Exploring 3 Undervalued Small Caps On TSX With Insider Buying

Reviewed by Simply Wall St

In the current Canadian market landscape, investors are navigating through a complex environment influenced by potential tariff escalations that could impact economic growth and inflation. Despite these uncertainties, the fundamental economic backdrop remains supportive with above-trend growth and low unemployment rates, prompting a focus on diversification to manage volatility and optimize portfolio performance. In this context, identifying small-cap stocks with strong fundamentals and insider buying can present opportunities for investors looking to capitalize on potential undervaluation amidst broader market fluctuations.

Top 10 Undervalued Small Caps With Insider Buying In Canada

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Primaris Real Estate Investment Trust | 12.3x | 3.3x | 41.48% | ★★★★★★ |

| Nexus Industrial REIT | 11.8x | 3.0x | 24.00% | ★★★★★★ |

| First National Financial | 13.4x | 3.8x | 43.93% | ★★★★★☆ |

| Boston Pizza Royalties Income Fund | 12.1x | 7.5x | 42.41% | ★★★★★☆ |

| Bragg Gaming Group | NA | 1.3x | -85.78% | ★★★★☆☆ |

| Bonterra Energy | 5.1x | 0.6x | 30.25% | ★★★★☆☆ |

| Saturn Oil & Gas | 2.0x | 0.6x | -93.81% | ★★★☆☆☆ |

| Itafos | 25.8x | 0.6x | 49.16% | ★★★☆☆☆ |

| Minto Apartment Real Estate Investment Trust | NA | 5.5x | 12.83% | ★★★☆☆☆ |

| CareRx | NA | 0.5x | 45.97% | ★★★☆☆☆ |

Let's take a closer look at a couple of our picks from the screened companies.

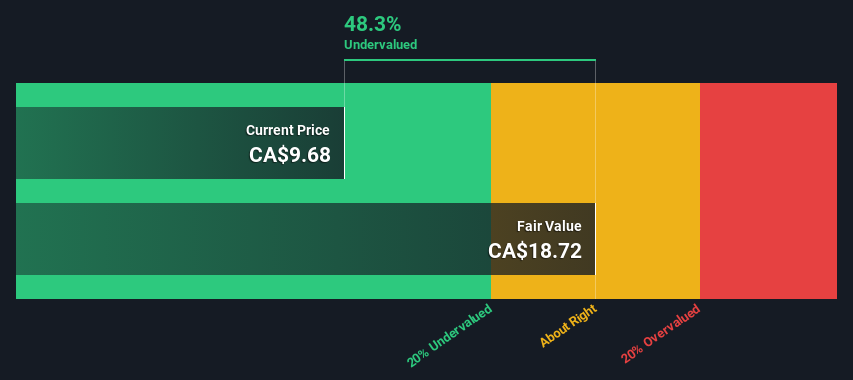

Advantage Energy (TSX:AAV)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Advantage Energy is a Canadian energy company primarily engaged in the exploration, development, and production of natural gas and liquids with a market capitalization of CA$1.47 billion.

Operations: Advantage generates revenue primarily from its oil and gas operations, with the latest reported figure being CA$488.84 million. The company's gross profit margin has experienced a decline to 56.81% in the most recent period, indicating changes in cost structures or pricing dynamics over time.

PE: 35.4x

Advantage Energy, a Canadian small-cap stock, shows promise with insider confidence as John Festival recently purchased 40,000 shares for C$398,000. Despite a drop in profit margins from 30.7% to 9.3%, the company forecasts earnings growth of nearly 45% annually. While relying entirely on external borrowing presents financial risks, Advantage's production guidance for 2025 suggests output between 80,000 and 83,000 boe/d. This positions them well for potential growth in the energy sector.

- Click to explore a detailed breakdown of our findings in Advantage Energy's valuation report.

Examine Advantage Energy's past performance report to understand how it has performed in the past.

Vermilion Energy (TSX:VET)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Vermilion Energy is an international oil and gas exploration and production company with a market cap of CA$3.45 billion, primarily focusing on the extraction and development of hydrocarbon resources.

Operations: The company generates revenue primarily from oil and gas exploration and production, with recent figures indicating a gross profit margin of 64.63%. Operating expenses have shown fluctuations, impacting net income margins significantly over time.

PE: -2.6x

Vermilion Energy, a Canadian energy company, is catching attention for its potential value. Despite relying solely on external borrowing for funding, they recently closed a US$400 million senior unsecured notes offering with a 7.25% coupon rate due in 2033. This move aims to manage existing debt and fund acquisitions like Westbrick Energy. Earnings are projected to grow by 43% annually, signaling strong future prospects despite current financial risks. Notably, insider confidence is evident as key figures have increased their shareholdings recently.

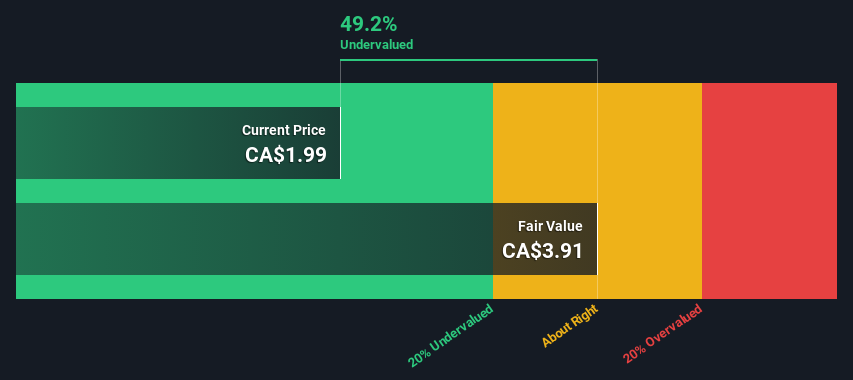

Itafos (TSXV:IFOS)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Itafos operates in the phosphate fertilizer industry, with key operations at Conda and Arraias, and has a market capitalization of CAD $0.24 billion.

Operations: The company generates revenue primarily from its Conda and Arraias segments, with Conda contributing significantly more. Over recent periods, the gross profit margin has shown fluctuations, reaching 28.32% in September 2024. Operating expenses and non-operating expenses also impact the financial outcomes, with notable figures such as $27.70 million for operating expenses in September 2024 and $95.66 million for non-operating expenses during the same period.

PE: 25.8x

Itafos, a small Canadian company, is drawing attention with insider confidence shown through recent share purchases. Despite facing challenges like a drop in profit margins from 16.9% to 2.2%, the firm remains resilient by issuing production guidance for fiscal 2025, targeting sales between 340,000 and 360,000 tonnes of P2O5. While relying on external borrowing poses risks, their strategic focus on phosphate production highlights potential for growth in this niche market amidst fluctuating financial outcomes.

Taking Advantage

- Explore the 26 names from our Undervalued TSX Small Caps With Insider Buying screener here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:IFOS

Flawless balance sheet with solid track record.

Market Insights

Community Narratives