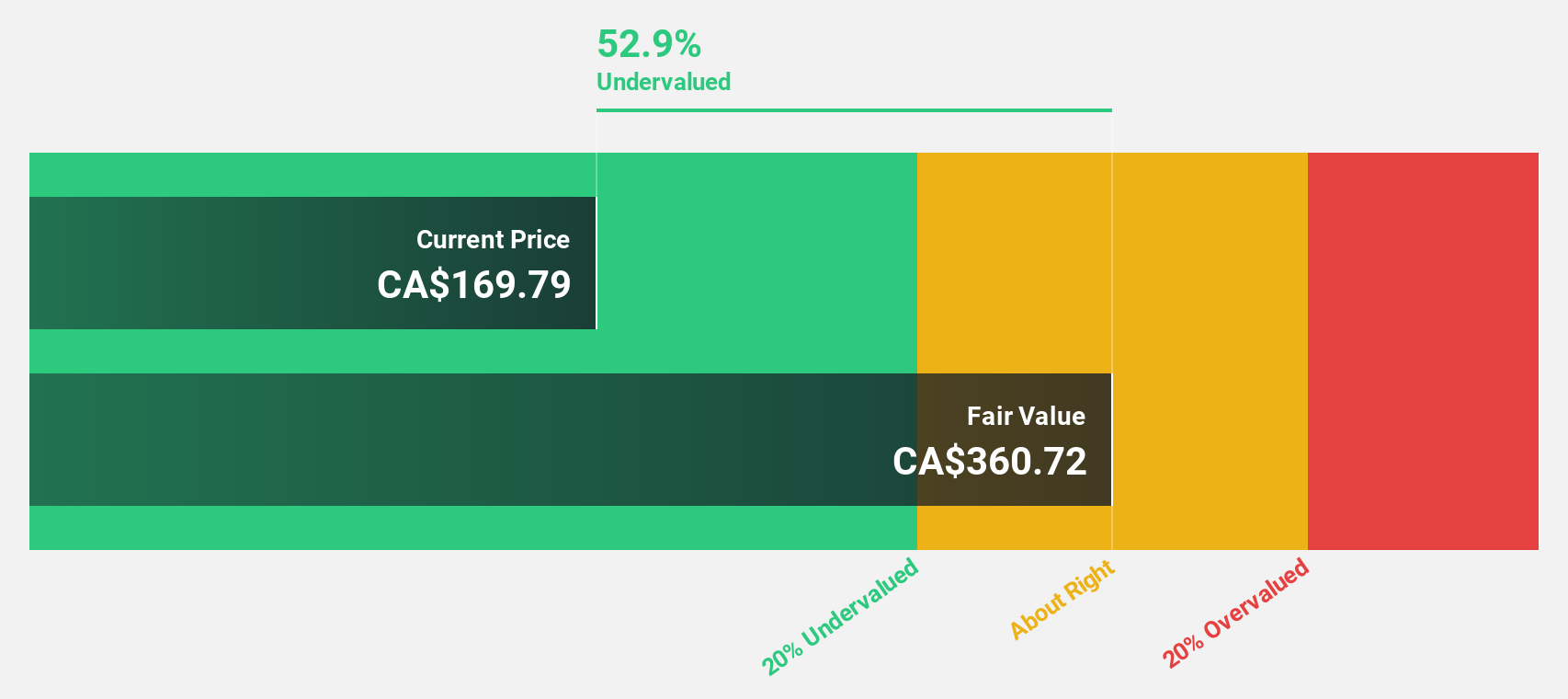

goeasy (TSX:GSY)

Overview: goeasy Ltd. operates in Canada, offering non-prime leasing and lending services through its easyhome, easyfinancial, and LendCare brands with a market capitalization of approximately CA$3.31 billion.

Operations: The company generates revenue through its easyhome and easyfinancial segments, totaling CA$153.99 million and CA$1.17 billion respectively.

Estimated Discount To Fair Value: 37%

goeasy Ltd., priced at CA$197.12, is valued below its estimated fair value of CA$313.13, reflecting a potential undervaluation based on discounted cash flow analysis. With earnings growth last year at 54.3% and projected annual revenue growth of 32.4%, it outpaces the Canadian market significantly. However, its dividends are poorly covered by cash flows and there has been considerable insider selling recently, which might raise concerns about its future financial stability.

- The analysis detailed in our goeasy growth report hints at robust future financial performance.

- Click here to discover the nuances of goeasy with our detailed financial health report.

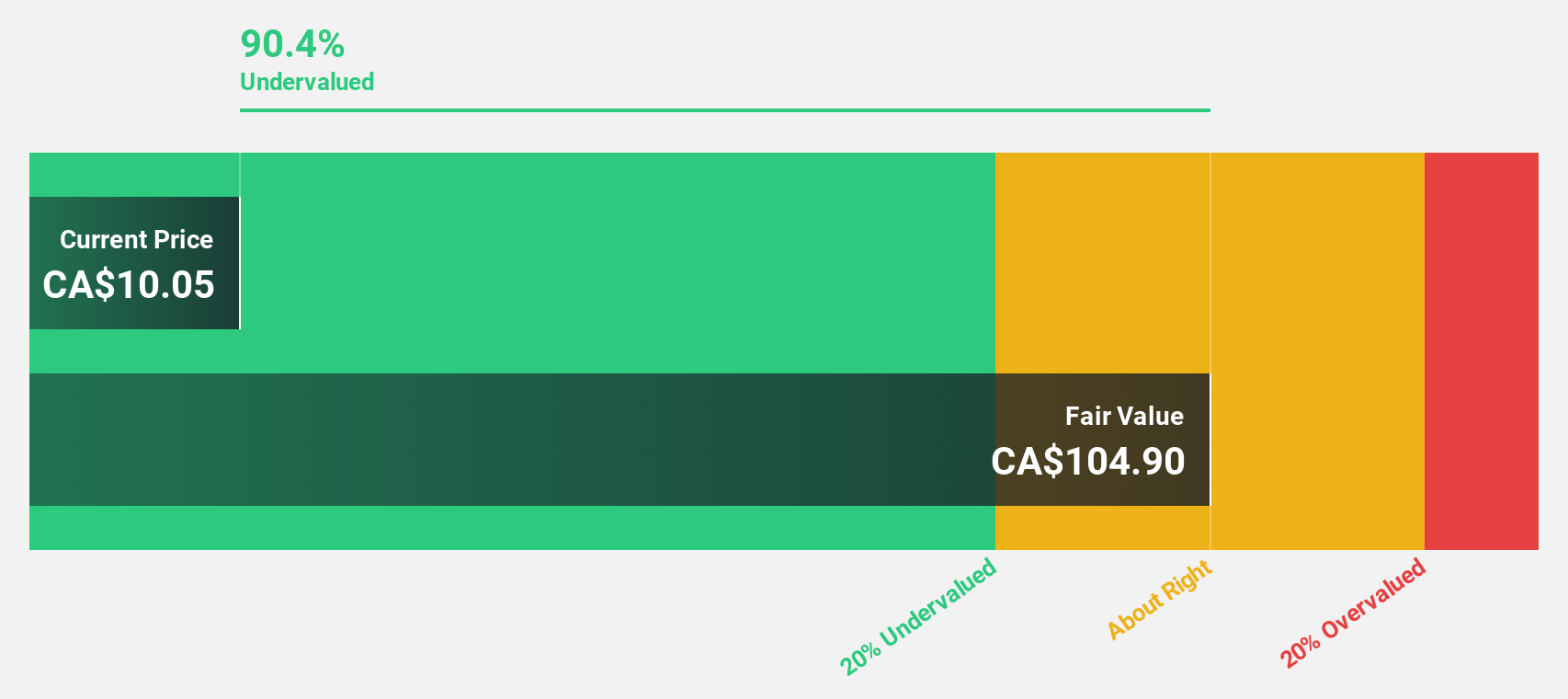

Ivanhoe Mines (TSX:IVN)

Overview: Ivanhoe Mines Ltd. is a company focused on the mining, development, and exploration of minerals and precious metals primarily in Africa, with a market capitalization of approximately CA$23.25 billion.

Operations: The company primarily generates revenue through the mining, development, and exploration of minerals and precious metals in Africa.

Estimated Discount To Fair Value: 14.2%

Ivanhoe Mines, trading at CA$17.65, appears undervalued based on a discounted cash flow valuation of CA$20.58. Despite recent financial losses, the company is poised for significant earnings growth, forecasted at 64.72% annually. Recent operational successes include the early and on-budget completion of its Phase 3 concentrator at Kamoa-Kakula, enhancing production capabilities substantially with expectations to exceed 600,000 tonnes of copper annually soon. However, substantial insider selling over the past quarter could signal caution among investors regarding its near-term prospects.

- Our growth report here indicates Ivanhoe Mines may be poised for an improving outlook.

- Unlock comprehensive insights into our analysis of Ivanhoe Mines stock in this financial health report.

Taking Advantage

- Gain an insight into the universe of 21 Undervalued TSX Stocks Based On Cash Flows by clicking here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're helping make it simple.

Find out whether goeasy is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:GSY

goeasy

Provides non-prime leasing and lending services under the easyhome, easyfinancial, and LendCare brands to consumers in Canada.

High growth potential with proven track record and pays a dividend.