- Canada

- /

- Metals and Mining

- /

- TSX:IVN

3 Top Growth Companies With High Insider Ownership On The TSX

Reviewed by Simply Wall St

The Canadian market has been buoyed by recent interest rate cuts, with the TSX extending its gains as investors respond positively to the easing monetary policy. In this favorable environment, growth companies with high insider ownership can be particularly attractive, as they often signal strong internal confidence and alignment with shareholder interests.

Top 10 Growth Companies With High Insider Ownership In Canada

| Name | Insider Ownership | Earnings Growth |

| Vox Royalty (TSX:VOXR) | 12.3% | 70.7% |

| Allied Gold (TSX:AAUC) | 21.9% | 73.5% |

| Almonty Industries (TSX:AII) | 17.7% | 117.6% |

| goeasy (TSX:GSY) | 21.2% | 17.1% |

| Alvopetro Energy (TSXV:ALV) | 19.4% | 72.4% |

| Amerigo Resources (TSX:ARG) | 12% | 36.8% |

| Propel Holdings (TSX:PRL) | 40% | 37.2% |

| Aritzia (TSX:ATZ) | 18.9% | 60.4% |

| Medicenna Therapeutics (TSX:MDNA) | 15.4% | 57.2% |

| Alpha Cognition (CNSX:ACOG) | 17% | 69.5% |

Here's a peek at a few of the choices from the screener.

Aritzia (TSX:ATZ)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Aritzia Inc., with a market cap of CA$5.70 billion, designs, develops, and sells apparel and accessories for women in the United States and Canada.

Operations: The company's revenue segment includes CA$2.37 billion from apparel.

Insider Ownership: 18.9%

Earnings Growth Forecast: 60.4% p.a.

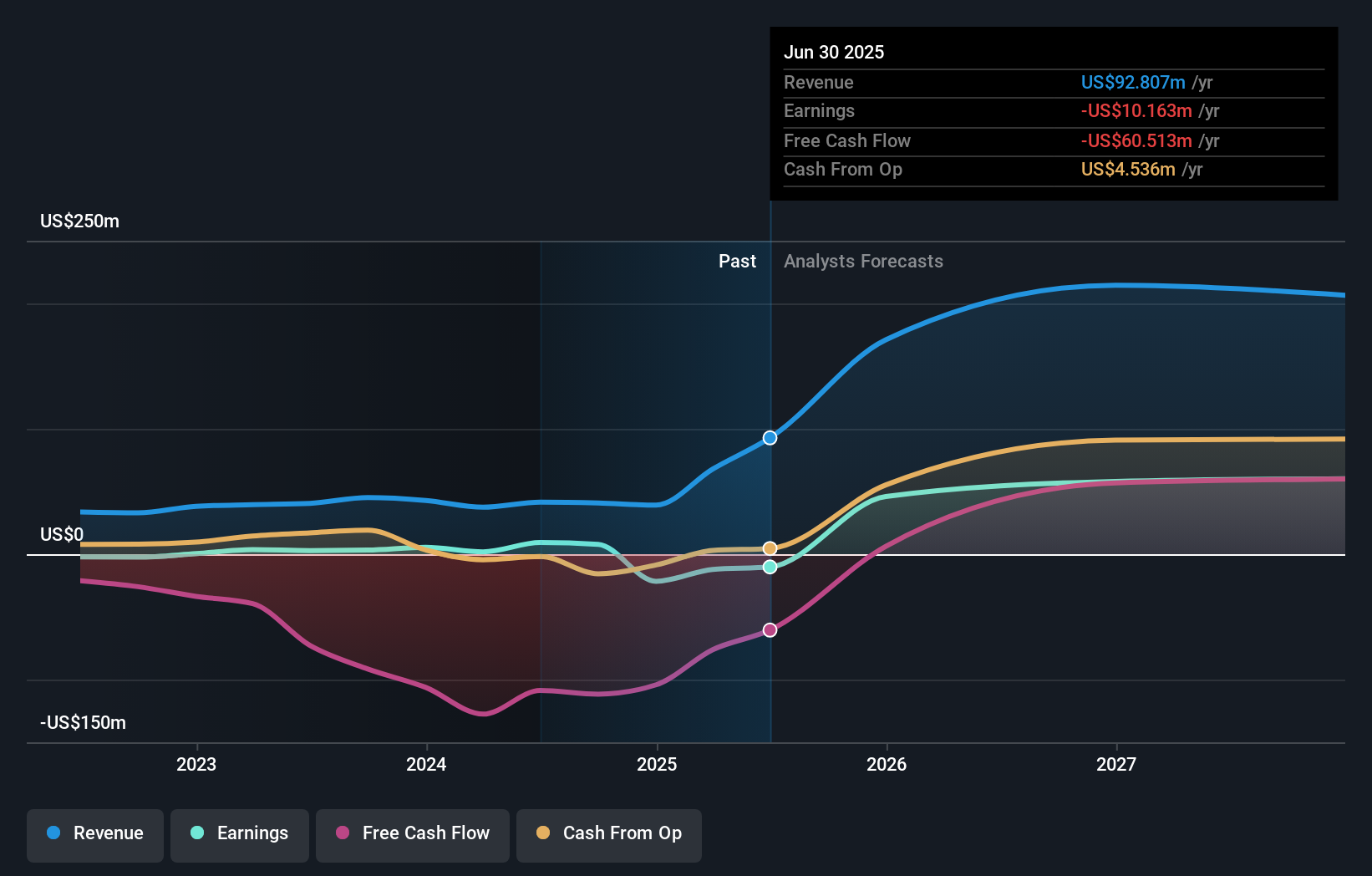

Aritzia, a growth company with high insider ownership in Canada, reported Q1 2024 sales of C$498.63 million, up from C$462.67 million last year, though net income slightly declined to C$15.83 million. Despite no recent insider buying or stock repurchases, the company forecasts strong revenue growth for FY 2025 between C$2.52 billion and C$2.62 billion and expects annual profit growth significantly above the market average at 60%.

- Click to explore a detailed breakdown of our findings in Aritzia's earnings growth report.

- Our valuation report here indicates Aritzia may be overvalued.

Aya Gold & Silver (TSX:AYA)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Aya Gold & Silver Inc. (TSX:AYA) explores, evaluates, and develops precious metals projects in Morocco with a market cap of CA$2.42 billion.

Operations: Aya Gold & Silver Inc. generated $41.54 million from the production at its Zgounder Silver Mine in Morocco.

Insider Ownership: 10.2%

Earnings Growth Forecast: 71.4% p.a.

Aya Gold & Silver, with significant insider ownership, is forecasted to grow earnings by 71.38% annually and revenue by 46.7% annually over the next three years. Recent high-grade drill results from its Boumadine project in Morocco extend the mineralized trend to 5.4km, indicating substantial upside potential. Despite past shareholder dilution, Aya's strategic expansions and strong financial performance—such as Q2 net income of US$6.84 million—underscore its growth trajectory in the Canadian market.

- Dive into the specifics of Aya Gold & Silver here with our thorough growth forecast report.

- In light of our recent valuation report, it seems possible that Aya Gold & Silver is trading beyond its estimated value.

Ivanhoe Mines (TSX:IVN)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Ivanhoe Mines Ltd. focuses on the mining, development, and exploration of minerals and precious metals primarily in Africa, with a market cap of CA$25.95 billion.

Operations: Ivanhoe Mines Ltd. generates revenue through its mining, development, and exploration activities of minerals and precious metals in Africa.

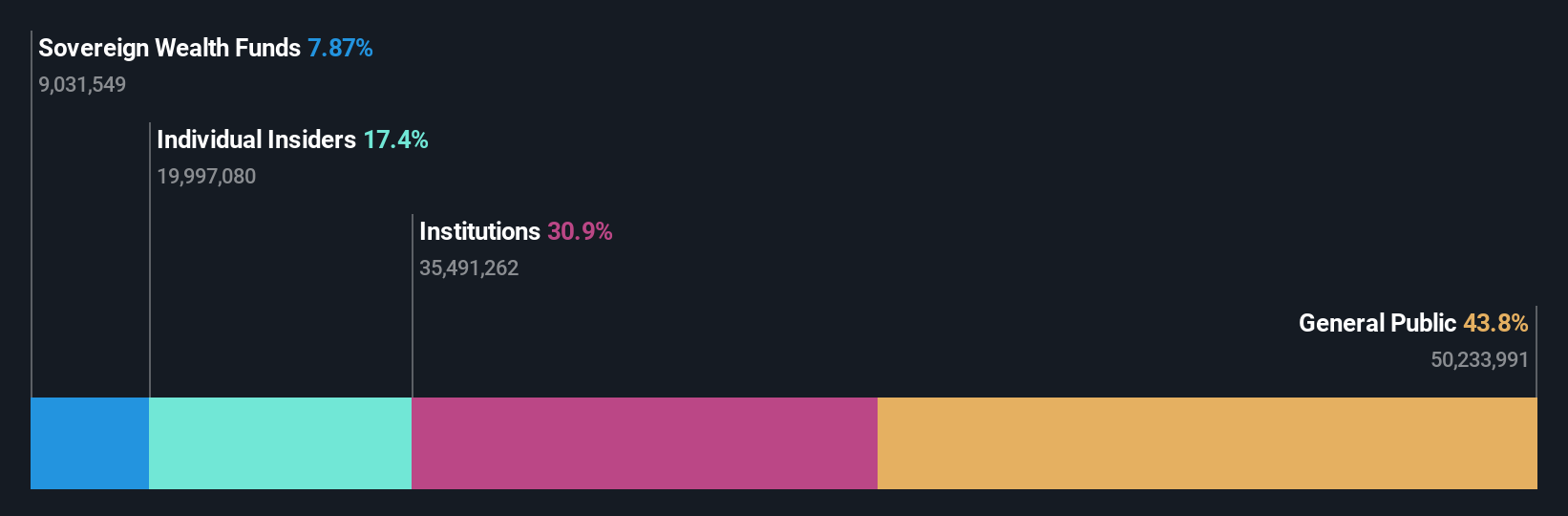

Insider Ownership: 12.3%

Earnings Growth Forecast: 68.3% p.a.

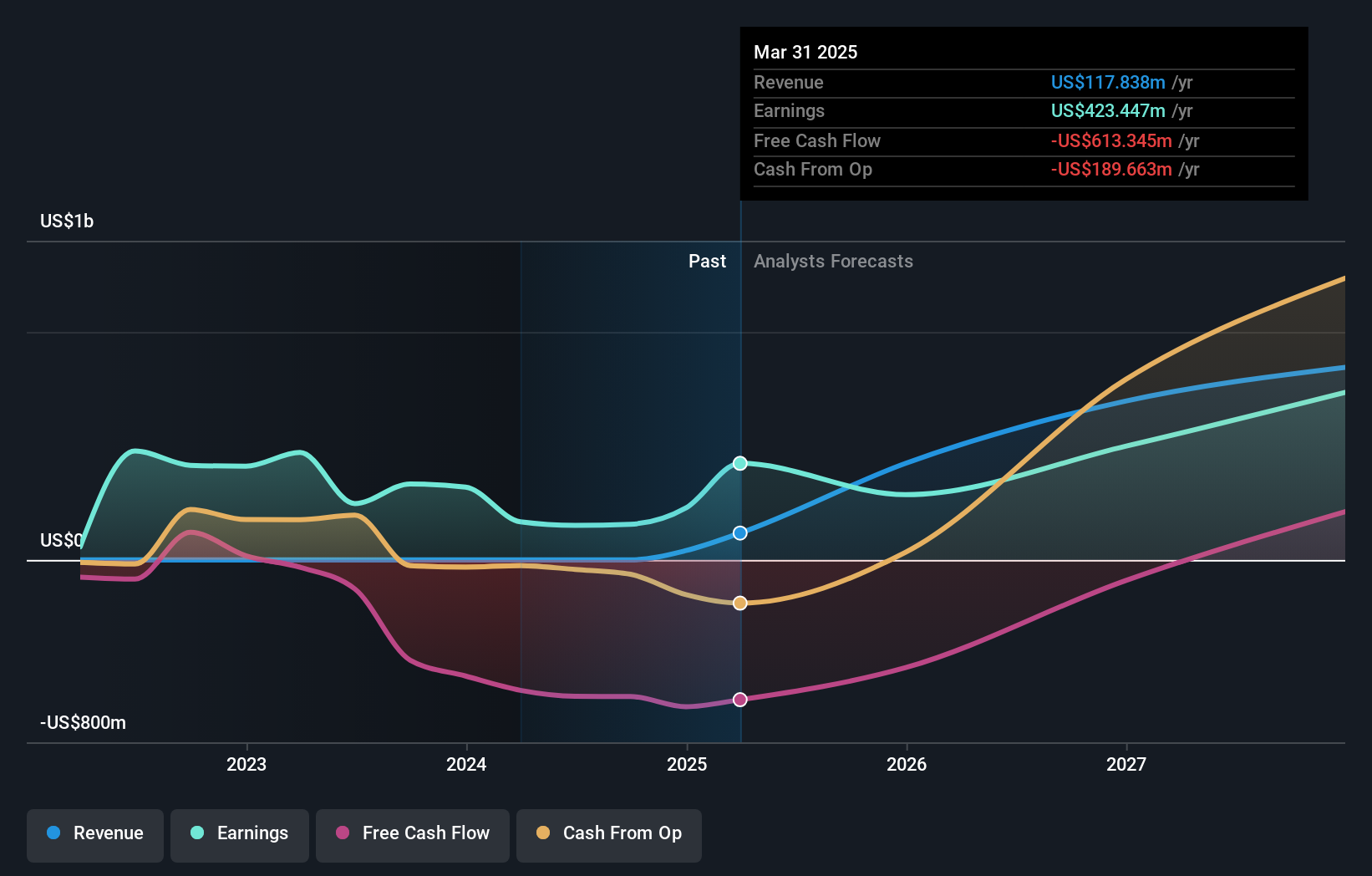

Ivanhoe Mines, a growth company with high insider ownership, is forecasted to grow earnings by 68.3% and revenue by 83.5% annually. Recent developments include a memorandum of understanding with Zambia's Ministry of Mines to co-develop mineral projects and record production figures at the Kamoa-Kakula Copper Complex in the DRC. Although shareholders have faced dilution, Ivanhoe trades below its estimated fair value and shows substantial potential for long-term growth in the Canadian market.

- Click here and access our complete growth analysis report to understand the dynamics of Ivanhoe Mines.

- The analysis detailed in our Ivanhoe Mines valuation report hints at an inflated share price compared to its estimated value.

Seize The Opportunity

- Click through to start exploring the rest of the 33 Fast Growing TSX Companies With High Insider Ownership now.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:IVN

Ivanhoe Mines

Engages in the mining, development, and exploration of minerals and precious metals primarily in Africa.

High growth potential and fair value.