- Canada

- /

- Oil and Gas

- /

- TSX:IMO

Imperial Oil (TSX:IMO): Taking Stock of Valuation After a Recent 11% Share Price Pullback

Reviewed by Simply Wall St

Imperial Oil (TSX:IMO) has quietly slipped about 11% over the past month after a strong run earlier this year, and that pullback is starting to catch the eye of value focused energy investors.

See our latest analysis for Imperial Oil.

The recent 11% slide in Imperial Oil’s share price over 30 days looks more like a breather within a strong year to date share price return of nearly 38%, backed by a hefty five year total shareholder return above 490%. This suggests momentum is cooling, but the longer term trend remains firmly constructive.

If this pullback has you thinking about what else is setting up for the next leg higher in energy, it is worth scanning aerospace and defense stocks for other mission critical plays riding structural spending themes.

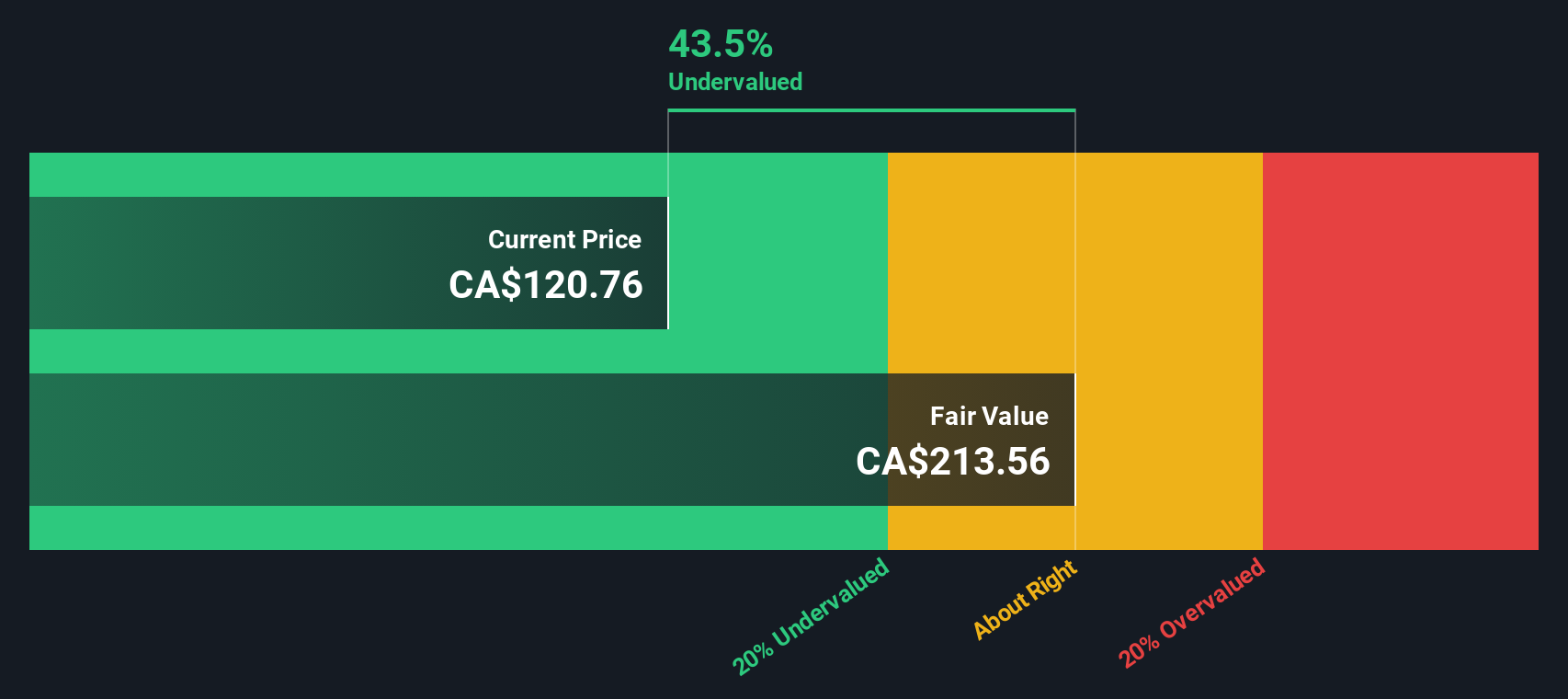

With Imperial Oil trading above consensus targets yet screening as materially undervalued on intrinsic metrics, investors face a key dilemma: is this pullback an entry point, or is the market already pricing in tomorrow’s cash flows?

Most Popular Narrative: 9.5% Overvalued

With Imperial Oil last closing at CA$123.82 against a narrative fair value of roughly CA$113.06, the current market price sits ahead of intrinsic estimates built from detailed cash flow assumptions and medium term margin forecasts.

The analysts have a consensus price target of CA$106.353 for Imperial Oil based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of CA$131.0, and the most bearish reporting a price target of just CA$81.0.

Want to see what justifies paying up today for slower growth tomorrow? The narrative leans on firm revenues, thinner margins, and a richer future earnings multiple. Curious how those moving parts combine into that fair value, using a sub 7 percent discount rate and steady buyback assumptions? Dive in to unpack the full playbook behind this pricing view.

Result: Fair Value of $113.06 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, key risks linger, including decarbonization policy tightening and structurally high sustaining capex. Either of these could derail the margin and cash flow story.

Find out about the key risks to this Imperial Oil narrative.

Another Lens on Value

While the narrative model suggests Imperial Oil is about 9.5% overvalued, our SWS DCF model points the other way, implying shares trade roughly 55% below intrinsic value at around CA$275 per share. When cash flows and discount rates disagree with sentiment, which signal should investors trust?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Imperial Oil Narrative

If you see this differently or want to dig into the numbers yourself, you can build a tailored view in just minutes: Do it your way.

A great starting point for your Imperial Oil research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Before you move on, consider upgrading your watchlist with a focused run through our most powerful screeners, built to surface opportunities others may overlook.

- Explore potential turnarounds by scanning these 3627 penny stocks with strong financials, which pair small share prices with relatively resilient fundamentals and balance sheets.

- Evaluate structural trends in automation and data by assessing these 25 AI penny stocks that may benefit from demand for intelligent software and infrastructure.

- Review your long term core holdings with these 912 undervalued stocks based on cash flows, focusing on companies that appear to trade below estimated intrinsic value based on projected cash flows and clearly defined assumptions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:IMO

Imperial Oil

Engages in exploration, production, and sale of crude oil and natural gas in Canada.

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)