- Canada

- /

- Paper and Forestry Products

- /

- TSX:CFX

This Insider Has Just Sold Shares In Canfor Pulp Products Inc. (TSE:CFX)

We'd be surprised if Canfor Pulp Products Inc. (TSE:CFX) shareholders haven't noticed that an insider, Peter John Bentley, recently sold CA$141k worth of stock at CA$7.06 per share. However, the silver lining is that the sale only reduced their total holding by 2.1%, so we're hesitant to read anything much into it, on its own.

See our latest analysis for Canfor Pulp Products

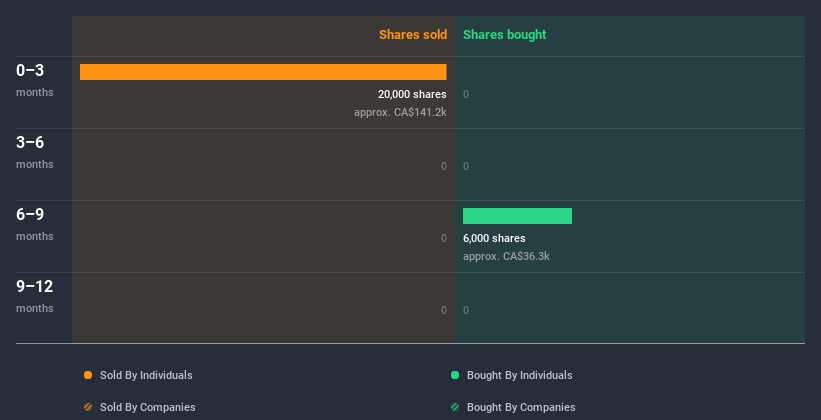

The Last 12 Months Of Insider Transactions At Canfor Pulp Products

In fact, the recent sale by Peter John Bentley was the biggest sale of Canfor Pulp Products shares made by an insider individual in the last twelve months, according to our records. So it's clear an insider wanted to take some cash off the table, even below the current price of CA$7.46. We generally consider it a negative if insiders have been selling, especially if they did so below the current price, because it implies that they considered a lower price to be reasonable. While insider selling is not a positive sign, we can't be sure if it does mean insiders think the shares are fully valued, so it's only a weak sign. We note that the biggest single sale was only 2.1%of Peter John Bentley's holding.

The chart below shows insider transactions (by companies and individuals) over the last year. By clicking on the graph below, you can see the precise details of each insider transaction!

I will like Canfor Pulp Products better if I see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Insider Ownership

Another way to test the alignment between the leaders of a company and other shareholders is to look at how many shares they own. I reckon it's a good sign if insiders own a significant number of shares in the company. From what we can see in our data, insiders own only about CA$855k worth of Canfor Pulp Products shares. We might be missing something but that seems like very low insider ownership.

So What Do The Canfor Pulp Products Insider Transactions Indicate?

An insider sold Canfor Pulp Products shares recently, but they didn't buy any. Zooming out, the longer term picture doesn't give us much comfort. When you consider that most companies have higher levels of insider ownership, we're a little wary. So we're not rushing to buy, to say the least. In addition to knowing about insider transactions going on, it's beneficial to identify the risks facing Canfor Pulp Products. Case in point: We've spotted 2 warning signs for Canfor Pulp Products you should be aware of.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of interesting companies, that have HIGH return on equity and low debt.

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions, but not derivative transactions.

If you’re looking to trade Canfor Pulp Products, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About TSX:CFX

Canfor Pulp Products

Produces and supplies pulp and paper products worldwide.

Undervalued with low risk.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)