- Canada

- /

- Metals and Mining

- /

- TSX:FVI

Should Fortuna’s Precious Metals Rally And Index Leadership Require Action From Fortuna Mining (TSX:FVI) Investors?

Reviewed by Sasha Jovanovic

- Fortuna Silver Mines has recently extended its rally and led the TSX Smallcap Index as renewed attention flowed into the precious metals segment after a key S&P/TSX trend indicator moved higher.

- This momentum highlights how Fortuna’s diversified operations across Latin America and West Africa can benefit when broader market signals refocus investors on gold and silver producers.

- Against this backdrop of sector-wide renewed interest in precious metals, we’ll examine how Fortuna’s diversified mining footprint could reshape its investment narrative.

These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Fortuna Mining Investment Narrative Recap

To own Fortuna, you need to believe its multi-mine gold and silver portfolio can convert volatile metal prices into durable cash flow, despite higher costs and project concentration. The recent rally and leadership in the TSX Smallcap Index spotlight the stock, but do not materially change the near term reliance on successful ramp-up at core assets or the risk that elevated all in sustaining costs could pressure margins if sector sentiment cools.

The Q3 2025 earnings release, showing US$251.36 million in sales and US$123.59 million in net income, is the most relevant recent announcement in this context, because it illustrates how Fortuna’s current asset base is performing just as renewed interest in precious metals lifts the share price. That backdrop matters for investors weighing the importance of cost control and project execution as key catalysts for the next phase of the story.

Yet despite the recent strength, investors should be aware that concentration risk around a smaller set of core assets could...

Read the full narrative on Fortuna Mining (it's free!)

Fortuna Mining's narrative projects $1.0 billion revenue and $235.3 million earnings by 2028. This requires a 4.5% yearly revenue decline and an earnings increase of about $64 million from $171.2 million today.

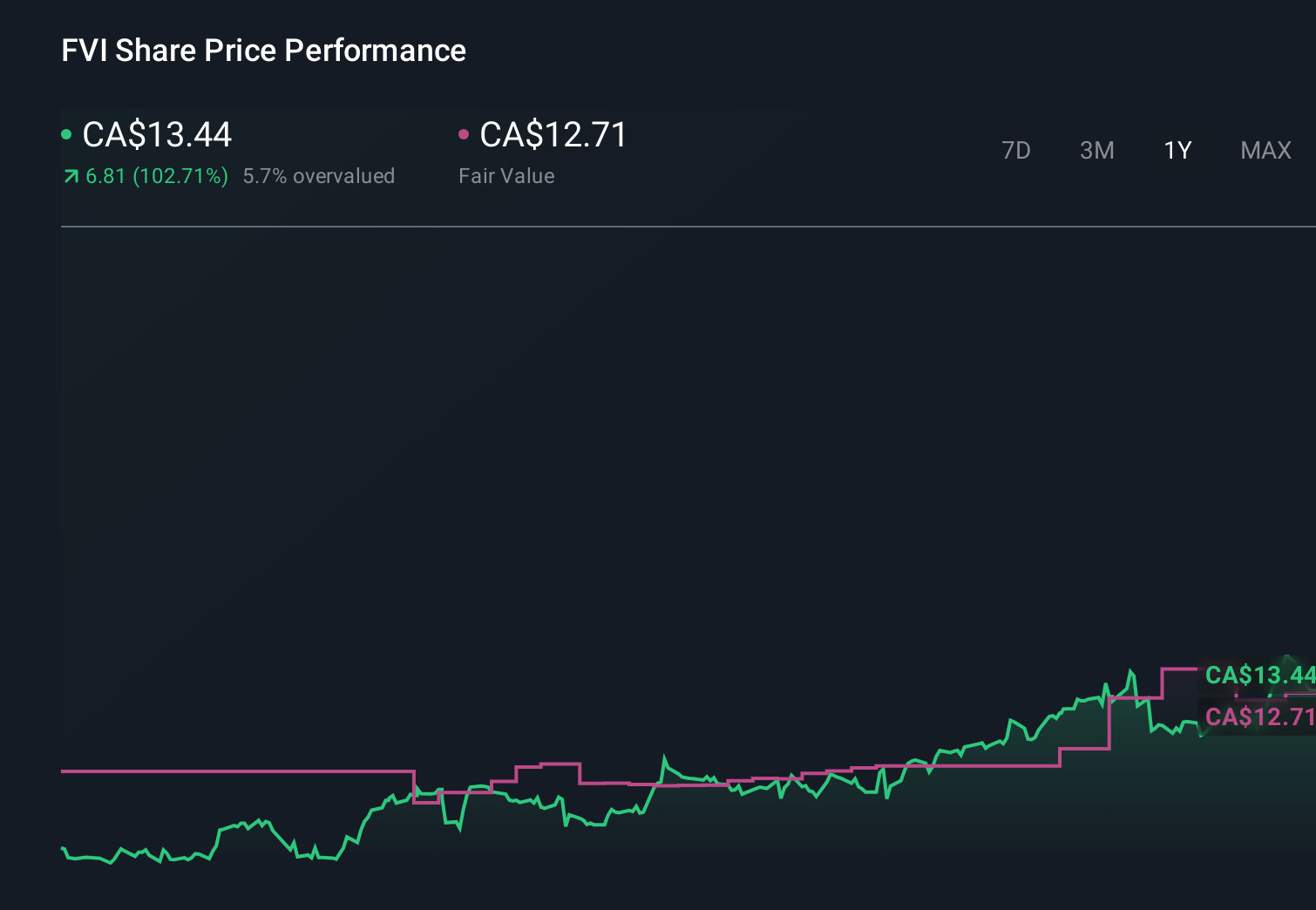

Uncover how Fortuna Mining's forecasts yield a CA$12.71 fair value, a 5% downside to its current price.

Exploring Other Perspectives

Three fair value estimates from the Simply Wall St Community cluster between CA$9.80 and CA$12.71, underscoring how differently individuals can view Fortuna’s worth. Against that range, the reliance on a few core mines and successful project execution puts the recent momentum into sharper context for readers who want to compare several viewpoints.

Explore 3 other fair value estimates on Fortuna Mining - why the stock might be worth 27% less than the current price!

Build Your Own Fortuna Mining Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Fortuna Mining research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Fortuna Mining research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Fortuna Mining's overall financial health at a glance.

Looking For Alternative Opportunities?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- We've found 13 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:FVI

Fortuna Mining

Engages in the precious and base metal mining and related activities in Argentina, Burkina Faso, Côte d’Ivoire, Mexico, Peru, and Senegal.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Stride Stock: Online Education Finds Its Second Act

CS Disco Stock: Legal AI Is Moving From Efficiency Tool to Competitive Necessity

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)