- Canada

- /

- Metals and Mining

- /

- TSX:AII

3 TSX Growth Companies With At Least 11% Insider Ownership

Reviewed by Simply Wall St

As the Canadian economy faces challenges with a recent contraction in GDP and rate cuts by the Bank of Canada amid tariff uncertainties, investors are keenly observing growth opportunities that may arise from these shifting dynamics. In such an environment, companies with substantial insider ownership often stand out as they can signal confidence from those closest to the business, making them potential candidates for investors looking to capitalize on growth within a recovering market.

Top 10 Growth Companies With High Insider Ownership In Canada

| Name | Insider Ownership | Earnings Growth |

| Propel Holdings (TSX:PRL) | 36.5% | 38.9% |

| Robex Resources (TSXV:RBX) | 28.2% | 130.7% |

| Orla Mining (TSX:OLA) | 11.5% | 40.8% |

| West Red Lake Gold Mines (TSXV:WRLG) | 13.5% | 77.6% |

| Allied Gold (TSX:AAUC) | 17.7% | 79.2% |

| Almonty Industries (TSX:AII) | 17.2% | 53% |

| Aritzia (TSX:ATZ) | 18.6% | 45.1% |

| Enterprise Group (TSX:E) | 32.2% | 56.3% |

| Colliers International Group (TSX:CIGI) | 14.1% | 23.9% |

| CHAR Technologies (TSXV:YES) | 10.8% | 60.5% |

Here's a peek at a few of the choices from the screener.

Almonty Industries (TSX:AII)

Simply Wall St Growth Rating: ★★★★★★

Overview: Almonty Industries Inc. is involved in the mining, processing, and shipping of tungsten concentrate with a market cap of CA$377.87 million.

Operations: Almonty Industries Inc.'s revenue is derived from its activities in mining, processing, and shipping tungsten concentrate.

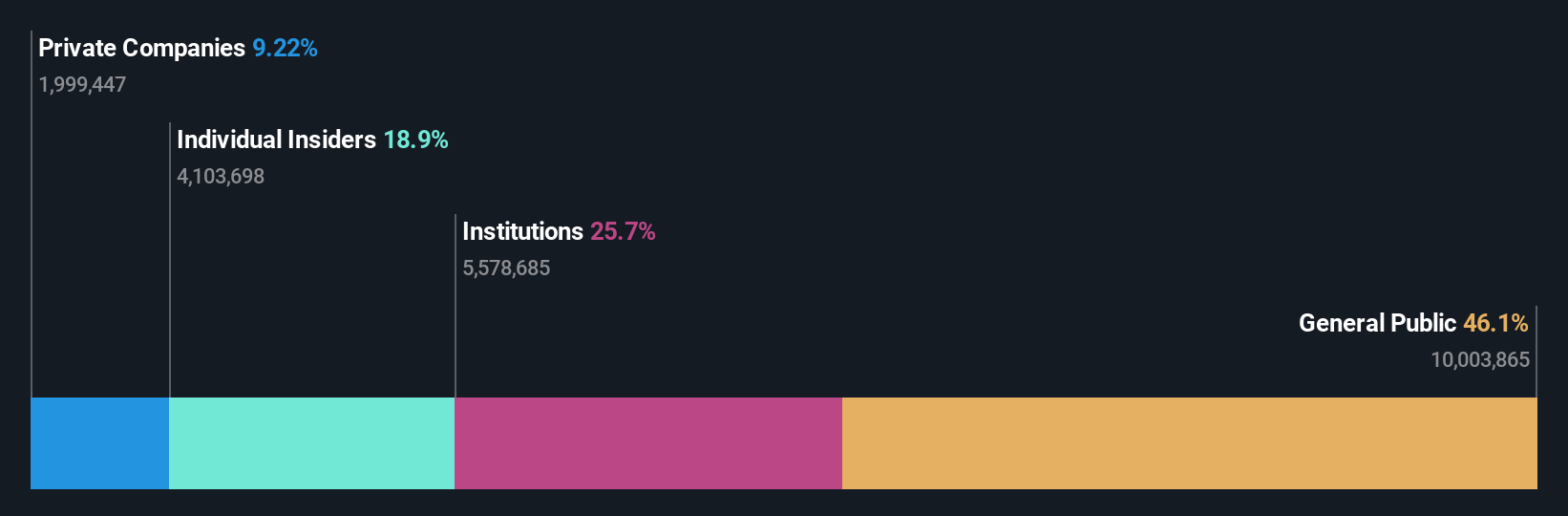

Insider Ownership: 17.2%

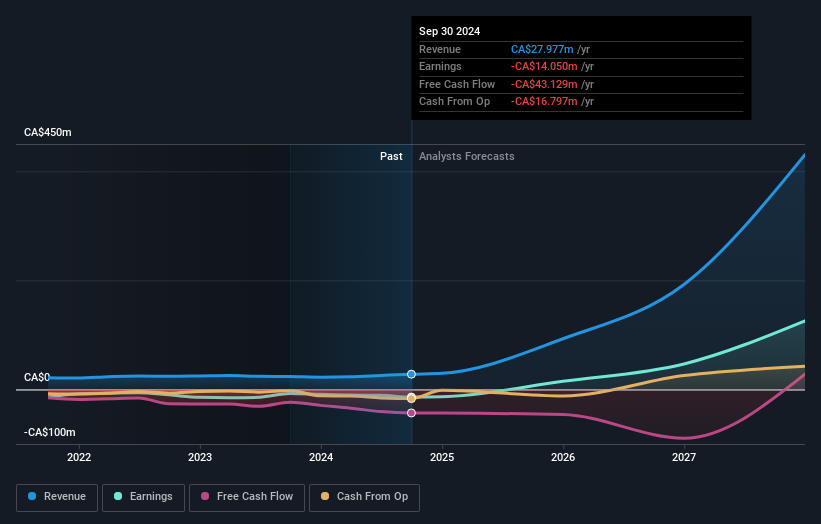

Almonty Industries is positioned for growth with high insider ownership, trading significantly below its estimated fair value. The company anticipates becoming profitable within three years, with revenue growth forecast at 45.8% annually, outpacing the Canadian market. Recent strategic moves include a private placement raising CAD 2 million and an exclusive offtake agreement for its Sangdong Molybdenum Project, expected to enhance financial stability and reduce South Korea's reliance on Chinese molybdenum imports.

- Click to explore a detailed breakdown of our findings in Almonty Industries' earnings growth report.

- Our expertly prepared valuation report Almonty Industries implies its share price may be too high.

Orla Mining (TSX:OLA)

Simply Wall St Growth Rating: ★★★★★★

Overview: Orla Mining Ltd. is involved in the acquisition, exploration, development, and exploitation of mineral properties with a market cap of CA$2.99 billion.

Operations: The company generates revenue from the evaluation and exploration of mineral exploration properties, totaling $314.10 million.

Insider Ownership: 11.5%

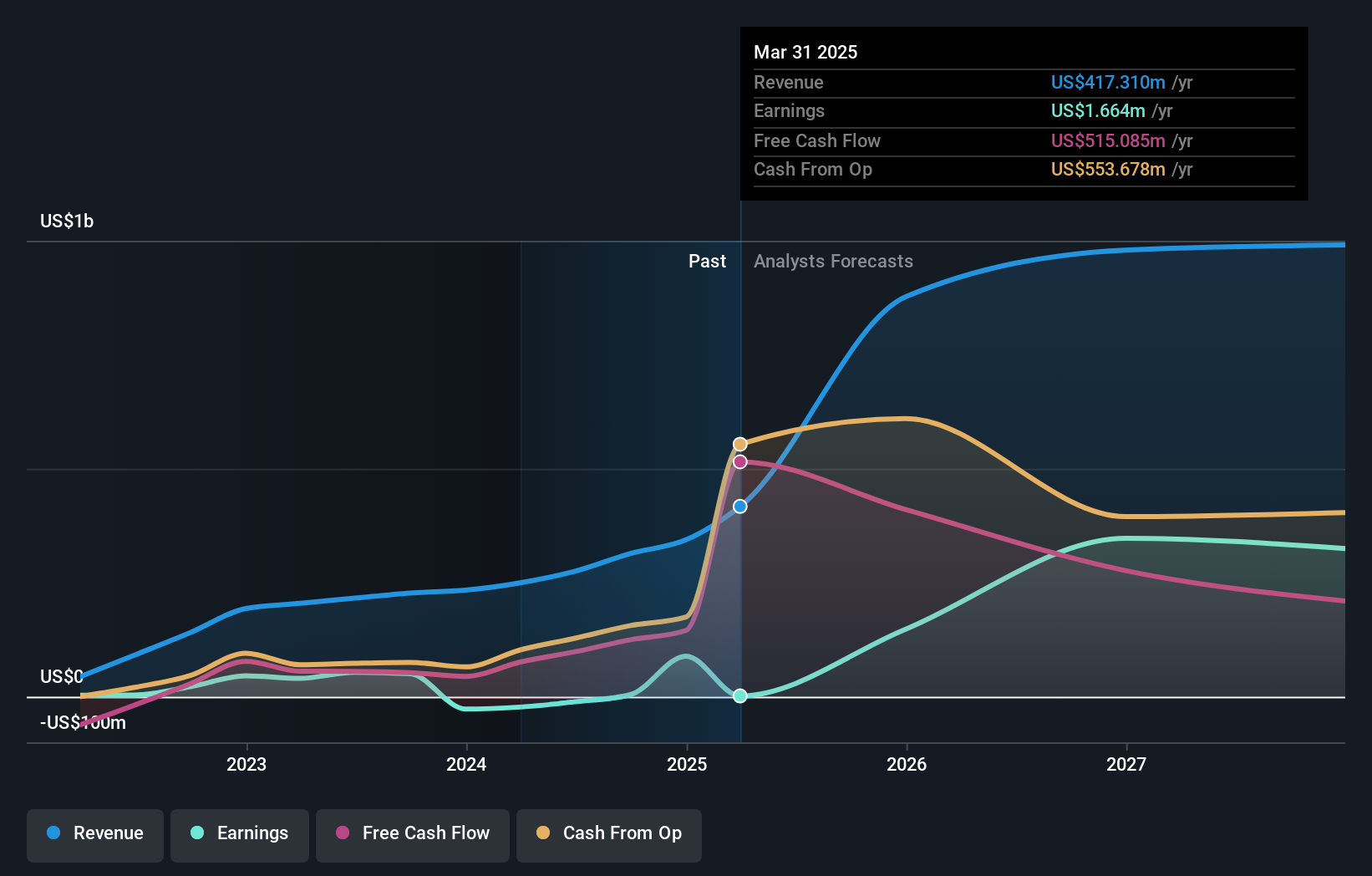

Orla Mining is poised for growth with substantial insider ownership, bolstered by its strategic acquisition of the Musselwhite Gold Mine for $810 million. This move doubles Orla's annual gold production capacity and enhances cash flow, supporting organic growth plans. Recent private placements involving key investors like Pierre Lassonde underscore confidence in Orla's trajectory. Despite a dip in profit margins, earnings are forecast to grow significantly at 40.83% annually, outpacing the Canadian market.

- Delve into the full analysis future growth report here for a deeper understanding of Orla Mining.

- Our valuation report unveils the possibility Orla Mining's shares may be trading at a premium.

TerraVest Industries (TSX:TVK)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: TerraVest Industries Inc. is a company that manufactures and sells goods and services across various sectors including agriculture, mining, energy, chemicals, utilities, transportation, and construction in Canada, the United States, and internationally with a market cap of CA$2.54 billion.

Operations: The company's revenue segments consist of CA$203.45 million from Service, CA$110.10 million from Processing Equipment, CA$269.56 million from Compressed Gas Equipment, and CA$329.58 million from HVAC and Containment Equipment.

Insider Ownership: 21%

TerraVest Industries shows promise with its recent inclusion in multiple S&P/TSX indices, indicating market recognition. Despite a decrease in quarterly net income, annual earnings grew by 51.1%, and revenue is forecast to grow at 10.4% annually, outpacing the Canadian market's growth rate. The company has increased its dividend by 17%, reflecting confidence in future cash flows. Insider activity over the past three months indicates more buying than selling, though significant selling was noted recently.

- Click here to discover the nuances of TerraVest Industries with our detailed analytical future growth report.

- In light of our recent valuation report, it seems possible that TerraVest Industries is trading beyond its estimated value.

Taking Advantage

- Unlock more gems! Our Fast Growing TSX Companies With High Insider Ownership screener has unearthed 40 more companies for you to explore.Click here to unveil our expertly curated list of 43 Fast Growing TSX Companies With High Insider Ownership.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:AII

Almonty Industries

Engages in mining, processing, and shipping of tungsten concentrate.

Exceptional growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)