- Canada

- /

- Oil and Gas

- /

- TSXV:LGN

TSX Growth Leaders With High Insider Confidence December 2025

Reviewed by Simply Wall St

As Canadian markets continue their upward trajectory with the TSX achieving impressive double-digit gains, investors are keenly observing key economic indicators and central bank decisions that could shape the financial landscape heading into 2026. In this environment, stocks with high insider ownership often signal strong confidence in a company's future prospects, making them particularly noteworthy for those seeking growth opportunities amidst evolving market conditions.

Top 10 Growth Companies With High Insider Ownership In Canada

| Name | Insider Ownership | Earnings Growth |

| Zedcor (TSXV:ZDC) | 19.2% | 122.6% |

| West Red Lake Gold Mines (TSXV:WRLG) | 11.1% | 78% |

| Stingray Group (TSX:RAY.A) | 22.9% | 33.9% |

| Robex Resources (TSXV:RBX) | 20.6% | 97.7% |

| Propel Holdings (TSX:PRL) | 30.6% | 30.6% |

| goeasy (TSX:GSY) | 21.7% | 27.3% |

| Enterprise Group (TSX:E) | 34.2% | 33.8% |

| CEMATRIX (TSX:CEMX) | 10.6% | 58.3% |

| Almonty Industries (TSX:AII) | 11.4% | 63.4% |

| Allied Gold (TSX:AAUC) | 15.4% | 104.6% |

Below we spotlight a couple of our favorites from our exclusive screener.

Almonty Industries (TSX:AII)

Simply Wall St Growth Rating: ★★★★★★

Overview: Almonty Industries Inc. is involved in the mining, processing, and shipping of tungsten concentrate with a market cap of CA$2.49 billion.

Operations: Revenue segments for Almonty Industries Inc. include mining, processing, and shipping of tungsten concentrate.

Insider Ownership: 11.4%

Revenue Growth Forecast: 53.2% p.a.

Almonty Industries is poised for substantial growth, with forecasts indicating revenue expansion of 53.2% annually and a high expected return on equity. The company has seen significant insider buying recently, suggesting confidence in its prospects. Despite past shareholder dilution, Almonty remains undervalued by 73% compared to fair value estimates. Recent developments include a $112.5 million equity offering and strategic U.S. expansion through the acquisition of the Gentung Browns Lake Tungsten Project, enhancing its global tungsten supply capabilities.

- Click to explore a detailed breakdown of our findings in Almonty Industries' earnings growth report.

- The analysis detailed in our Almonty Industries valuation report hints at an inflated share price compared to its estimated value.

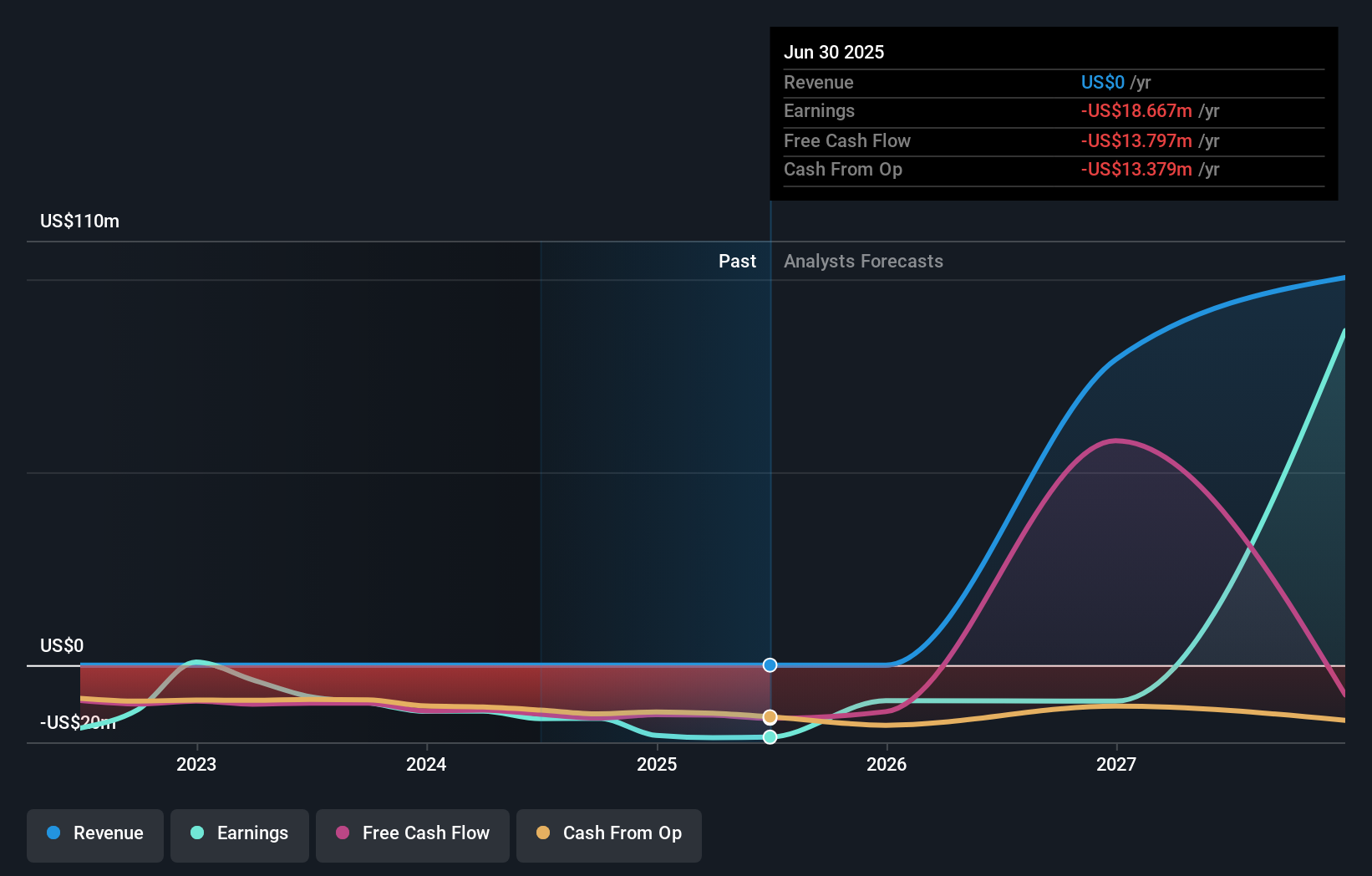

Meridian Mining (TSX:MNO)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Meridian Mining UK Societas focuses on acquiring, exploring, and developing mineral properties in Brazil and has a market cap of CA$648.88 million.

Operations: The company operates in the acquisition, exploration, and development of mineral properties within Brazil.

Insider Ownership: 12.3%

Revenue Growth Forecast: 58.6% p.a.

Meridian Mining is advancing its Cabacal project, receiving regulatory approval for a Preliminary Licence, a key step towards production. Despite recent losses of US$5.2 million in Q3 2025, the company is focused on development with significant insider buying indicating confidence. The anticipated revenue growth of 58.6% annually surpasses market averages, although past shareholder dilution remains a concern. Ongoing exploration at Cigarra and Santa Helena enhances Meridian's potential as it targets profitability within three years.

- Delve into the full analysis future growth report here for a deeper understanding of Meridian Mining.

- In light of our recent valuation report, it seems possible that Meridian Mining is trading beyond its estimated value.

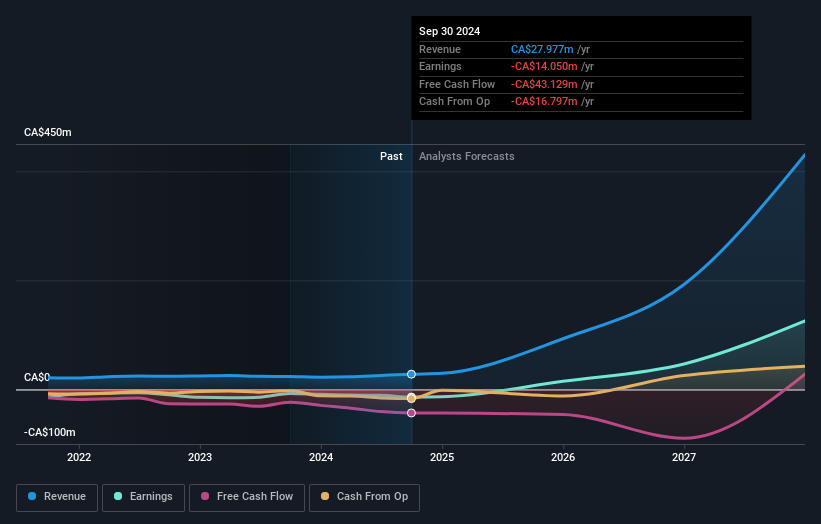

Logan Energy (TSXV:LGN)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Logan Energy Corp. is involved in the exploration, development, and production of crude oil and natural gas properties with a market cap of CA$494.41 million.

Operations: The company generates revenue of CA$146.21 million from its oil and gas exploration and production activities.

Insider Ownership: 20%

Revenue Growth Forecast: 28.2% p.a.

Logan Energy's recent earnings report shows significant growth, with Q3 revenue reaching C$46.19 million, up from C$29.01 million the previous year. Despite production guidance being slightly below expectations, the company achieved record quarterly production of 15,046 BOE/d. Logan's earnings are forecast to grow at a robust 30.8% annually over the next three years, outpacing market averages and reflecting strong potential for continued expansion without recent insider trading activity impacting investor confidence.

- Dive into the specifics of Logan Energy here with our thorough growth forecast report.

- The analysis detailed in our Logan Energy valuation report hints at an deflated share price compared to its estimated value.

Seize The Opportunity

- Investigate our full lineup of 45 Fast Growing TSX Companies With High Insider Ownership right here.

- Contemplating Other Strategies? The end of cancer? These 29 emerging AI stocks are developing tech that will allow early idenification of life changing disesaes like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:LGN

Logan Energy

Engages in the exploration, development, and production of crude oil and natural gas properties.

High growth potential and fair value.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

Deep Value Multi Bagger Opportunity

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion

Thanks for sharing these. They really help when I pick what dividend stocks to invest in