- Canada

- /

- Metals and Mining

- /

- TSX:CGG

3 TSX Stocks That May Be Trading Up To 28.7% Below Intrinsic Value Estimates

Reviewed by Simply Wall St

With Canada's election now behind it, a significant source of uncertainty has been removed, allowing policymakers to focus on trade and economic issues. As the newly formed government considers fiscal stimulus and potential interest rate cuts to support growth, investors may find opportunities in stocks that appear undervalued against intrinsic value estimates.

Top 10 Undervalued Stocks Based On Cash Flows In Canada

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Propel Holdings (TSX:PRL) | CA$29.57 | CA$44.34 | 33.3% |

| Badger Infrastructure Solutions (TSX:BDGI) | CA$40.52 | CA$75.71 | 46.5% |

| Docebo (TSX:DCBO) | CA$43.44 | CA$78.95 | 45% |

| Savaria (TSX:SIS) | CA$17.82 | CA$30.26 | 41.1% |

| Enterprise Group (TSX:E) | CA$1.61 | CA$2.85 | 43.5% |

| Lithium Royalty (TSX:LIRC) | CA$5.45 | CA$8.39 | 35% |

| Cameco (TSX:CCO) | CA$66.29 | CA$92.92 | 28.7% |

| AtkinsRéalis Group (TSX:ATRL) | CA$71.21 | CA$112.54 | 36.7% |

| Obsidian Energy (TSX:OBE) | CA$5.58 | CA$8.58 | 35% |

| CAE (TSX:CAE) | CA$35.01 | CA$57.11 | 38.7% |

Underneath we present a selection of stocks filtered out by our screen.

Cameco (TSX:CCO)

Overview: Cameco Corporation supplies uranium for electricity generation and has a market cap of CA$27.91 billion.

Operations: The company's revenue segments consist of CA$2.73 billion from Uranium, CA$521.38 million from Fuel Services, and CA$3.01 billion from Westinghouse (WEC).

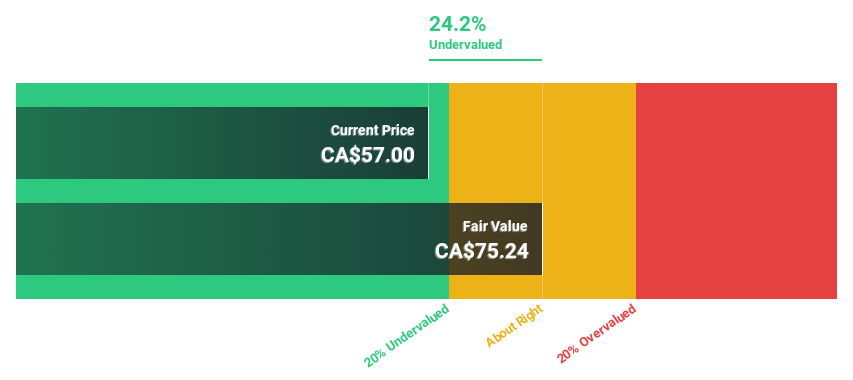

Estimated Discount To Fair Value: 28.7%

Cameco's recent earnings report shows a turnaround with a net income of CAD 69.76 million for Q1 2025, compared to a loss last year. The stock is trading at CA$66.29, significantly below its estimated fair value of CA$92.92, indicating it may be undervalued based on cash flows. Analysts expect robust earnings growth of 27.8% annually over the next three years, outpacing the Canadian market's average growth rate of 16%.

- Our expertly prepared growth report on Cameco implies its future financial outlook may be stronger than recent results.

- Navigate through the intricacies of Cameco with our comprehensive financial health report here.

China Gold International Resources (TSX:CGG)

Overview: China Gold International Resources Corp. Ltd. is a mining company focused on acquiring, exploring, developing, and mining gold and base metal resources in China and Canada, with a market cap of approximately CA$3.50 billion.

Operations: The company's revenue segments include Mine - Produced Gold at $246.95 million and Mine - Produced Copper Concentrate at $509.70 million.

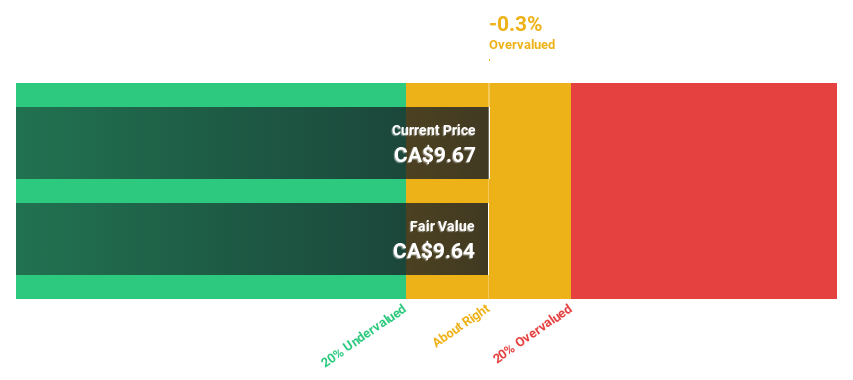

Estimated Discount To Fair Value: 14.2%

China Gold International Resources reported a net income of US$62.73 million for 2024, rebounding from a loss the previous year, with sales rising to US$756.65 million. Trading at CA$9, the stock is below its estimated fair value of CA$10.49 and offers potential value based on cash flows. Earnings are expected to grow significantly at 38% annually over three years, surpassing Canadian market averages despite slower revenue growth projections.

- Our comprehensive growth report raises the possibility that China Gold International Resources is poised for substantial financial growth.

- Click to explore a detailed breakdown of our findings in China Gold International Resources' balance sheet health report.

Colliers International Group (TSX:CIGI)

Overview: Colliers International Group Inc. is a global provider of commercial real estate services to corporate and institutional clients, with a market cap of CA$8.52 billion.

Operations: Colliers International Group Inc. generates revenue through its diverse commercial real estate services offered to clients across various regions, including the United States, Canada, Europe, Australia, the United Kingdom, Poland, China, and India.

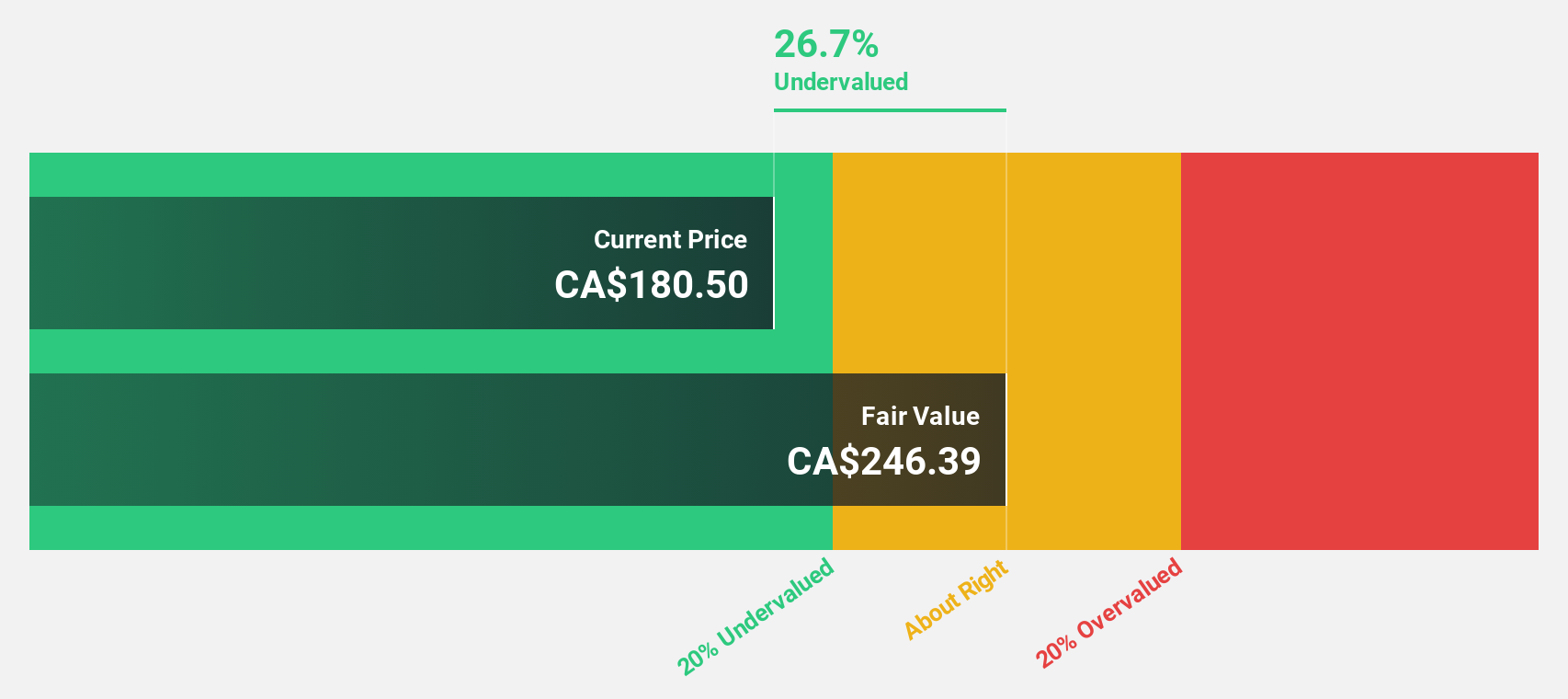

Estimated Discount To Fair Value: 23.1%

Colliers International Group is trading at CA$163.22, below its estimated fair value of CA$212.2, presenting a potential opportunity based on cash flows. Despite a recent net loss of US$4.26 million for Q1 2025, earnings are forecast to grow at 16.37% annually, outpacing the Canadian market average of 15.9%. However, the company faces challenges with high debt levels and slower revenue growth projections compared to significant profit growth expectations.

- Upon reviewing our latest growth report, Colliers International Group's projected financial performance appears quite optimistic.

- Get an in-depth perspective on Colliers International Group's balance sheet by reading our health report here.

Key Takeaways

- Dive into all 19 of the Undervalued TSX Stocks Based On Cash Flows we have identified here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:CGG

China Gold International Resources

A gold and base metal mining company, acquires, explores, develops, and mines mineral resources in the People’s Republic of China and Canada.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives