- Canada

- /

- Real Estate

- /

- TSX:CIGI

Top TSX Growth Companies With Insider Ownership In October 2024

Reviewed by Simply Wall St

Over the last 12 months, the Canadian market has experienced a robust upswing with a 23% increase, and earnings are projected to grow by 15% annually. In this thriving environment, growth companies with high insider ownership can be particularly appealing as they often indicate strong confidence from those closest to the business in its future potential.

Top 10 Growth Companies With High Insider Ownership In Canada

| Name | Insider Ownership | Earnings Growth |

| Vox Royalty (TSX:VOXR) | 11.8% | 70.7% |

| Almonty Industries (TSX:AII) | 17.7% | 117.6% |

| goeasy (TSX:GSY) | 21.2% | 17.1% |

| Alvopetro Energy (TSXV:ALV) | 19.4% | 76.5% |

| VersaBank (TSX:VBNK) | 13.3% | 30.4% |

| Aritzia (TSX:ATZ) | 18.9% | 59.7% |

| Aya Gold & Silver (TSX:AYA) | 10.2% | 71.4% |

| Allied Gold (TSX:AAUC) | 18.3% | 73% |

| Medicenna Therapeutics (TSX:MDNA) | 15.4% | 57.2% |

| Alpha Cognition (CNSX:ACOG) | 17% | 69.5% |

Let's dive into some prime choices out of the screener.

Aya Gold & Silver (TSX:AYA)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Aya Gold & Silver Inc. is involved in the exploration, evaluation, and development of precious metals projects in Morocco, with a market cap of CA$2.40 billion.

Operations: The company's revenue is primarily derived from the production at the Zgounder Silver Mine in Morocco, amounting to $41.54 million.

Insider Ownership: 10.2%

Aya Gold & Silver demonstrates significant growth potential, with earnings forecasted to grow 71.38% annually, outpacing the Canadian market. Recent exploration at Boumadine in Morocco revealed high-grade silver results and expanded mineralized trends, enhancing its resource base. The company is also spinning out its Amizmiz Gold Project into Mx2 Mining, maintaining majority ownership which could unlock further value. Despite past shareholder dilution, insider ownership remains high, aligning management's interests with investors'.

- Click to explore a detailed breakdown of our findings in Aya Gold & Silver's earnings growth report.

- According our valuation report, there's an indication that Aya Gold & Silver's share price might be on the expensive side.

Colliers International Group (TSX:CIGI)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Colliers International Group Inc. offers commercial real estate professional and investment management services to corporate and institutional clients globally, with a market cap of CA$10.38 billion.

Operations: The company's revenue is derived from several segments: Americas ($2.59 billion), Asia Pacific ($614.55 million), Investment Management ($496.42 million), and Europe, Middle East & Africa (EMEA) ($734.93 million).

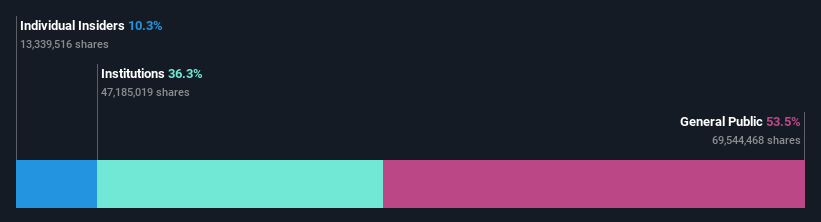

Insider Ownership: 14.1%

Colliers International Group shows strong growth potential, with earnings expected to rise significantly at 20.8% annually, surpassing the Canadian market's average. The company's recent financial results highlight a turnaround from losses to a net income of US$36.72 million in Q2 2024. Despite no substantial insider buying recently and some significant selling, Colliers maintains robust revenue forecasts between 8% and 13%, bolstered by acquisitions like Englobe, although debt coverage remains a concern.

- Dive into the specifics of Colliers International Group here with our thorough growth forecast report.

- Upon reviewing our latest valuation report, Colliers International Group's share price might be too optimistic.

Artemis Gold (TSXV:ARTG)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Artemis Gold Inc. is a gold development company that specializes in identifying, acquiring, and developing gold properties, with a market cap of CA$3.09 billion.

Operations: Artemis Gold Inc. focuses on the identification, acquisition, and development of gold properties without currently reporting any revenue segments.

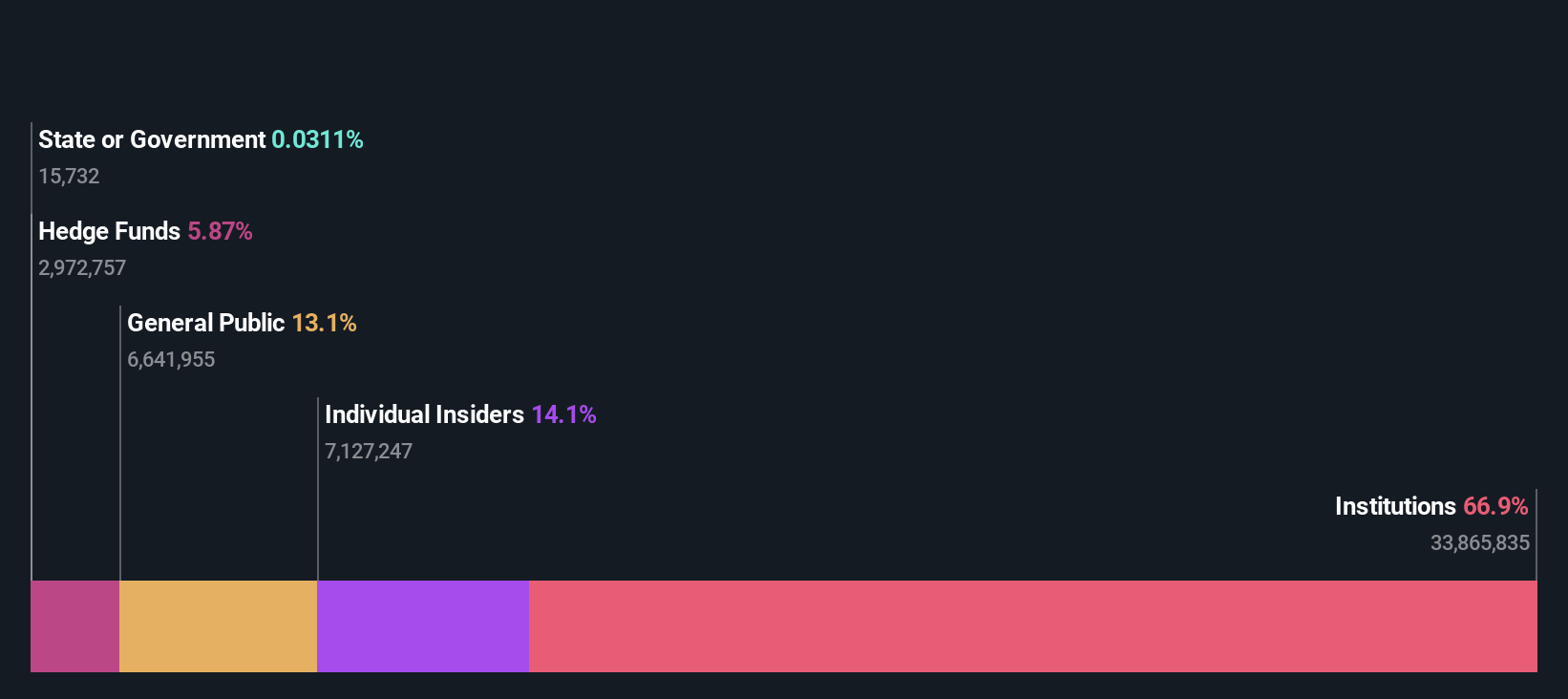

Insider Ownership: 29.9%

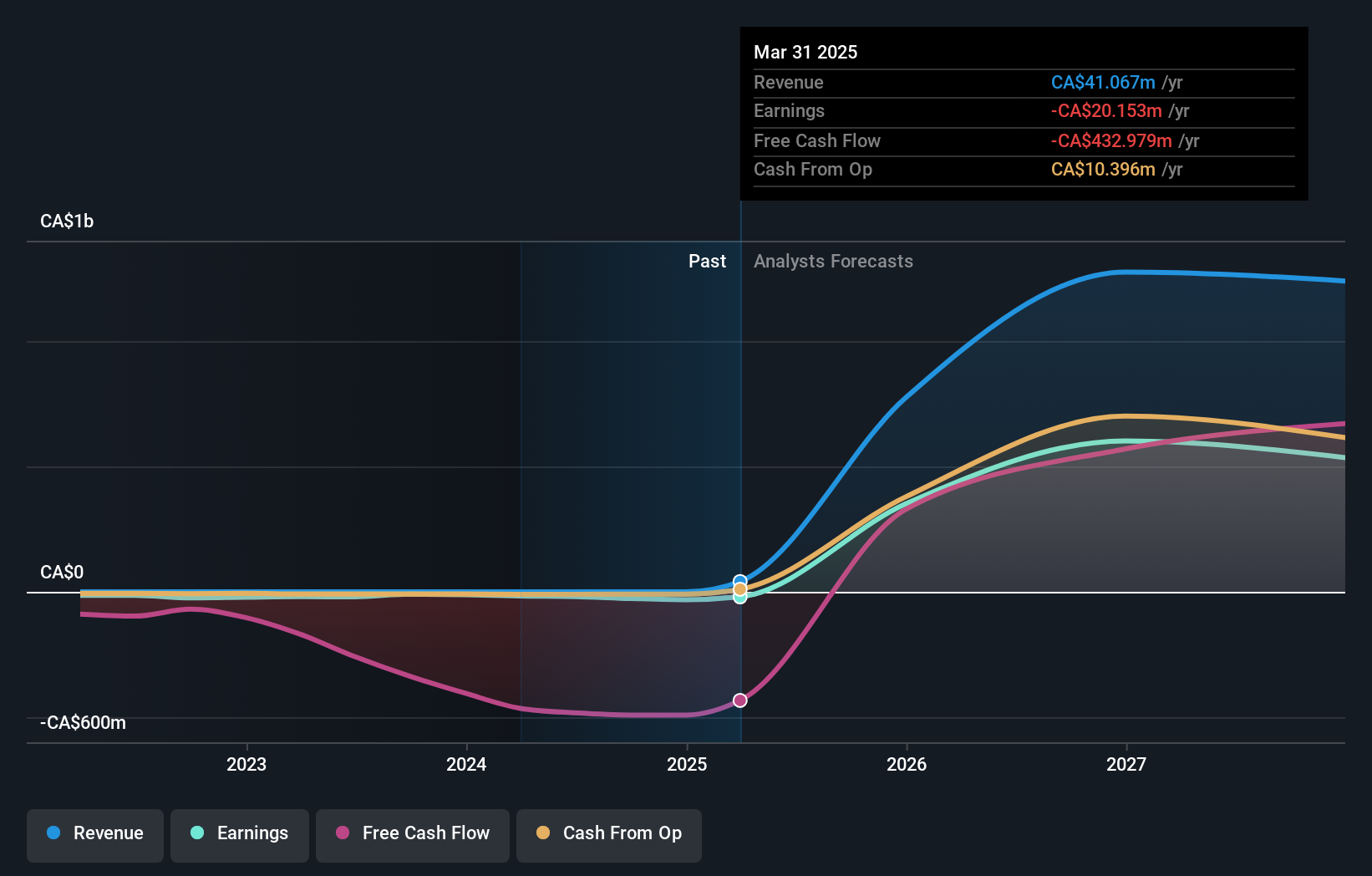

Artemis Gold is poised for significant growth, with revenue projected to increase by 45.9% annually, outpacing the Canadian market. Despite recent losses, the company is on track to become profitable within three years. The Blackwater Mine project is over 95% complete and fully funded, targeting its first gold pour in late Q4 2024. Challenges like wildfire delays have been mitigated through cost-saving measures and schedule acceleration initiatives to maintain progress.

- Click here and access our complete growth analysis report to understand the dynamics of Artemis Gold.

- Our expertly prepared valuation report Artemis Gold implies its share price may be lower than expected.

Where To Now?

- Take a closer look at our Fast Growing TSX Companies With High Insider Ownership list of 35 companies by clicking here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:CIGI

Colliers International Group

Provides commercial real estate professional and investment management services to corporate and institutional clients in the Americas, Europe, the Middle East, Africa, and the Asia Pacific.

High growth potential with solid track record.