- Canada

- /

- Metals and Mining

- /

- TSX:IVN

A Look at Ivanhoe Mines (TSX:IVN) Valuation After New 2026–2027 Copper Production Guidance

Reviewed by Simply Wall St

Ivanhoe Mines (TSX:IVN) just laid out fresh production guidance that ramps up copper output at its flagship Kamoa Kakula complex through 2027, a material signal for how its growth story could translate into future cash flow.

See our latest analysis for Ivanhoe Mines.

Despite the upbeat guidance, Ivanhoe Mines’ share price, now at CA$13.71, still shows a negative year to date share price return. Its five year total shareholder return remains firmly positive, suggesting long term momentum is intact even as shorter term sentiment recalibrates.

If this kind of growth narrative has your attention, it is also worth scanning fast growing stocks with high insider ownership to uncover other under the radar names with both strong fundamentals and aligned insiders.

With production ramping up and the share price still lagging recent highs, analysts see upside from here. The key question is whether Ivanhoe Mines is genuinely undervalued today or already reflecting the market’s expectations for future copper growth.

Most Popular Narrative: 23.6% Undervalued

Compared to Ivanhoe Mines’ last close at CA$13.71, the most followed narrative places fair value meaningfully higher, implying the market is underestimating its future copper engine.

Completion and ramp up of the Kamoa Kakula smelter (targeted for September) and the associated drop in logistics costs are expected to meaningfully reduce unit costs, directly boosting future operating margins and cash flow.

Ongoing capacity expansions at Kamoa Kakula (Phases 1 to 3) and de bottlenecking at Kipushi, alongside operational recovery from the recent seismic event, are projected to drive substantial increases in copper and zinc output, supporting strong top line revenue growth in the next 12 to 24 months as production returns to full scale.

Want to see how aggressive production growth, shifting margins and a richer copper price deck combine into that valuation call? The full narrative unpacks the exact revenue, earnings and multiple assumptions behind this upside view.

Result: Fair Value of $17.95 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent seismic or operational setbacks at Kamoa Kakula, along with potential cost overruns on expansion projects, could quickly erode today’s optimistic valuation assumptions.

Find out about the key risks to this Ivanhoe Mines narrative.

Another Way to Look at Value

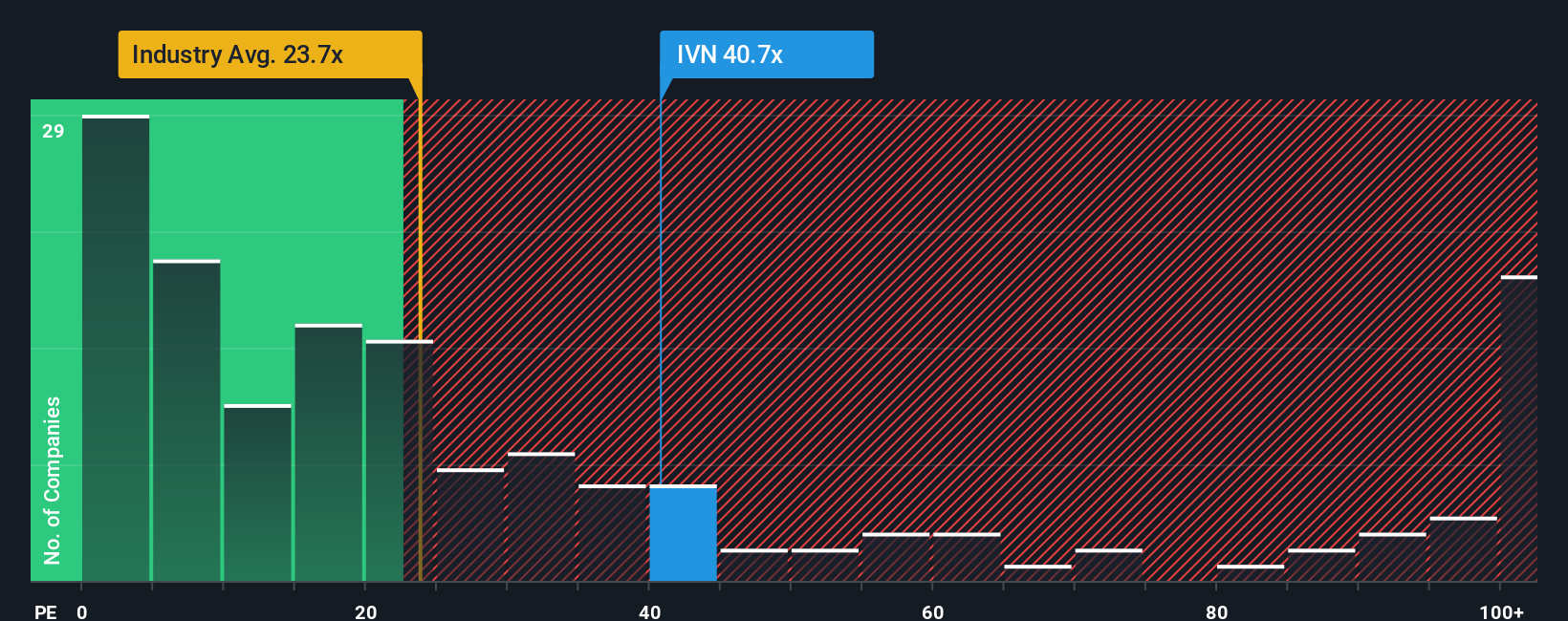

While the narrative suggests Ivanhoe Mines is 23.6% undervalued, a simple earnings ratio check tells a different story. At 46.2 times earnings, versus a fair ratio of 27.3 times and an industry average of 21.4 times, the stock screens as expensive, raising the risk that any execution stumble hits the share price hard. Which signal do you trust more: the growth story or the current multiple?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Ivanhoe Mines Narrative

If you want to stress test these assumptions or rely on your own homework instead, you can build a custom narrative in minutes: Do it your way.

A great starting point for your Ivanhoe Mines research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Ready to keep your edge and avoid missing the next breakout story? Use the Simply Wall St Screener to uncover stocks that match your strategy with precision.

- Target reliable income streams by scanning these 13 dividend stocks with yields > 3% that can strengthen your portfolio with consistent cash returns.

- Position yourself for the next wave in medicine by evaluating these 30 healthcare AI stocks transforming diagnostics, treatment, and patient outcomes.

- Capture high potential growth early by assessing these 26 AI penny stocks at the forefront of automation, data intelligence, and next generation software.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:IVN

Ivanhoe Mines

Engages in the mining, development, and exploration of minerals and precious metals in Africa.

High growth potential with proven track record.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Hitit Bilgisayar Hizmetleri will achieve a 19.7% revenue boost in the next five years

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)