Lisa Crossley became the CEO of Reliq Health Technologies Inc. (CVE:RHT) in 2016, and we think it's a good time to look at the executive's compensation against the backdrop of overall company performance. This analysis will also look to assess whether the CEO is appropriately paid, considering recent earnings growth and investor returns for Reliq Health Technologies.

View our latest analysis for Reliq Health Technologies

Comparing Reliq Health Technologies Inc.'s CEO Compensation With the industry

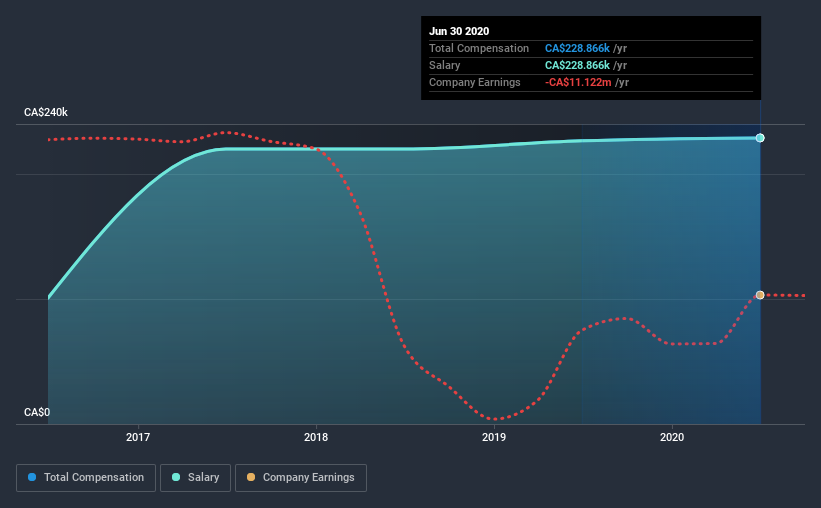

According to our data, Reliq Health Technologies Inc. has a market capitalization of CA$75m, and paid its CEO total annual compensation worth CA$229k over the year to June 2020. That's mostly flat as compared to the prior year's compensation. It is worth noting that the CEO compensation consists entirely of the salary, worth CA$229k.

On comparing similar-sized companies in the industry with market capitalizations below CA$256m, we found that the median total CEO compensation was CA$263k. From this we gather that Lisa Crossley is paid around the median for CEOs in the industry. Moreover, Lisa Crossley also holds CA$999k worth of Reliq Health Technologies stock directly under their own name, which reveals to us that they have a significant personal stake in the company.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | CA$229k | CA$227k | 100% |

| Other | - | - | - |

| Total Compensation | CA$229k | CA$227k | 100% |

On an industry level, around 75% of total compensation represents salary and 25% is other remuneration. Speaking on a company level, Reliq Health Technologies prefers to tread along a traditional path, disbursing all compensation through a salary. If salary is the major component in total compensation, it suggests that the CEO receives a higher fixed proportion of the total compensation, regardless of performance.

A Look at Reliq Health Technologies Inc.'s Growth Numbers

Over the last three years, Reliq Health Technologies Inc. has shrunk its earnings per share by 4.9% per year. It achieved revenue growth of 133% over the last year.

Investors would be a bit wary of companies that have lower EPS But on the other hand, revenue growth is strong, suggesting a brighter future. It's hard to reach a conclusion about business performance right now. This may be one to watch. While we don't have analyst forecasts for the company, shareholders might want to examine this detailed historical graph of earnings, revenue and cash flow.

Has Reliq Health Technologies Inc. Been A Good Investment?

Since shareholders would have lost about 66% over three years, some Reliq Health Technologies Inc. investors would surely be feeling negative emotions. So shareholders would probably want the company to be lessto generous with CEO compensation.

In Summary...

Reliq Health Technologies rewards its CEO solely through a salary, ignoring non-salary benefits completely. As we noted earlier, Reliq Health Technologies pays its CEO in line with similar-sized companies belonging to the same industry. However, revenues have increased over the past year, a positive sign for the company. In contrast, over the same time span, shareholder returns are negative. EPS is also not growing, undoubtedly leading to further headaches. Overall, we wouldn't say CEO is highly paid, but shareholders might not go for a raise before business metrics start to improve precipitously.

CEO pay is simply one of the many factors that need to be considered while examining business performance. We identified 5 warning signs for Reliq Health Technologies (2 are concerning!) that you should be aware of before investing here.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

When trading Reliq Health Technologies or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TSXV:RHT

Reliq Health Technologies

A healthcare technology company, develops secure telemedicine and virtual care solutions for the healthcare market.

Slight with mediocre balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Stride Stock: Online Education Finds Its Second Act

CS Disco Stock: Legal AI Is Moving From Efficiency Tool to Competitive Necessity

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)