- Canada

- /

- Oil and Gas

- /

- TSX:URC

Uranium Royalty (TSX:URC) Q2 Profitability Relies Heavily on One-Off Gain, Challenging Bull Case

Reviewed by Simply Wall St

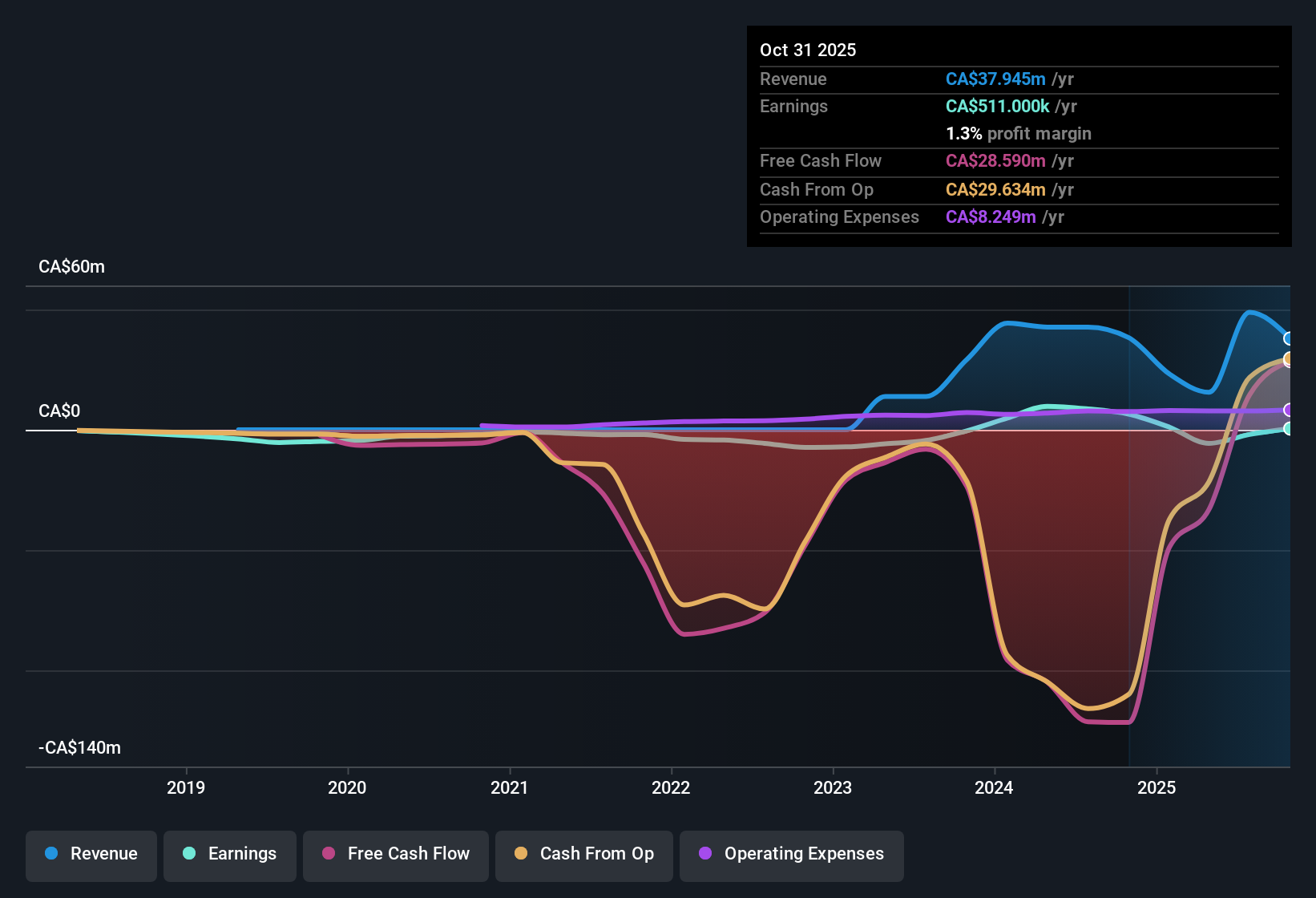

Uranium Royalty (TSX:URC) has just posted its Q2 2026 numbers, with revenue at CA$0.04 million and net income of CA$2.06 million translating to EPS of CA$0.02, as investors watch how these figures play into the stock’s current CA$5.06 share price. The company has seen quarterly revenue swing from CA$0 in Q1 2025 to CA$33.21 million in Q1 2026, while EPS has moved from a loss of CA$0.02 per share in early 2025 to a positive CA$0.02 in the latest quarter. This sets up a story where reported profitability is improving, but the durability of those margins is still the key question.

See our full analysis for Uranium Royalty.With the latest headline numbers on the table, the next step is to see how they line up against the prevailing narratives around Uranium Royalty. This highlights where the data backs the story and where it pushes investors to rethink their assumptions.

Curious how numbers become stories that shape markets? Explore Community Narratives

Net Margin Slips to 1.3 Percent on Trailing Basis

- Over the last 12 months Uranium Royalty reported a net profit margin of 1.3 percent, down from 17 percent in the prior year, even though Q2 2026 net income excluding extra items was CA$2.06 million on only CA$0.04 million of revenue.

- Bears point to this margin compression as a sign that profitability is less robust than it looks, and the trailing data partly backs that view:

- Trailing 12 month net income excluding extra items of CA$0.51 million contrasts with several recent quarterly losses, including CA$2.16 million in Q1 2025 and CA$1.91 million in Q3 2025.

- The shift from a 17 percent margin to 1.3 percent, alongside negative quarterly EPS through most of 2025 before turning positive in 2026, highlights how sensitive URC’s profitability has been over the period.

CA$2.4 Million One Off Gain Distorts Profit Picture

- The trailing 12 month results include a CA$2.4 million one off gain, while Q2 2026 alone shows CA$2.06 million of net income excluding extra items, so a material slice of reported profit over the year is tied to a single identifiable item.

- Critics highlight that this one off gain complicates valuation, and the numbers reinforce their caution:

- Across the last six reported quarters, net income excluding extra items swung from a loss of CA$2.16 million in Q1 2025 to a profit of CA$2.06 million in Q2 2026, indicating that the trailing tally is heavily influenced by a few positive periods rather than steady performance.

- With trailing net income excluding extra items at just CA$0.51 million despite the CA$2.4 million gain, the underlying earnings base looks relatively modest when that gain is considered separately.

Rich 18.4x Sales Multiple Versus Sector

- URC trades on a trailing Price to Sales ratio of 18.4 times, above its peer average of 16.9 times and far above the Canadian Oil and Gas industry average of 2.8 times, even though trailing 12 month revenue is CA$37.95 million and trailing net income excluding extra items is only CA$0.51 million.

- What is surprising is how this premium lines up against both the weaker margin profile and the longer term growth record:

- On one hand, URC has delivered about 28 percent compound earnings growth per year over the past five years and has been profitable over that stretch, which can help explain why the market is willing to pay more than 16 times sales and well above the 2.8 times sector level.

- On the other hand, earnings were negative in the most recent year and the trailing margin sits at 1.3 percent, which means today’s CA$5.06 share price is being supported more by that five year growth history than by the most recent 12 month profitability.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Uranium Royalty's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

Explore Alternative Opportunities

Uranium Royalty’s thin net margins, dependence on one off gains, and premium sales multiple suggest its recent profitability may be fragile rather than firmly established.

If you want businesses where earnings strength looks more durable, use our stable growth stocks screener (2103 results) to quickly find companies delivering steadier revenue momentum and more reliable profit trajectories across cycles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:URC

Uranium Royalty

Operates as a pure-play uranium royalty company in Canada, the United States, Namibia, and Spain.

Flawless balance sheet with low risk.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Butler National (Buks) outperforms.

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)