- Canada

- /

- Oil and Gas

- /

- TSX:FSY

3 Promising TSX Penny Stocks With Market Caps Under CA$200M

Reviewed by Simply Wall St

The Canadian market has been experiencing shifts in bond yields, which have implications for future investment strategies, particularly with the potential for bonds to outperform cash as interest rates fluctuate. In this context, penny stocks—though somewhat of an outdated term—remain a relevant area of interest for investors seeking growth opportunities at lower price points. These smaller or newer companies can offer a unique blend of value and growth potential when backed by strong financials, making them attractive options for those looking to explore under-the-radar investments.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Financial Health Rating |

| Pulse Seismic (TSX:PSD) | CA$2.39 | CA$116.93M | ★★★★★★ |

| Silvercorp Metals (TSX:SVM) | CA$4.32 | CA$913.76M | ★★★★★★ |

| Mandalay Resources (TSX:MND) | CA$3.94 | CA$368.12M | ★★★★★★ |

| Findev (TSXV:FDI) | CA$0.53 | CA$12.75M | ★★★★★★ |

| PetroTal (TSX:TAL) | CA$0.54 | CA$501.61M | ★★★★★★ |

| Foraco International (TSX:FAR) | CA$2.41 | CA$231.32M | ★★★★★☆ |

| East West Petroleum (TSXV:EW) | CA$0.04 | CA$3.62M | ★★★★★★ |

| NamSys (TSXV:CTZ) | CA$1.15 | CA$33.85M | ★★★★★★ |

| Hemisphere Energy (TSXV:HME) | CA$1.83 | CA$179.46M | ★★★★★☆ |

| Enterprise Group (TSX:E) | CA$1.89 | CA$113.26M | ★★★★☆☆ |

Click here to see the full list of 950 stocks from our TSX Penny Stocks screener.

Let's dive into some prime choices out of the screener.

Forsys Metals (TSX:FSY)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Forsys Metals Corp., with a market cap of CA$128.20 million, focuses on the acquisition, exploration, and development of mineral properties in Africa through its subsidiaries.

Operations: Forsys Metals Corp. currently does not report any revenue segments.

Market Cap: CA$128.2M

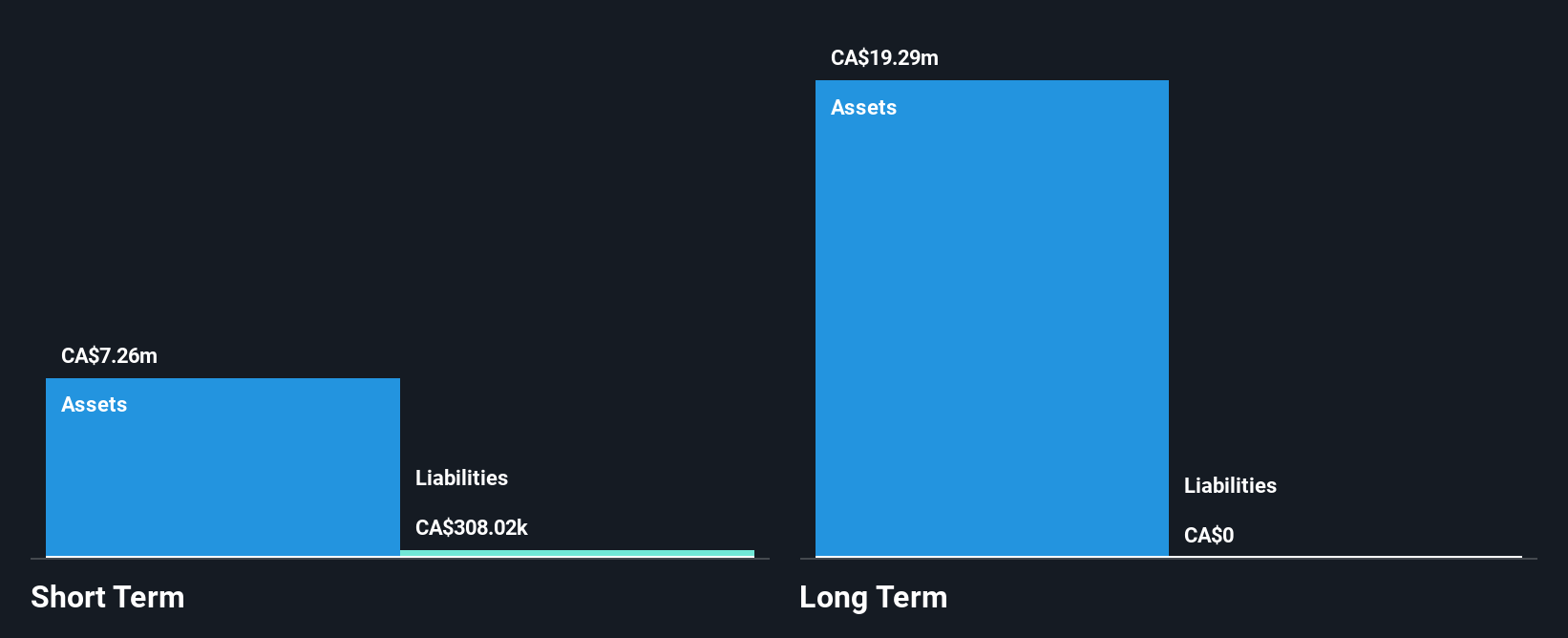

Forsys Metals Corp., with a market cap of CA$128.20 million, operates as a pre-revenue entity focused on mineral exploration in Africa. The company is debt-free and has no long-term liabilities, but it faces financial challenges with less than a year of cash runway and ongoing shareholder dilution. Recent earnings reports show reduced net losses compared to the previous year, yet profitability remains elusive with forecasts indicating further declines in earnings over the next three years. Despite these hurdles, Forsys benefits from an experienced management team and board of directors, providing some stability amidst its current volatility.

- Jump into the full analysis health report here for a deeper understanding of Forsys Metals.

- Explore Forsys Metals' analyst forecasts in our growth report.

RTG Mining (TSX:RTG)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: RTG Mining Inc. is involved in the exploration and development of mineral properties, with a market capitalization of CA$33.86 million.

Operations: RTG Mining Inc. currently does not report any revenue segments as it is focused on the exploration and development of mineral properties.

Market Cap: CA$33.86M

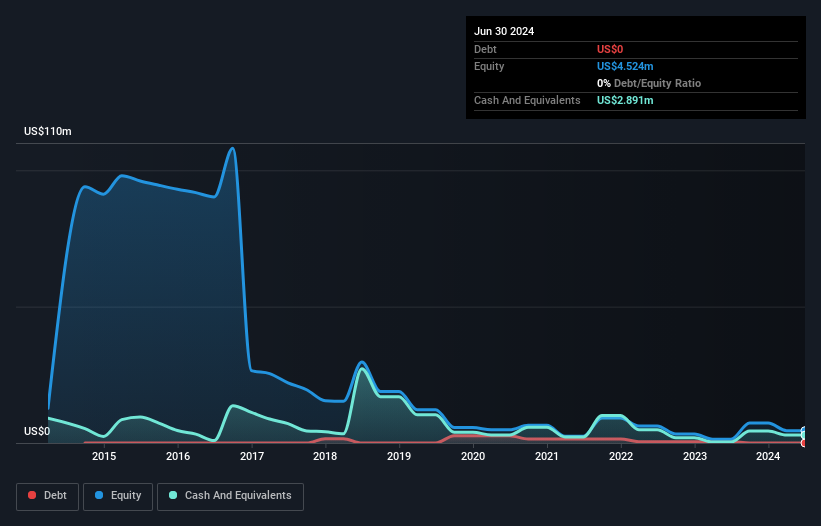

RTG Mining Inc., with a market cap of CA$33.86 million, is pre-revenue and focused on mineral exploration. The company is debt-free, which mitigates financial risk, but faces challenges with less than a year of cash runway. Despite its unprofitability, RTG has reduced losses by 25% annually over the past five years and maintains strong short-term asset coverage over liabilities. The board and management team are experienced, providing strategic stability amidst high share price volatility. Shareholders have not faced significant dilution recently, offering some reassurance in this speculative investment space.

- Navigate through the intricacies of RTG Mining with our comprehensive balance sheet health report here.

- Learn about RTG Mining's historical performance here.

Rock Tech Lithium (TSXV:RCK)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Rock Tech Lithium Inc. is involved in the exploration and development of lithium properties, with a market cap of CA$107.22 million.

Operations: Currently, there are no reported revenue segments for this company.

Market Cap: CA$107.22M

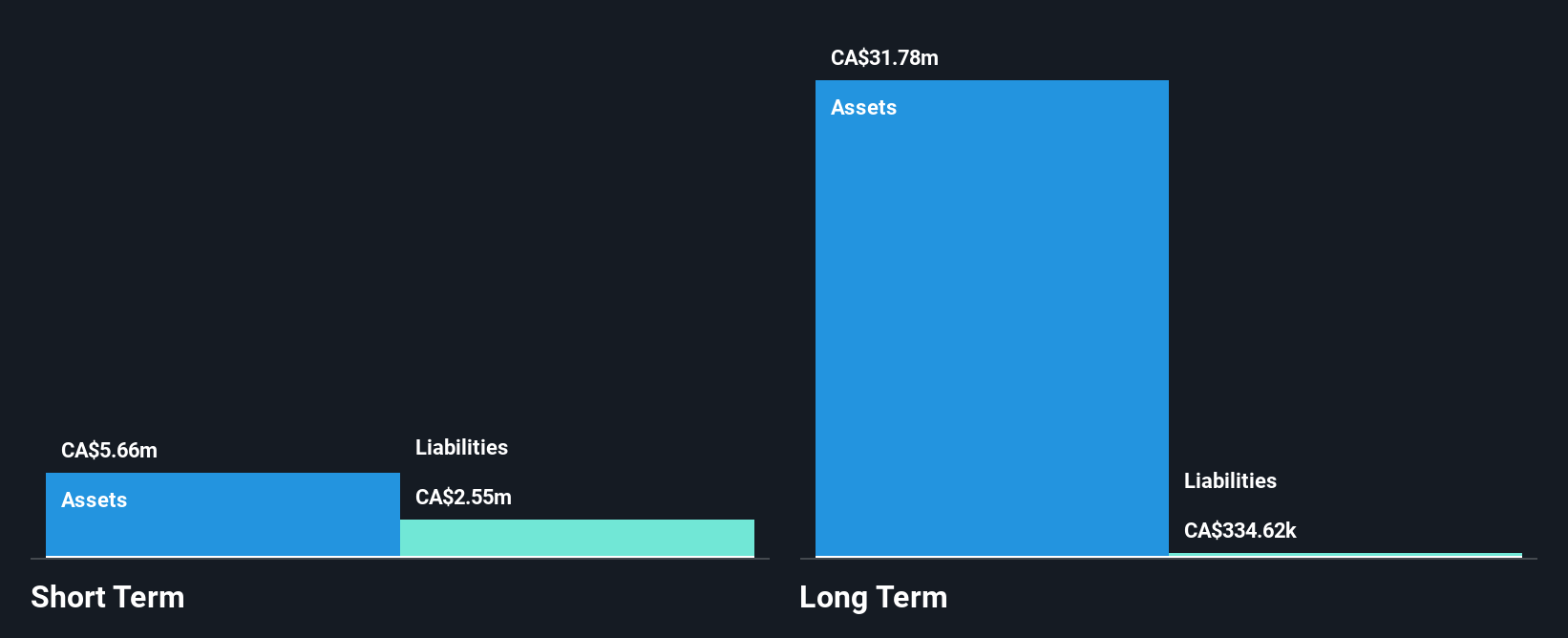

Rock Tech Lithium Inc., with a market cap of CA$107.22 million, is pre-revenue and focused on lithium exploration. The company has no debt and possesses short-term assets of CA$5.3 million, surpassing its liabilities, but only supports a three-month cash runway without additional funding. Recent private placements raised over CA$4.7 million, including government support from Canada's Critical Minerals Infrastructure Fund, enhancing financial stability temporarily despite ongoing losses and shareholder dilution. Management is relatively inexperienced with an average tenure under one year; however, the board's seasoned presence provides some strategic oversight in this speculative sector.

- Unlock comprehensive insights into our analysis of Rock Tech Lithium stock in this financial health report.

- Gain insights into Rock Tech Lithium's future direction by reviewing our growth report.

Seize The Opportunity

- Discover the full array of 950 TSX Penny Stocks right here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:FSY

Forsys Metals

Engages in the acquisition, exploration, and development of mineral properties in Africa.

Flawless balance sheet moderate.

Similar Companies

Market Insights

Community Narratives