Stock Analysis

- Canada

- /

- Metals and Mining

- /

- TSX:IVN

TSX Growth Companies With High Insider Ownership Showcasing Three Top Picks

Reviewed by Simply Wall St

The Canadian market has shown robust performance, with an 8.4% increase over the past year and earnings expected to grow by 15% annually. In this context, stocks with high insider ownership can be particularly appealing, as they often indicate a strong alignment between company management and shareholder interests.

Top 10 Growth Companies With High Insider Ownership In Canada

| Name | Insider Ownership | Earnings Growth |

| Vox Royalty (TSX:VOXR) | 12.3% | 58.7% |

| Payfare (TSX:PAY) | 15% | 46.7% |

| goeasy (TSX:GSY) | 21.5% | 15.8% |

| Propel Holdings (TSX:PRL) | 40% | 36.4% |

| Allied Gold (TSX:AAUC) | 22.5% | 71.7% |

| Aya Gold & Silver (TSX:AYA) | 10.3% | 51.6% |

| Ivanhoe Mines (TSX:IVN) | 12.6% | 64.7% |

| Silver X Mining (TSXV:AGX) | 14.2% | 144.2% |

| Magna Mining (TSXV:NICU) | 10.6% | 95.1% |

| Almonty Industries (TSX:AII) | 12.3% | 105% |

Let's review some notable picks from our screened stocks.

Colliers International Group (TSX:CIGI)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Colliers International Group Inc. operates globally, offering commercial real estate professional and investment management services, with a market capitalization of approximately CA$7.67 billion.

Operations: The company's revenue is segmented as follows: Americas generates CA$2.53 billion, Asia Pacific brings in CA$616.58 million, Investment Management accounts for CA$489.23 million, and Europe, Middle East & Africa contributes CA$730.10 million.

Insider Ownership: 14.2%

Earnings Growth Forecast: 38.3% p.a.

Colliers International Group has recently demonstrated robust financial improvements, with a significant recovery from last year's net loss to a net income of US$12.66 million in Q1 2024. Despite trading below its estimated fair value and concerns over shareholder dilution, the company is poised for continued growth, with projected earnings growth outpacing the Canadian market. Insider transactions have been more about purchases than sales, reflecting confidence from those closest to the company. However, debt levels remain a concern as they are not well covered by operating cash flow.

- Click here to discover the nuances of Colliers International Group with our detailed analytical future growth report.

- Our valuation report here indicates Colliers International Group may be undervalued.

goeasy (TSX:GSY)

Simply Wall St Growth Rating: ★★★★★☆

Overview: goeasy Ltd., operating under the easyhome, easyfinancial, and LendCare brands, offers non-prime leasing and lending services in Canada with a market capitalization of approximately CA$3.31 billion.

Operations: The company generates revenue through its easyhome and easyfinancial segments, with CA$153.99 million from leasing services and CA$1.17 billion from lending services.

Insider Ownership: 21.5%

Earnings Growth Forecast: 15.8% p.a.

goeasy Ltd. has shown promising growth with a substantial 32.4% annual revenue increase, outpacing the Canadian market's 7.3%. Despite this, its dividend coverage by cash flows is weak, and debt levels are concerning as they are poorly covered by operating cash flow. Recent executive appointments suggest strategic strengthening in consumer credit services, potentially enhancing operational efficiency and market reach. However, earnings growth forecasts at 15.8% annually, though above the market average, indicate moderate rather than exceptional future profitability expansion.

- Dive into the specifics of goeasy here with our thorough growth forecast report.

- The valuation report we've compiled suggests that goeasy's current price could be quite moderate.

Ivanhoe Mines (TSX:IVN)

Simply Wall St Growth Rating: ★★★★★☆

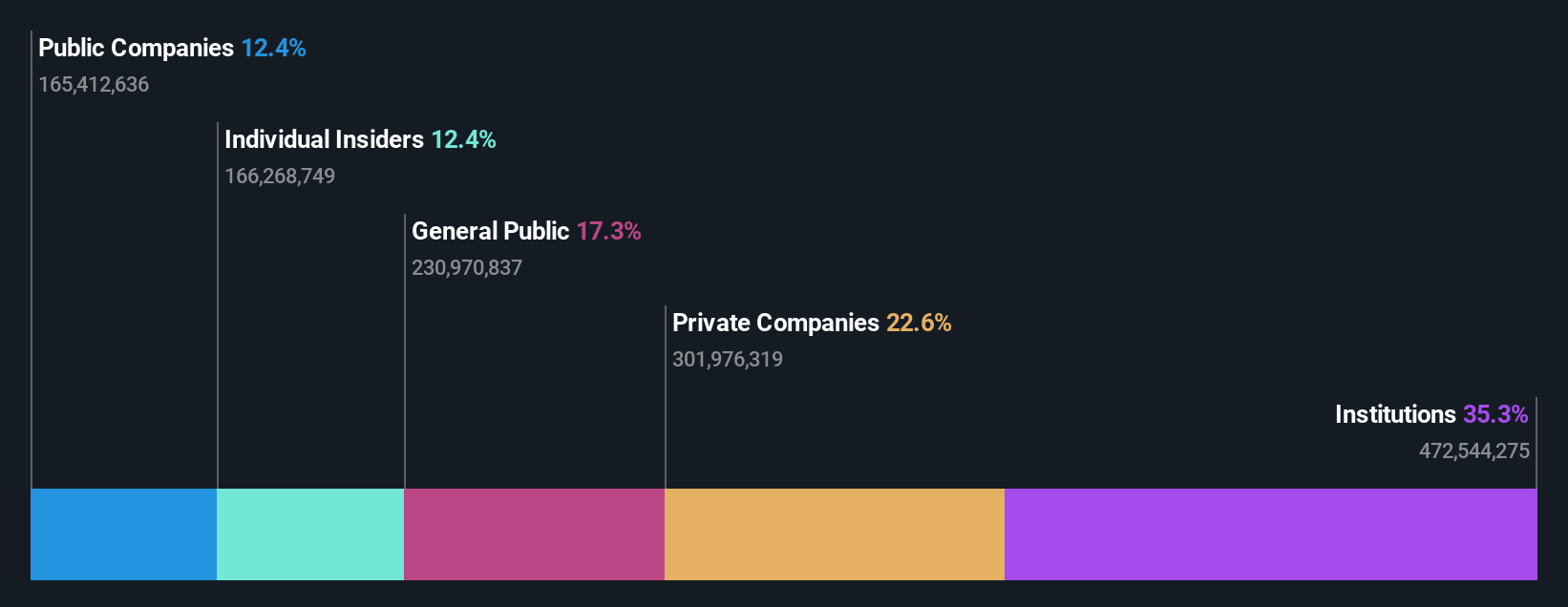

Overview: Ivanhoe Mines Ltd. is a mining company focused on the exploration, development, and extraction of minerals and precious metals, primarily in Africa, with a market capitalization of approximately CA$23.25 billion.

Operations: The company primarily generates its revenue from the exploration, development, and extraction of minerals and precious metals in Africa.

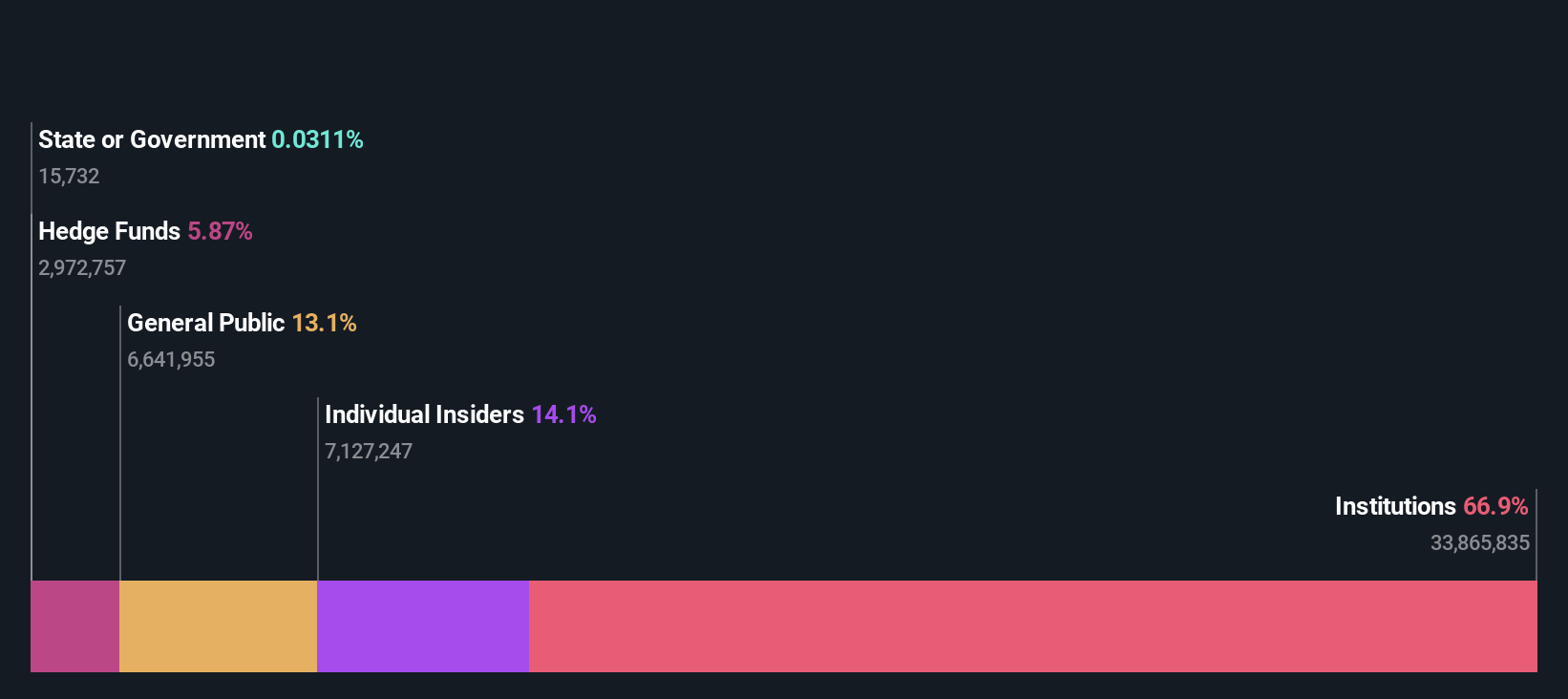

Insider Ownership: 12.6%

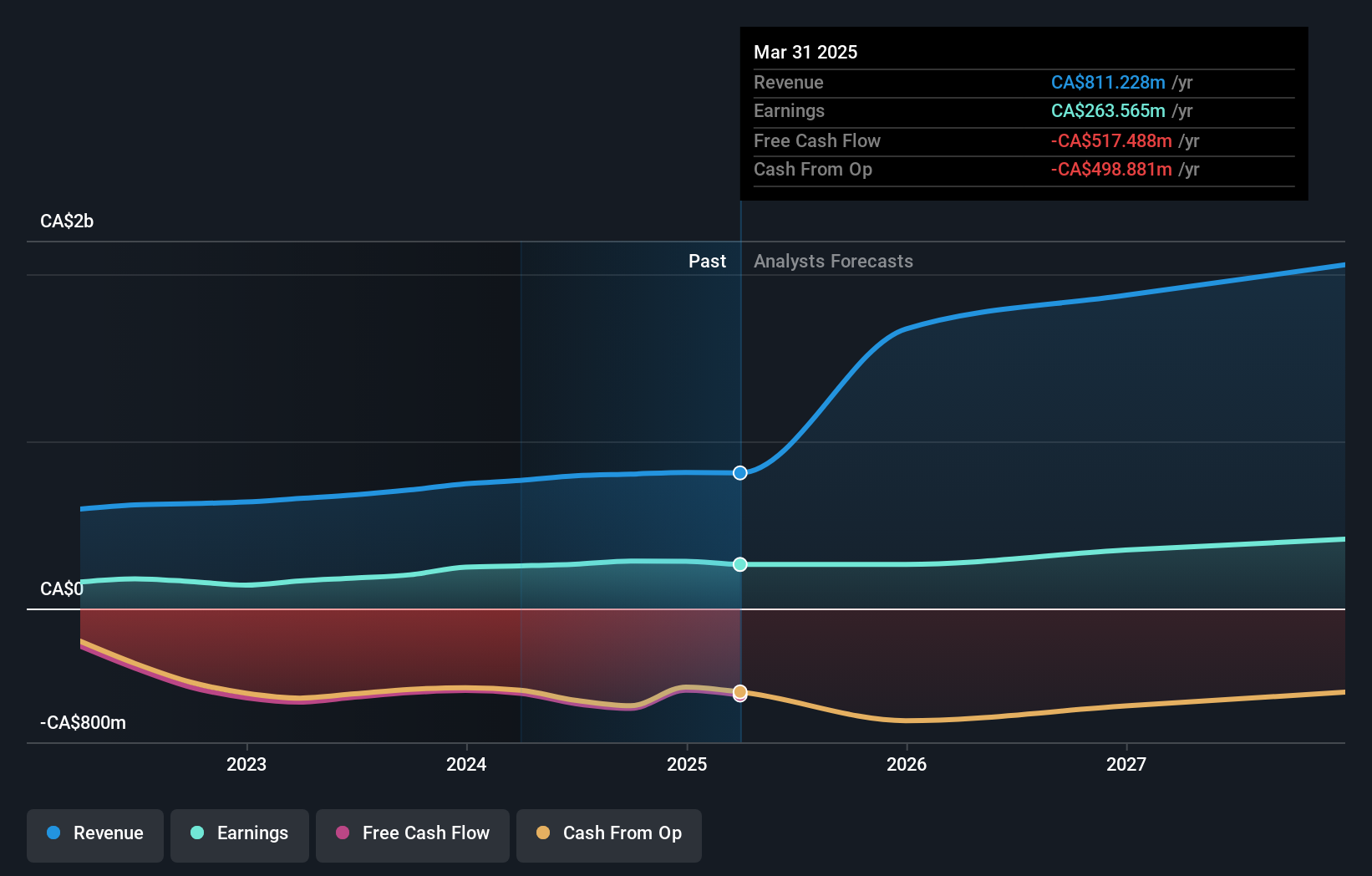

Earnings Growth Forecast: 64.7% p.a.

Ivanhoe Mines, despite limited insider buying recently, is poised for robust growth with earnings expected to surge by 64.7% annually and revenue by 83% per year, significantly outpacing the Canadian market. However, shareholder dilution over the past year and substantial insider selling raise concerns. The recent completion of the Phase 3 concentrator at Kamoa-Kakula ahead of schedule enhances its production capabilities, potentially increasing annual copper output significantly once fully operational early in Q3 2024.

- Navigate through the intricacies of Ivanhoe Mines with our comprehensive analyst estimates report here.

- According our valuation report, there's an indication that Ivanhoe Mines' share price might be on the expensive side.

Taking Advantage

- Get an in-depth perspective on all 29 Fast Growing TSX Companies With High Insider Ownership by using our screener here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're helping make it simple.

Find out whether Ivanhoe Mines is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:IVN

Ivanhoe Mines

Engages in the mining, development, and exploration of minerals and precious metals primarily in Africa.

High growth potential and slightly overvalued.