- Canada

- /

- Oil and Gas

- /

- TSX:EFR

Energy Fuels (TSX:EFR) Valuation After TSX Smallcap Index Inclusion and Strong 1-Year Shareholder Returns

Reviewed by Simply Wall St

Energy Fuels (TSX:EFR) has just been added to the TSX Smallcap Index, a move that can draw more institutional attention, improve trading liquidity, and sharpen investor focus on its uranium and vanadium operations.

See our latest analysis for Energy Fuels.

The index inclusion lands after a powerful run, with the share price up strongly on a year to date basis and backed by a 1 year total shareholder return above 140 percent, even though recent short term share price weakness suggests some momentum is cooling as investors reassess risk and growth expectations.

If this kind of re rating story has your attention, it could be a good moment to broaden your search and discover fast growing stocks with high insider ownership.

With Energy Fuels now firmly on the TSX Smallcap radar and analysts still seeing hefty upside to the current share price, investors face a key question: is there still real value here, or is future growth already priced in?

Most Popular Narrative: 42.7% Undervalued

With the most followed narrative putting fair value near CA$33.63 against a last close of CA$19.26, the valuation case hinges on aggressive growth and margin expansion.

Completion and commissioning of the White Mesa Mill rare earth separation Phase 2 expansion (potentially increasing monazite processing to 60,000 tonnes/year and enabling commercial-scale heavy rare earth production such as Dy/Tb) could establish Energy Fuels as a major western supplier, capturing price premiums driven by western supply chain security and increasing electrification demand, supporting long-term revenue and margin upside.

Curious how a currently loss making miner gets this kind of upgrade? The narrative leans on explosive top line growth, a dramatic swing in profitability, and a future earnings multiple more often reserved for market darlings. Want to see exactly how those moving parts combine to justify that fair value?

Result: Fair Value of $33.63 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this bullish setup depends on securing reliable rare earth feedstock and substantial project financing. Delays or setbacks in these areas could rapidly cool sentiment.

Find out about the key risks to this Energy Fuels narrative.

Another View: Market Ratios Flash a Caution Signal

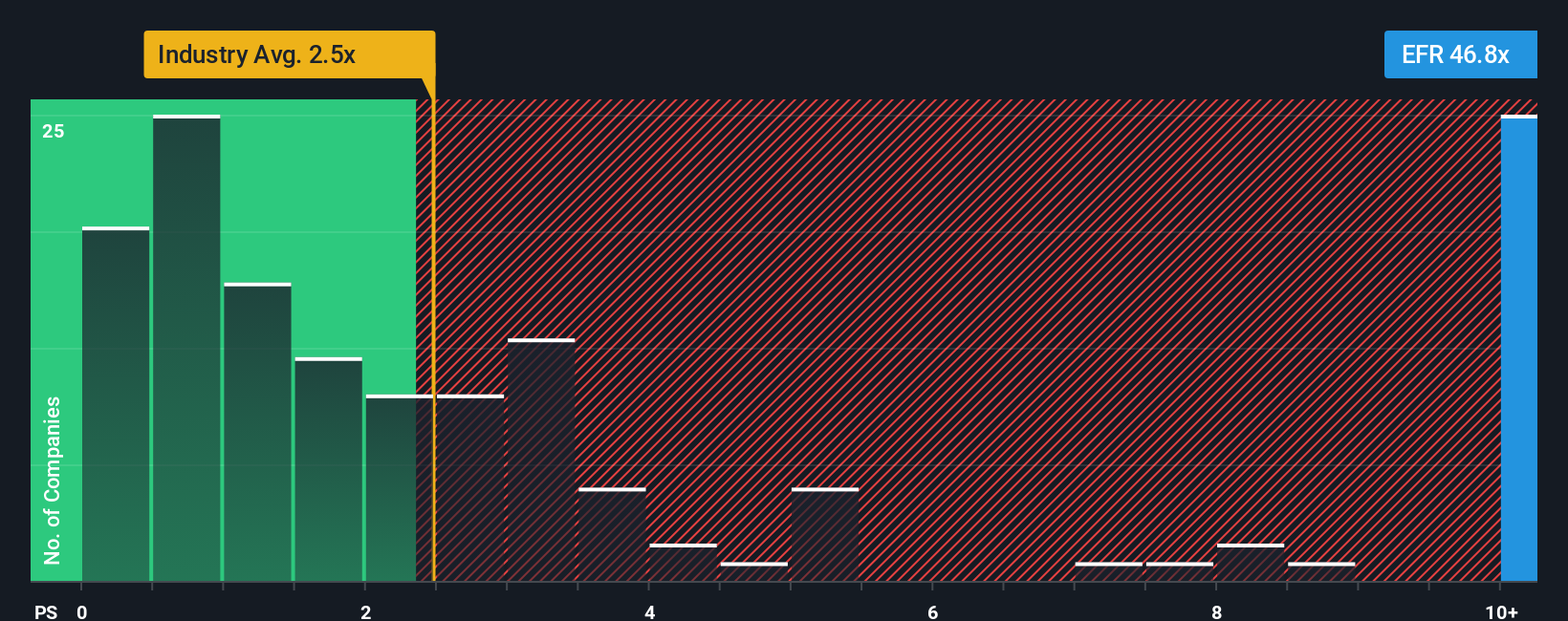

While the narrative points to deep upside, the current price to sales ratio near 42 times towers over the Canadian Oil and Gas average of 2.8 times, the peer average of 14.1 times, and an estimated fair ratio around 1.3 times. This raises real valuation risk if growth underdelivers.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Energy Fuels Narrative

If you see the story differently or want to dive into the numbers yourself, you can build a personalized thesis in just minutes: Do it your way.

A great starting point for your Energy Fuels research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

Ready for your next high conviction idea?

Before you move on, lock in your next opportunity by using the Simply Wall St Screener to uncover focused ideas that match your strategy and risk profile.

- Capture mispriced potential by targeting companies trading below their estimated worth through these 909 undervalued stocks based on cash flows.

- Ride powerful structural trends in medicine and automation by focusing on breakthrough innovators within these 30 healthcare AI stocks.

- Strengthen your income stream by zeroing in on reliable payers using these 13 dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Energy Fuels might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:EFR

Energy Fuels

Engages in the exploration, recovery, recycling, exploration, operation, development, permitting, evaluation, and sale of uranium mineral properties in the United States.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)