- Canada

- /

- Metals and Mining

- /

- TSX:IVN

3 TSX Stocks Estimated To Be Up To 47.7% Below Intrinsic Value

Reviewed by Simply Wall St

The Canadian market has stayed flat over the past 7 days but has risen 21% over the past 12 months, with earnings forecasted to grow by 15% annually. In this context, identifying undervalued stocks can present significant opportunities for investors looking to capitalize on potential growth and value.

Top 10 Undervalued Stocks Based On Cash Flows In Canada

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Computer Modelling Group (TSX:CMG) | CA$11.12 | CA$22.01 | 49.5% |

| Endeavour Mining (TSX:EDV) | CA$32.73 | CA$61.78 | 47% |

| Kinaxis (TSX:KXS) | CA$156.97 | CA$279.64 | 43.9% |

| Viemed Healthcare (TSX:VMD) | CA$10.45 | CA$20.08 | 48% |

| Real Matters (TSX:REAL) | CA$9.15 | CA$17.50 | 47.7% |

| Bragg Gaming Group (TSX:BRAG) | CA$6.94 | CA$10.71 | 35.2% |

| Blackline Safety (TSX:BLN) | CA$5.60 | CA$10.99 | 49% |

| Boyd Group Services (TSX:BYD) | CA$203.67 | CA$336.34 | 39.4% |

| Opsens (TSX:OPS) | CA$2.90 | CA$4.64 | 37.5% |

| GFL Environmental (TSX:GFL) | CA$53.12 | CA$79.82 | 33.4% |

We're going to check out a few of the best picks from our screener tool.

Endeavour Mining (TSX:EDV)

Overview: Endeavour Mining plc, with a market cap of CA$8.00 billion, operates as a gold mining company in West Africa through its subsidiaries.

Operations: Endeavour Mining plc generates revenue from its Houndé Mine ($612.70 million), Sabodala Massawa Mine ($509.60 million), Mana Mine in Burkina Faso ($308.40 million), and Ity Mine in Côte D’Ivoire ($708.10 million).

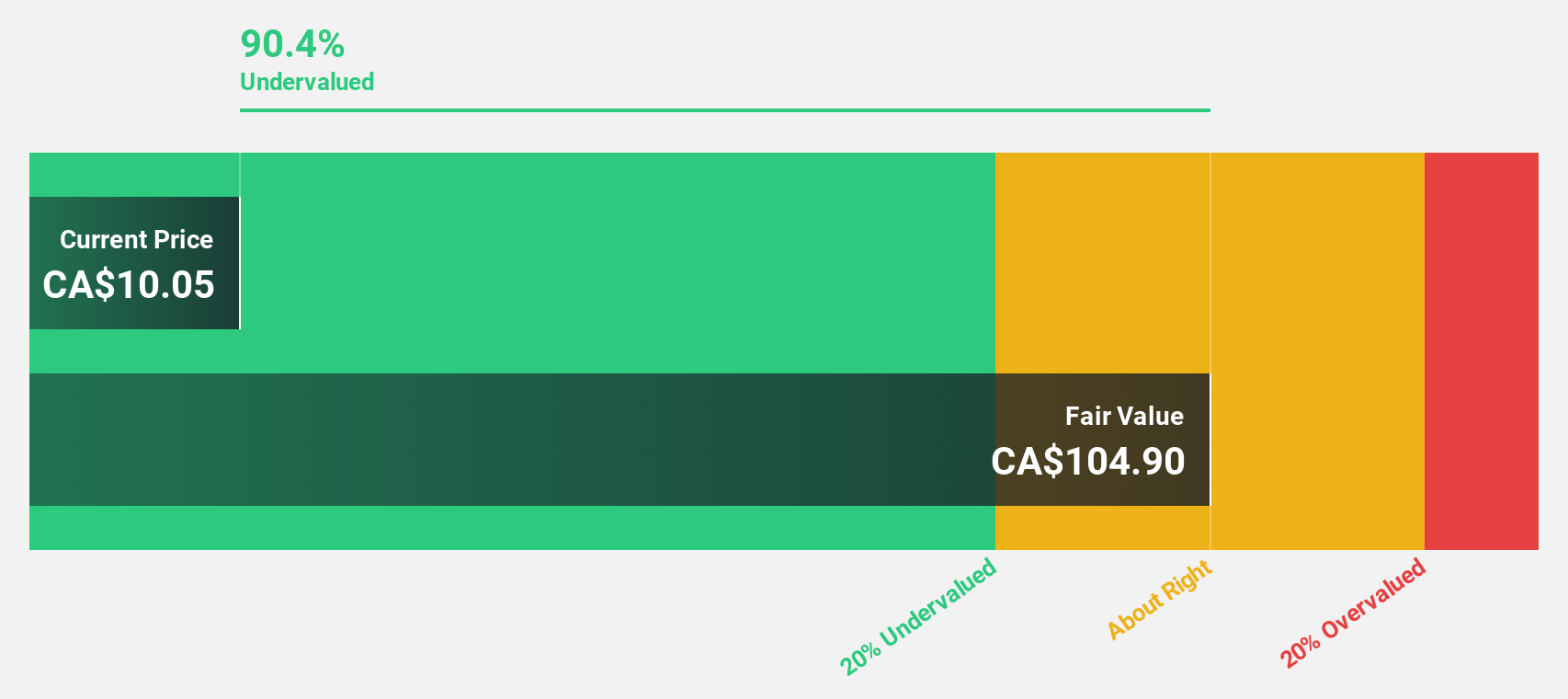

Estimated Discount To Fair Value: 47%

Endeavour Mining is trading at CA$32.73, significantly below its estimated fair value of CA$61.78, indicating it may be undervalued based on cash flows. Despite recent insider selling, the company has achieved commercial production at its Sabodala-Massawa and Lafigué mines, which should bolster future cash flows. Analysts forecast strong revenue growth of 11.2% annually and a high return on equity (20.2%) within three years, supporting the stock's potential for appreciation despite current losses and dividend sustainability concerns.

- Our growth report here indicates Endeavour Mining may be poised for an improving outlook.

- Take a closer look at Endeavour Mining's balance sheet health here in our report.

Ivanhoe Mines (TSX:IVN)

Overview: Ivanhoe Mines Ltd. engages in the mining, development, and exploration of minerals and precious metals primarily in Africa, with a market cap of CA$27.77 billion.

Operations: Ivanhoe Mines Ltd. generates revenue through the mining, development, and exploration of minerals and precious metals primarily in Africa.

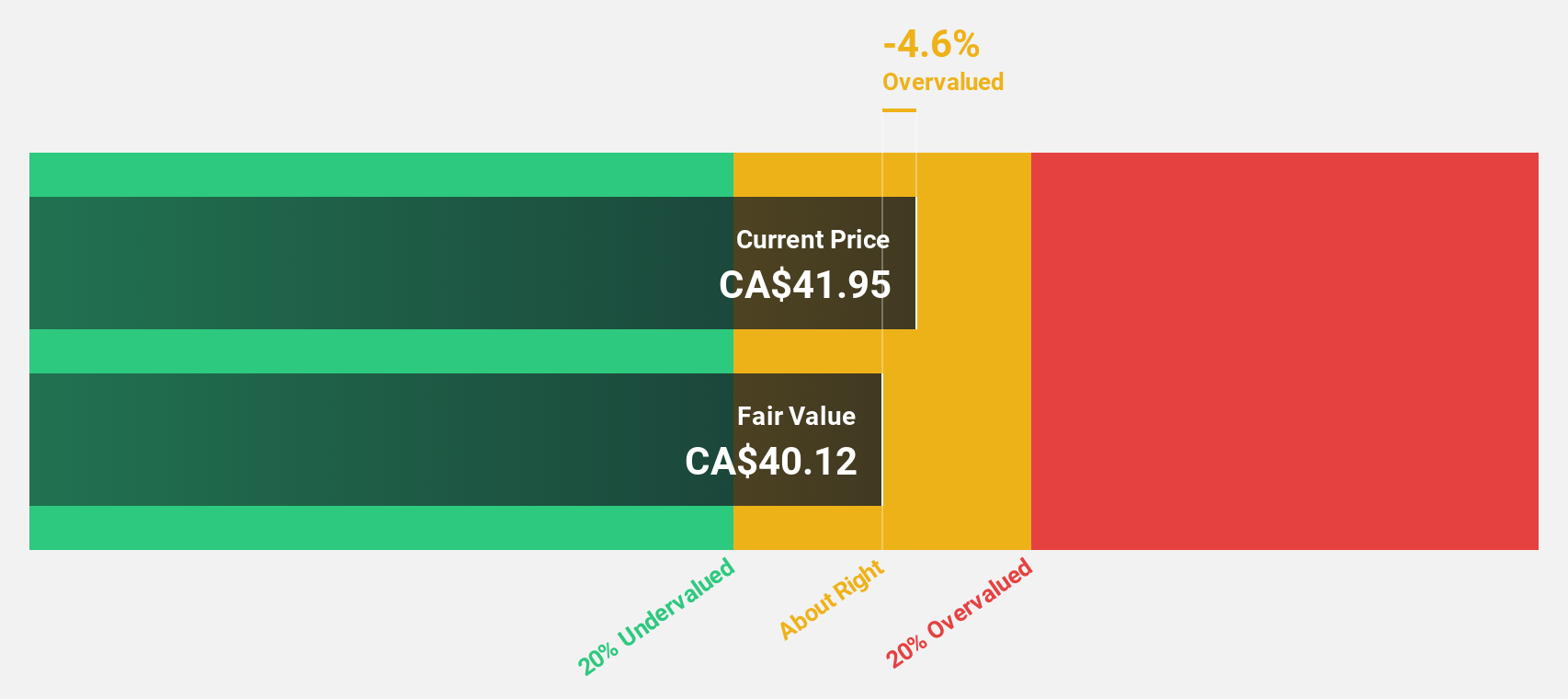

Estimated Discount To Fair Value: 12.3%

Ivanhoe Mines, trading at CA$20.56, is undervalued relative to its estimated fair value of CA$23.44. The company has signed an MOU with Zambia's Ministry of Mines for exploration activities and reported record copper production from its Kamoa-Kakula Copper Complex in the DRC. Despite a recent dip in earnings, Ivanhoe's revenue and profit growth forecasts significantly outpace the Canadian market averages, highlighting strong cash flow potential amid ongoing project developments and expansions.

- Our expertly prepared growth report on Ivanhoe Mines implies its future financial outlook may be stronger than recent results.

- Unlock comprehensive insights into our analysis of Ivanhoe Mines stock in this financial health report.

Real Matters (TSX:REAL)

Overview: Real Matters Inc. is a technology and network management company operating in Canada and the United States with a market cap of CA$671.92 million.

Operations: The company generates revenue from three primary segments: CA$32.73 million from Canada, CA$8.53 million from U.S. Title, and CA$128.03 million from U.S. Appraisal.

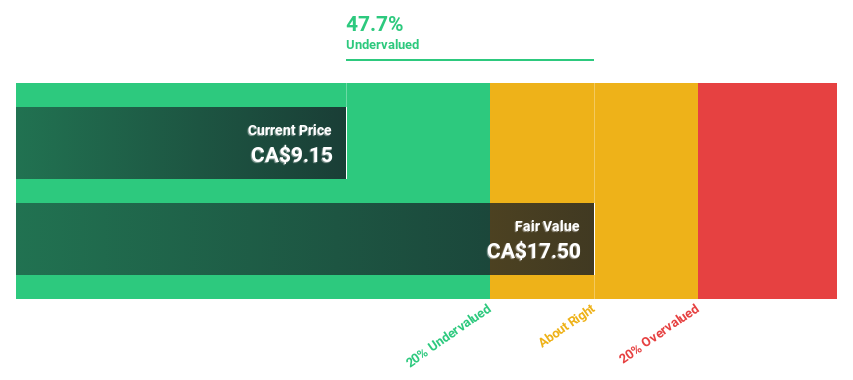

Estimated Discount To Fair Value: 47.7%

Real Matters, trading at CA$9.15, is significantly undervalued relative to its estimated fair value of CA$17.5. The company recently reported earnings for Q3 2024 with sales of US$49.49 million and net income of US$1.7 million, marking profitability after previous losses. Despite being dropped from the S&P Global BMI Index in September 2024, Real Matters' revenue and earnings are forecast to grow faster than the Canadian market averages, indicating strong cash flow potential amidst its current valuation gap.

- Our comprehensive growth report raises the possibility that Real Matters is poised for substantial financial growth.

- Navigate through the intricacies of Real Matters with our comprehensive financial health report here.

Next Steps

- Discover the full array of 24 Undervalued TSX Stocks Based On Cash Flows right here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:IVN

Ivanhoe Mines

Engages in the mining, development, and exploration of minerals and precious metals primarily in Africa.

High growth potential and fair value.