iA Financial (TSX:IAG): Valuation Check After New Bereavement Support Partnership with Empathy

Reviewed by Simply Wall St

iA Financial (TSX:IAG) just rolled out a new angle on life insurance, partnering with Empathy to give Canadian beneficiaries dedicated bereavement support starting Spring 2026. The offering blends tech tools with one-on-one human guidance.

See our latest analysis for iA Financial.

That push into tech enabled bereavement care lands at a strong moment for the stock, with a roughly 32 percent year to date share price return and a powerful five year total shareholder return above 260 percent suggesting momentum is still very much building.

If this kind of innovation has your radar up, it could be a good time to explore other financial names with resilient business models and discover fast growing stocks with high insider ownership

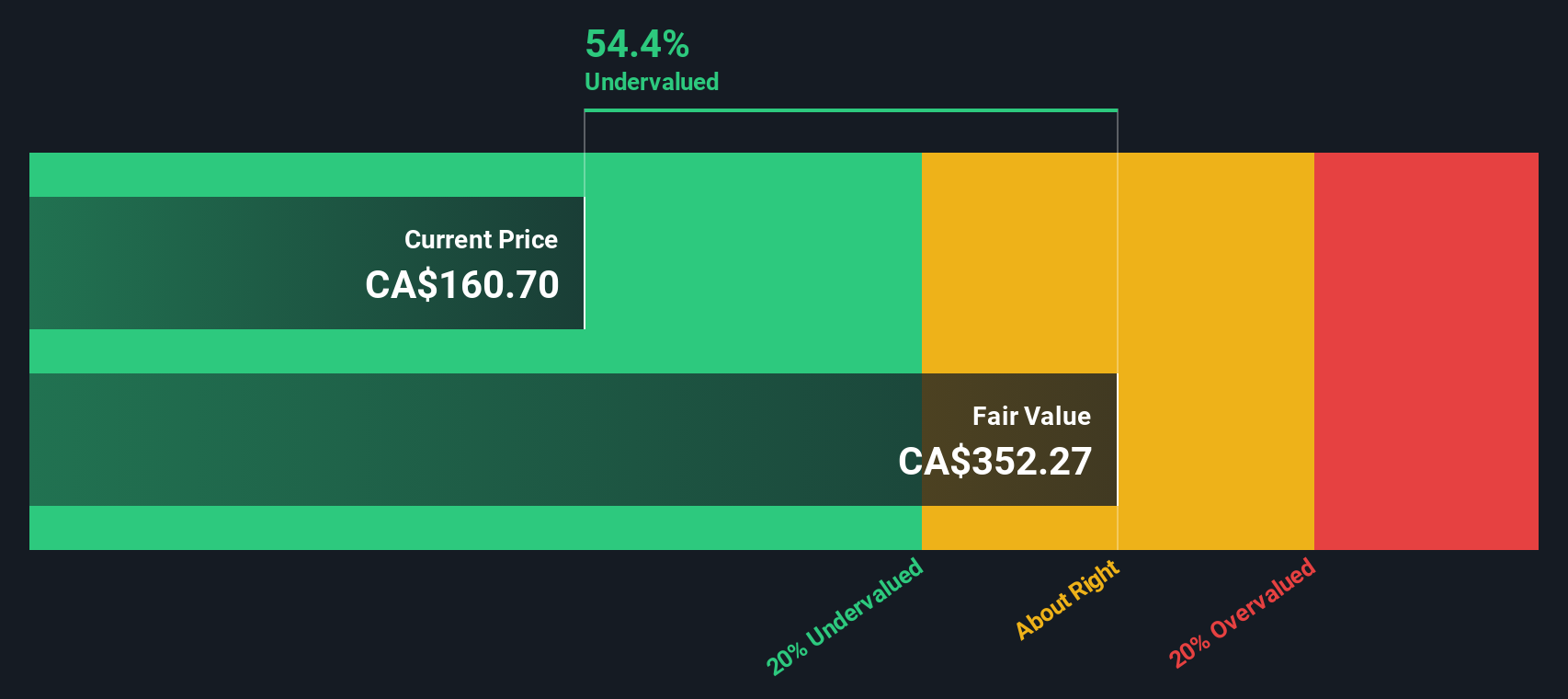

With the shares hovering near analyst targets but still trading at a sizable discount to intrinsic value, the key debate now is straightforward: is iA Financial a buy at these levels, or is future growth already priced in?

Price-to-Earnings of 14.6x: Is it justified?

On a headline basis, iA Financial’s CA$173.52 share price reflects a 14.6 times price to earnings multiple, placing the stock at a premium to several benchmarks.

The price to earnings ratio compares what investors pay today for each dollar of current earnings, a core yardstick for mature, profitable insurers like iA Financial. At 14.6 times earnings, the market appears to be assigning a richer tag to iA’s profit stream, even though earnings are forecast to grow at a mid single digit pace.

That premium stands out because our analysis suggests a fair price to earnings ratio closer to 13.4 times, a level the market could ultimately gravitate toward if sentiment normalizes. The stock is also more expensive than the North American insurance industry average at 13.2 times and the more focused peer group average at 12.4 times, reinforcing that investors are paying up relative to sector norms for iA’s earnings profile.

Explore the SWS fair ratio for iA Financial

Result: Price-to-Earnings of 14.6x (OVERVALUED)

However, lingering macro uncertainty, modest earnings growth and any stumble in its tech integration push could quickly challenge the premium valuation that investors now assign.

Find out about the key risks to this iA Financial narrative.

Another View: DCF Paints a Very Different Picture

While the current 14.6 times earnings multiple looks rich, our DCF model suggests iA Financial could be deeply undervalued, with fair value closer to CA$368.96, about 53 percent above today’s price. If both are right, is the multiple or the cash flow story mispriced?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out iA Financial for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 905 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own iA Financial Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a custom view in under three minutes: Do it your way

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding iA Financial.

Ready for your next investment move?

Before you move on, you may wish to scan fresh ideas on Simply Wall Street’s Screener, where data driven filters can help uncover opportunities others often overlook.

- Look for potential mispricings by targeting companies trading below their cash flow value through these 905 undervalued stocks based on cash flows to explore the possibility of a future rerating.

- Explore innovation and growth themes by focusing on these 25 AI penny stocks to position your portfolio within the AI theme.

- Review potential income opportunities by uncovering regular payers with these 12 dividend stocks with yields > 3% so you can evaluate how your capital may work across different market conditions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if iA Financial might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:IAG

iA Financial

Provides insurance and wealth management services for individual and group basis in Canada and the United States.

Solid track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Rocket Lab USA Will Ignite a 30% Revenue Growth Journey

Dollar general to grow

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Trending Discussion