Intact Financial (TSE:IFC) Is Paying Out A Larger Dividend Than Last Year

The board of Intact Financial Corporation (TSE:IFC) has announced that it will be increasing its dividend by 10.0% on the 29th of March to CA$1.21, up from last year's comparable payment of CA$1.10. Although the dividend is now higher, the yield is only 1.9%, which is below the industry average.

See our latest analysis for Intact Financial

Intact Financial's Payment Has Solid Earnings Coverage

While yield is important, another factor to consider about a company's dividend is whether the current payout levels are feasible. The last payment made up 73% of earnings, but cash flows were much higher. Since the dividend is just paying out cash to shareholders, we care more about the cash payout ratio from which we can see plenty is being left over for reinvestment in the business.

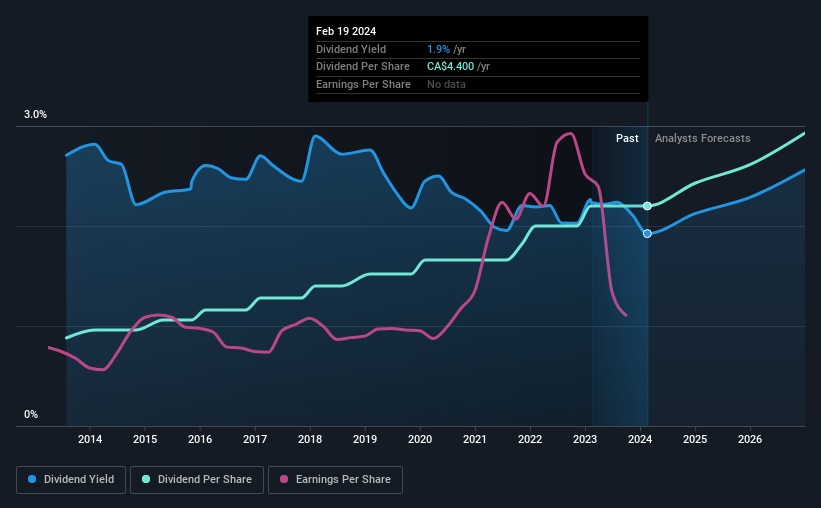

Looking forward, earnings per share is forecast to rise by 157.4% over the next year. Assuming the dividend continues along recent trends, we think the payout ratio could be 33% by next year, which is in a pretty sustainable range.

Intact Financial Has A Solid Track Record

The company has a sustained record of paying dividends with very little fluctuation. The annual payment during the last 10 years was CA$1.76 in 2014, and the most recent fiscal year payment was CA$4.40. This means that it has been growing its distributions at 9.6% per annum over that time. The growth of the dividend has been pretty reliable, so we think this can offer investors some nice additional income in their portfolio.

Dividend Growth May Be Hard To Achieve

Investors who have held shares in the company for the past few years will be happy with the dividend income they have received. Earnings have grown at around 4.3% a year for the past five years, which isn't massive but still better than seeing them shrink. There are exceptions, but limited earnings growth and a high payout ratio can signal that a company has reached maturity. When the rate of return on reinvestment opportunities falls below a certain minimum level, companies often elect to pay a larger dividend instead. This is why many mature companies often have larger dividend yields.

We Really Like Intact Financial's Dividend

Overall, a dividend increase is always good, and we think that Intact Financial is a strong income stock thanks to its track record and growing earnings. Distributions are quite easily covered by earnings, which are also being converted to cash flows. All of these factors considered, we think this has solid potential as a dividend stock.

Market movements attest to how highly valued a consistent dividend policy is compared to one which is more unpredictable. At the same time, there are other factors our readers should be conscious of before pouring capital into a stock. For instance, we've picked out 3 warning signs for Intact Financial that investors should take into consideration. Looking for more high-yielding dividend ideas? Try our collection of strong dividend payers.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:IFC

Intact Financial

Through its subsidiaries, provides property and casualty insurance products to individuals and businesses in Canada, the United States, the United Kingdom, and internationally.

Solid track record established dividend payer.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)