- Canada

- /

- Metals and Mining

- /

- TSXV:NMI

TSX Highlights: Foraco International And 2 Promising Penny Stocks

Reviewed by Simply Wall St

As the Canadian market continues its upward trajectory, with the TSX showing robust gains, investors are keeping an eye on central bank meetings and economic indicators that could influence future performance. In such a climate, identifying stocks with strong fundamentals becomes crucial for those looking to enhance their portfolios. While 'penny stocks' might seem like a term from yesteryear, they still hold potential for growth; companies with solid financials can offer significant opportunities at lower price points.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Rewards & Risks |

| Westbridge Renewable Energy (TSXV:WEB) | CA$2.19 | CA$54.35M | ✅ 3 ⚠️ 3 View Analysis > |

| Canso Select Opportunities (TSXV:CSOC.A) | CA$4.11 | CA$21.03M | ✅ 2 ⚠️ 2 View Analysis > |

| Sailfish Royalty (TSXV:FISH) | CA$3.30 | CA$251.96M | ✅ 1 ⚠️ 4 View Analysis > |

| Zoomd Technologies (TSXV:ZOMD) | CA$1.23 | CA$123.98M | ✅ 4 ⚠️ 2 View Analysis > |

| Montero Mining and Exploration (TSXV:MON) | CA$0.48 | CA$3.72M | ✅ 2 ⚠️ 4 View Analysis > |

| CEMATRIX (TSX:CEMX) | CA$0.34 | CA$49.57M | ✅ 3 ⚠️ 1 View Analysis > |

| Thor Explorations (TSXV:THX) | CA$1.25 | CA$811.66M | ✅ 3 ⚠️ 2 View Analysis > |

| Automotive Finco (TSXV:AFCC.H) | CA$1.17 | CA$23.19M | ✅ 2 ⚠️ 3 View Analysis > |

| Pulse Seismic (TSX:PSD) | CA$3.08 | CA$160.29M | ✅ 2 ⚠️ 1 View Analysis > |

| Hemisphere Energy (TSXV:HME) | CA$2.09 | CA$198.72M | ✅ 3 ⚠️ 2 View Analysis > |

Click here to see the full list of 393 stocks from our TSX Penny Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Foraco International (TSX:FAR)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Foraco International SA, with a market cap of CA$246.31 million, offers drilling services across North America, South America, the Asia Pacific, the Middle East, Africa, and Europe.

Operations: The company generates revenue from its Water segment, which brought in $43.65 million, and its Mining segment, which accounted for $212.27 million.

Market Cap: CA$246.31M

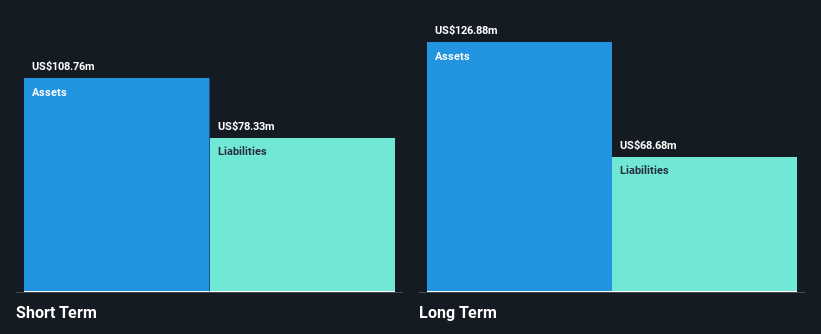

Foraco International SA, with a market cap of CA$246.31 million, has secured significant long-term contracts in the U.S., Canada, and Chile valued at over US$210 million, enhancing its revenue base from mining services. Despite a high net debt to equity ratio of 64.1%, the company benefits from stable short-term asset coverage over liabilities and well-covered interest payments by EBIT (4.4x). However, recent earnings have declined compared to last year with negative growth (-37.7%), impacting profit margins and return on equity (14.2%). The stock trades at a favorable P/E ratio of 10.6x against the Canadian market average of 15.9x.

- Jump into the full analysis health report here for a deeper understanding of Foraco International.

- Review our growth performance report to gain insights into Foraco International's future.

Metavista3D (TSXV:DDD)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Metavista3D Inc. focuses on the research and development of pseudo-holographic display technologies, with a market cap of CA$120.64 million.

Operations: Metavista3D Inc. has not reported any revenue segments.

Market Cap: CA$120.64M

Metavista3D Inc., with a market cap of CA$120.64 million, is pre-revenue and focuses on developing pseudo-holographic display technologies. The company recently showcased its AI-driven 3D E-Mirror technology at industry events, highlighting advancements in real-time visualization for automotive applications. Despite lacking significant revenue streams, Metavista3D has secured a loan agreement for up to CAD 12.5 million to support its R&D efforts, ensuring sufficient cash runway for over a year without long-term liabilities. However, the stock remains highly volatile compared to most Canadian stocks and has not experienced shareholder dilution recently.

- Get an in-depth perspective on Metavista3D's performance by reading our balance sheet health report here.

- Understand Metavista3D's track record by examining our performance history report.

Namibia Critical Metals (TSXV:NMI)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Namibia Critical Metals Inc. focuses on acquiring, exploring, developing, and evaluating a diversified portfolio of critical metals properties in Namibia with a market cap of CA$57.82 million.

Operations: Namibia Critical Metals Inc. has not reported any revenue segments.

Market Cap: CA$57.82M

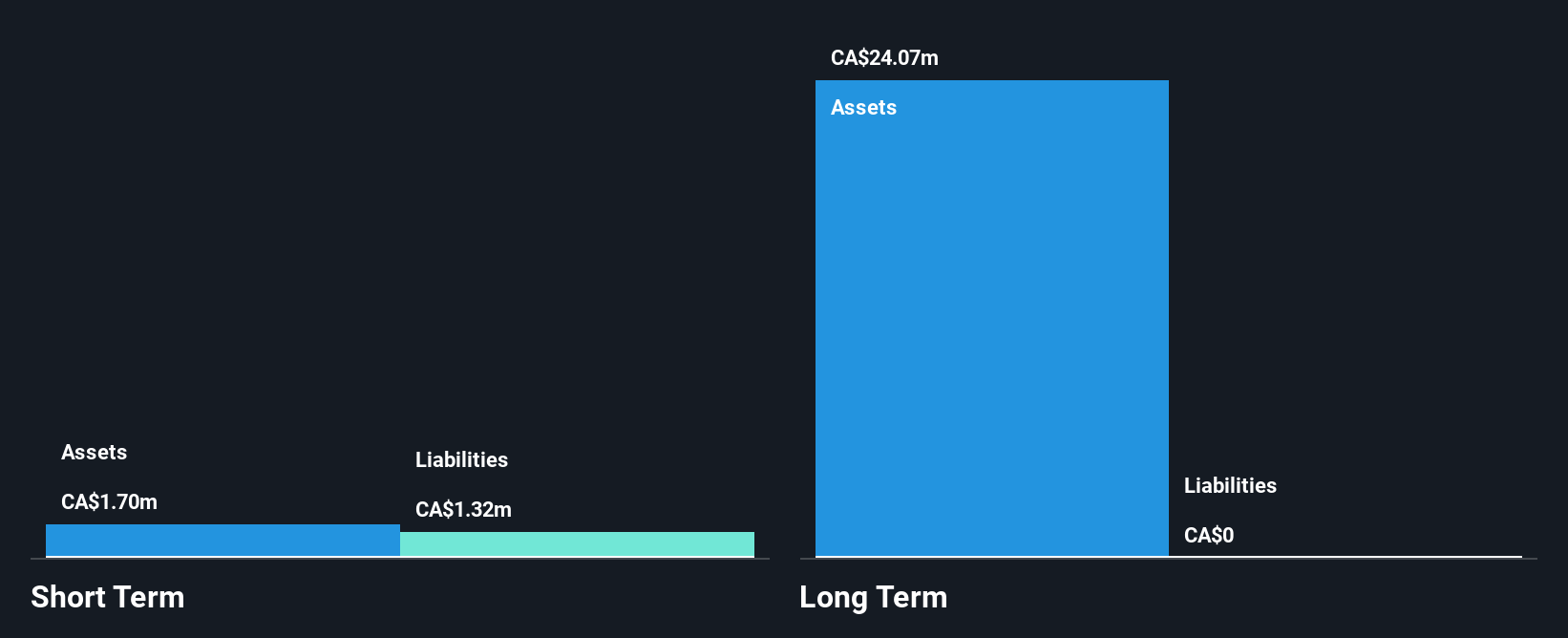

Namibia Critical Metals Inc., with a market cap of CA$57.82 million, is pre-revenue and focuses on critical metals exploration in Namibia. The company reported increased net losses for the third quarter and nine months ending August 31, 2025, compared to the previous year. Despite this, it remains debt-free with short-term assets exceeding liabilities and no long-term liabilities. The management team has an average tenure of 4.8 years, indicating experience. Although unprofitable, it has reduced losses over five years by 16.7% annually and maintains a cash runway exceeding one year based on current free cash flow trends.

- Click here and access our complete financial health analysis report to understand the dynamics of Namibia Critical Metals.

- Examine Namibia Critical Metals' past performance report to understand how it has performed in prior years.

Make It Happen

- Gain an insight into the universe of 393 TSX Penny Stocks by clicking here.

- Ready To Venture Into Other Investment Styles? AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Namibia Critical Metals might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:NMI

Namibia Critical Metals

Engages in the acquisition, exploration, development, and evaluation of a diversified portfolio of critical metals properties in Namibia.

Flawless balance sheet with low risk.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Rocket Lab USA Will Ignite a 30% Revenue Growth Journey

Dollar general to grow

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026