- Canada

- /

- Metals and Mining

- /

- TSX:ARIS

Aris Mining (TSX:ARIS) Is Up 6.2% After New Segovia Mill Boosts Gold Output Capacity

Reviewed by Sasha Jovanovic

- Aris Mining recently reported a surge in gold output driven by its Segovia mine, where a second mill has boosted processing capacity and near-term production, while development at Marmato and other projects in Colombia and Guyana continues to advance.

- This combination of higher processing capacity, a progressing long-life project pipeline, and a solid cash position is reshaping how investors assess the company’s future operating profile and growth prospects.

- We’ll now examine how the new Segovia mill’s expanded capacity influences Aris Mining’s longer-term investment narrative and growth assumptions.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Aris Mining Investment Narrative Recap

To own Aris Mining, you need to believe its Colombian core plus longer-life projects like Marmato, Soto Norte, and Toroparu can translate higher current output into durable cash generation. The new Segovia mill materially supports the key short term catalyst of production growth, but it does not remove the main risk, which remains Colombia focused geopolitical, permitting, and ESG uncertainty that could slow or disrupt these assets.

The most relevant recent announcement is the commissioning of Segovia’s second mill, which lifted processing capacity from 2,000 tpd to 3,000 tpd and has already driven stronger group production. This reinforces the near term production ramp that underpins many investors’ expectations, while leaving execution risks at Segovia and Marmato, including potential delays and cost overruns, very much in focus.

Yet behind the higher output and strong cash position, investors still need to be aware of the company’s concentrated exposure to Colombian regulatory risk and...

Read the full narrative on Aris Mining (it's free!)

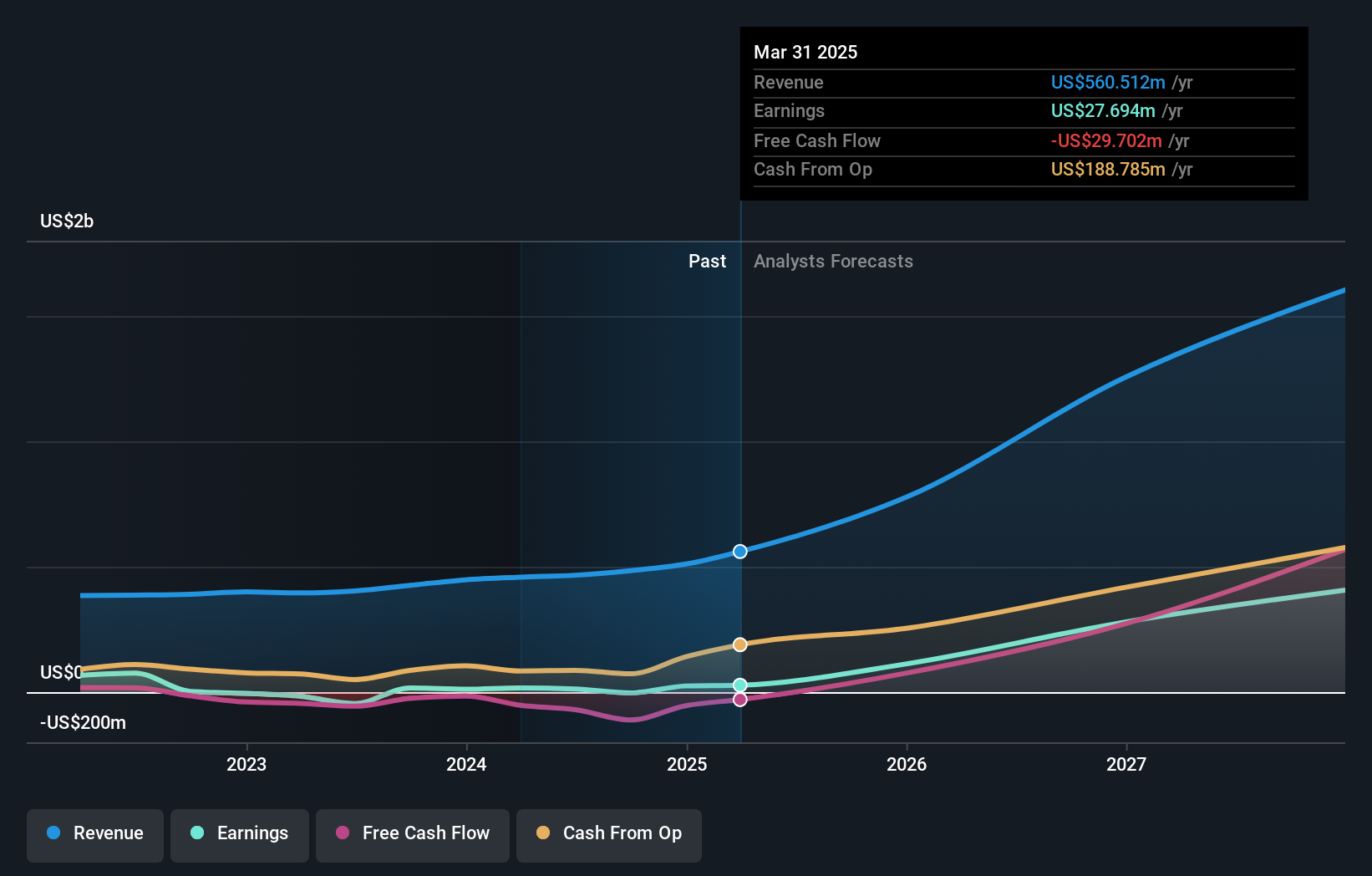

Aris Mining's narrative projects $1.5 billion revenue and $695.3 million earnings by 2028. This requires 32.4% yearly revenue growth and a $690.2 million earnings increase from $5.1 million today.

Uncover how Aris Mining's forecasts yield a CA$26.59 fair value, a 27% upside to its current price.

Exploring Other Perspectives

Seven fair value estimates from the Simply Wall St Community span a wide range, from US$4.47 to US$49 per share, showing how far apart individual views can be. When you set those opinions against Aris Mining’s heavy exposure to Colombian political and regulatory risk, it becomes even more important to compare several perspectives before forming a view on the company’s longer term performance.

Explore 7 other fair value estimates on Aris Mining - why the stock might be worth less than half the current price!

Build Your Own Aris Mining Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Aris Mining research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Aris Mining research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Aris Mining's overall financial health at a glance.

Ready For A Different Approach?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- We've found 11 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:ARIS

Aris Mining

Engages in the acquisition, exploration, development, and operation of gold properties in Canada, Colombia, and Guyana.

High growth potential with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Rocket Lab USA Will Ignite a 30% Revenue Growth Journey

Mastersystem Infotama will achieve 18.9% revenue growth as fair value hits IDR1,650

Insiders Sell, Investors Watch: What’s Going On at PG?

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Trending Discussion