- Canada

- /

- Metals and Mining

- /

- TSXV:LCE

3 TSX Penny Stocks With At Least CA$10M Market Cap

Reviewed by Simply Wall St

Despite recent volatility, the Canadian stock market has shown resilience, with the TSX reaching new highs after a tumultuous first half of 2025. In this context, investors may find opportunities in penny stocks—an older term that still signifies smaller or less-established companies. These stocks can offer potential value and growth when backed by strong financials and clear business strategies.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Rewards & Risks |

| Westbridge Renewable Energy (TSXV:WEB) | CA$0.67 | CA$67.77M | ✅ 3 ⚠️ 3 View Analysis > |

| illumin Holdings (TSX:ILLM) | CA$2.01 | CA$104.26M | ✅ 4 ⚠️ 1 View Analysis > |

| Fintech Select (TSXV:FTEC) | CA$0.025 | CA$2M | ✅ 2 ⚠️ 3 View Analysis > |

| Findev (TSXV:FDI) | CA$0.42 | CA$12.32M | ✅ 2 ⚠️ 4 View Analysis > |

| Thor Explorations (TSXV:THX) | CA$0.76 | CA$505.63M | ✅ 3 ⚠️ 2 View Analysis > |

| Automotive Finco (TSXV:AFCC.H) | CA$0.94 | CA$18.63M | ✅ 2 ⚠️ 4 View Analysis > |

| Amerigo Resources (TSX:ARG) | CA$2.27 | CA$364.97M | ✅ 3 ⚠️ 2 View Analysis > |

| Pulse Seismic (TSX:PSD) | CA$3.56 | CA$173.58M | ✅ 1 ⚠️ 1 View Analysis > |

| Hemisphere Energy (TSXV:HME) | CA$1.90 | CA$177.52M | ✅ 3 ⚠️ 1 View Analysis > |

| McChip Resources (TSXV:MCS) | CA$1.10 | CA$6.28M | ✅ 2 ⚠️ 4 View Analysis > |

Click here to see the full list of 444 stocks from our TSX Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Max Power Mining (CNSX:MAXX)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Max Power Mining Corp. is a junior mineral exploration company focused on acquiring, exploring, and evaluating natural resource properties, with a market cap of CA$13.89 million.

Operations: Currently, the company does not report any distinct revenue segments.

Market Cap: CA$13.89M

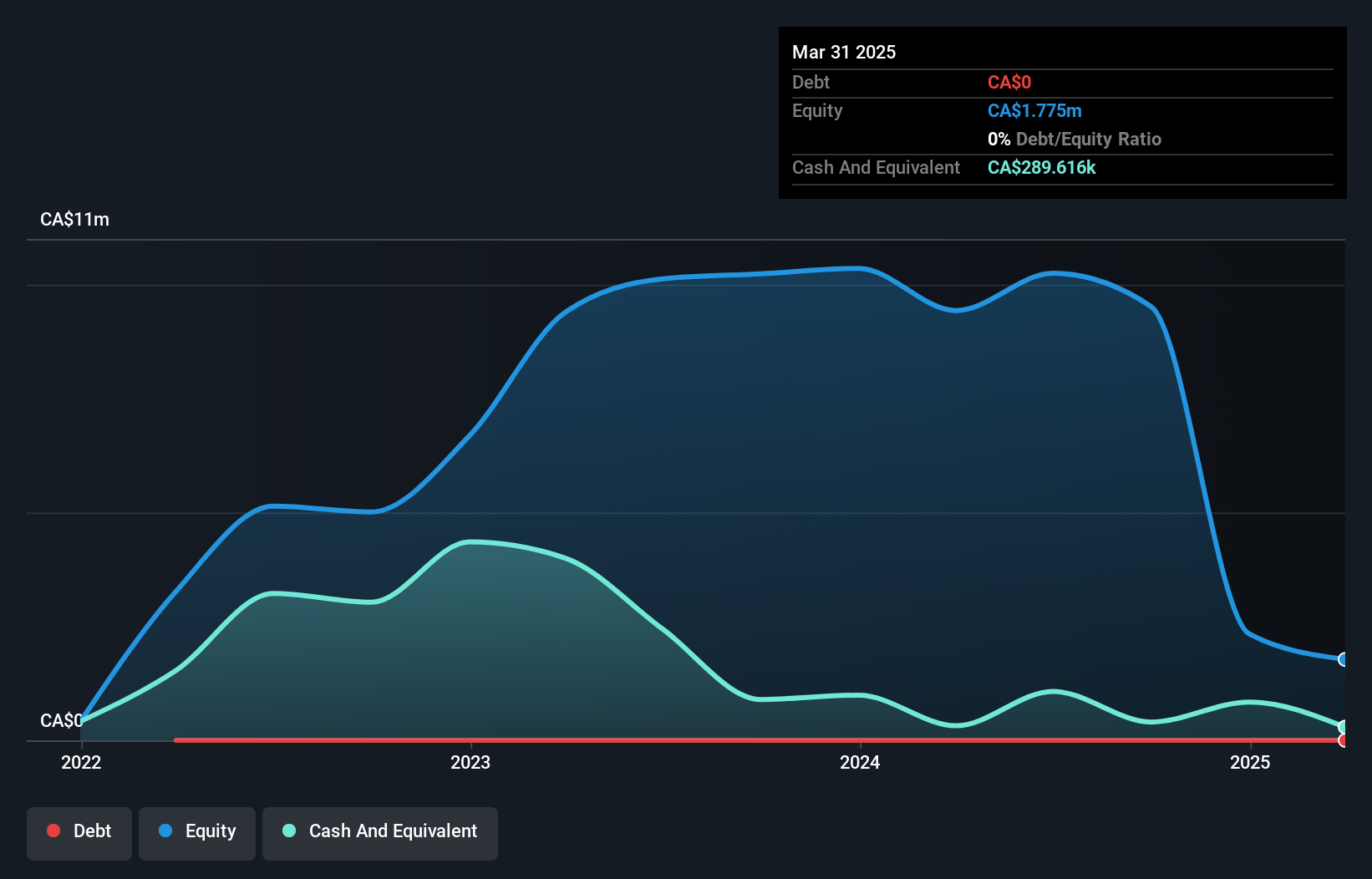

Max Power Mining Corp., a pre-revenue junior mineral exploration company, is navigating financial challenges with a market cap of CA$13.89 million and no significant revenue streams. Despite being debt-free and having short-term assets exceeding liabilities, the company faces concerns over its cash runway and unprofitability. Recent strategic moves include forming an alliance with REV Exploration Corp. to explore Natural Hydrogen in Western Canada, potentially reducing costs and improving efficiency through shared resources. Leadership changes have brought experienced professionals like Rob Norris to the board, which may bolster strategic direction amid ongoing financial uncertainties highlighted by auditor concerns.

- Dive into the specifics of Max Power Mining here with our thorough balance sheet health report.

- Gain insights into Max Power Mining's historical outcomes by reviewing our past performance report.

INX Digital Company (NEOE:INXD)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: The INX Digital Company, Inc. operates a trading platform for cryptocurrencies and digital securities, with a market cap of CA$41.66 million.

Operations: INXD's revenue is primarily derived from Switzerland ($0.89 million), followed by the United States ($0.22 million), Japan ($0.03 million), and other countries ($0.07 million).

Market Cap: CA$41.66M

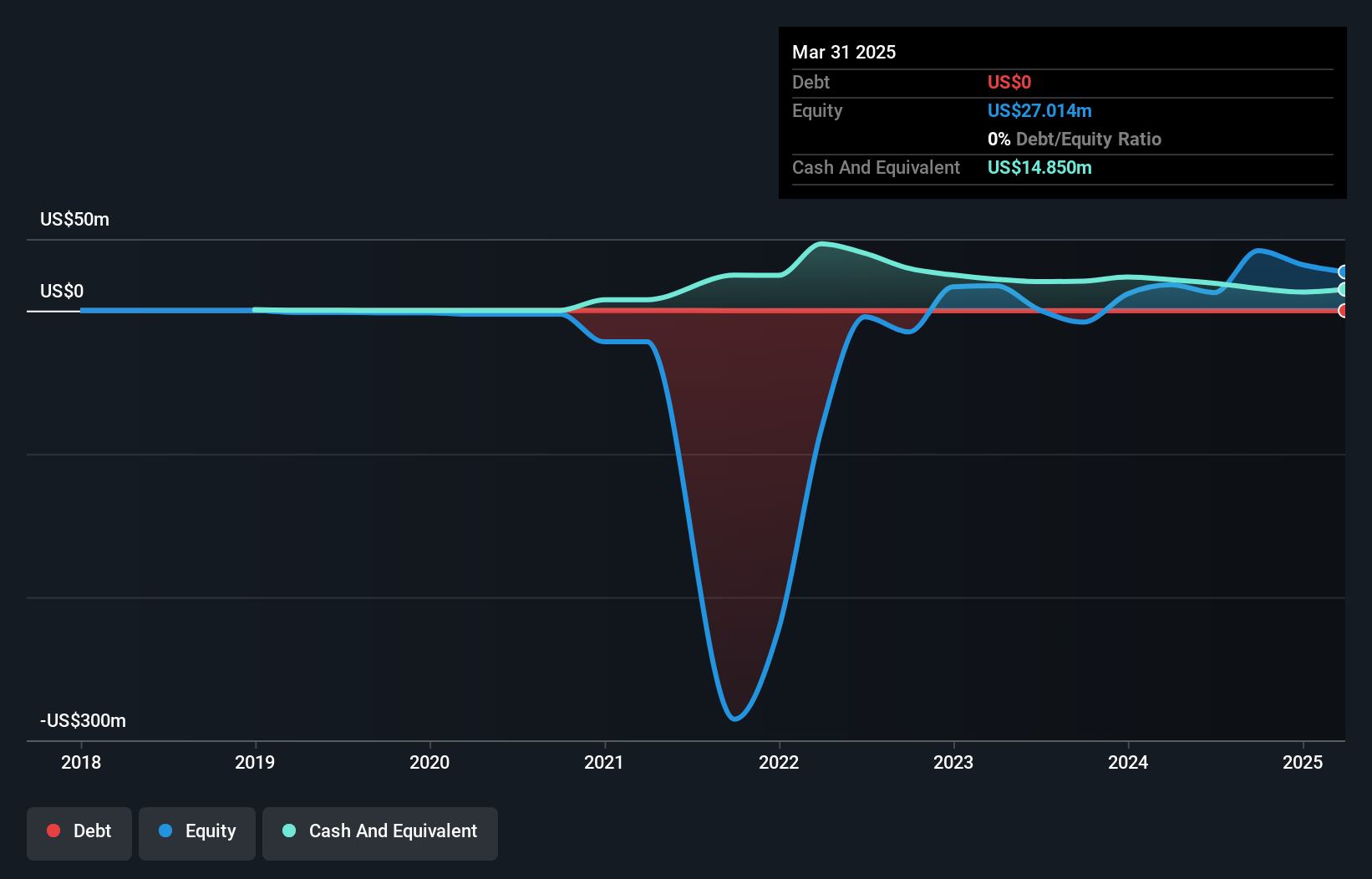

INX Digital Company, Inc., with a market cap of CA$41.66 million, is currently pre-revenue and debt-free. Despite high return on equity and experienced management, recent financial results show a net loss of US$5.19 million for Q1 2025, reversing from profitability the previous year. The company's short-term assets exceed liabilities by US$11.2 million, providing some financial stability amid volatile share prices and high earnings quality concerns due to its limited revenue streams primarily from Switzerland and the United States. Recent shareholder meetings discussed strategic arrangements potentially impacting future operations.

- Jump into the full analysis health report here for a deeper understanding of INX Digital Company.

- Assess INX Digital Company's previous results with our detailed historical performance reports.

Century Lithium (TSXV:LCE)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Century Lithium Corp. is an exploration and development-stage company focused on identifying, acquiring, exploring, evaluating, and developing lithium and other mineral properties in the United States with a market cap of CA$44.85 million.

Operations: Century Lithium Corp. currently does not report any revenue segments as it is in the exploration and development stage.

Market Cap: CA$44.85M

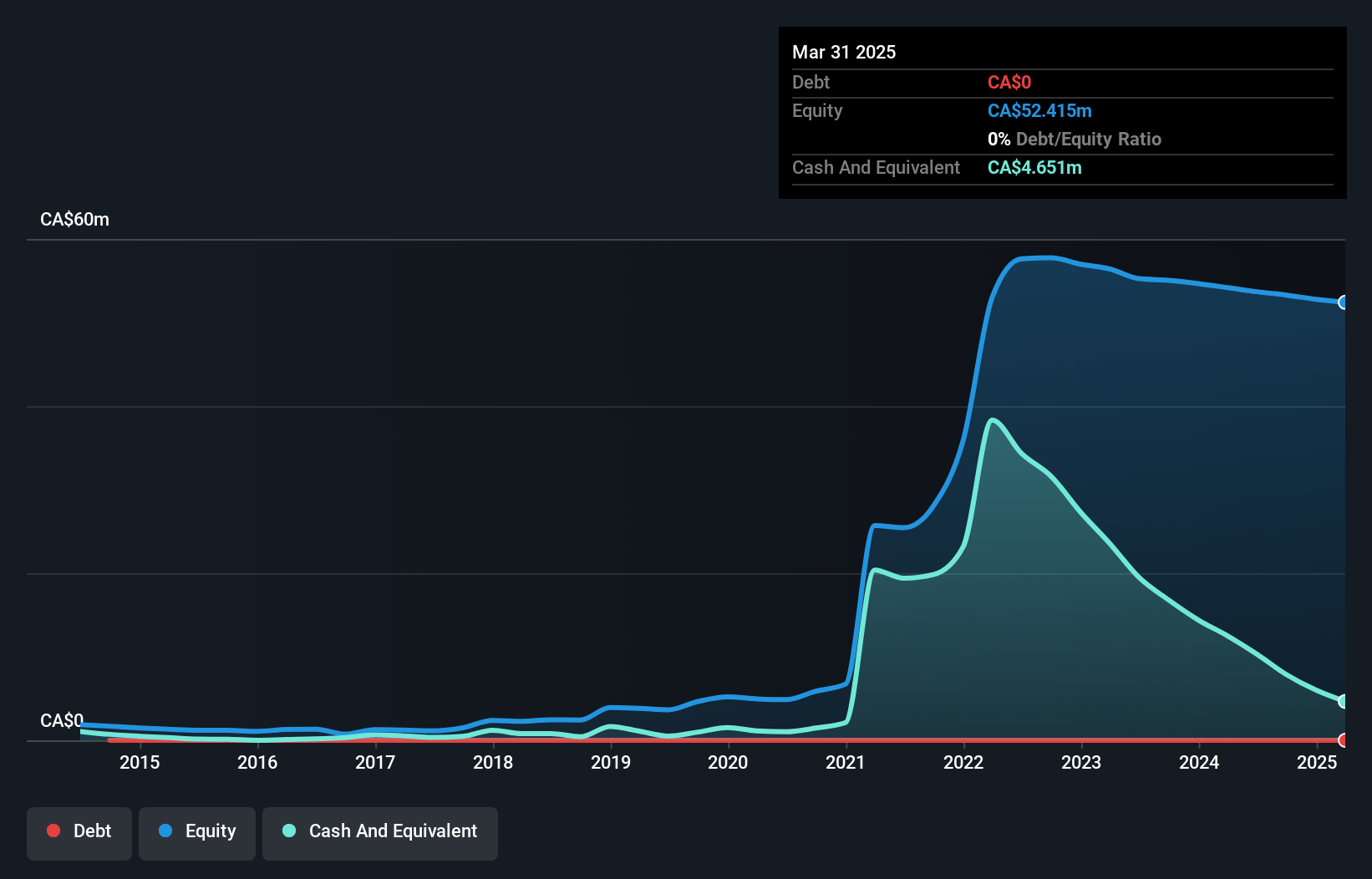

Century Lithium Corp., with a market cap of CA$44.85 million, remains pre-revenue as it focuses on developing its Angel Island lithium project in Nevada. The company recently announced successful production of commercial-grade lithium iron phosphate battery cells using its lithium carbonate, highlighting potential future revenue streams. Despite being debt-free and having an experienced management team, Century Lithium faces challenges with a limited cash runway of seven months before recent capital raises and ongoing unprofitability. Short-term assets stand at CA$4.8 million against liabilities of CA$434.5K, providing some financial buffer during exploration stages.

- Unlock comprehensive insights into our analysis of Century Lithium stock in this financial health report.

- Examine Century Lithium's past performance report to understand how it has performed in prior years.

Taking Advantage

- Explore the 444 names from our TSX Penny Stocks screener here.

- Ready For A Different Approach? Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:LCE

Century Lithium

An exploration and development-stage company, engages in the identification, acquisition, exploration, evaluation, and development of lithium and other mineral properties in the United States.

Excellent balance sheet with slight risk.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)