- Canada

- /

- Metals and Mining

- /

- TSX:FNV

Franco-Nevada (TSX:FNV): Revisiting Valuation After Lassonde’s Award and TSX Dividend Index Inclusion

Reviewed by Simply Wall St

Franco-Nevada (TSX:FNV) is back on investors radar after co founder Pierre Lassonde received a major lifetime achievement award and the company joined the TSX Composite Dividend Index, together spotlighting its royalty model and income profile.

See our latest analysis for Franco-Nevada.

Those headlines land at a time when sentiment is already tilting in Franco-Nevada’s favor, with a 67.54% year to date share price return and a 73.47% one year total shareholder return signaling strong, sustained momentum.

If you like how Franco-Nevada mixes resilience with income, it could be worth seeing what other income focused names are doing by exploring these 13 dividend stocks with yields > 3%.

With earnings and dividends rising alongside a more than 67 percent year-to-date rally, Franco-Nevada now trades within touching distance of analyst targets. This raises a key question: is there still upside left, or is future growth already priced in?

Most Popular Narrative: 14.2% Undervalued

With Franco-Nevada last closing at CA$292.32 against a narrative fair value of CA$340.59, the current rally still looks modest beside projected potential.

The Revenue Growth assumption has increased significantly from 7.60 percent to 19.71 percent, indicating a materially more optimistic outlook for top line expansion.

The Net Profit Margin expectation has improved from 65.98 percent to 68.36 percent, suggesting a stronger long term profitability profile.

Want to see what kind of business delivers that blend of faster growth and fatter margins, yet a lower future earnings multiple than before? The narrative walks through a detailed earnings roadmap, a richer revenue mix, and a valuation framework that leans on premium profitability rather than speculative hype. Curious how those moving parts add up to that fair value gap? Read on to unpack the full story behind the numbers.

Result: Fair Value of CA$340.59 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sustained weakness in gold prices or disruptions at key assets like Candelaria could quickly erode the margin strength that underpins the undervaluation case.

Find out about the key risks to this Franco-Nevada narrative.

Another Angle on Valuation

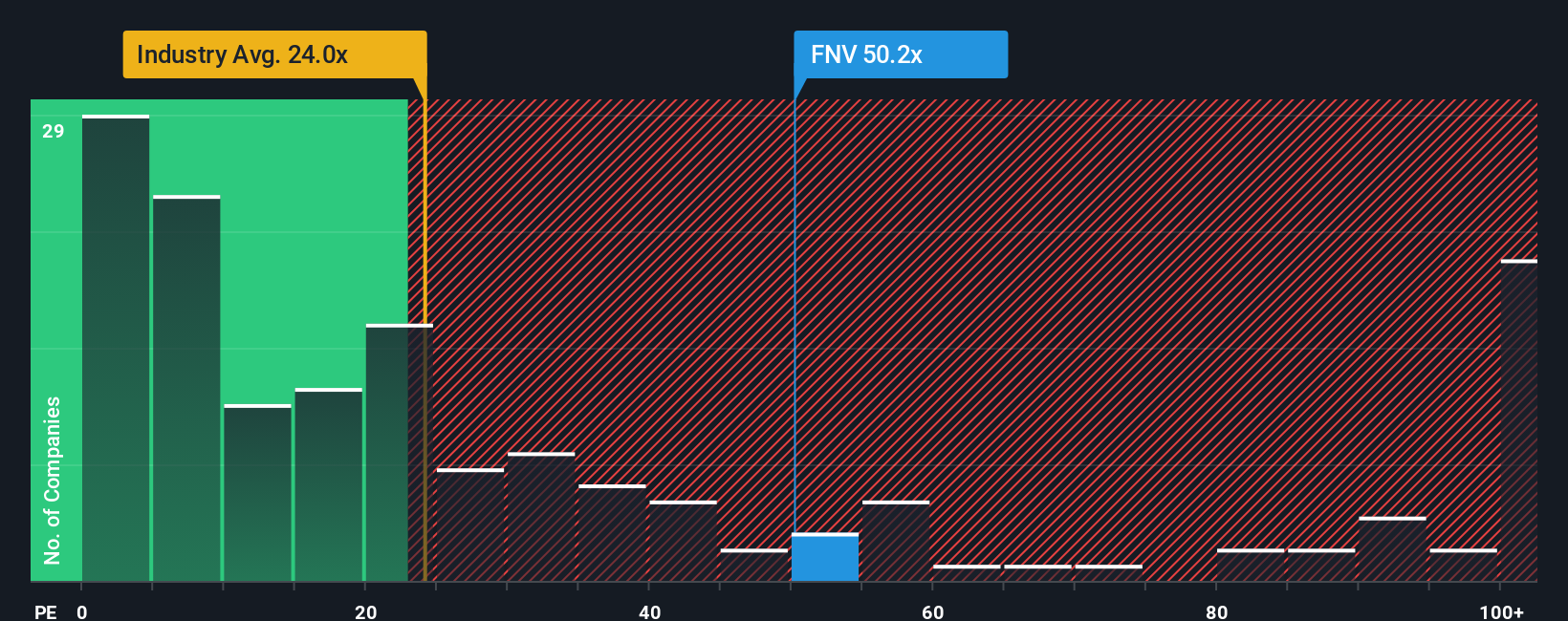

Step away from fair value models and Franco-Nevada looks far from cheap. Its 44.5x earnings multiple towers over the sector, at 21.5x for the Canadian metals group and 30.1x for peers, and even sits well above a 24x fair ratio. This leaves investors asking how much optimism is already priced in.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Franco-Nevada Narrative

If you see the story differently or simply want to dig into the numbers yourself, you can build a personalized view in just minutes: Do it your way.

A great starting point for your Franco-Nevada research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Ready for your next investing move?

Keep your edge by acting now, not later, and tap into fresh stock ideas powered by the Simply Wall St Screener before the market fully catches on.

- Capture growth at the earliest stages by targeting under the radar names using these 3612 penny stocks with strong financials before wider attention changes their valuations.

- Explore structural trends influencing the economy by zeroing in on innovation leaders with these 26 AI penny stocks that may play a role in the next wave of returns.

- Look for potential mispricings by focusing on strong businesses that appear to be trading below their worth through these 908 undervalued stocks based on cash flows while the opportunity window is still open.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:FNV

Franco-Nevada

Operates as a royalty and stream company focused on precious metals in South America, Central America, Mexico, the United States, Canada, Australia, Europe, and internationally.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Hitit Bilgisayar Hizmetleri will achieve a 19.7% revenue boost in the next five years

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)