It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

In contrast to all that, many investors prefer to focus on companies like ADF Group (TSE:DRX), which has not only revenues, but also profits. While profit isn't the sole metric that should be considered when investing, it's worth recognising businesses that can consistently produce it.

See our latest analysis for ADF Group

How Fast Is ADF Group Growing Its Earnings Per Share?

Investors and investment funds chase profits, and that means share prices tend rise with positive earnings per share (EPS) outcomes. So for many budding investors, improving EPS is considered a good sign. It's an outstanding feat for ADF Group to have grown EPS from CA$0.49 to CA$1.59 in just one year. Even though that growth rate may not be repeated, that looks like a breakout improvement. Could this be a sign that the business has reached an inflection point?

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. The music to the ears of ADF Group shareholders is that EBIT margins have grown from 9.5% to 18% in the last 12 months and revenues are on an upwards trend as well. That's great to see, on both counts.

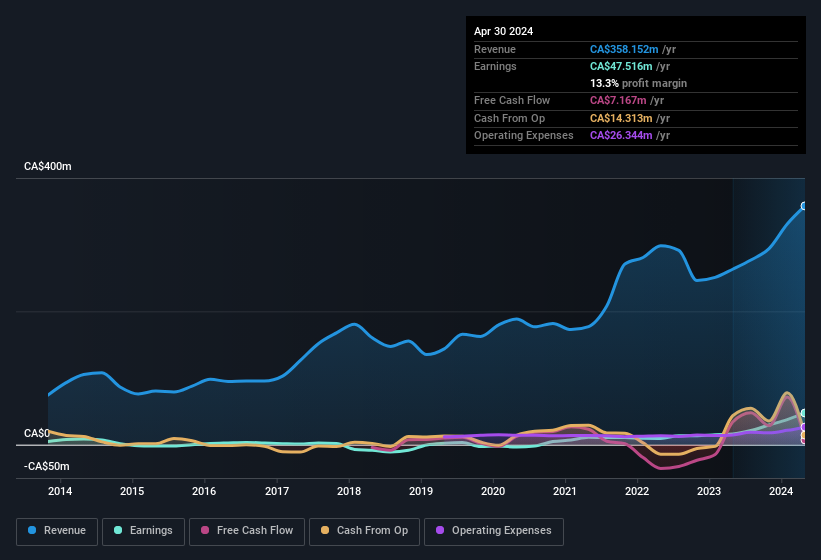

You can take a look at the company's revenue and earnings growth trend, in the chart below. Click on the chart to see the exact numbers.

Since ADF Group is no giant, with a market capitalisation of CA$380m, you should definitely check its cash and debt before getting too excited about its prospects.

Are ADF Group Insiders Aligned With All Shareholders?

It's said that there's no smoke without fire. For investors, insider buying is often the smoke that indicates which stocks could set the market alight. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

Not only did ADF Group insiders refrain from selling stock during the year, but they also spent CA$121k buying it. This is a good look for the company as it paints an optimistic picture for the future. Zooming in, we can see that the biggest insider purchase was by Independent Director Jean Rochette for CA$100k worth of shares, at about CA$5.04 per share.

The good news, alongside the insider buying, for ADF Group bulls is that insiders (collectively) have a meaningful investment in the stock. Given insiders own a significant chunk of shares, currently valued at CA$106m, they have plenty of motivation to push the business to succeed. That holding amounts to 28% of the stock on issue, thus making insiders influential owners of the business and aligned with the interests of shareholders.

Does ADF Group Deserve A Spot On Your Watchlist?

ADF Group's earnings per share have been soaring, with growth rates sky high. What's more, insiders own a significant stake in the company and have been buying more shares. This quick rundown suggests that the business may be of good quality, and also at an inflection point, so maybe ADF Group deserves timely attention. It is worth noting though that we have found 1 warning sign for ADF Group that you need to take into consideration.

Keen growth investors love to see insider activity. Thankfully, ADF Group isn't the only one. You can see a a curated list of Canadian companies which have exhibited consistent growth accompanied by high insider ownership.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:DRX

ADF Group

Engages in the design and engineering of connections including industrial coatings in Canada and the United States.

Flawless balance sheet with high growth potential.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Cheap if able to sustain revenue, and a potential bargain if able to turn store openings into revenue growth

Butler National (Buks) outperforms.

A tech powerhouse quietly powering the world’s AI infrastructure.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)