- Canada

- /

- Oil and Gas

- /

- TSX:PEY

TSX Dividend Stocks Spotlight On Three Canadian Picks

Reviewed by Simply Wall St

As the Canadian market reflects on a remarkable 2024, with the TSX gaining 18%, investors are now navigating a landscape of mixed headwinds and tailwinds for 2025. In this environment, dividend stocks stand out as appealing options, offering potential stability and income amidst policy uncertainties around tariffs and interest rates.

Top 10 Dividend Stocks In Canada

| Name | Dividend Yield | Dividend Rating |

| Whitecap Resources (TSX:WCP) | 6.90% | ★★★★★★ |

| Acadian Timber (TSX:ADN) | 6.59% | ★★★★★★ |

| Russel Metals (TSX:RUS) | 4.13% | ★★★★★☆ |

| Power Corporation of Canada (TSX:POW) | 5.15% | ★★★★★☆ |

| Royal Bank of Canada (TSX:RY) | 3.40% | ★★★★★☆ |

| IGM Financial (TSX:IGM) | 5.05% | ★★★★★☆ |

| Firm Capital Mortgage Investment (TSX:FC) | 8.20% | ★★★★★☆ |

| Richards Packaging Income Fund (TSX:RPI.UN) | 5.60% | ★★★★★☆ |

| Canadian Natural Resources (TSX:CNQ) | 4.47% | ★★★★★☆ |

| Sun Life Financial (TSX:SLF) | 3.99% | ★★★★★☆ |

Click here to see the full list of 28 stocks from our Top TSX Dividend Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

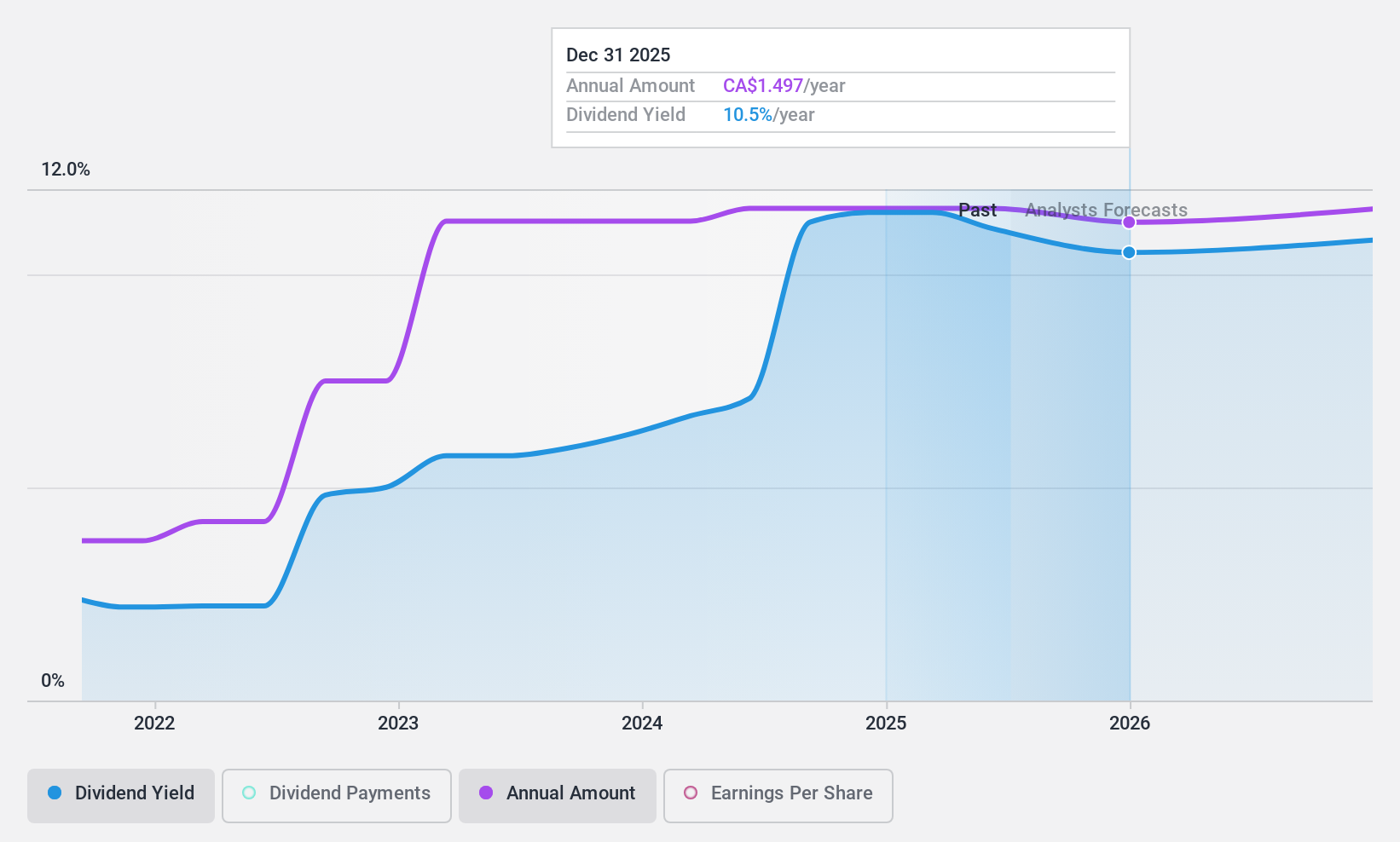

High Liner Foods (TSX:HLF)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: High Liner Foods Incorporated processes and markets frozen seafood products in North America with a market cap of CA$476.18 million.

Operations: High Liner Foods generates revenue of $961.30 million from the manufacturing and marketing of prepared and packaged frozen seafood products in North America.

Dividend Yield: 4.3%

High Liner Foods' dividend payments are well-covered by both earnings and cash flows, with payout ratios of 24.3% and 12.3%, respectively, suggesting sustainability. However, the company's dividend history has been volatile and unreliable over the past decade, indicating potential risk for income-focused investors. Despite trading at a discount to its estimated fair value, High Liner's high debt level poses financial concerns that may impact future dividend stability or growth prospects in the Canadian market.

- Take a closer look at High Liner Foods' potential here in our dividend report.

- Our comprehensive valuation report raises the possibility that High Liner Foods is priced lower than what may be justified by its financials.

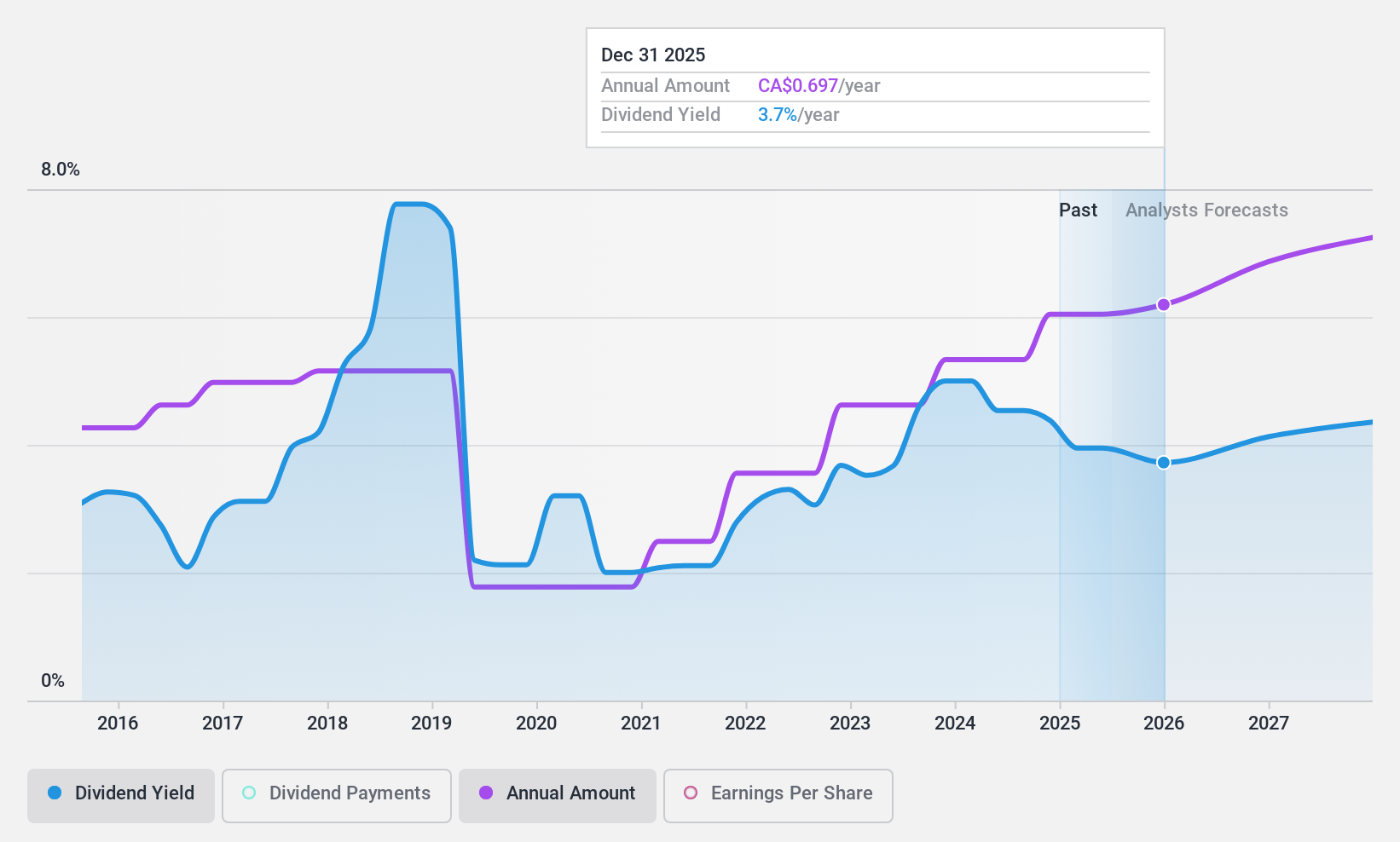

Peyto Exploration & Development (TSX:PEY)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Peyto Exploration & Development Corp. is an energy company focused on the exploration, development, and production of natural gas, oil, and natural gas liquids in Alberta's Deep Basin with a market cap of CA$3.41 billion.

Operations: Peyto Exploration & Development Corp. generates revenue of CA$900.94 million from its oil and gas exploration and production activities.

Dividend Yield: 7.6%

Peyto Exploration & Development offers a high dividend yield of 7.6%, placing it among the top Canadian dividend payers, but its sustainability is questionable. The payout ratio of 88.2% suggests coverage by earnings; however, dividends are not well-supported by free cash flows with a cash payout ratio of 124.7%. Historical volatility in payments over the past decade and recent insider selling further highlight potential risks for dividend stability despite trading below estimated fair value.

- Click here to discover the nuances of Peyto Exploration & Development with our detailed analytical dividend report.

- Our valuation report unveils the possibility Peyto Exploration & Development's shares may be trading at a discount.

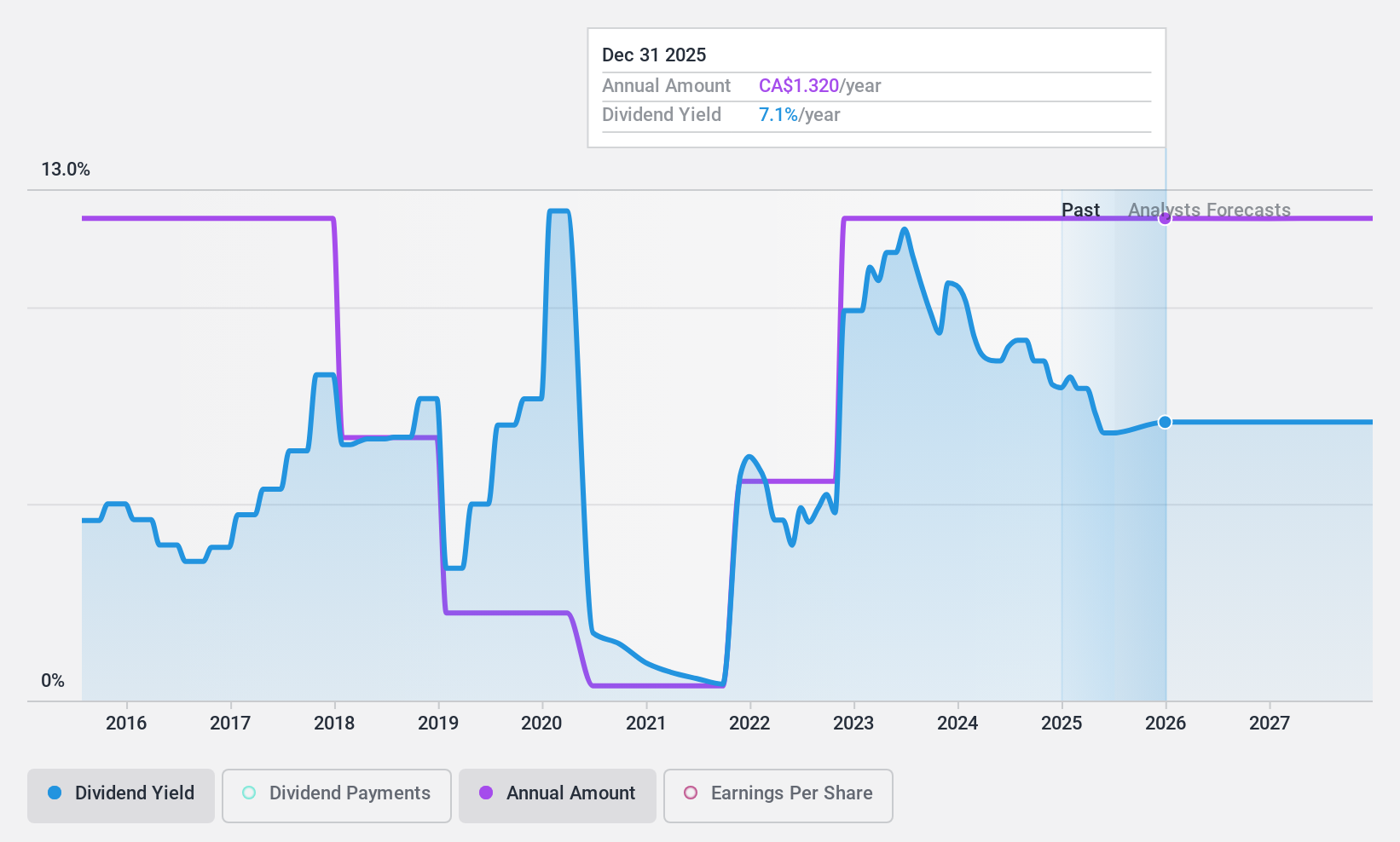

Parex Resources (TSX:PXT)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Parex Resources Inc. is involved in the exploration, development, production, and marketing of oil and natural gas in Colombia with a market cap of CA$1.50 billion.

Operations: Parex Resources Inc. generates revenue of $1.16 billion from its oil and gas exploration and production activities.

Dividend Yield: 9.8%

Parex Resources offers a high dividend yield of 9.81%, ranking it in the top 25% of Canadian dividend payers. Despite only four years of dividend history, payments have been reliable and growing. The payout ratio stands at 44.9%, indicating strong coverage by earnings, while a cash payout ratio of 31% supports sustainability through cash flows. Trading below estimated fair value enhances its appeal, though declining earnings forecasts may pose future challenges for growth stability.

- Delve into the full analysis dividend report here for a deeper understanding of Parex Resources.

- According our valuation report, there's an indication that Parex Resources' share price might be on the cheaper side.

Turning Ideas Into Actions

- Unlock more gems! Our Top TSX Dividend Stocks screener has unearthed 25 more companies for you to explore.Click here to unveil our expertly curated list of 28 Top TSX Dividend Stocks.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:PEY

Peyto Exploration & Development

Engages in the exploration, development, and production of natural gas, oil, and natural gas liquids in Alberta’s deep basin.

Undervalued with solid track record and pays a dividend.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)