Undervalued Small Caps On TSX With Insider Buying In January 2025 Canada

Reviewed by Simply Wall St

As we enter 2025, the Canadian market is navigating a landscape shaped by recent policy changes in the U.S., with particular attention on energy reforms and tariff uncertainties. Despite these challenges, the TSX index has shown resilience, buoyed by a solid economic backdrop and potential monetary easing from the Bank of Canada. In this environment, identifying promising small-cap stocks involves looking for companies that can leverage positive economic conditions while managing external risks effectively.

Top 10 Undervalued Small Caps With Insider Buying In Canada

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Primaris Real Estate Investment Trust | 12.0x | 3.2x | 45.17% | ★★★★★★ |

| Boston Pizza Royalties Income Fund | 12.1x | 7.5x | 46.10% | ★★★★★☆ |

| Nexus Industrial REIT | 12.4x | 3.1x | 26.56% | ★★★★★☆ |

| Vermilion Energy | NA | 1.2x | -4464.71% | ★★★★☆☆ |

| Bragg Gaming Group | NA | 1.0x | -37.53% | ★★★★☆☆ |

| Minto Apartment Real Estate Investment Trust | NA | 5.4x | 21.61% | ★★★★☆☆ |

| Savaria | 30.7x | 1.6x | 28.30% | ★★★☆☆☆ |

| Parex Resources | 3.6x | 0.8x | -5.73% | ★★★☆☆☆ |

| Saturn Oil & Gas | 2.0x | 0.6x | -74.82% | ★★★☆☆☆ |

| StorageVault Canada | NA | 4.6x | -658.50% | ★★★☆☆☆ |

Let's review some notable picks from our screened stocks.

High Liner Foods (TSX:HLF)

Simply Wall St Value Rating: ★★★★☆☆

Overview: High Liner Foods is engaged in the manufacturing and marketing of prepared and packaged frozen seafood, with a focus on providing high-quality seafood products.

Operations: The company generates revenue primarily from the manufacturing and marketing of prepared and packaged frozen seafood, with recent revenue figures around $961.31 million. Over several periods, its gross profit margin has shown fluctuations, reaching 22.36% in the latest period provided. Operating expenses are a significant component of costs, with general and administrative expenses consistently being a major part of these costs across multiple periods.

PE: 5.3x

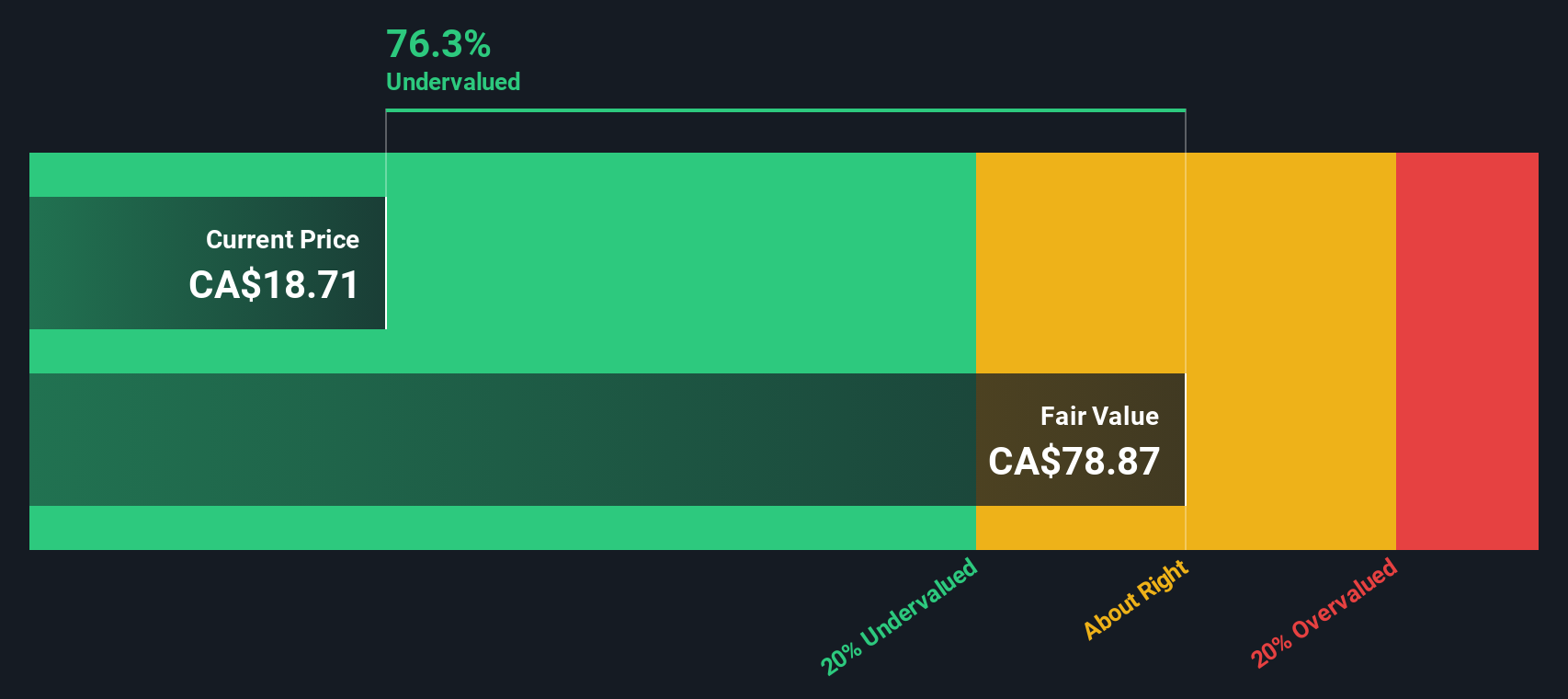

High Liner Foods, a Canadian company with modest market capitalization, has recently demonstrated insider confidence through share purchases. From June to September 2024, they bought back 153,469 shares for C$1.5 million. Despite a decline in sales to US$228.88 million in Q3 2024 from the previous year's US$259.7 million, net income surged to US$18.35 million from US$5.49 million, reflecting improved earnings quality despite high debt levels and reliance on external borrowing for funding.

- Delve into the full analysis valuation report here for a deeper understanding of High Liner Foods.

Explore historical data to track High Liner Foods' performance over time in our Past section.

H&R Real Estate Investment Trust (TSX:HR.UN)

Simply Wall St Value Rating: ★★★★☆☆

Overview: H&R Real Estate Investment Trust operates a diversified portfolio across office, retail, industrial, and residential properties with a market cap of CA$2.98 billion.

Operations: The primary revenue streams for the company include office, retail, industrial, and residential segments. The gross profit margin has shown fluctuations over time, with a notable high of 82.57% in early 2020 and more recent figures around 66.33%. Operating expenses have varied but generally remain a small component relative to revenue. Non-operating expenses have had significant impacts on net income margins, which have experienced variability including negative periods in recent years.

PE: -9.4x

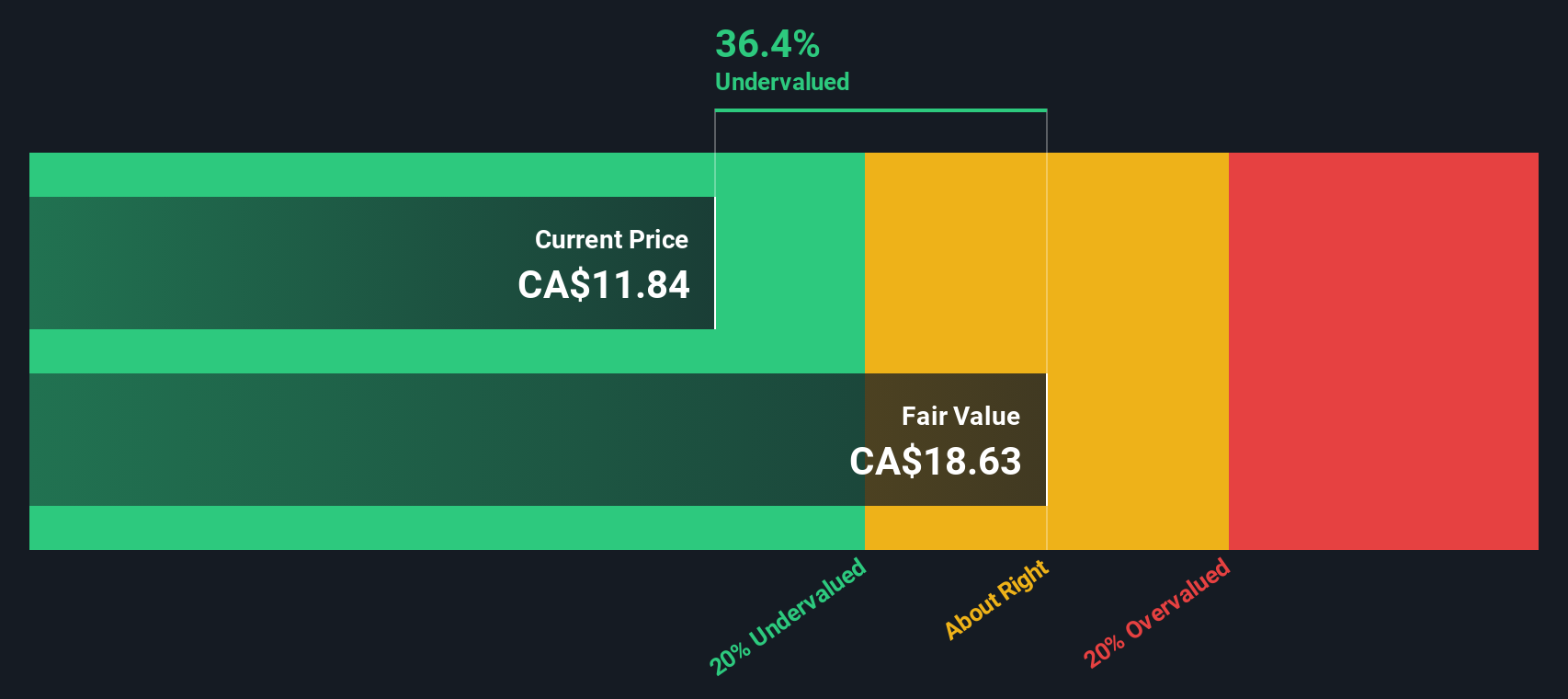

H&R Real Estate Investment Trust, a smaller player in Canada's investment landscape, is experiencing insider confidence with recent share purchases. Despite reporting a net loss of C$9.72 million for Q3 2024 and C$250.6 million for the nine months ending September 30, 2024, the company declared consistent monthly distributions of C$0.05 per unit for January 2025. Earnings are forecasted to grow by an impressive rate annually, hinting at potential recovery and growth opportunities ahead despite current financial challenges driven by high-risk external borrowing sources.

NorthWest Healthcare Properties Real Estate Investment Trust (TSX:NWH.UN)

Simply Wall St Value Rating: ★★★★★☆

Overview: NorthWest Healthcare Properties Real Estate Investment Trust operates within the healthcare real estate industry, focusing on managing and developing a portfolio of properties with a market capitalization of CA$1.91 billion.

Operations: The company generates revenue primarily from the healthcare real estate industry, with a recent figure of CA$483.34 million. Its cost of goods sold (COGS) is CA$113.96 million, leading to a gross profit margin of 76.42%. Operating expenses include general and administrative costs amounting to CA$55.49 million, while non-operating expenses significantly impact net income figures, resulting in a recent net income margin of -93.39%.

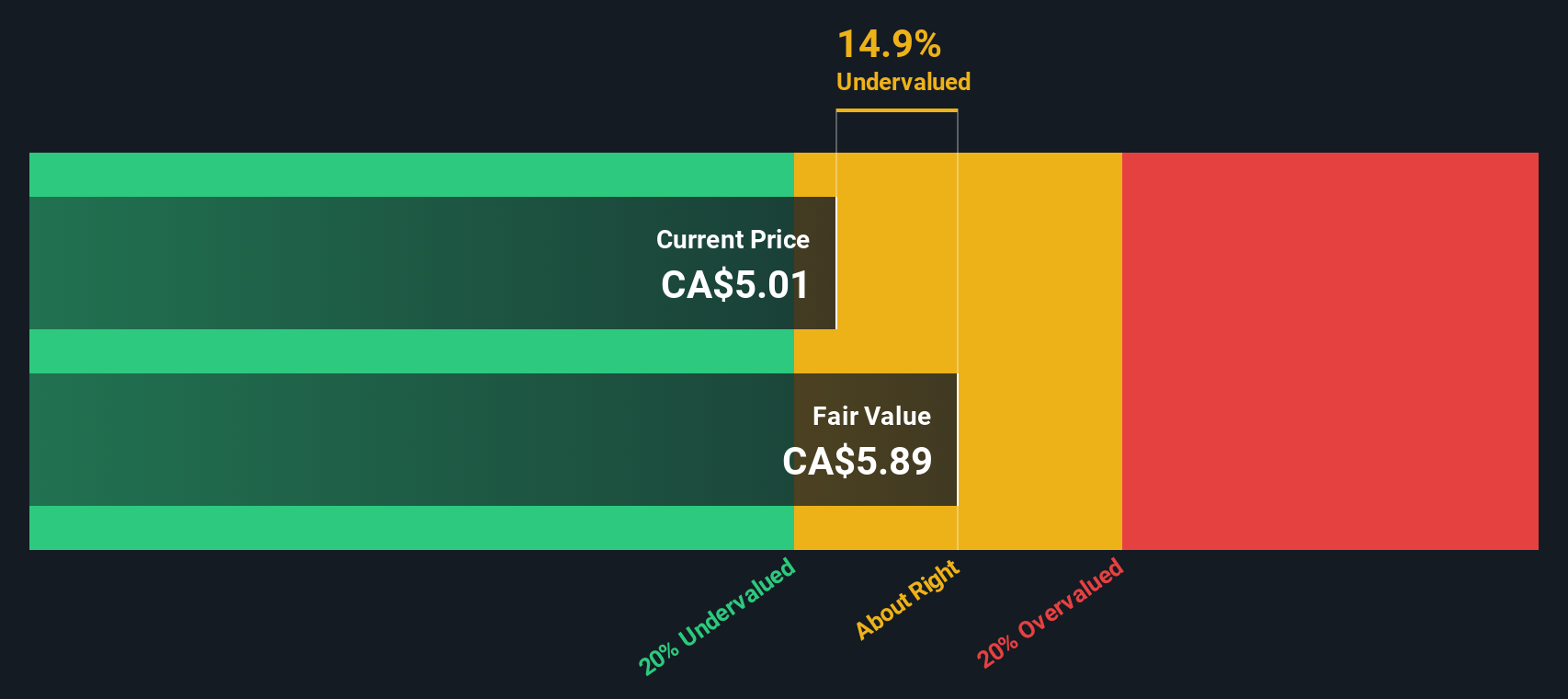

PE: -2.5x

NorthWest Healthcare Properties Real Estate Investment Trust is navigating a challenging financial landscape, with earnings forecasted to grow by 111% annually, despite interest payments that are not well covered. The company relies entirely on external borrowing for funding, which carries higher risk. Notably, insider confidence is evident as Independent Trustee Robert Julien purchased 600,000 shares worth approximately C$2.72 million recently. The consistent monthly dividend of C$0.03 per unit underscores the company's commitment to shareholder returns amidst these dynamics.

Next Steps

- Gain an insight into the universe of 27 Undervalued TSX Small Caps With Insider Buying by clicking here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if High Liner Foods might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:HLF

High Liner Foods

Processes and markets prepared and packaged frozen seafood products in North America.

Undervalued with mediocre balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Stride Stock: Online Education Finds Its Second Act

CS Disco Stock: Legal AI Is Moving From Efficiency Tool to Competitive Necessity

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)