- Canada

- /

- Commercial Services

- /

- NEOE:BCBN

3 TSX Penny Stocks With Market Caps Larger Than CA$20M

Reviewed by Simply Wall St

The Canadian stock market has shown resilience, with the TSX rising over 2% recently, even as global markets grapple with tariff uncertainties and economic pressures. Amidst this backdrop, penny stocks—often seen as smaller or newer companies—offer intriguing opportunities for growth at accessible price points. Despite being a somewhat outdated term, these stocks can still represent hidden gems when they possess strong financials and clear growth potential.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Rewards & Risks |

| Westbridge Renewable Energy (TSXV:WEB) | CA$0.60 | CA$56.64M | ✅ 4 ⚠️ 4 View Analysis > |

| NTG Clarity Networks (TSXV:NCI) | CA$1.56 | CA$66.86M | ✅ 4 ⚠️ 2 View Analysis > |

| Thor Explorations (TSXV:THX) | CA$0.61 | CA$399.18M | ✅ 3 ⚠️ 2 View Analysis > |

| Orezone Gold (TSX:ORE) | CA$1.22 | CA$627.66M | ✅ 4 ⚠️ 1 View Analysis > |

| Amerigo Resources (TSX:ARG) | CA$1.77 | CA$287.36M | ✅ 2 ⚠️ 2 View Analysis > |

| PetroTal (TSX:TAL) | CA$0.55 | CA$512.47M | ✅ 4 ⚠️ 3 View Analysis > |

| Pulse Seismic (TSX:PSD) | CA$2.50 | CA$128M | ✅ 1 ⚠️ 2 View Analysis > |

| McCoy Global (TSX:MCB) | CA$3.36 | CA$91.06M | ✅ 3 ⚠️ 2 View Analysis > |

| Findev (TSXV:FDI) | CA$0.49 | CA$13.89M | ✅ 2 ⚠️ 3 View Analysis > |

| BluMetric Environmental (TSXV:BLM) | CA$1.21 | CA$42.83M | ✅ 2 ⚠️ 4 View Analysis > |

Click here to see the full list of 924 stocks from our TSX Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Base Carbon (NEOE:BCBN)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Base Carbon Inc. provides capital, development expertise, and management resources to projects in voluntary carbon and broader environmental markets, with a market cap of CA$46.66 million.

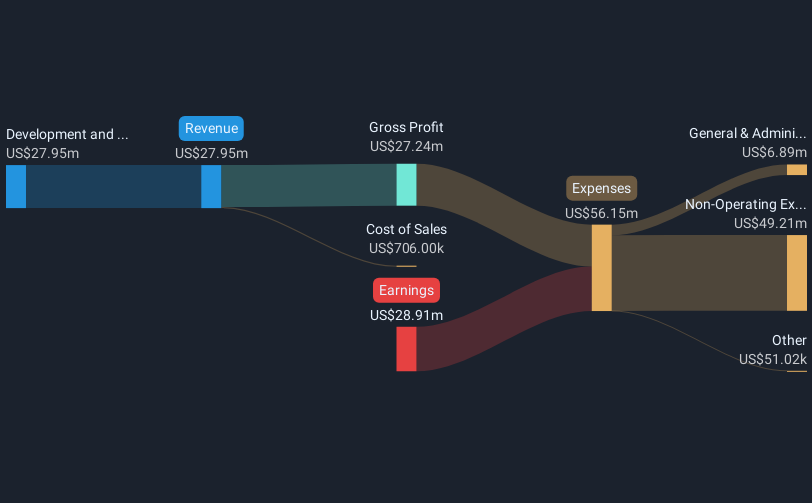

Operations: The company generates revenue of $27.95 million from the development and deployment of its projects in voluntary carbon and environmental markets.

Market Cap: CA$46.66M

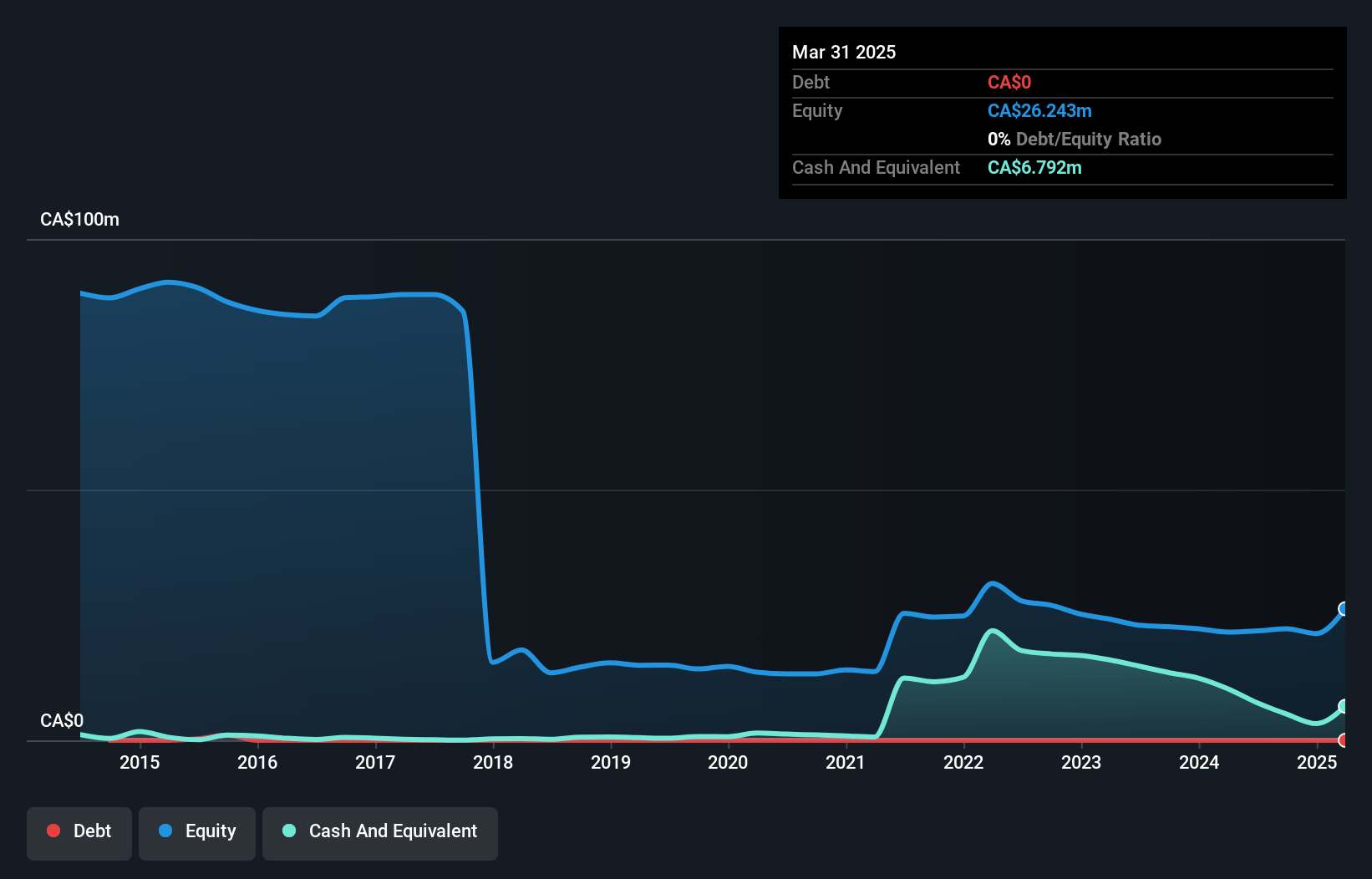

Base Carbon Inc., with a market cap of CA$46.66 million, has shown significant revenue growth of 335.4% over the past year, generating US$27.95 million from its environmental projects. Despite this growth, the company is currently unprofitable and reported a net loss of US$28.91 million for 2024, compared to a net income in the previous year. The absence of debt and strong asset coverage for liabilities are positive aspects; however, an auditor's report expressed doubts about its ability to continue as a going concern due to financial challenges, highlighting risks associated with investing in such stocks.

- Click to explore a detailed breakdown of our findings in Base Carbon's financial health report.

- Examine Base Carbon's past performance report to understand how it has performed in prior years.

Forsys Metals (TSX:FSY)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Forsys Metals Corp. is involved in the acquisition, exploration, and development of mineral properties in Africa with a market cap of CA$101.13 million.

Operations: Forsys Metals Corp. does not report specific revenue segments.

Market Cap: CA$101.13M

Forsys Metals Corp., with a market cap of CA$101.13 million, is pre-revenue and currently unprofitable, with no forecasted profitability in the near term. The company has been actively engaged in its Norasa Uranium project, showing promising results from ore-sorting testwork aimed at enhancing processing efficiency and reducing costs. Recent drilling at the Valencia site indicates potential resource expansion. Despite having no long-term liabilities and sufficient short-term assets to cover liabilities, Forsys faces high volatility in its share price and limited cash runway, although recent capital raises may provide some relief.

- Dive into the specifics of Forsys Metals here with our thorough balance sheet health report.

- Assess Forsys Metals' previous results with our detailed historical performance reports.

Electric Metals (USA) (TSXV:EML)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Electric Metals (USA) Limited focuses on acquiring, exploring, and developing mineral properties in the United States, Canada, and Australia with a market cap of CA$21.08 million.

Operations: Electric Metals (USA) Limited has not reported any revenue segments.

Market Cap: CA$21.08M

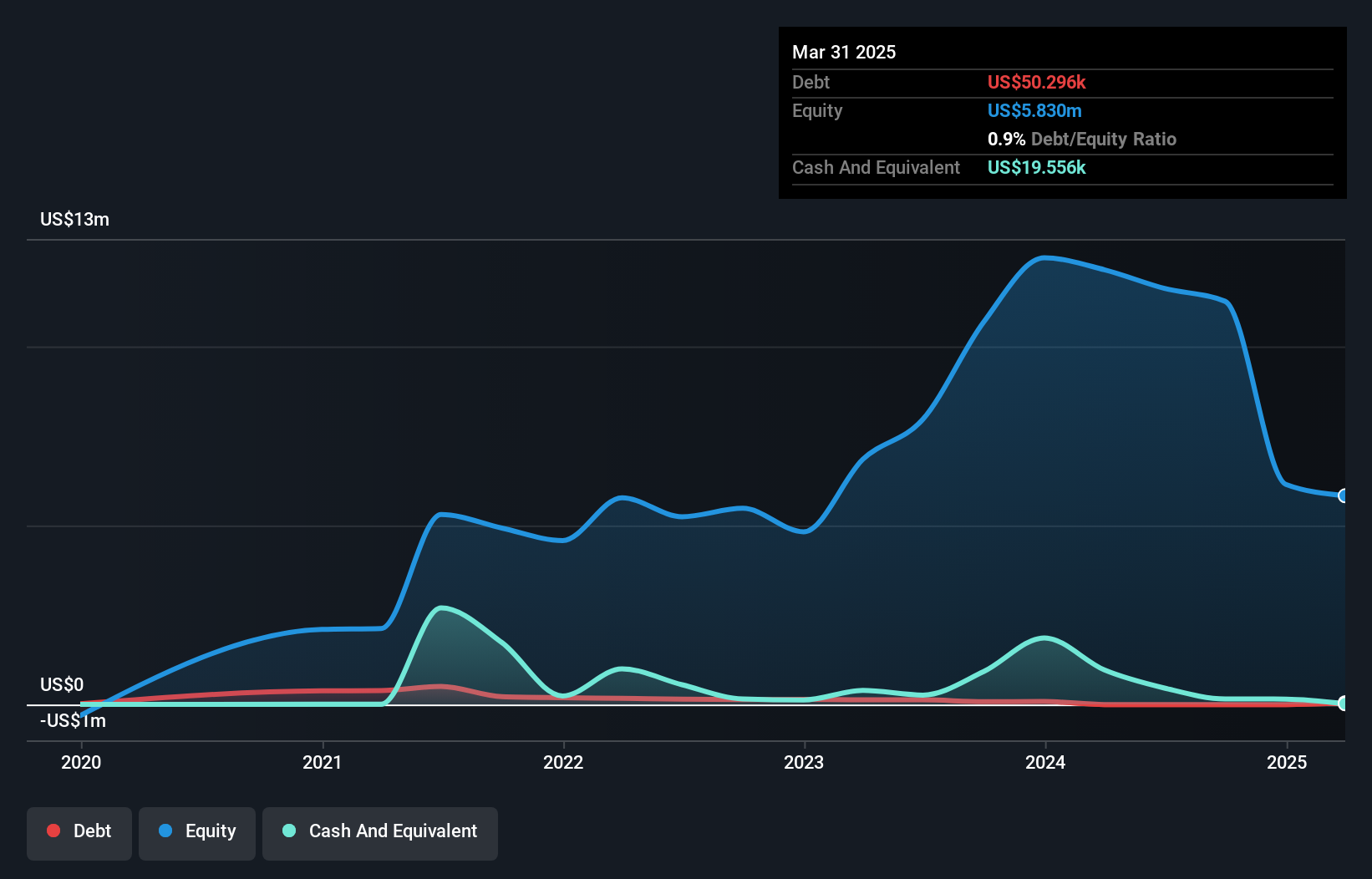

Electric Metals (USA) Limited, with a market cap of CA$21.08 million, is pre-revenue and currently unprofitable. The company focuses on the Emily Manganese Project in Minnesota, which aligns with recent U.S. policy shifts promoting domestic mineral production. This project could reduce reliance on foreign manganese supply for EV batteries and energy storage sectors. Despite being debt-free, Electric Metals faces challenges such as high share price volatility and insufficient short-term assets to cover liabilities. Recent agreements aim to enhance investor outreach in Chinese markets, potentially broadening its shareholder base amidst ongoing financial constraints.

- Navigate through the intricacies of Electric Metals (USA) with our comprehensive balance sheet health report here.

- Understand Electric Metals (USA)'s track record by examining our performance history report.

Summing It All Up

- Embark on your investment journey to our 924 TSX Penny Stocks selection here.

- Looking For Alternative Opportunities? Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Base Carbon might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NEOE:BCBN

Base Carbon

Provides capital, development expertise, and management operating resources.

Flawless balance sheet with very low risk.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)