- Canada

- /

- Metals and Mining

- /

- TSX:CG

Is Centerra Gold’s (TSX:CG) Crane Creek Earn-In Sharpening Its North American Growth Strategy?

Reviewed by Sasha Jovanovic

- In December 2025, Headwater Gold Inc. announced a definitive earn-in agreement allowing a Centerra Gold Inc. subsidiary to acquire up to a 70% interest in the fully permitted Crane Creek gold project in Idaho through up to US$25,000,000 in staged exploration expenditures and completion of a preliminary economic assessment.

- The deal gives Centerra operatorship and a path to majority ownership at Crane Creek, adding another early-stage North American exploration option that could complement its existing project pipeline if exploration results prove successful.

- We’ll now examine how Centerra’s option to fund up to US$25,000,000 at Crane Creek may influence its existing investment narrative.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Centerra Gold Investment Narrative Recap

To own Centerra Gold, you generally need to believe its existing mines and defined projects can offset cost pressures and royalty burdens while funding growth without stressing the balance sheet. The Crane Creek earn in looks incremental rather than a major swing factor, so it does not change the near term focus on execution at Mount Milligan, Oksut and the restart projects, nor the key risk that high all in sustaining costs could pressure margins if gold prices ease.

The Crane Creek option fits alongside Centerra’s broader project pipeline, but the more immediate context comes from its November 2025 decision to extend share buybacks and maintain its quarterly dividend. That capital return profile, underpinned by recent profitability and a debt free balance sheet, remains more central to the current equity story than early stage exploration in Idaho, even if successful drilling at Crane Creek could add longer term optionality.

Yet investors also need to weigh how high all in sustaining costs could affect Centerra if gold prices were to...

Read the full narrative on Centerra Gold (it's free!)

Centerra Gold's narrative projects $1.6 billion revenue and $106.3 million earnings by 2028.

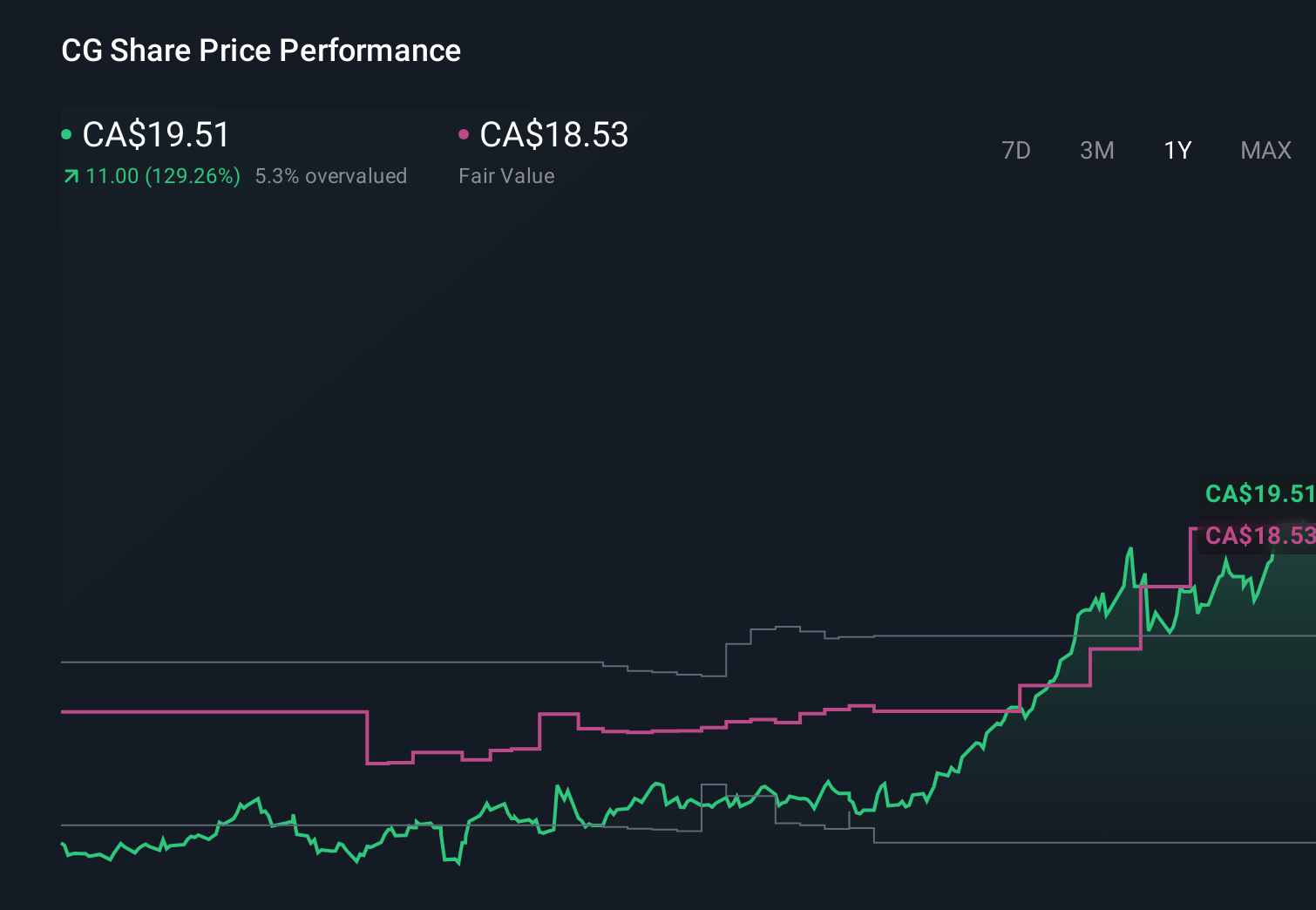

Uncover how Centerra Gold's forecasts yield a CA$18.53 fair value, a 5% downside to its current price.

Exploring Other Perspectives

Eight fair value estimates from the Simply Wall St Community range from CA$7.07 to CA$34.70, showing how far apart individual views on Centerra can be. Against this spread, the company’s reliance on higher gold prices to support margins amid elevated all in sustaining costs gives you a clear reason to compare several different risk and reward cases before deciding how it might fit in your portfolio.

Explore 8 other fair value estimates on Centerra Gold - why the stock might be worth as much as 78% more than the current price!

Build Your Own Centerra Gold Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Centerra Gold research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Centerra Gold research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Centerra Gold's overall financial health at a glance.

Seeking Other Investments?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 36 companies in the world exploring or producing it. Find the list for free.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:CG

Centerra Gold

Engages in the acquisition, exploration, development, and operation of gold and copper properties in North America, Turkey, and internationally.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)