- Canada

- /

- Oil and Gas

- /

- TSX:CCO

Cameco's (TSE:CCO) five-year earnings growth trails the 44% YoY shareholder returns

Buying shares in the best businesses can build meaningful wealth for you and your family. And highest quality companies can see their share prices grow by huge amounts. Don't believe it? Then look at the Cameco Corporation (TSE:CCO) share price. It's 513% higher than it was five years ago. If that doesn't get you thinking about long term investing, we don't know what will. It's even up 5.3% in the last week. Anyone who held for that rewarding ride would probably be keen to talk about it.

After a strong gain in the past week, it's worth seeing if longer term returns have been driven by improving fundamentals.

See our latest analysis for Cameco

Given that Cameco only made minimal earnings in the last twelve months, we'll focus on revenue to gauge its business development. Generally speaking, we'd consider a stock like this alongside loss-making companies, simply because the quantum of the profit is so low. For shareholders to have confidence a company will grow profits significantly, it must grow revenue.

For the last half decade, Cameco can boast revenue growth at a rate of 8.1% per year. That's a pretty good long term growth rate. However, the share price gain of 44% during the period is considerably stronger. It might not be cheap but a (long-term) growth stock like this is usually well worth taking a closer look at.

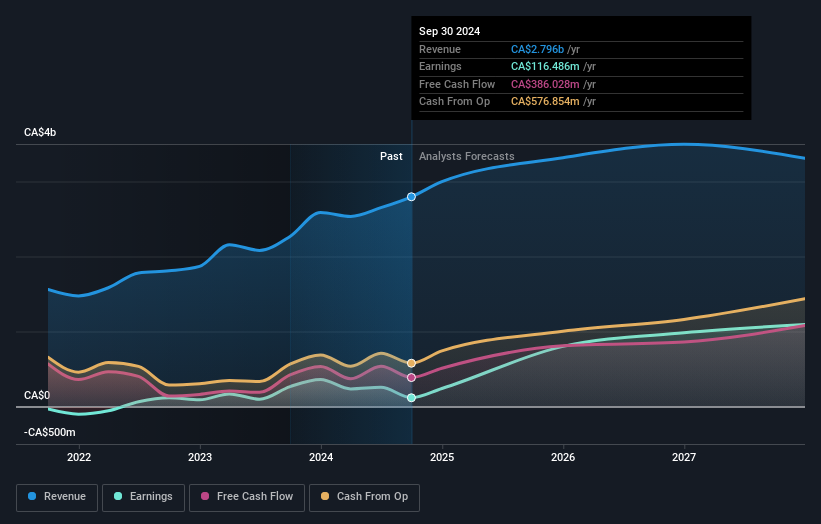

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

We like that insiders have been buying shares in the last twelve months. Having said that, most people consider earnings and revenue growth trends to be a more meaningful guide to the business. If you are thinking of buying or selling Cameco stock, you should check out this free report showing analyst profit forecasts.

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. Whereas the share price return only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising or spin-off. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. We note that for Cameco the TSR over the last 5 years was 523%, which is better than the share price return mentioned above. This is largely a result of its dividend payments!

A Different Perspective

Cameco shareholders are up 10% for the year (even including dividends). But that was short of the market average. If we look back over five years, the returns are even better, coming in at 44% per year for five years. Maybe the share price is just taking a breather while the business executes on its growth strategy. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Consider for instance, the ever-present spectre of investment risk. We've identified 1 warning sign with Cameco , and understanding them should be part of your investment process.

There are plenty of other companies that have insiders buying up shares. You probably do not want to miss this free list of undervalued small cap companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Canadian exchanges.

If you're looking to trade Cameco, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:CCO

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives