- Canada

- /

- Metals and Mining

- /

- TSX:CXB

Shareholders May Not Be So Generous With Calibre Mining Corp.'s (TSE:CXB) CEO Compensation And Here's Why

Key Insights

- Calibre Mining's Annual General Meeting to take place on 12th of June

- Total pay for CEO Darren Hall includes US$415.1k salary

- The total compensation is similar to the average for the industry

- Calibre Mining's three-year loss to shareholders was 13% while its EPS was down 26% over the past three years

In the past three years, the share price of Calibre Mining Corp. (TSE:CXB) has struggled to generate growth for its shareholders. Per share earnings growth is also lacking, despite revenue growth. Shareholders will have a chance to take their concerns to the board at the next AGM on 12th of June and vote on resolutions including executive compensation, which studies show may have an impact on company performance. Here's why we think shareholders should hold off on a raise for the CEO at the moment.

View our latest analysis for Calibre Mining

Comparing Calibre Mining Corp.'s CEO Compensation With The Industry

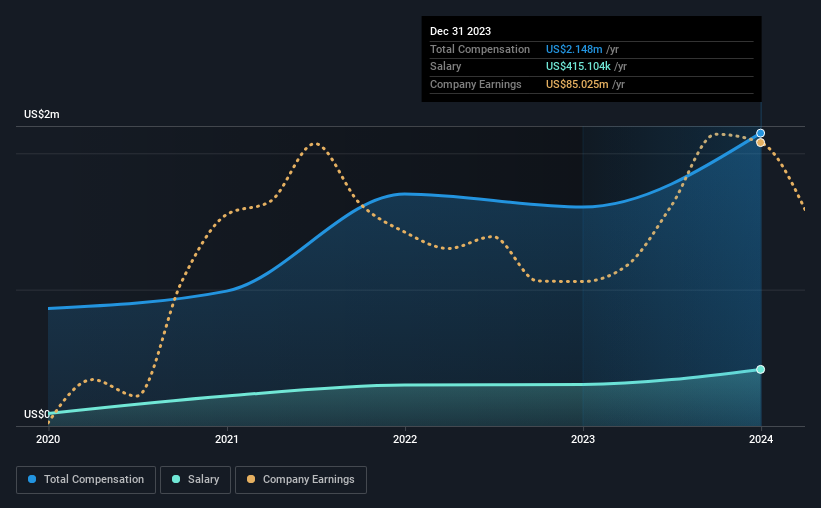

According to our data, Calibre Mining Corp. has a market capitalization of CA$1.6b, and paid its CEO total annual compensation worth US$2.1m over the year to December 2023. We note that's an increase of 34% above last year. While this analysis focuses on total compensation, it's worth acknowledging that the salary portion is lower, valued at US$415k.

In comparison with other companies in the Canadian Metals and Mining industry with market capitalizations ranging from CA$547m to CA$2.2b, the reported median CEO total compensation was US$1.8m. From this we gather that Darren Hall is paid around the median for CEOs in the industry. Moreover, Darren Hall also holds CA$5.0m worth of Calibre Mining stock directly under their own name, which reveals to us that they have a significant personal stake in the company.

| Component | 2023 | 2022 | Proportion (2023) |

| Salary | US$415k | US$304k | 19% |

| Other | US$1.7m | US$1.3m | 81% |

| Total Compensation | US$2.1m | US$1.6m | 100% |

Talking in terms of the industry, salary represented approximately 94% of total compensation out of all the companies we analyzed, while other remuneration made up 6% of the pie. Calibre Mining sets aside a smaller share of compensation for salary, in comparison to the overall industry. If non-salary compensation dominates total pay, it's an indicator that the executive's salary is tied to company performance.

Calibre Mining Corp.'s Growth

Over the last three years, Calibre Mining Corp. has shrunk its earnings per share by 26% per year. Its revenue is up 30% over the last year.

Investors would be a bit wary of companies that have lower EPS But on the other hand, revenue growth is strong, suggesting a brighter future. In conclusion we can't form a strong opinion about business performance yet; but it's one worth watching. Historical performance can sometimes be a good indicator on what's coming up next but if you want to peer into the company's future you might be interested in this free visualization of analyst forecasts.

Has Calibre Mining Corp. Been A Good Investment?

With a three year total loss of 13% for the shareholders, Calibre Mining Corp. would certainly have some dissatisfied shareholders. So shareholders would probably want the company to be less generous with CEO compensation.

In Summary...

The loss to shareholders over the past three years is certainly concerning and possibly has something to do with the fact that the company's earnings haven't grown. In the upcoming AGM, shareholders will get the opportunity to discuss any issues with the board, including those related to CEO remuneration and assess if the board's plan is in line with their expectations.

CEO compensation is an important area to keep your eyes on, but we've also need to pay attention to other attributes of the company. That's why we did our research, and identified 2 warning signs for Calibre Mining (of which 1 is significant!) that you should know about in order to have a holistic understanding of the stock.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:CXB

Calibre Mining

Engages in the exploration, development, and mining of gold properties.

Adequate balance sheet and fair value.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)