- Canada

- /

- Metals and Mining

- /

- CNSX:ULTH

TSX Penny Stocks To Watch In October 2025

Reviewed by Simply Wall St

The Canadian market has shown resilience despite challenges such as trade uncertainties, a U.S. government shutdown, and emerging credit concerns. Investors are encouraged to use market volatility as an opportunity to rebalance portfolios and explore new investment avenues. Though the term 'penny stocks' might feel outdated, these smaller or newer companies can still offer significant growth potential when backed by strong financials, providing investors with opportunities to uncover hidden value in quality stocks.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Rewards & Risks |

| Westbridge Renewable Energy (TSXV:WEB) | CA$2.63 | CA$65.98M | ✅ 3 ⚠️ 4 View Analysis > |

| Zoomd Technologies (TSXV:ZOMD) | CA$2.23 | CA$214.6M | ✅ 3 ⚠️ 2 View Analysis > |

| Montero Mining and Exploration (TSXV:MON) | CA$0.415 | CA$3.22M | ✅ 2 ⚠️ 4 View Analysis > |

| CEMATRIX (TSX:CEMX) | CA$0.35 | CA$54.82M | ✅ 2 ⚠️ 1 View Analysis > |

| Thor Explorations (TSXV:THX) | CA$1.185 | CA$871.54M | ✅ 3 ⚠️ 2 View Analysis > |

| Automotive Finco (TSXV:AFCC.H) | CA$1.04 | CA$19.82M | ✅ 2 ⚠️ 3 View Analysis > |

| Amerigo Resources (TSX:ARG) | CA$2.66 | CA$447.33M | ✅ 3 ⚠️ 2 View Analysis > |

| Pulse Seismic (TSX:PSD) | CA$3.38 | CA$172.06M | ✅ 2 ⚠️ 1 View Analysis > |

| Hemisphere Energy (TSXV:HME) | CA$2.04 | CA$195.08M | ✅ 3 ⚠️ 1 View Analysis > |

| Matachewan Consolidated Mines (TSXV:MCM.A) | CA$0.79 | CA$9.83M | ✅ 2 ⚠️ 4 View Analysis > |

Click here to see the full list of 411 stocks from our TSX Penny Stocks screener.

Here's a peek at a few of the choices from the screener.

United Lithium (CNSX:ULTH)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: United Lithium Corp. is involved in the exploration and development of lithium properties across Sweden, Finland, and the United States, with a market cap of CA$11.94 million.

Operations: No revenue segments are reported for United Lithium Corp.

Market Cap: CA$11.94M

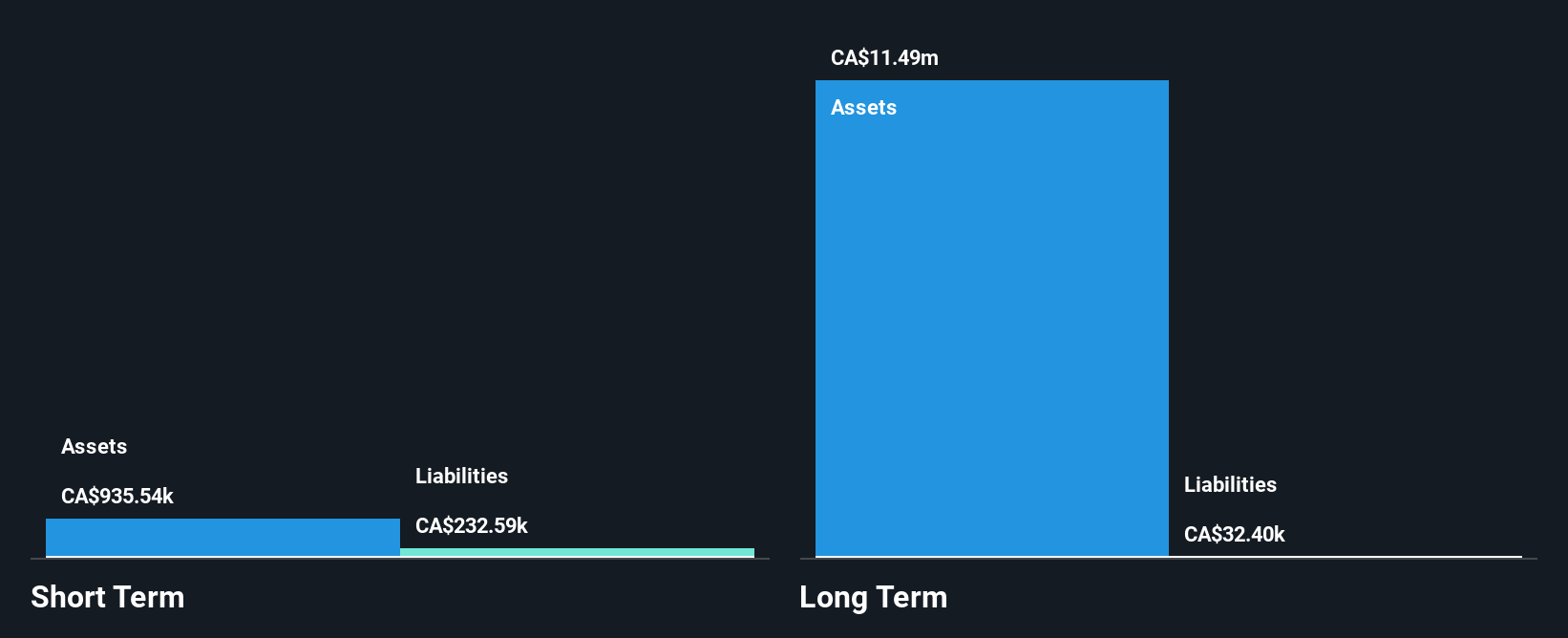

United Lithium Corp., with a market cap of CA$11.94 million, is pre-revenue and has experienced increased volatility over the past year. It holds more short-term assets than liabilities but faces a cash runway of less than a year if current free cash flow trends persist. Recent developments include a binding agreement to acquire Swedish Minerals Ab for CA$6 million, aiming to bolster its strategic-metals portfolio in Europe. The transaction involves equity exchange and a non-brokered private placement to raise up to CA$2.25 million, positioning United as part of Europe's clean-energy transition efforts amidst management changes.

- Get an in-depth perspective on United Lithium's performance by reading our balance sheet health report here.

- Review our historical performance report to gain insights into United Lithium's track record.

Doubleview Gold (TSXV:DBG)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Doubleview Gold Corp. focuses on acquiring, exploring, and developing mineral resource properties in Canada with a market cap of CA$180.94 million.

Operations: Doubleview Gold Corp. currently does not report any revenue segments.

Market Cap: CA$180.94M

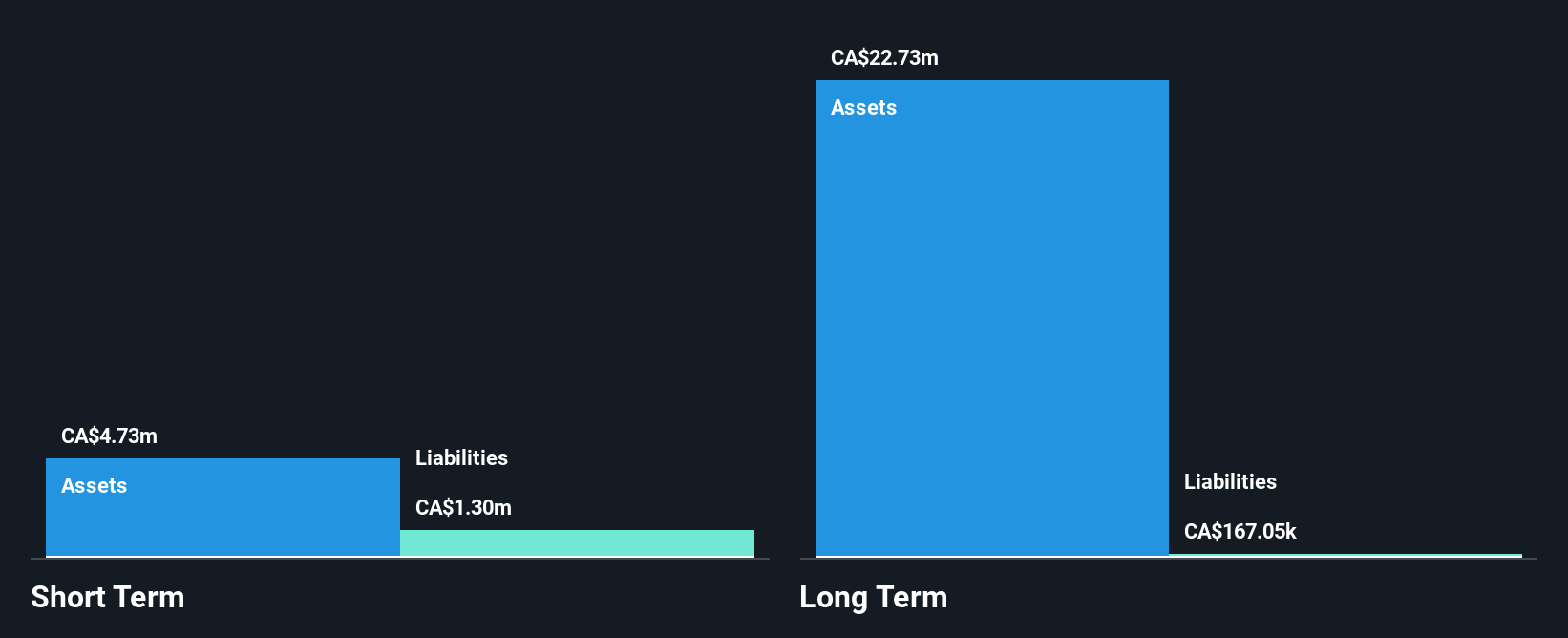

Doubleview Gold Corp., with a market cap of CA$180.94 million, is pre-revenue and focuses on mineral exploration in Canada. The company has experienced management and board teams, with average tenures of 6.8 and 8 years respectively, suggesting stability in leadership. Despite being debt-free and having short-term assets exceeding liabilities, Doubleview faces less than a year of cash runway under current conditions. Recent assay results from the Hat Project have expanded the mineralized zone significantly, potentially enhancing its resource base as it progresses towards a Preliminary Economic Assessment amidst ongoing drilling activities.

- Take a closer look at Doubleview Gold's potential here in our financial health report.

- Evaluate Doubleview Gold's historical performance by accessing our past performance report.

Northern Superior Resources (TSXV:SUP)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Northern Superior Resources Inc. is a junior mining company focused on the exploration and development of gold properties in Ontario and Québec, Canada, with a market cap of CA$377.61 million.

Operations: Northern Superior Resources Inc. does not report any revenue segments.

Market Cap: CA$377.61M

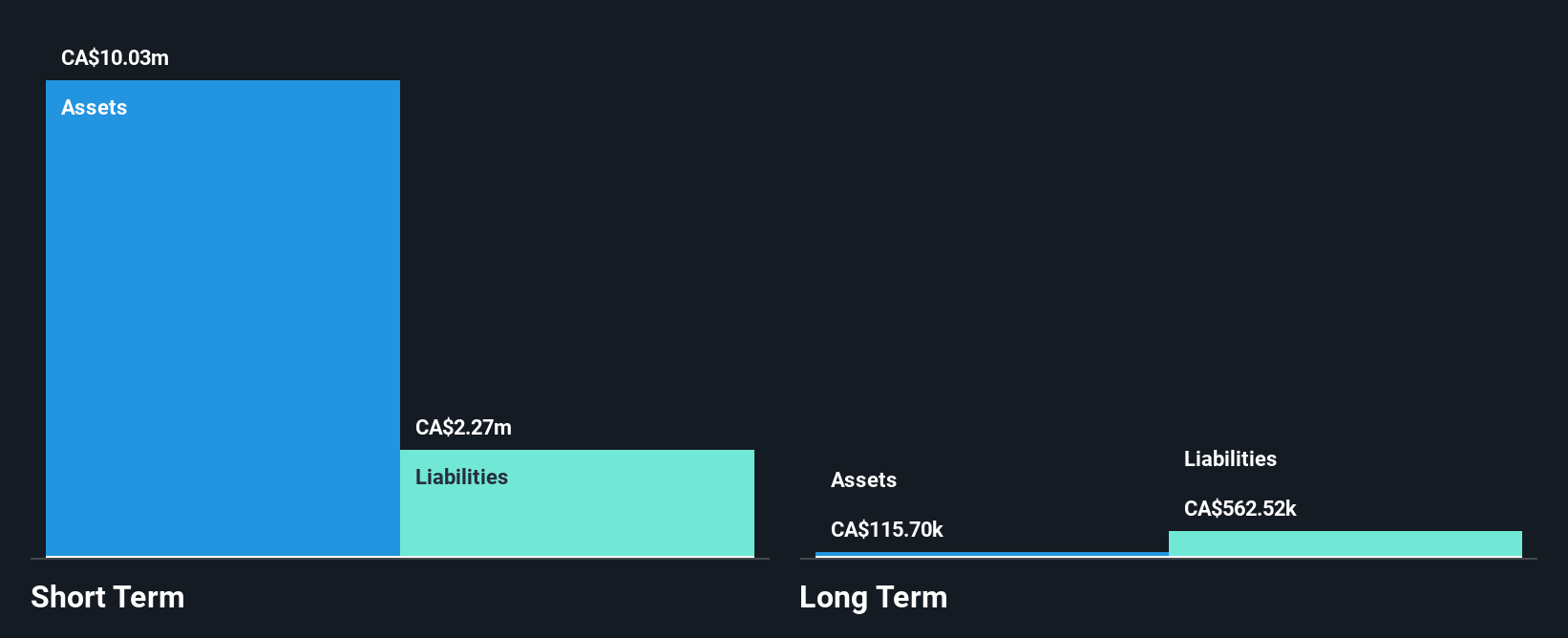

Northern Superior Resources Inc., with a market cap of CA$377.61 million, is pre-revenue and focuses on gold exploration in Ontario and Québec. The company remains debt-free, with short-term assets exceeding both short- and long-term liabilities. However, it faces less than a year of cash runway if free cash flow continues to decline at historical rates. Recent developments include an acquisition agreement by IAMGOLD Corporation valued at approximately CA$375 million, alongside ongoing exploration activities in the Chibougamau Gold Camp targeting extensions of mineralized zones which may enhance its resource profile before the transaction closes.

- Navigate through the intricacies of Northern Superior Resources with our comprehensive balance sheet health report here.

- Learn about Northern Superior Resources' future growth trajectory here.

Turning Ideas Into Actions

- Dive into all 411 of the TSX Penny Stocks we have identified here.

- Interested In Other Possibilities? Trump's oil boom is here — pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About CNSX:ULTH

United Lithium

Engages in the exploration and development of lithium properties in Sweden, Finland, and the United States of America.

Flawless balance sheet with slight risk.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)