- Taiwan

- /

- Electronic Equipment and Components

- /

- TWSE:2383

3 Stocks That May Be Priced Below Their Estimated Value In January 2025

Reviewed by Simply Wall St

As global markets experience a rebound driven by easing core U.S. inflation and strong bank earnings, major indices like the S&P 500 and Dow Jones Industrial Average have recorded significant gains. This environment of cooling inflation and value stock outperformance presents opportunities for investors to explore stocks that may be trading below their intrinsic value, particularly as market dynamics shift in favor of sectors such as energy and financials. Identifying undervalued stocks involves assessing companies with strong fundamentals that are temporarily overlooked by the market, offering potential for growth as economic conditions stabilize.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Atlantic Union Bankshares (NYSE:AUB) | US$37.87 | US$75.61 | 49.9% |

| Beijing Yuanliu Hongyuan Electronic Technology (SHSE:603267) | CN¥35.51 | CN¥70.87 | 49.9% |

| Sudarshan Chemical Industries (BSE:506655) | ₹1114.10 | ₹2219.85 | 49.8% |

| Solum (KOSE:A248070) | ₩18700.00 | ₩37393.72 | 50% |

| Equity Bancshares (NYSE:EQBK) | US$43.13 | US$86.02 | 49.9% |

| GemPharmatech (SHSE:688046) | CN¥13.06 | CN¥26.07 | 49.9% |

| ReadyTech Holdings (ASX:RDY) | A$3.10 | A$6.19 | 50% |

| Zhejiang Juhua (SHSE:600160) | CN¥25.37 | CN¥50.53 | 49.8% |

| LifeMD (NasdaqGM:LFMD) | US$4.90 | US$9.77 | 49.8% |

| Shinko Electric Industries (TSE:6967) | ¥5870.00 | ¥11700.97 | 49.8% |

Let's dive into some prime choices out of the screener.

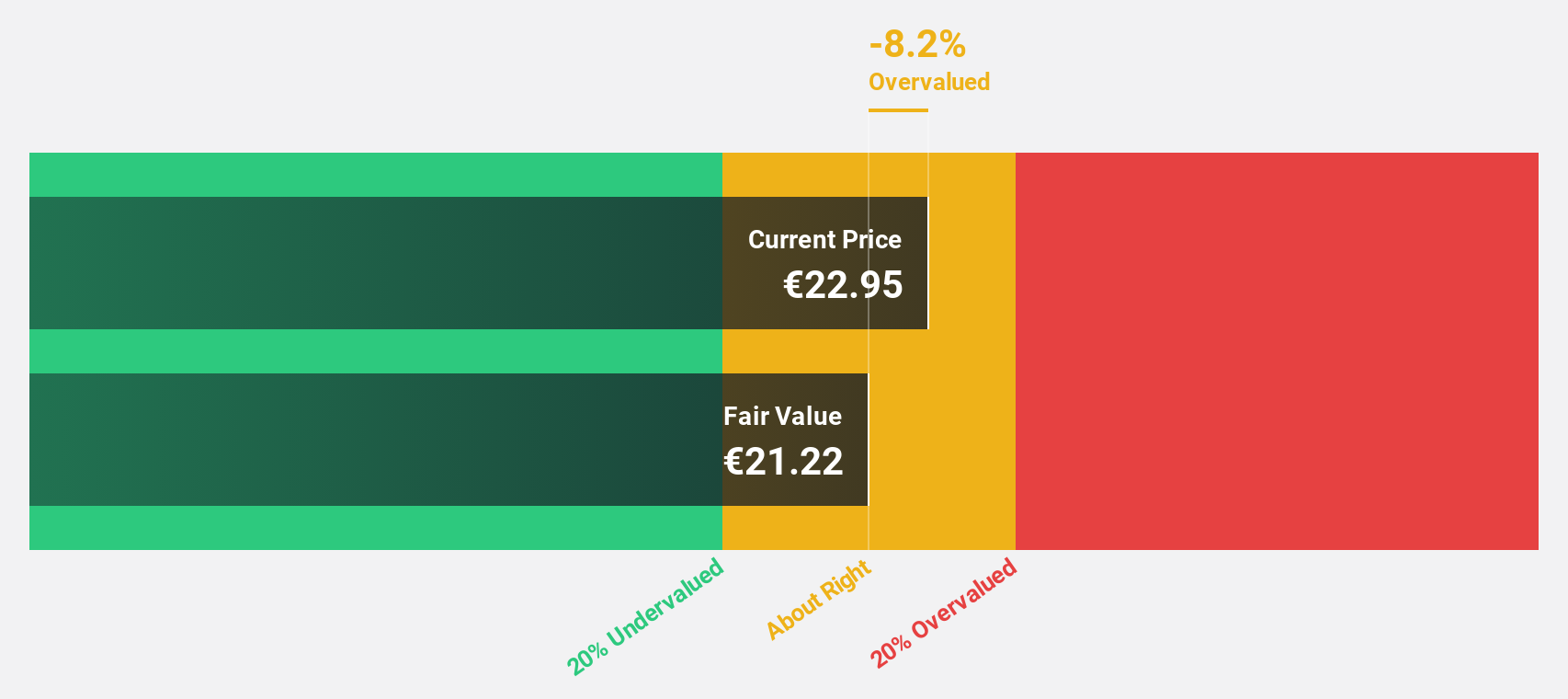

Planisware SAS (ENXTPA:PLNW)

Overview: Planisware SAS is a business-to-business software-as-a-service provider with operations in Europe, the Americas, the Asia-Pacific, and internationally, and has a market cap of €1.86 billion.

Operations: The company's revenue primarily comes from its Software & Programming segment, totaling €170.48 million.

Estimated Discount To Fair Value: 14.5%

Planisware SAS is trading at €26.5, below its estimated fair value of €30.98, representing a 14.5% discount. While not significantly undervalued, the company's earnings are projected to grow at 18.4% annually, outpacing the French market's growth rate of 12.1%. Revenue growth is expected at 14.7%, surpassing the market average of 5.5%. These factors suggest potential for future appreciation despite modest current undervaluation based on cash flows.

- In light of our recent growth report, it seems possible that Planisware SAS' financial performance will exceed current levels.

- Delve into the full analysis health report here for a deeper understanding of Planisware SAS.

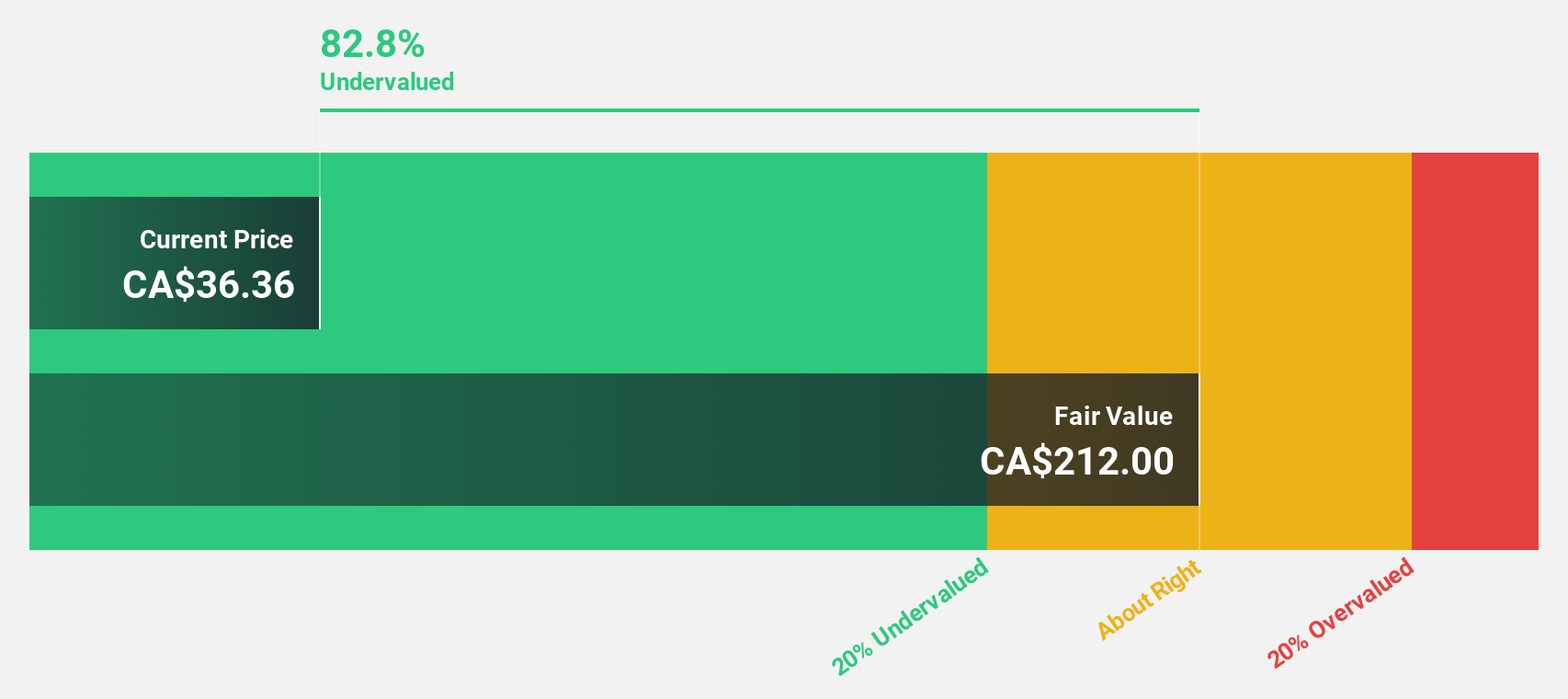

Alamos Gold (TSX:AGI)

Overview: Alamos Gold Inc. is involved in the acquisition, exploration, development, and extraction of precious metals in Canada and Mexico with a market cap of CA$11.86 billion.

Operations: The company's revenue segments include Mulatos at $479.90 million, Island Gold at $319.20 million, and Young-Davidson at $389.60 million.

Estimated Discount To Fair Value: 27.8%

Alamos Gold is trading at CA$28.23, significantly below its estimated fair value of CA$39.11, indicating a more than 20% undervaluation. The company's earnings are projected to grow 36.3% annually over the next three years, surpassing the Canadian market's rate of 15.8%. Recent strategic moves include a share buyback program and strong production results, enhancing potential cash flow-based valuation despite lower forecasted return on equity and revenue growth rates.

- Our growth report here indicates Alamos Gold may be poised for an improving outlook.

- Click here and access our complete balance sheet health report to understand the dynamics of Alamos Gold.

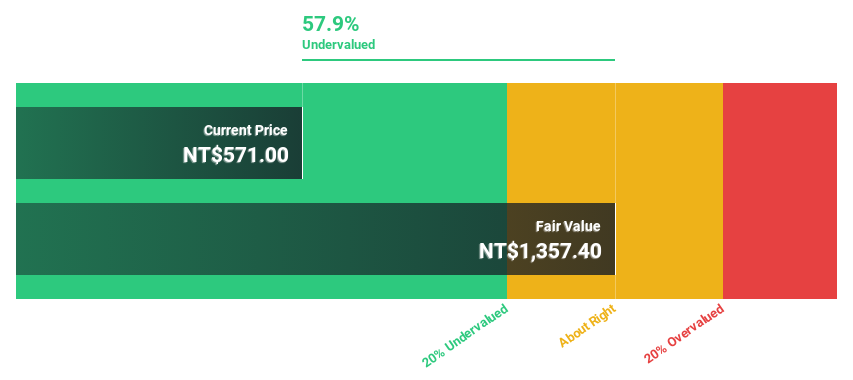

Elite Material (TWSE:2383)

Overview: Elite Material Co., Ltd. produces and sells copper clad laminates, electronic-industrial specialty chemicals and raw materials, and electronic components in Taiwan, China, and internationally, with a market cap of NT$206.44 billion.

Operations: The company's revenue segments consist of NT$14.61 billion from the Domestic Segment and NT$54.56 billion from Foreign Departments.

Estimated Discount To Fair Value: 32.6%

Elite Material is trading at NT$598, below its fair value estimate of NT$886.98, reflecting significant undervaluation. Earnings are projected to grow 17.28% annually, outpacing the Taiwan market's rate of 17.3%, while revenue growth is expected at 14.5% per year. Recent earnings reports show substantial increases in sales and net income compared to the previous year, reinforcing its potential for cash flow-driven valuation despite high non-cash earnings levels.

- According our earnings growth report, there's an indication that Elite Material might be ready to expand.

- Get an in-depth perspective on Elite Material's balance sheet by reading our health report here.

Where To Now?

- Unlock our comprehensive list of 877 Undervalued Stocks Based On Cash Flows by clicking here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Elite Material might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:2383

Elite Material

Engages in the production and sale of copper clad laminates, electronic-industrial specialty chemical and raw materials, and electronic components in Taiwan, China, and internationally.

Undervalued with solid track record.

Similar Companies

Market Insights

Community Narratives