Stock Analysis

- Canada

- /

- Capital Markets

- /

- TSX:OLY

Top TSX Dividend Stocks To Consider In July 2024

Reviewed by Simply Wall St

As the Canadian market experiences a solid performance in the first half of 2024, with particularly strong showings in sectors like technology and utilities, investors might consider how dividend stocks could fit into their portfolios. Given the current economic climate and positive market momentum, dividend stocks could offer a blend of stability and potential income amidst ongoing economic developments.

Top 10 Dividend Stocks In Canada

| Name | Dividend Yield | Dividend Rating |

| Bank of Nova Scotia (TSX:BNS) | 6.78% | ★★★★★★ |

| Whitecap Resources (TSX:WCP) | 7.29% | ★★★★★★ |

| Enghouse Systems (TSX:ENGH) | 3.45% | ★★★★★☆ |

| Boston Pizza Royalties Income Fund (TSX:BPF.UN) | 8.48% | ★★★★★☆ |

| Secure Energy Services (TSX:SES) | 3.30% | ★★★★★☆ |

| Royal Bank of Canada (TSX:RY) | 3.90% | ★★★★★☆ |

| Russel Metals (TSX:RUS) | 4.51% | ★★★★★☆ |

| Canadian Natural Resources (TSX:CNQ) | 4.31% | ★★★★★☆ |

| Canadian Western Bank (TSX:CWB) | 3.23% | ★★★★★☆ |

| Firm Capital Mortgage Investment (TSX:FC) | 9.08% | ★★★★★☆ |

Click here to see the full list of 33 stocks from our Top TSX Dividend Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

Leon's Furniture (TSX:LNF)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Leon's Furniture Limited operates as a retailer in Canada, offering home furnishings, mattresses, appliances, and electronics with a market capitalization of approximately CA$1.56 billion.

Operations: Leon's Furniture Limited generates CA$2.50 billion in revenue primarily from the retail of home furnishings, mattresses, appliances, and electronics.

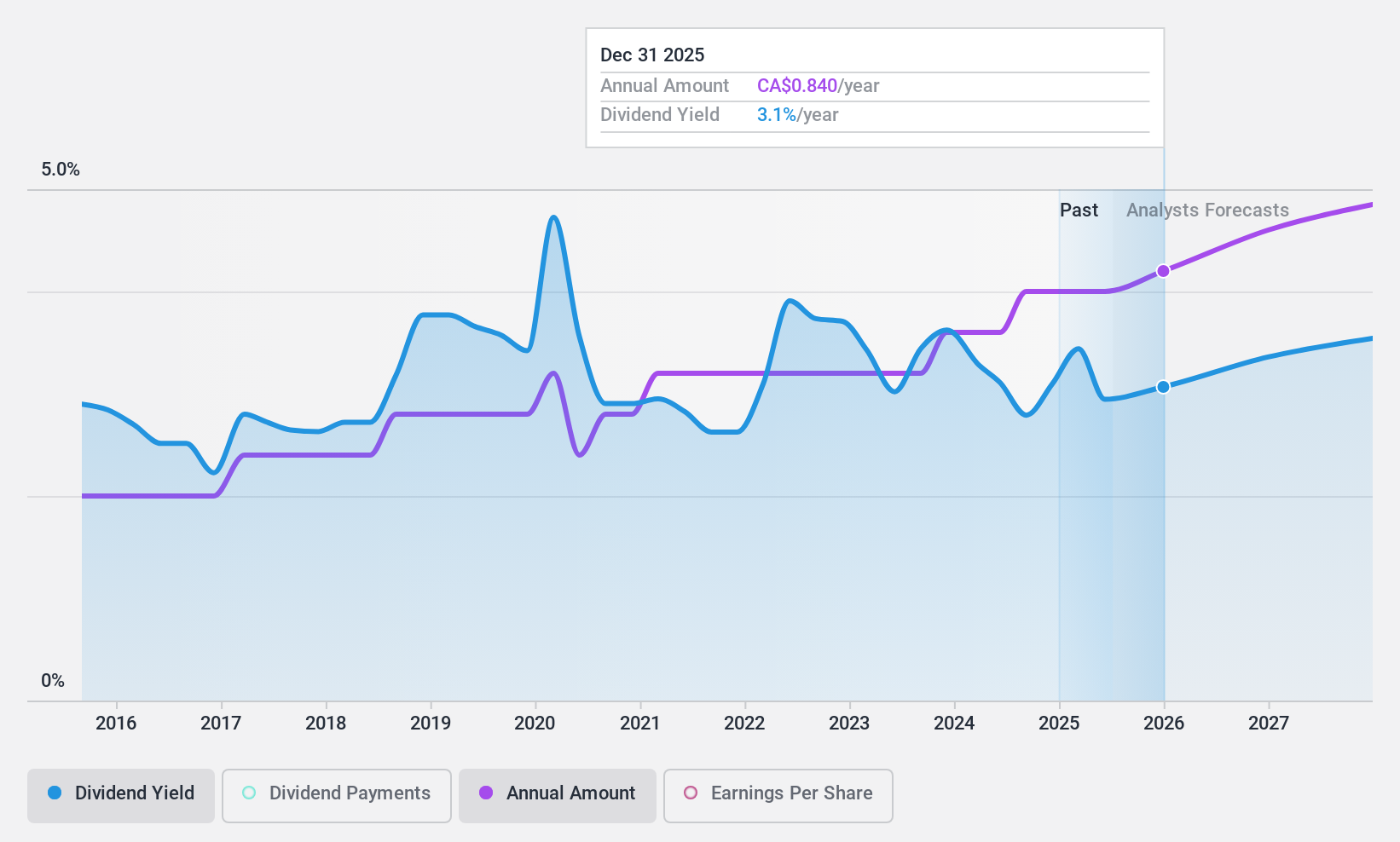

Dividend Yield: 3.1%

Leon's Furniture Limited (LNF) is trading at 69% below its estimated fair value, indicating potential undervaluation relative to the market. Despite a low dividend yield of 3.15%, which is underwhelming compared to top Canadian dividend payers, LNF maintains a sustainable payout with a cash payout ratio of 25.1% and an earnings payout ratio of 31.9%. However, dividends have shown volatility over the past decade with significant annual fluctuations exceeding 20%. Recent financial results show growth, with net income rising from CA$12.92 million to CA$18.82 million year-over-year as of Q1 2024, supporting potential future stability in dividend payments despite past inconsistencies.

- Get an in-depth perspective on Leon's Furniture's performance by reading our dividend report here.

- Upon reviewing our latest valuation report, Leon's Furniture's share price might be too pessimistic.

Olympia Financial Group (TSX:OLY)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Olympia Financial Group Inc. specializes in providing trust services through its subsidiary, Olympia Trust Company, operating as a non-deposit taking trust company in Canada, with a market capitalization of approximately CA$224.97 million.

Operations: Olympia Financial Group Inc. generates revenue through various segments, including Health (CA$10.04 million), Corporate (CA$0.18 million), Exempt Edge (CA$1.37 million), Investment Account Services (CA$78.05 million), Currency and Global Payments (CA$8.63 million), and Corporate and Shareholder Services (CA$3.78 million).

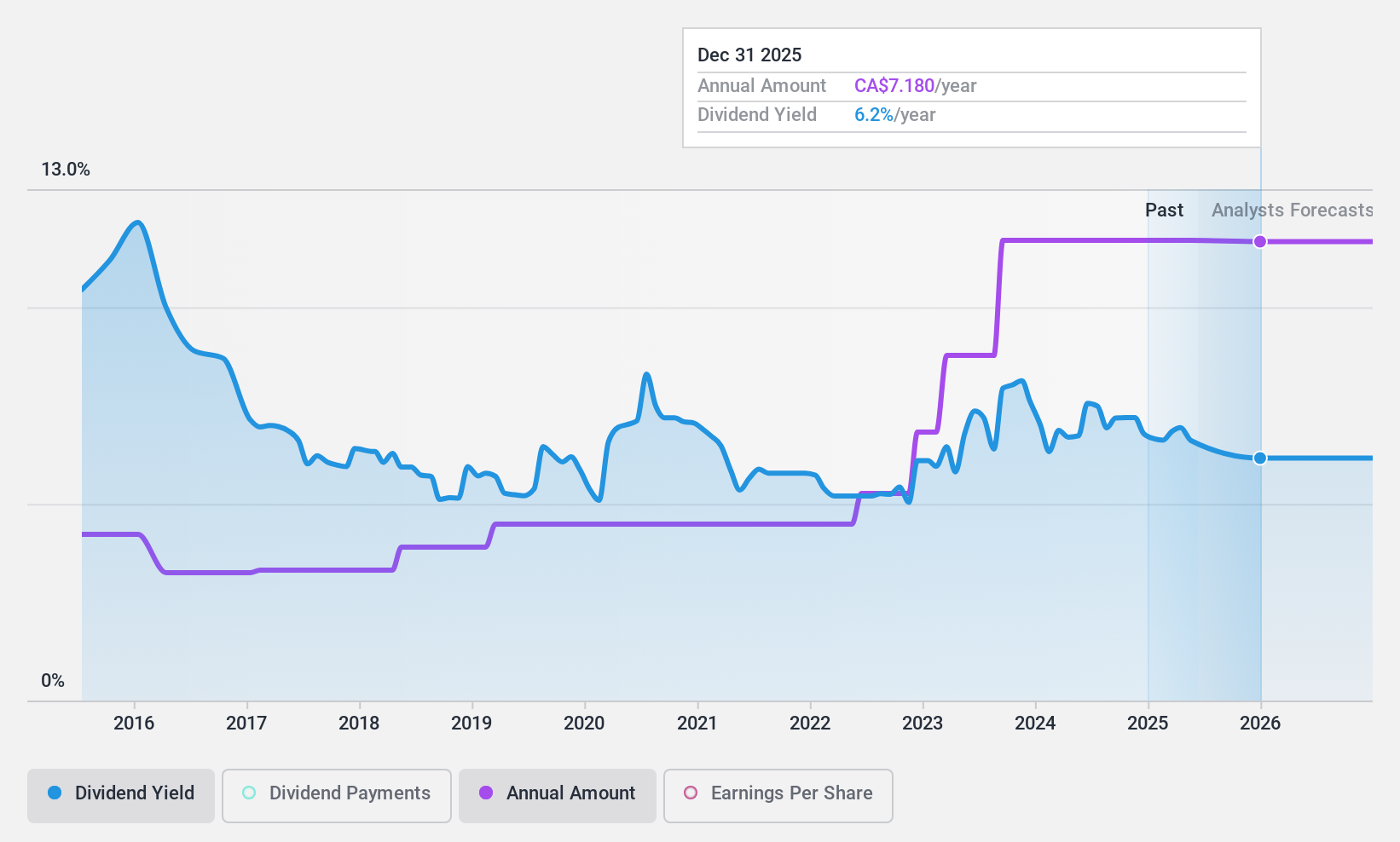

Dividend Yield: 7.7%

Olympia Financial Group maintains a monthly dividend of CA$0.60, with recent affirmations underscoring commitment despite a volatile dividend history over the past decade. The company's dividends are well-covered by both earnings and cash flows, with payout ratios at 63.4% and 76% respectively. However, it trades slightly below fair value and faces an expected earnings decline of 10% annually over the next three years, posing potential challenges to future dividend growth and stability.

- Click here to discover the nuances of Olympia Financial Group with our detailed analytical dividend report.

- According our valuation report, there's an indication that Olympia Financial Group's share price might be on the cheaper side.

Total Energy Services (TSX:TOT)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Total Energy Services Inc. is an energy services company with operations mainly in Canada, the United States, and Australia, boasting a market capitalization of approximately CA$378.04 million.

Operations: Total Energy Services Inc. generates revenue through four primary segments: Well Servicing at CA$93.37 million, Contract Drilling Services at CA$286.01 million, Compression and Process Services at CA$397.05 million, and Rentals and Transportation Services at CA$82.87 million.

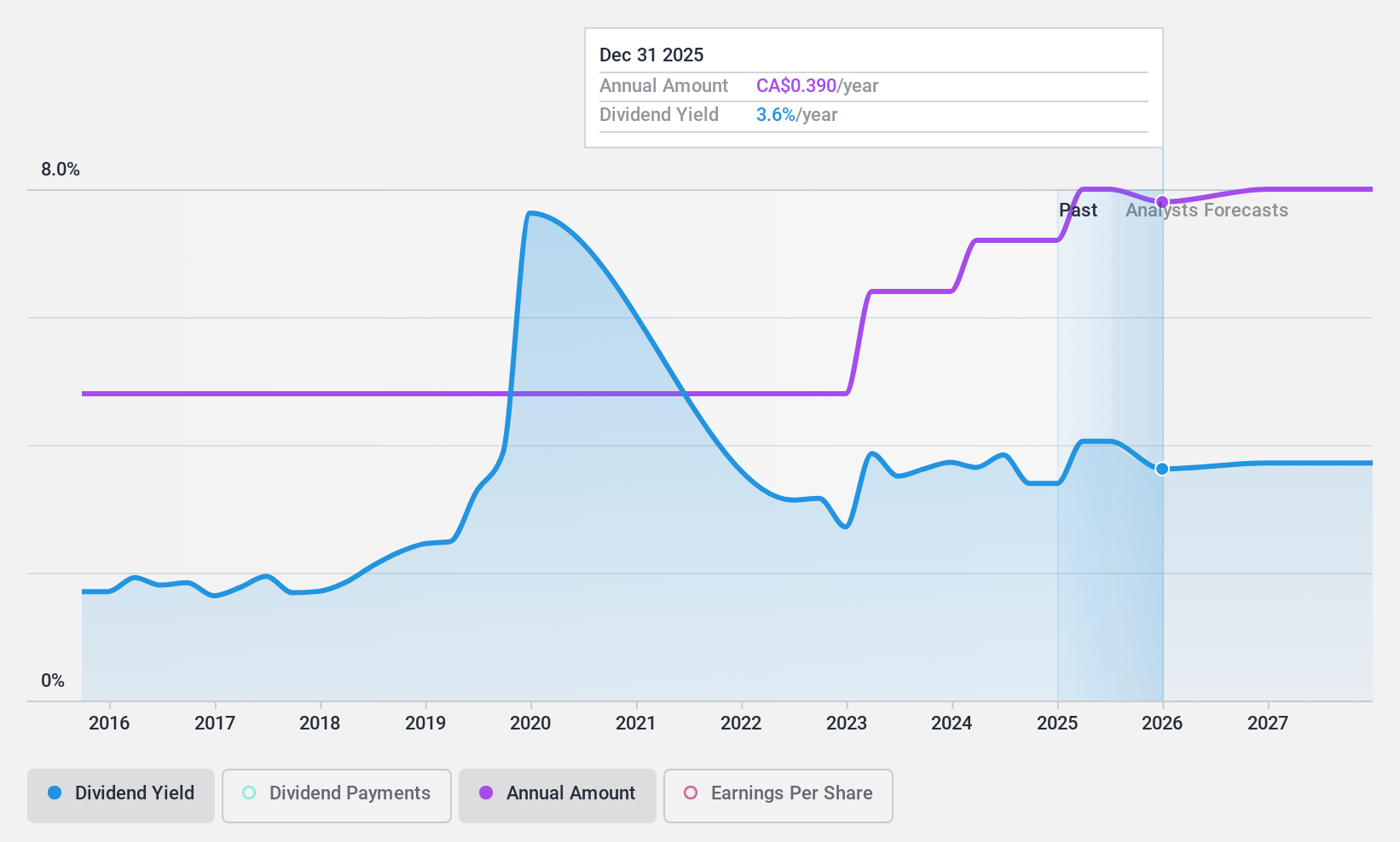

Dividend Yield: 3.7%

Total Energy Services recently confirmed a quarterly dividend of CAD 0.09 per share, maintaining its payout amidst a backdrop of declining sales and net income in Q1 2024, with sales dropping to CAD 204.69 million from CAD 237.78 million year-over-year, and net income falling to CAD 15.48 million from CAD 24.04 million. Despite this downturn, the dividends are well-supported by earnings and cash flows with payout ratios at 40% and 17.8% respectively, though the company's overall dividend track record has been unstable with significant volatility over the past decade.

- Take a closer look at Total Energy Services' potential here in our dividend report.

- Insights from our recent valuation report point to the potential undervaluation of Total Energy Services shares in the market.

Key Takeaways

- Discover the full array of 33 Top TSX Dividend Stocks right here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're helping make it simple.

Find out whether Olympia Financial Group is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:OLY

Olympia Financial Group

Through its subsidiary, Olympia Trust Company, operates as a non-deposit taking trust company in Canada.

Outstanding track record with flawless balance sheet and pays a dividend.