- Canada

- /

- Oil and Gas

- /

- TSX:IMO

Why Investors Shouldn't Be Surprised By Imperial Oil Limited's (TSE:IMO) Low P/E

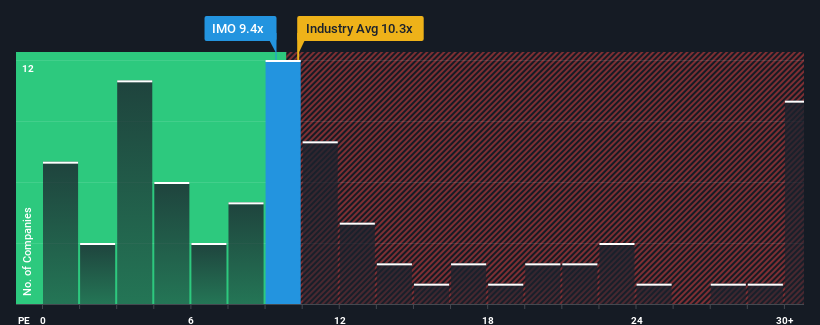

When close to half the companies in Canada have price-to-earnings ratios (or "P/E's") above 15x, you may consider Imperial Oil Limited (TSE:IMO) as an attractive investment with its 9.4x P/E ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/E.

There hasn't been much to differentiate Imperial Oil's and the market's earnings growth lately. One possibility is that the P/E is low because investors think this modest earnings performance may begin to slide. If not, then existing shareholders have reason to be optimistic about the future direction of the share price.

Check out our latest analysis for Imperial Oil

Is There Any Growth For Imperial Oil?

In order to justify its P/E ratio, Imperial Oil would need to produce sluggish growth that's trailing the market.

If we review the last year of earnings, the company posted a result that saw barely any deviation from a year ago. Still, the latest three year period has seen an excellent 1,224% overall rise in EPS, in spite of its uninspiring short-term performance. Therefore, it's fair to say the earnings growth recently has been superb for the company.

Looking ahead now, EPS is anticipated to slump, contracting by 3.6% per year during the coming three years according to the seven analysts following the company. Meanwhile, the broader market is forecast to expand by 8.4% per year, which paints a poor picture.

With this information, we are not surprised that Imperial Oil is trading at a P/E lower than the market. Nonetheless, there's no guarantee the P/E has reached a floor yet with earnings going in reverse. There's potential for the P/E to fall to even lower levels if the company doesn't improve its profitability.

The Bottom Line On Imperial Oil's P/E

We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

As we suspected, our examination of Imperial Oil's analyst forecasts revealed that its outlook for shrinking earnings is contributing to its low P/E. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. It's hard to see the share price rising strongly in the near future under these circumstances.

You always need to take note of risks, for example - Imperial Oil has 1 warning sign we think you should be aware of.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:IMO

Imperial Oil

Engages in exploration, production, and sale of crude oil and natural gas in Canada.

Undervalued with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives