- Canada

- /

- Personal Products

- /

- CNSX:LEEF

Leef Brands Inc. (CSE:LEEF) Stock's 33% Dive Might Signal An Opportunity But It Requires Some Scrutiny

The Leef Brands Inc. (CSE:LEEF) share price has fared very poorly over the last month, falling by a substantial 33%. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 20% in that time.

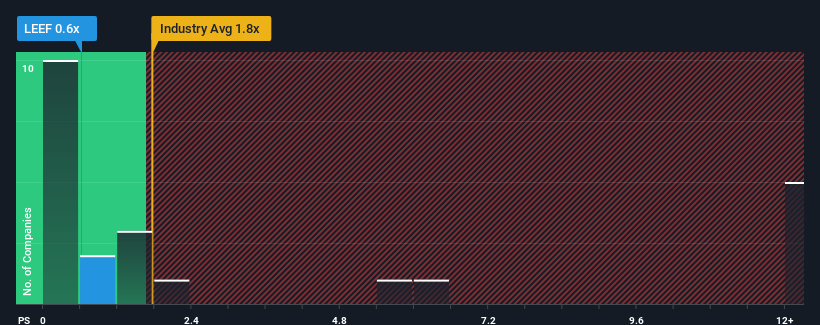

After such a large drop in price, Leef Brands' price-to-sales (or "P/S") ratio of 0.6x might make it look like a buy right now compared to the Personal Products industry in Canada, where around half of the companies have P/S ratios above 1.7x and even P/S above 5x are quite common. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for Leef Brands

What Does Leef Brands' Recent Performance Look Like?

As an illustration, revenue has deteriorated at Leef Brands over the last year, which is not ideal at all. Perhaps the market believes the recent revenue performance isn't good enough to keep up the industry, causing the P/S ratio to suffer. Those who are bullish on Leef Brands will be hoping that this isn't the case so that they can pick up the stock at a lower valuation.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Leef Brands' earnings, revenue and cash flow.Is There Any Revenue Growth Forecasted For Leef Brands?

The only time you'd be truly comfortable seeing a P/S as low as Leef Brands' is when the company's growth is on track to lag the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 1.9%. Even so, admirably revenue has lifted 209% in aggregate from three years ago, notwithstanding the last 12 months. Accordingly, while they would have preferred to keep the run going, shareholders would definitely welcome the medium-term rates of revenue growth.

Comparing that to the industry, which is only predicted to deliver 7.4% growth in the next 12 months, the company's momentum is stronger based on recent medium-term annualised revenue results.

With this in mind, we find it intriguing that Leef Brands' P/S isn't as high compared to that of its industry peers. Apparently some shareholders believe the recent performance has exceeded its limits and have been accepting significantly lower selling prices.

What We Can Learn From Leef Brands' P/S?

The southerly movements of Leef Brands' shares means its P/S is now sitting at a pretty low level. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our examination of Leef Brands revealed its three-year revenue trends aren't boosting its P/S anywhere near as much as we would have predicted, given they look better than current industry expectations. When we see robust revenue growth that outpaces the industry, we presume that there are notable underlying risks to the company's future performance, which is exerting downward pressure on the P/S ratio. At least price risks look to be very low if recent medium-term revenue trends continue, but investors seem to think future revenue could see a lot of volatility.

You need to take note of risks, for example - Leef Brands has 6 warning signs (and 3 which shouldn't be ignored) we think you should know about.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About CNSX:LEEF

Leef Brands

Operates as a cannabis branded products manufacturer in the United States.

Slight risk and slightly overvalued.

Market Insights

Community Narratives