- Canada

- /

- Metals and Mining

- /

- TSXV:RYR

TSX Penny Stocks To Watch: 3 Picks With Over CA$10M Market Cap

Reviewed by Simply Wall St

The Canadian market is showing strong momentum as it heads into 2025, supported by resilient consumer spending and rising corporate profits. Amidst this optimistic backdrop, investors may find value in exploring smaller or newer companies that are often overlooked. Despite the somewhat outdated term, penny stocks can still offer significant opportunities for those focusing on solid financial foundations and potential long-term growth.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Financial Health Rating |

| Alvopetro Energy (TSXV:ALV) | CA$4.54 | CA$165.86M | ★★★★★★ |

| Amerigo Resources (TSX:ARG) | CA$1.74 | CA$288.49M | ★★★★★☆ |

| Pulse Seismic (TSX:PSD) | CA$2.34 | CA$119.07M | ★★★★★★ |

| PetroTal (TSX:TAL) | CA$0.63 | CA$574.88M | ★★★★★★ |

| Mandalay Resources (TSX:MND) | CA$3.52 | CA$330.8M | ★★★★★★ |

| Findev (TSXV:FDI) | CA$0.455 | CA$13.03M | ★★★★★☆ |

| Foraco International (TSX:FAR) | CA$2.18 | CA$215.73M | ★★★★★☆ |

| Winshear Gold (TSXV:WINS) | CA$0.16 | CA$5.03M | ★★★★★★ |

| NamSys (TSXV:CTZ) | CA$1.07 | CA$28.74M | ★★★★★★ |

| East West Petroleum (TSXV:EW) | CA$0.04 | CA$3.62M | ★★★★★★ |

Click here to see the full list of 959 stocks from our TSX Penny Stocks screener.

Let's dive into some prime choices out of the screener.

InPlay Oil (TSX:IPO)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: InPlay Oil Corp. focuses on acquiring, exploring, developing, and producing petroleum and natural gas properties in Canada, with a market cap of CA$164.92 million.

Operations: The company's revenue is primarily derived from its Oil & Gas - Exploration & Production segment, amounting to CA$140.26 million.

Market Cap: CA$164.92M

InPlay Oil Corp. has faced challenges with declining revenue and profit margins, as seen in its recent earnings report. Despite trading significantly below estimated fair value, the company shows potential for price appreciation according to analysts. Its net debt to equity ratio is satisfactory at 19.1%, and interest payments are well-covered by EBIT, though the dividend yield of 9.84% isn't supported by free cash flows. The management team is relatively new with an average tenure of 1.6 years, while the board remains experienced at 10.8 years average tenure, providing some stability amidst financial volatility.

- Jump into the full analysis health report here for a deeper understanding of InPlay Oil.

- Gain insights into InPlay Oil's future direction by reviewing our growth report.

Royal Road Minerals (TSXV:RYR)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Royal Road Minerals Limited is involved in the exploration and development of mineral properties across the Kingdom of Saudi Arabia, Morocco, Colombia, and Nicaragua, with a market cap of CA$30.56 million.

Operations: Royal Road Minerals Limited currently does not report any revenue segments.

Market Cap: CA$30.56M

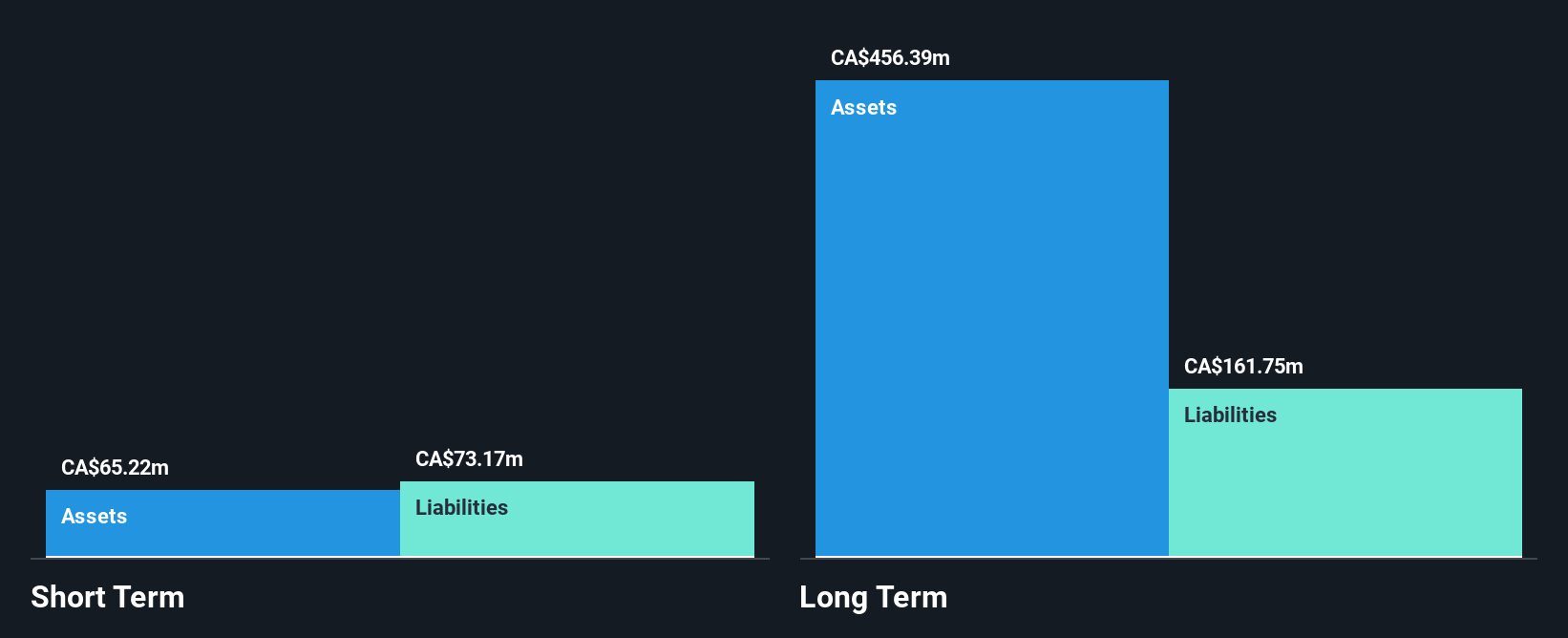

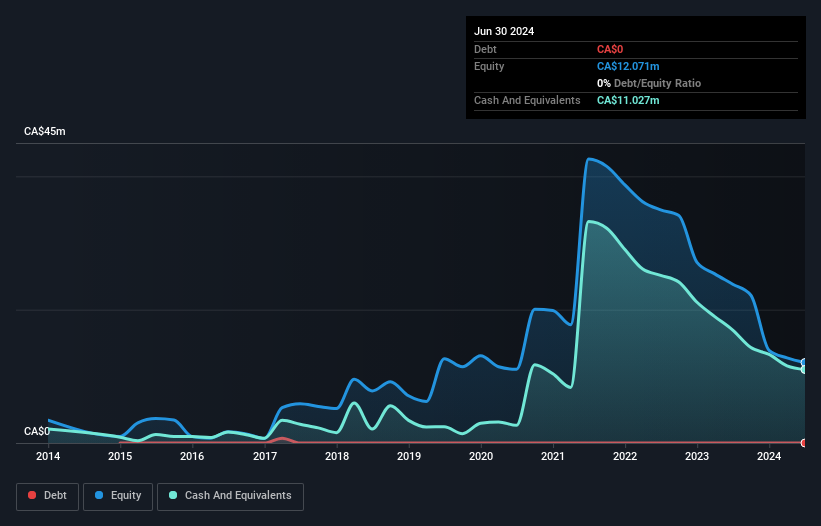

Royal Road Minerals Limited, with a market cap of CA$30.56 million, is pre-revenue and focuses on mineral exploration in regions like Saudi Arabia and Morocco. Recent developments include relinquishing rights to the Al Miyah tender to concentrate on the Jabal Sahabiyah project in Saudi Arabia, where significant copper and gold mineralization is being explored. The company has also secured permits for its Alouana project in Morocco. Despite not generating revenue yet, Royal Road maintains a stable financial position with short-term assets exceeding liabilities and no debt burden, providing a cash runway sufficient for over a year at current expenditure levels.

- Click here and access our complete financial health analysis report to understand the dynamics of Royal Road Minerals.

- Gain insights into Royal Road Minerals' past trends and performance with our report on the company's historical track record.

Unigold (TSXV:UGD)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Unigold Inc. is a junior natural resource company engaged in exploring and developing gold projects in the Dominican Republic, with a market cap of CA$17.83 million.

Operations: Unigold Inc. has not reported any revenue segments.

Market Cap: CA$17.83M

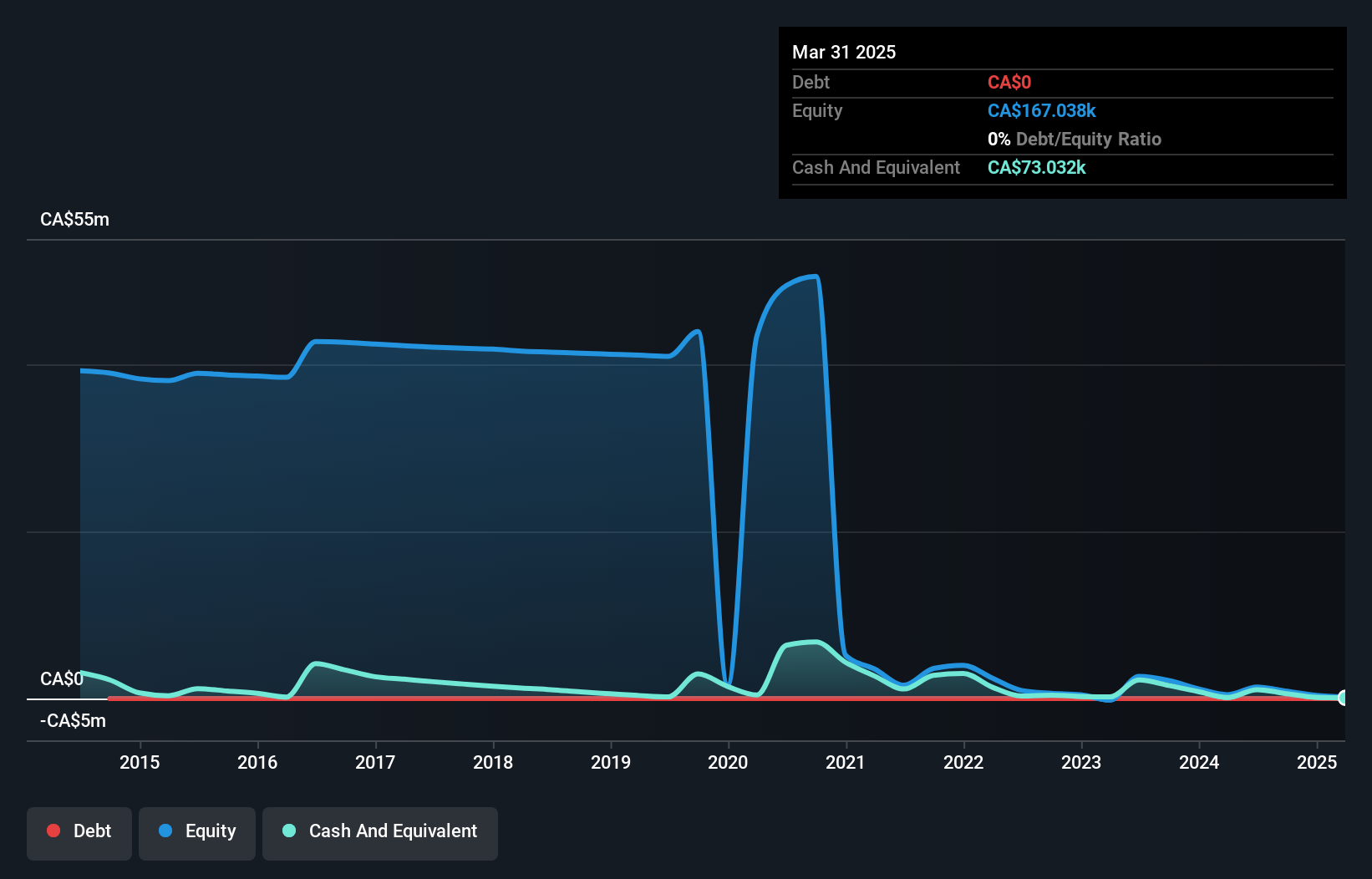

Unigold Inc., with a market cap of CA$17.83 million, is pre-revenue and focuses on gold exploration in the Dominican Republic. The company reported a reduced net loss for the second quarter of 2024 compared to the previous year. Despite having no debt and experienced management, Unigold faces financial challenges with less than a year of cash runway and recent shareholder dilution. Short-term assets exceed liabilities, but high share price volatility persists. The company's negative return on equity reflects its unprofitability, compounded by declining earnings over five years at an annual rate of 6.6%.

- Unlock comprehensive insights into our analysis of Unigold stock in this financial health report.

- Assess Unigold's previous results with our detailed historical performance reports.

Where To Now?

- Access the full spectrum of 959 TSX Penny Stocks by clicking on this link.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:RYR

Royal Road Minerals

Engages in the exploration and development of mineral properties in the Kingdom of Saudi Arabia, Morocco, Colombia, and Nicaragua.

Flawless balance sheet slight.

Market Insights

Community Narratives