- Canada

- /

- Electrical

- /

- TSX:HPS.A

Top Undiscovered Gems in Canada for September 2024

Reviewed by Simply Wall St

In the last week, the Canadian market has been flat, with a notable 3.1% drop in the Energy sector, yet it remains up 13% over the past year and earnings are forecast to grow by 15% annually. In this context of steady overall growth and sector-specific fluctuations, identifying promising yet under-the-radar stocks becomes crucial for investors seeking to capitalize on emerging opportunities.

Top 10 Undiscovered Gems With Strong Fundamentals In Canada

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| TWC Enterprises | 6.74% | 10.99% | 25.68% | ★★★★★★ |

| Reconnaissance Energy Africa | NA | 15.28% | 7.58% | ★★★★★★ |

| Jaguar Mining | 1.19% | 5.49% | 5.12% | ★★★★★★ |

| Taiga Building Products | NA | 6.05% | 10.50% | ★★★★★★ |

| Amerigo Resources | 12.87% | 7.49% | 12.97% | ★★★★★☆ |

| Firan Technology Group | 17.91% | 3.75% | 23.32% | ★★★★★☆ |

| Mako Mining | 22.90% | 38.12% | 54.79% | ★★★★★☆ |

| Pizza Pizza Royalty | 15.66% | 3.64% | 3.95% | ★★★★☆☆ |

| Queen's Road Capital Investment | 7.20% | 22.14% | 22.20% | ★★★★☆☆ |

| Genesis Land Development | 53.32% | 25.58% | 47.05% | ★★★★☆☆ |

We'll examine a selection from our screener results.

Hammond Power Solutions (TSX:HPS.A)

Simply Wall St Value Rating: ★★★★★★

Overview: Hammond Power Solutions Inc., along with its subsidiaries, specializes in designing, manufacturing, and selling various transformers across Canada, the United States, Mexico, and India and has a market cap of CA$1.41 billion.

Operations: Hammond Power Solutions Inc. generates CA$754.37 million from the manufacture and sale of transformers across multiple regions. The company's financial performance includes a notable gross profit margin trend, reflecting its operational efficiency in this sector.

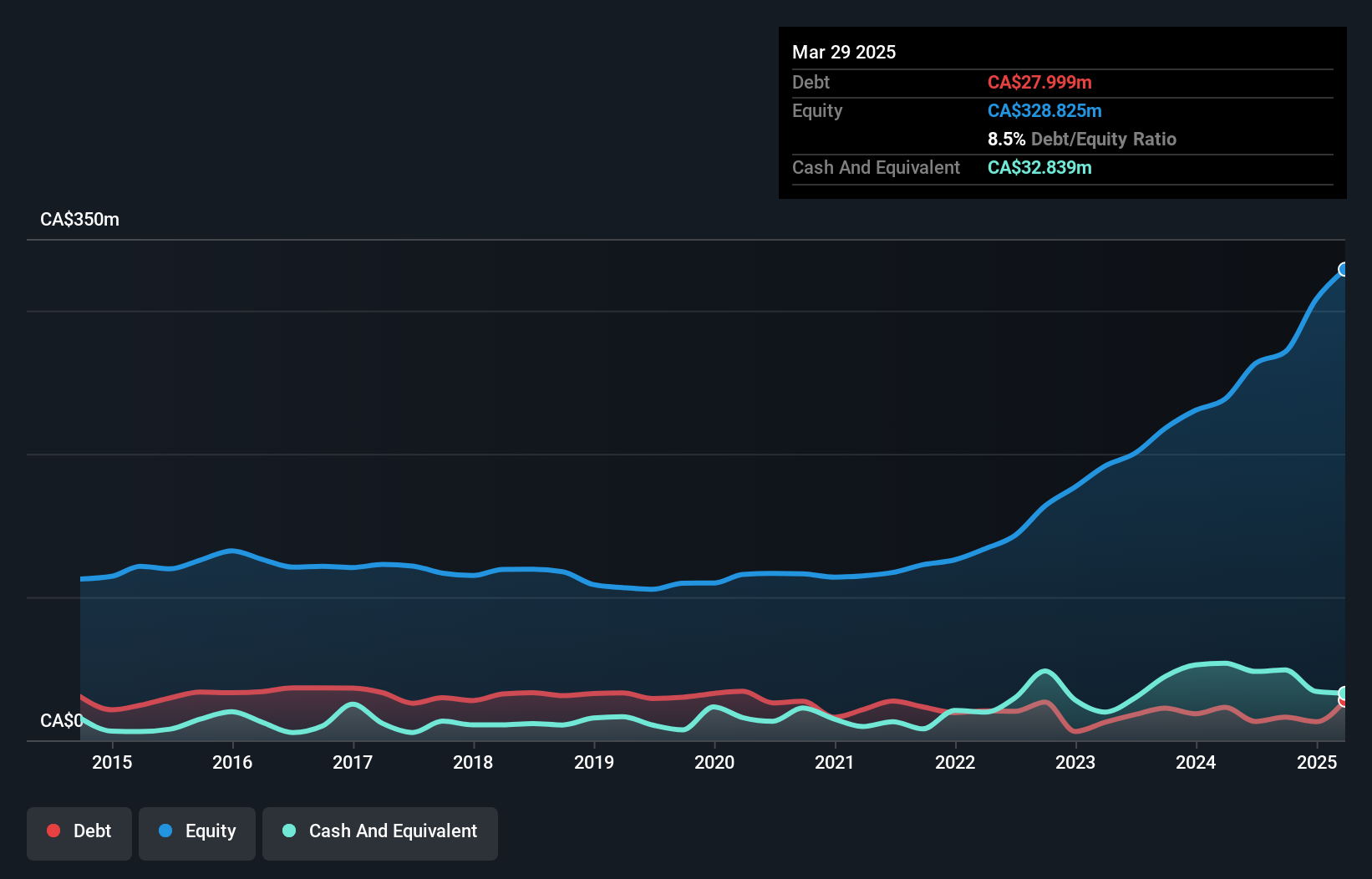

Hammond Power Solutions, a small Canadian company, has shown impressive financial performance. Its earnings grew by 12.3% over the past year, outpacing the Electrical industry’s 6.5%. The company reduced its debt to equity ratio from 27.7% to 5% in five years and trades at 49.1% below our fair value estimate. Recent quarterly results reported sales of C$197M and net income of C$23M compared to last year's C$172M and C$13M respectively, reflecting solid growth momentum.

- Navigate through the intricacies of Hammond Power Solutions with our comprehensive health report here.

Understand Hammond Power Solutions' track record by examining our Past report.

North West (TSX:NWC)

Simply Wall St Value Rating: ★★★★★★

Overview: The North West Company Inc., through its subsidiaries, engages in the retail of food and everyday products and services to rural communities and urban neighborhood markets in northern Canada, rural Alaska, the South Pacific, and the Caribbean with a market cap of CA$2.49 billion.

Operations: North West generates CA$2.52 billion in revenue from its retail operations focused on food and everyday products. The company's cost structure and profit margins are not detailed, but the significant revenue figure highlights its extensive market reach.

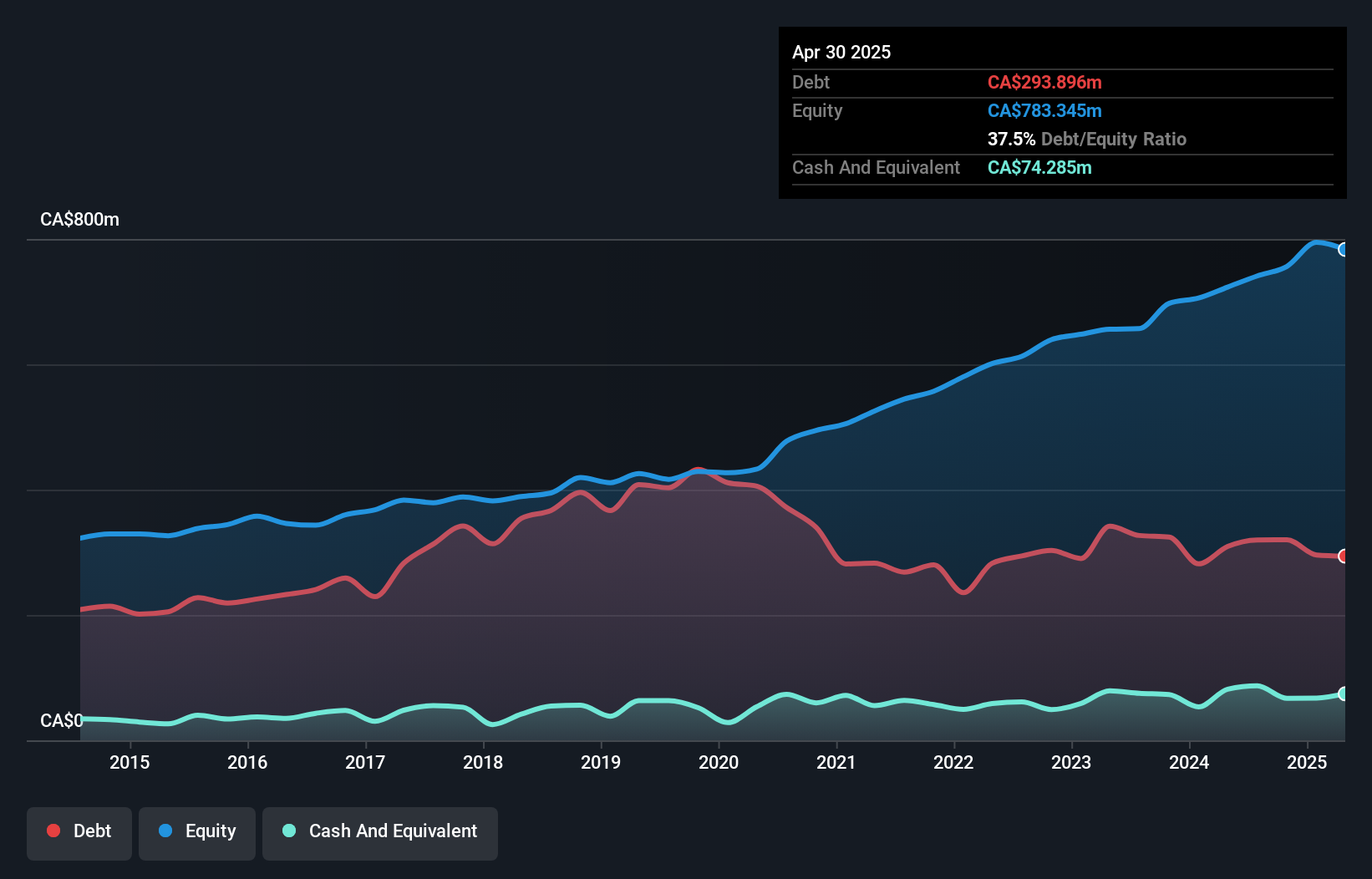

North West has shown consistent performance, with earnings growth of 9.5% over the past year, outpacing the Consumer Retailing industry’s -7.7%. The company’s net debt to equity ratio improved from 96.7% to 43.2% over five years, reflecting prudent financial management. Trading at 44.4% below estimated fair value, North West seems undervalued with high-quality earnings and well-covered interest payments (10.9x EBIT). Recent results include Q2 sales of C$646M and a net income of C$35M.

- Delve into the full analysis health report here for a deeper understanding of North West.

Evaluate North West's historical performance by accessing our past performance report.

TerraVest Industries (TSX:TVK)

Simply Wall St Value Rating: ★★★★★☆

Overview: TerraVest Industries Inc. manufactures and sells goods and services to energy, agriculture, mining, transportation, and other markets in Canada and the United States, with a market cap of CA$1.91 billion.

Operations: The company generates revenue from five segments: Service (CA$201.78 million), Processing Equipment (CA$117.58 million), Compressed Gas Equipment (CA$243.77 million), and HVAC and Containment Equipment (CA$292.90 million). The Corporate segment reported a loss of CA$0.93 million.

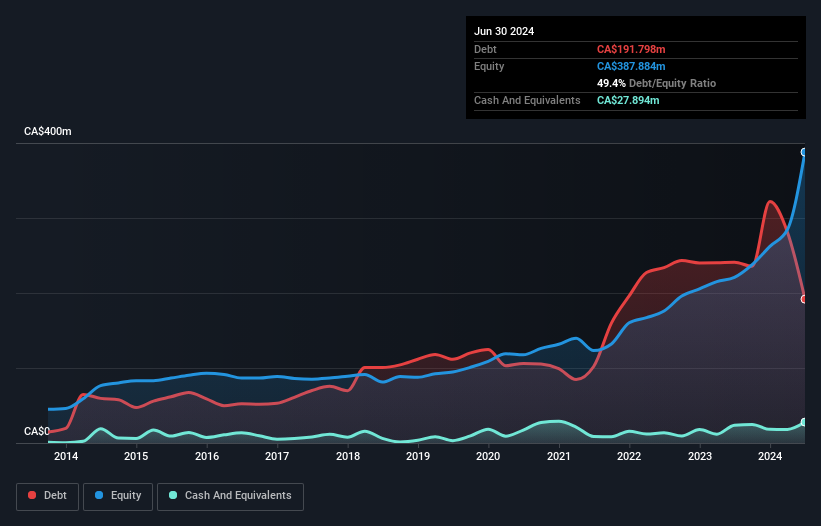

TerraVest Industries, with a market cap of CAD 681.16 million, has demonstrated robust growth. Recent earnings reveal a revenue jump to CAD 238.13 million for Q3 2024 from CAD 150.36 million last year, while net income increased to CAD 11.92 million from CAD 7.97 million. Basic EPS rose to CAD 0.63 from CAD 0.45 over the same period, and diluted EPS improved to CAD 0.61 from CAD 0.44 last year.

Make It Happen

- Discover the full array of 44 TSX Undiscovered Gems With Strong Fundamentals right here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hammond Power Solutions might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:HPS.A

Hammond Power Solutions

Engages in the design, manufacture, and sale of various transformers in Canada, the United States, Mexico, and India.

Flawless balance sheet and good value.