- Canada

- /

- Food and Staples Retail

- /

- TSX:NWC

Discovering Canada's Hidden Stock Gems for September 2024

Reviewed by Simply Wall St

Over the last 7 days, the Canadian market has dropped 2.3%, but it has risen by 12% over the past year, with earnings expected to grow by 15% annually in the coming years. In this fluctuating yet promising environment, identifying stocks with strong fundamentals and growth potential can be particularly rewarding.

Top 10 Undiscovered Gems With Strong Fundamentals In Canada

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| TWC Enterprises | 6.74% | 10.99% | 25.68% | ★★★★★★ |

| Reconnaissance Energy Africa | NA | 15.28% | 7.58% | ★★★★★★ |

| Jaguar Mining | 1.19% | 5.49% | 5.12% | ★★★★★★ |

| Taiga Building Products | NA | 6.05% | 10.50% | ★★★★★★ |

| Tenaz Energy | NA | 33.64% | 50.62% | ★★★★★☆ |

| Firan Technology Group | 17.91% | 3.75% | 23.32% | ★★★★★☆ |

| Mako Mining | 22.90% | 38.12% | 54.79% | ★★★★★☆ |

| Pizza Pizza Royalty | 15.66% | 3.64% | 3.95% | ★★★★☆☆ |

| Queen's Road Capital Investment | 7.20% | 22.14% | 22.20% | ★★★★☆☆ |

| Genesis Land Development | 53.32% | 25.58% | 47.05% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

Extendicare (TSX:EXE)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Extendicare Inc., with a market cap of CA$737.85 million, operates through its subsidiaries to provide care and services for seniors in Canada.

Operations: Extendicare generates revenue primarily from Long-Term Care (CA$798.80 million), Home Health Care (CA$525.16 million), and Managed Services (CA$64.32 million).

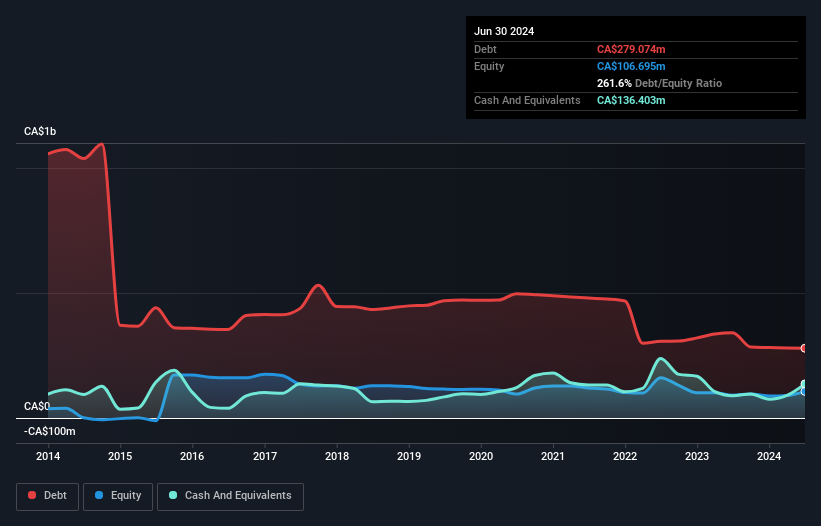

Extendicare, a small-cap healthcare provider in Canada, has seen its earnings skyrocket by 3957.1% over the past year, outpacing the industry average of 6%. The company’s debt-to-equity ratio has improved significantly from 405.7% to 261.6% over five years, although it remains high at 133.7%. With a P/E ratio of 12.4x, Extendicare is trading below the Canadian market average of 14.8x and boasts well-covered interest payments with EBIT covering interest expenses by nearly six times (5.9x).

- Delve into the full analysis health report here for a deeper understanding of Extendicare.

Gain insights into Extendicare's past trends and performance with our Past report.

North West (TSX:NWC)

Simply Wall St Value Rating: ★★★★★★

Overview: The North West Company Inc. operates as a retailer of food and everyday products and services in rural communities and urban neighborhood markets across northern Canada, rural Alaska, the South Pacific, and the Caribbean with a market cap of CA$2.45 billion.

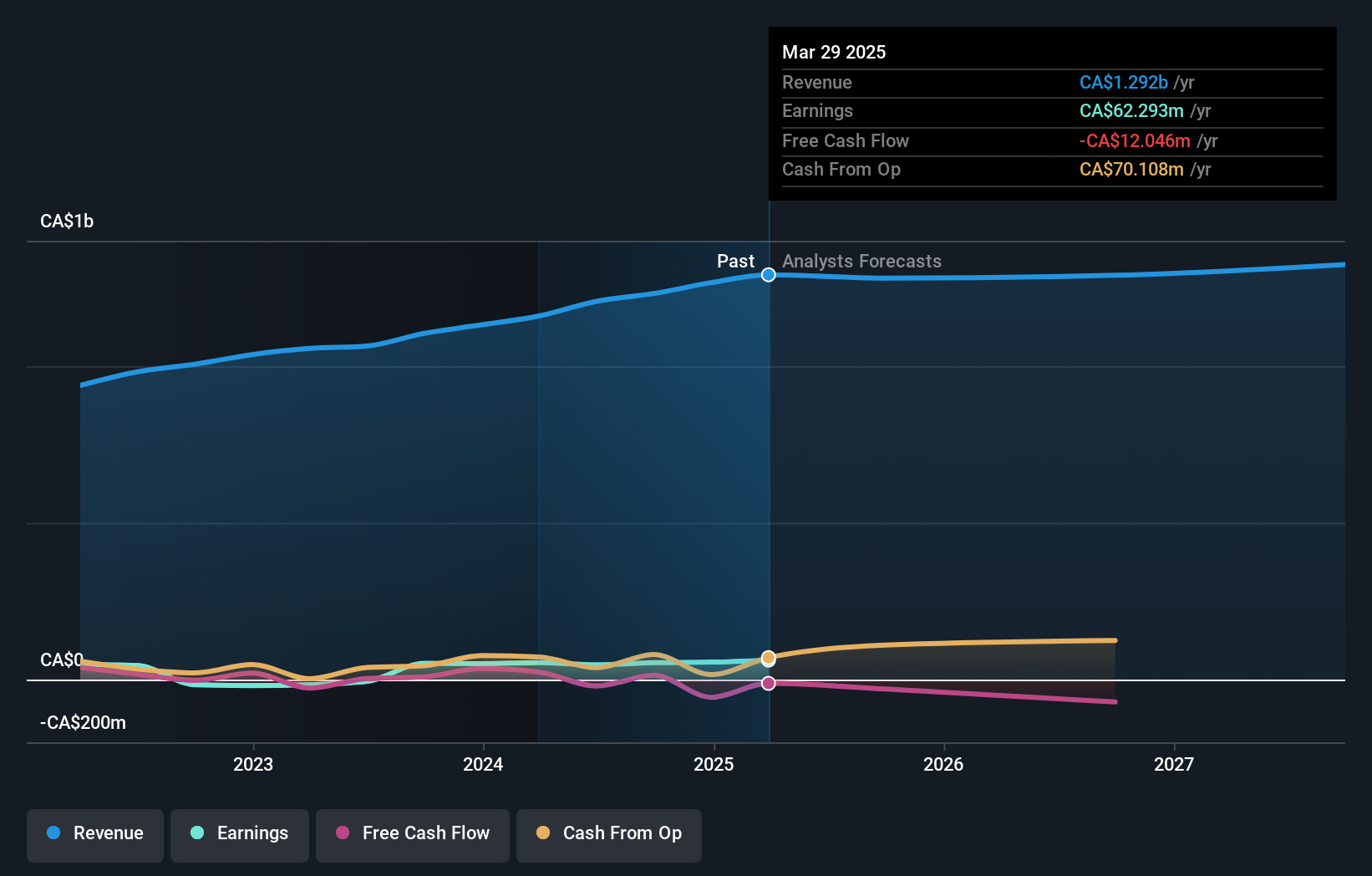

Operations: North West generates CA$2.52 billion in revenue from retailing food and everyday products and services. The company's market cap stands at CA$2.45 billion.

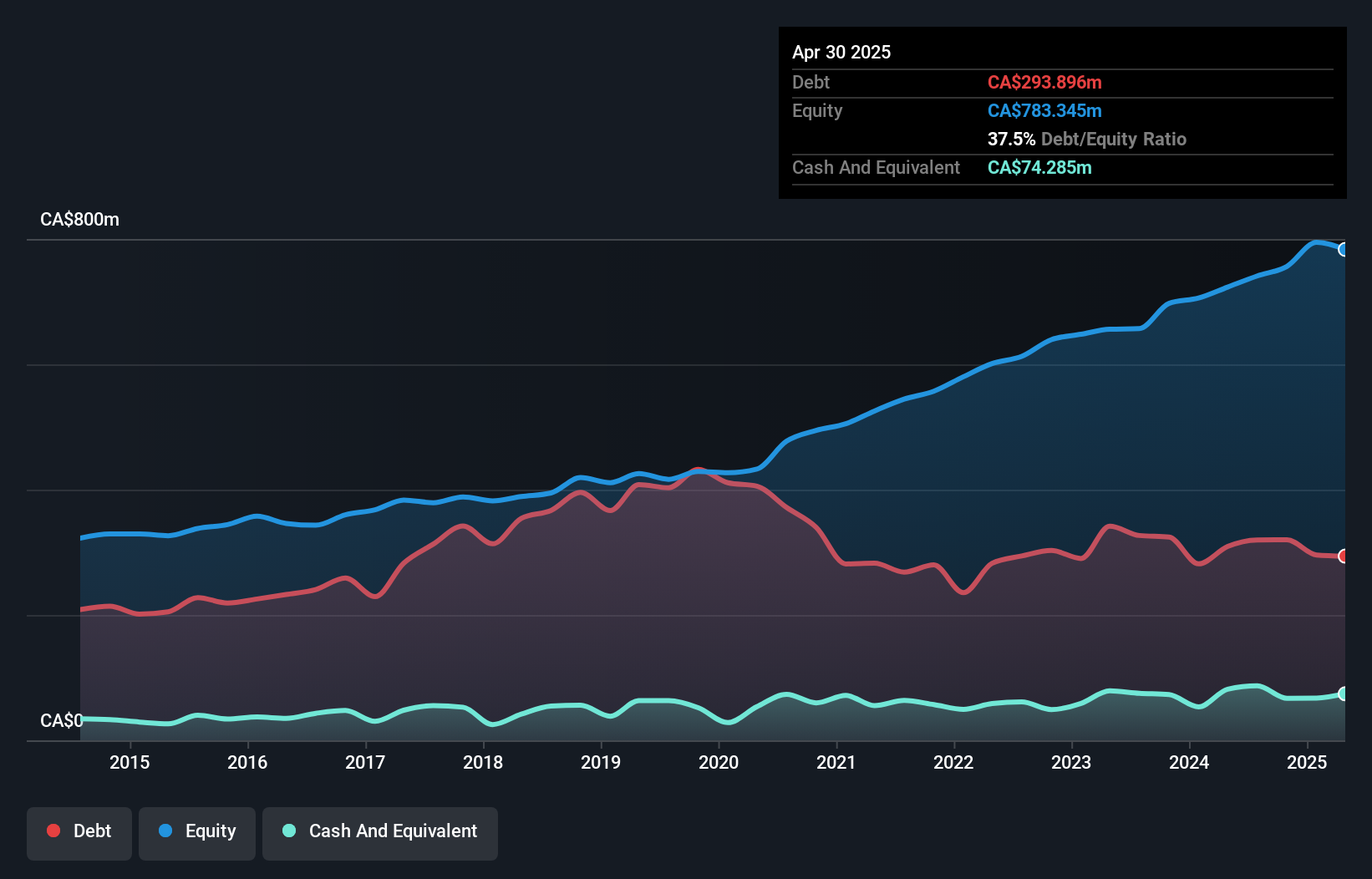

North West, a small Canadian retailer, has demonstrated high-quality earnings and robust debt management. Over the past five years, its debt to equity ratio has improved from 96.7% to 43.2%, and net debt to equity stands at a satisfactory 31.4%. Recent earnings grew by 9.5%, outpacing the Consumer Retailing industry’s -7.7%. Trading at 45% below estimated fair value, North West appears undervalued with well-covered interest payments (10.9x EBIT).

- Unlock comprehensive insights into our analysis of North West stock in this health report.

Explore historical data to track North West's performance over time in our Past section.

Rogers Sugar (TSX:RSI)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Rogers Sugar Inc. operates in the refining, packaging, marketing, and distribution of sugar and maple products across Canada, the United States, Europe, and other international markets with a market cap of CA$718.89 million.

Operations: Rogers Sugar Inc. generates revenue primarily from its sugar segment, contributing CA$981.45 million, and its maple products segment, adding CA$225.32 million.

Rogers Sugar, a smaller player in the Canadian market, reported CAD 309.09 million in sales for Q3 2024, up from CAD 262.29 million last year. However, net income dropped to CAD 7.38 million from CAD 14.18 million previously, with basic earnings per share falling to CAD 0.06 from CAD 0.13 a year ago. The company trades at nearly half its estimated fair value and has high-quality past earnings but faces challenges with its high net debt to equity ratio of 91%.

Where To Now?

- Gain an insight into the universe of 46 TSX Undiscovered Gems With Strong Fundamentals by clicking here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if North West might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:NWC

North West

Through its subsidiaries, engages in the retail of food and everyday products and services to rural communities and urban neighborhood markets in northern Canada, rural Alaska, the South Pacific, and the Caribbean.

Flawless balance sheet established dividend payer.