- Canada

- /

- Metals and Mining

- /

- TSX:FNV

It Might Not Be A Great Idea To Buy Franco-Nevada Corporation (TSE:FNV) For Its Next Dividend

Franco-Nevada Corporation (TSE:FNV) is about to trade ex-dividend in the next 2 days. Typically, the ex-dividend date is two business days before the record date, which is the date on which a company determines the shareholders eligible to receive a dividend. The ex-dividend date is important as the process of settlement involves at least two full business days. So if you miss that date, you would not show up on the company's books on the record date. Thus, you can purchase Franco-Nevada's shares before the 13th of March in order to receive the dividend, which the company will pay on the 27th of March.

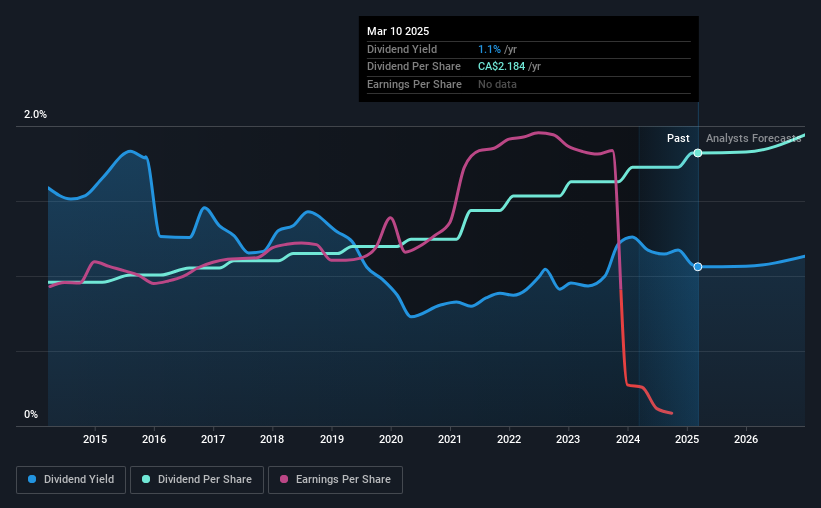

The company's next dividend payment will be US$0.38 per share. Last year, in total, the company distributed US$1.44 to shareholders. Looking at the last 12 months of distributions, Franco-Nevada has a trailing yield of approximately 1.1% on its current stock price of CA$205.77. Dividends are a major contributor to investment returns for long term holders, but only if the dividend continues to be paid. So we need to check whether the dividend payments are covered, and if earnings are growing.

Check out our latest analysis for Franco-Nevada

If a company pays out more in dividends than it earned, then the dividend might become unsustainable - hardly an ideal situation. Franco-Nevada reported a loss last year, so it's not great to see that it has continued paying a dividend. Given that the company reported a loss last year, we now need to see if it generated enough free cash flow to fund the dividend. If Franco-Nevada didn't generate enough cash to pay the dividend, then it must have either paid from cash in the bank or by borrowing money, neither of which is sustainable in the long term. Over the last year it paid out 61% of its free cash flow as dividends, within the usual range for most companies.

Click here to see the company's payout ratio, plus analyst estimates of its future dividends.

Have Earnings And Dividends Been Growing?

Businesses with shrinking earnings are tricky from a dividend perspective. Investors love dividends, so if earnings fall and the dividend is reduced, expect a stock to be sold off heavily at the same time. Franco-Nevada reported a loss last year, and the general trend suggests its earnings have also been declining in recent years, making us wonder if the dividend is at risk.

Many investors will assess a company's dividend performance by evaluating how much the dividend payments have changed over time. Franco-Nevada has delivered 6.6% dividend growth per year on average over the past 10 years.

We update our analysis on Franco-Nevada every 24 hours, so you can always get the latest insights on its financial health, here.

The Bottom Line

From a dividend perspective, should investors buy or avoid Franco-Nevada? It's hard to get used to Franco-Nevada paying a dividend despite reporting a loss over the past year. At least the dividend was covered by free cash flow, however. With the way things are shaping up from a dividend perspective, we'd be inclined to steer clear of Franco-Nevada.

Curious what other investors think of Franco-Nevada? See what analysts are forecasting, with this visualisation of its historical and future estimated earnings and cash flow.

If you're in the market for strong dividend payers, we recommend checking our selection of top dividend stocks.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:FNV

Franco-Nevada

Operates as a royalty and stream company focused on precious metals in South America, Central America, Mexico, the United States, Canada, Australia, Europe, and internationally.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)