- Hong Kong

- /

- Communications

- /

- SEHK:1523

Plover Bay Technologies And 2 Other Stocks That May Be Valued Below Their Intrinsic Worth

Reviewed by Simply Wall St

In the face of recent volatility, with U.S. stocks experiencing declines amid cautious Federal Reserve commentary and looming political uncertainties, investors are increasingly on the lookout for opportunities in undervalued stocks that might be trading below their intrinsic worth. Amid these market conditions, identifying stocks with strong fundamentals and potential for growth can offer a strategic advantage to investors looking to navigate the current economic landscape.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Shenzhen Lifotronic Technology (SHSE:688389) | CN¥15.45 | CN¥30.78 | 49.8% |

| Sandy Spring Bancorp (NasdaqGS:SASR) | US$34.58 | US$68.97 | 49.9% |

| Lindab International (OM:LIAB) | SEK226.40 | SEK451.04 | 49.8% |

| Absolent Air Care Group (OM:ABSO) | SEK255.00 | SEK509.82 | 50% |

| BYD Electronic (International) (SEHK:285) | HK$43.35 | HK$86.67 | 50% |

| STIF Société anonyme (ENXTPA:ALSTI) | €24.60 | €49.13 | 49.9% |

| Surgical Science Sweden (OM:SUS) | SEK159.10 | SEK317.00 | 49.8% |

| KebNi (OM:KEBNI B) | SEK1.084 | SEK2.17 | 50% |

| Salmones Camanchaca (SNSE:SALMOCAM) | CLP2400.00 | CLP4798.13 | 50% |

| Paycor HCM (NasdaqGS:PYCR) | US$19.33 | US$38.52 | 49.8% |

Let's dive into some prime choices out of the screener.

Plover Bay Technologies (SEHK:1523)

Overview: Plover Bay Technologies Limited is an investment holding company that designs, develops, and markets software-defined wide area network routers with a market capitalization of HK$4.98 billion.

Operations: The company's revenue segments include $15.19 million from sales of SD-WAN routers with fixed first connectivity, $59.87 million from sales of SD-WAN routers with mobile first connectivity, and $31.86 million from software licenses and warranty and support services.

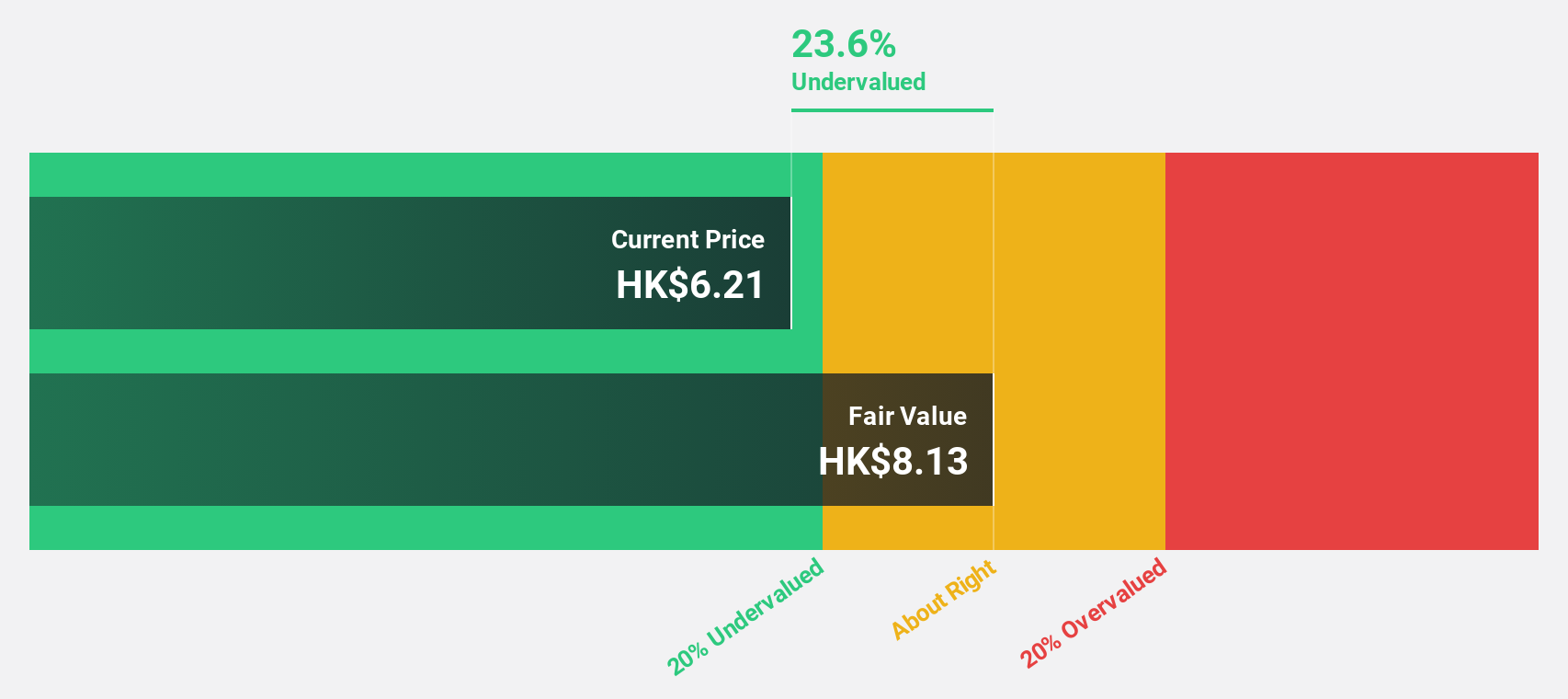

Estimated Discount To Fair Value: 22.9%

Plover Bay Technologies is trading 22.9% below its estimated fair value of HK$5.9, with a high forecasted return on equity of 73.3% in three years. Recent earnings exceeded last year's US$28.1 million by over 10%, driven by increased sales and improved margins. Earnings are projected to grow at 17.3% annually, outpacing the Hong Kong market's growth rate, highlighting its potential as an undervalued stock based on cash flows.

- According our earnings growth report, there's an indication that Plover Bay Technologies might be ready to expand.

- Unlock comprehensive insights into our analysis of Plover Bay Technologies stock in this financial health report.

Docebo (TSX:DCBO)

Overview: Docebo Inc. is a learning management software company offering an AI-powered learning platform across North America and internationally, with a market cap of CA$2.02 billion.

Operations: The company's revenue segment includes $209.17 million from its AI-enhanced educational software offerings.

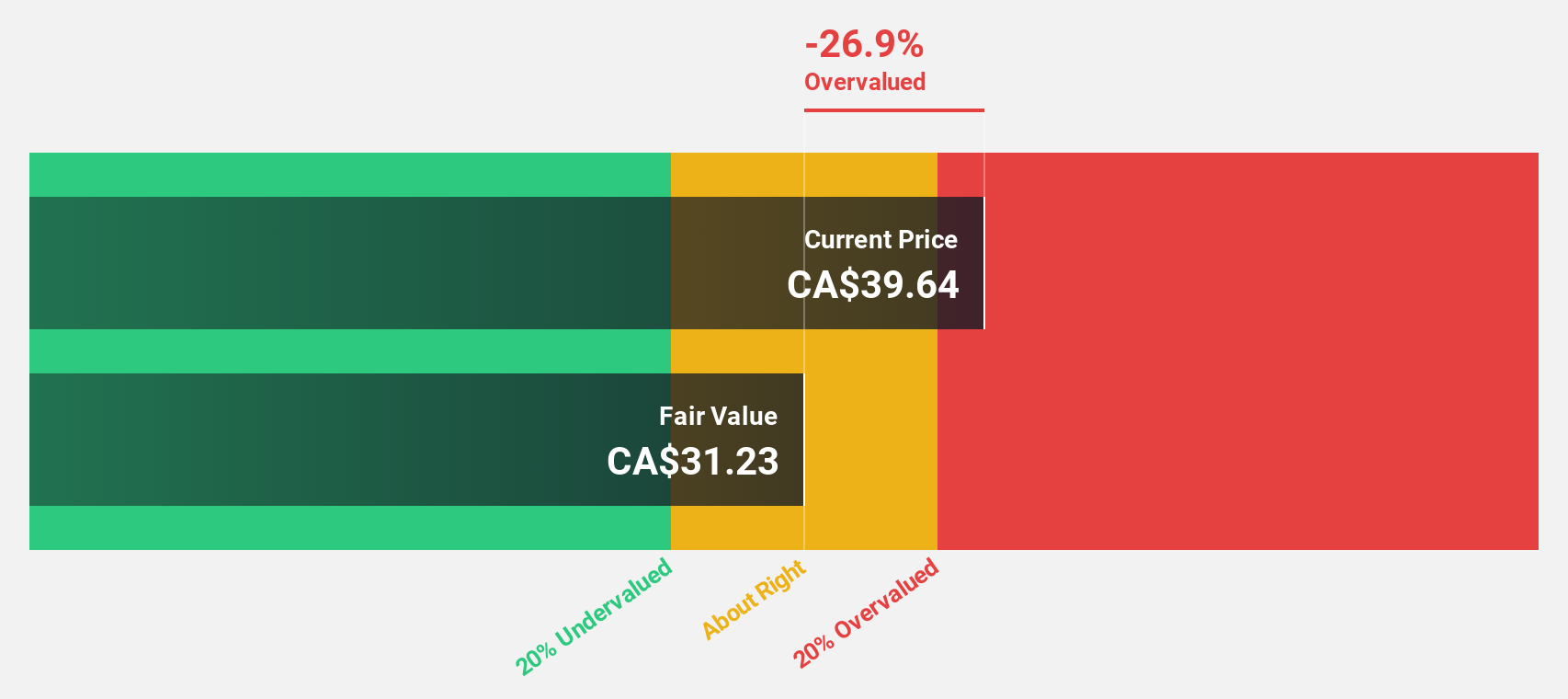

Estimated Discount To Fair Value: 10.6%

Docebo, trading at CA$66.68, is priced 10.6% below its fair value of CA$74.62, indicating potential undervaluation based on cash flows. The company reported significant earnings growth of 1381.8% over the past year and forecasts a robust annual profit increase of 38.7%, surpassing the Canadian market's average growth rate. Recent strategic alliances with Class Technologies and Deloitte enhance its offerings and could support future revenue expansion beyond the forecasted 14.1% annually.

- In light of our recent growth report, it seems possible that Docebo's financial performance will exceed current levels.

- Dive into the specifics of Docebo here with our thorough financial health report.

TerraVest Industries (TSX:TVK)

Overview: TerraVest Industries Inc. is a manufacturer and seller of goods and services across various sectors including agriculture, mining, energy, chemicals, utilities, transportation, and construction in Canada, the United States, and internationally with a market cap of CA$2.25 billion.

Operations: The company's revenue segments include Service (CA$203.45 million), Processing Equipment (CA$110.10 million), Compressed Gas Equipment (CA$269.56 million), and HVAC and Containment Equipment (CA$329.58 million).

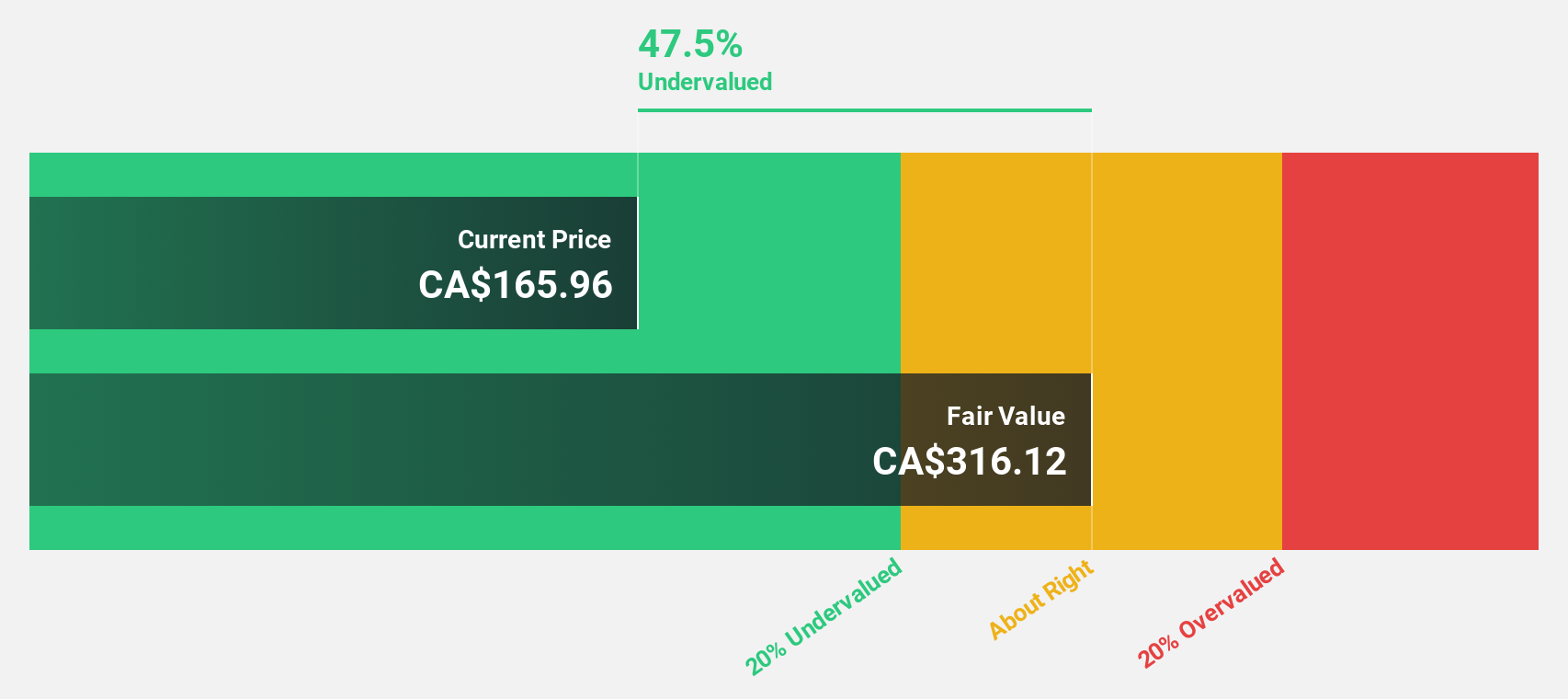

Estimated Discount To Fair Value: 12.4%

TerraVest Industries, trading at CA$115.21, is priced 12.4% below its estimated fair value of CA$131.54, suggesting it could be undervalued based on cash flows despite high debt levels and recent shareholder dilution. Earnings are expected to grow significantly at 21.3% annually over the next three years, outpacing the Canadian market's average growth rate. Recent index inclusions and a 17% dividend increase highlight positive momentum despite mixed quarterly earnings results compared to last year.

- Our earnings growth report unveils the potential for significant increases in TerraVest Industries' future results.

- Navigate through the intricacies of TerraVest Industries with our comprehensive financial health report here.

Key Takeaways

- Reveal the 874 hidden gems among our Undervalued Stocks Based On Cash Flows screener with a single click here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1523

Plover Bay Technologies

An investment holding company, designs, develops, and markets software defined wide area network routers.

Outstanding track record with excellent balance sheet.

Market Insights

Community Narratives