- Canada

- /

- Oil and Gas

- /

- TSX:BIR

Birchcliff Energy (TSE:BIR) Ticks All The Boxes When It Comes To Earnings Growth

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it currently lacks a track record of revenue and profit. Sometimes these stories can cloud the minds of investors, leading them to invest with their emotions rather than on the merit of good company fundamentals. Loss-making companies are always racing against time to reach financial sustainability, so investors in these companies may be taking on more risk than they should.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in Birchcliff Energy (TSE:BIR). Now this is not to say that the company presents the best investment opportunity around, but profitability is a key component to success in business.

Check out our latest analysis for Birchcliff Energy

How Fast Is Birchcliff Energy Growing Its Earnings Per Share?

Over the last three years, Birchcliff Energy has grown earnings per share (EPS) at as impressive rate from a relatively low point, resulting in a three year percentage growth rate that isn't particularly indicative of expected future performance. As a result, we'll zoom in on growth over the last year, instead. Birchcliff Energy boosted its trailing twelve month EPS from CA$1.56 to CA$1.82, in the last year. This amounts to a 17% gain; a figure that shareholders will be pleased to see.

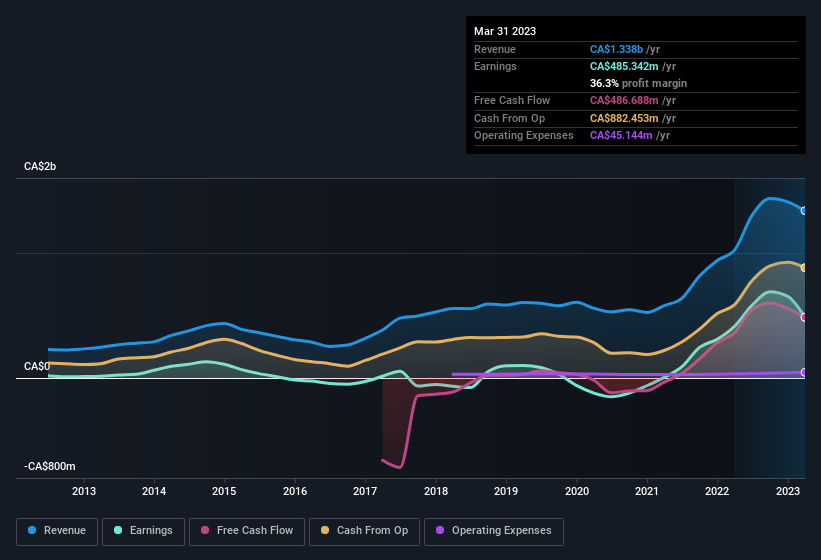

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. Our analysis has highlighted that Birchcliff Energy's revenue from operations did not account for all of their revenue in the previous 12 months, so our analysis of its margins might not accurately reflect the underlying business. On the revenue front, Birchcliff Energy has done well over the past year, growing revenue by 31% to CA$1.3b but EBIT margin figures were less stellar, seeing a decline over the last 12 months. So it seems the future may hold further growth, especially if EBIT margins can remain steady.

You can take a look at the company's revenue and earnings growth trend, in the chart below. For finer detail, click on the image.

You don't drive with your eyes on the rear-view mirror, so you might be more interested in this free report showing analyst forecasts for Birchcliff Energy's future profits.

Are Birchcliff Energy Insiders Aligned With All Shareholders?

It's said that there's no smoke without fire. For investors, insider buying is often the smoke that indicates which stocks could set the market alight. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

The CA$16k worth of shares that insiders sold during the last 12 months pales in comparison to the CA$1.4m they spent on acquiring shares in the company. This adds to the interest in Birchcliff Energy because it suggests that those who understand the company best, are optimistic. Zooming in, we can see that the biggest insider purchase was by Executive Vice President of Operations David Humphreys for CA$634k worth of shares, at about CA$10.79 per share.

On top of the insider buying, it's good to see that Birchcliff Energy insiders have a valuable investment in the business. Indeed, they hold CA$44m worth of its stock. This considerable investment should help drive long-term value in the business. Even though that's only about 2.1% of the company, it's enough money to indicate alignment between the leaders of the business and ordinary shareholders.

Shareholders have more to smile about than just insiders adding more shares to their already sizeable holdings. That's because on our analysis the CEO, Jeff Tonken, is paid less than the median for similar sized companies. For companies with market capitalisations between CA$1.4b and CA$4.4b, like Birchcliff Energy, the median CEO pay is around CA$3.3m.

The Birchcliff Energy CEO received CA$2.7m in compensation for the year ending December 2022. That is actually below the median for CEO's of similarly sized companies. CEO remuneration levels are not the most important metric for investors, but when the pay is modest, that does support enhanced alignment between the CEO and the ordinary shareholders. It can also be a sign of a culture of integrity, in a broader sense.

Does Birchcliff Energy Deserve A Spot On Your Watchlist?

As previously touched on, Birchcliff Energy is a growing business, which is encouraging. Better yet, insiders are significant shareholders, and have been buying more shares. That makes the company a prime candidate for your watchlist - and arguably a research priority. It is worth noting though that we have found 1 warning sign for Birchcliff Energy that you need to take into consideration.

The good news is that Birchcliff Energy is not the only growth stock with insider buying. Here's a list of them... with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Birchcliff Energy might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:BIR

Birchcliff Energy

An intermediate oil and natural gas company, engages in the exploration, development, and production of natural gas, light oil, condensate, and other natural gas liquids in Western Canada.

Solid track record with excellent balance sheet.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)