- Canada

- /

- Metals and Mining

- /

- TSX:ARIS

Why Aris Mining (TSX:ARIS) Is Up 6.0% After Joining S&P/TSX Index on Gold Output Surge and What's Next

Reviewed by Simply Wall St

- Aris Mining Corporation recently announced that its common shares will be added to the S&P/TSX Composite Index on September 22, 2025, following a period of significant gold production growth at its Segovia Operations after the commissioning of a second mill this past June.

- This index inclusion and operational momentum reflect Aris Mining’s rising profile among Canada’s leading public companies and growing recognition of its progress expanding production capacity and advancing major projects in Latin America.

- We’ll explore how Aris Mining’s addition to the S&P/TSX Composite Index may influence the company’s growth narrative and investment outlook.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

Aris Mining Investment Narrative Recap

To own Aris Mining, investors need to believe that operational expansion in Colombia, especially at the Segovia and Marmato mines, will drive a step-change in production, margin, and future cash flow. The recent index inclusion confirms strong operational momentum, but short-term upside is still most closely tied to successful execution of the Segovia processing ramp-up, while risks remain high around cost overruns, delays, or unexpected operating issues tied to these projects. So far, this news strengthens the most important near-term catalyst but does not materially alter the main execution risks.

Among recent announcements, the affirmation of Aris Mining’s 2025 production guidance, 230,000 to 275,000 ounces, reinforces confidence that the Segovia expansion is progressing as planned. Meeting this guidance underpins analysts’ assumptions around future growth and plays directly into the market’s focus on operational delivery remaining on track for the year.

Yet, despite strong momentum, execution risk at Segovia and Marmato, including potential delays or cost overruns, remains something investors need to keep a close eye on…

Read the full narrative on Aris Mining (it's free!)

Aris Mining's outlook anticipates $1.5 billion in revenue and $695.3 million in earnings by 2028. This is based on a projected annual revenue growth rate of 32.4% and a substantial increase in earnings, up $690.2 million from current earnings of $5.1 million.

Uncover how Aris Mining's forecasts yield a CA$16.14 fair value, a 21% upside to its current price.

Exploring Other Perspectives

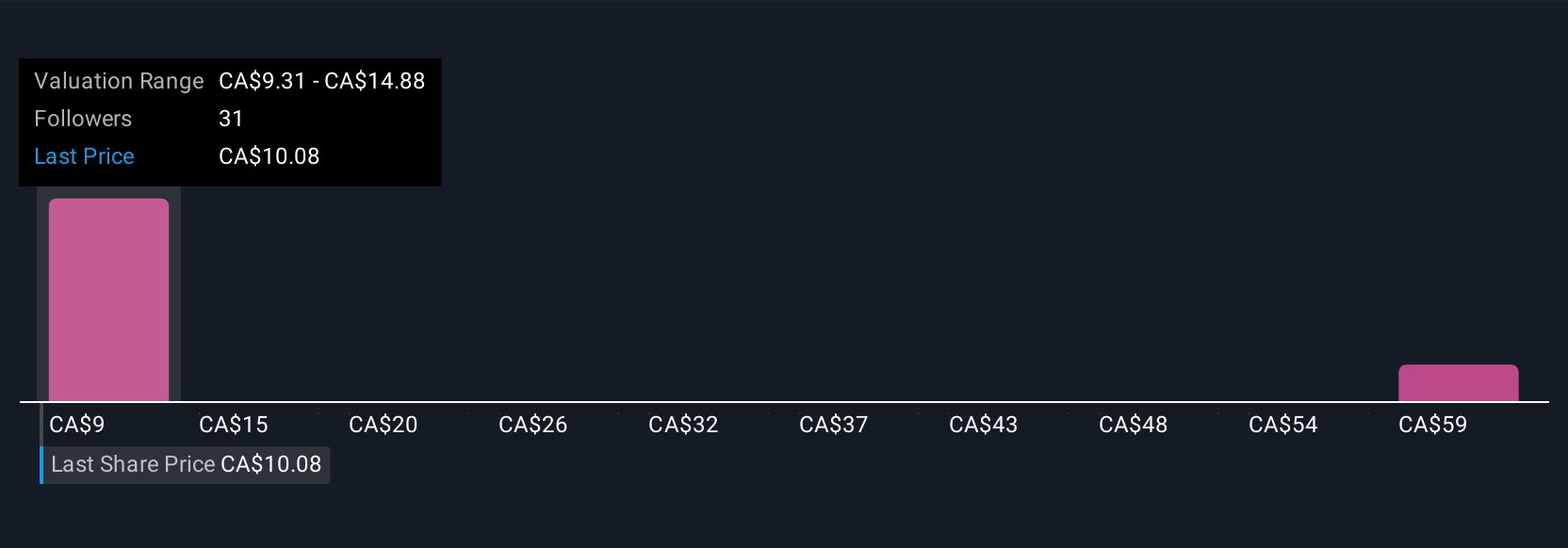

Simply Wall St Community fair value estimates for Aris Mining range from US$2.09 to US$65 across 7 contributor opinions. With production ramp-ups central to the growth story, opinions reflect how much forecasts can shift when margins and scaling deliver, or miss, expectations.

Explore 7 other fair value estimates on Aris Mining - why the stock might be worth less than half the current price!

Build Your Own Aris Mining Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Aris Mining research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Aris Mining research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Aris Mining's overall financial health at a glance.

Curious About Other Options?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- These 9 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Find companies with promising cash flow potential yet trading below their fair value.

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:ARIS

Aris Mining

Engages in the acquisition, exploration, development, and operation of gold properties in Canada, Colombia, and Guyana.

Exceptional growth potential with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Hitit Bilgisayar Hizmetleri will achieve a 19.7% revenue boost in the next five years

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)