- Canada

- /

- Healthcare Services

- /

- TSX:QIPT

Can You Imagine How Elated Protech Home Medical's (CVE:PTQ) Shareholders Feel About Its 331% Share Price Gain?

Generally speaking, investors are inspired to be stock pickers by the potential to find the big winners. You won't get it right every time, but when you do, the returns can be truly splendid. For example, the Protech Home Medical Corp. (CVE:PTQ) share price is up a whopping 331% in the last three years, a handsome return for long term holders. It's also good to see the share price up 57% over the last quarter. This could be related to the recent financial results, released recently - you can catch up on the most recent data by reading our company report.

View our latest analysis for Protech Home Medical

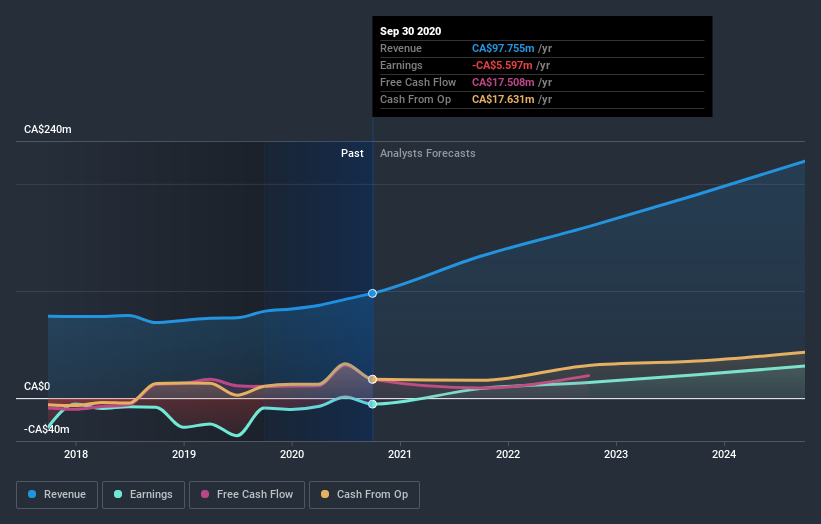

Given that Protech Home Medical didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

Protech Home Medical's revenue trended up 8.0% each year over three years. That's pretty nice growth. Arguably the very strong share price gain of 63% a year is very generous when compared to the revenue growth. After a price rise like that many will have the business, and plenty of them will be wondering whether the price moved too high, too fast.

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

We like that insiders have been buying shares in the last twelve months. Even so, future earnings will be far more important to whether current shareholders make money. This free report showing analyst forecasts should help you form a view on Protech Home Medical

A Different Perspective

Pleasingly, Protech Home Medical's total shareholder return last year was 169%. That gain actually surpasses the 63% TSR it generated (per year) over three years. The improving returns to shareholders suggests the stock is becoming more popular with time. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. To that end, you should be aware of the 2 warning signs we've spotted with Protech Home Medical .

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on CA exchanges.

When trading Protech Home Medical or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Quipt Home Medical might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TSX:QIPT

Quipt Home Medical

Through its subsidiaries, engages in the provision of durable and home medical equipment and supplies in the United States.

Undervalued with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives