As we approach the end of 2025, the Canadian market remains resilient despite challenges such as trade uncertainties and emerging credit concerns. Investors are encouraged to use market volatility as an opportunity to rebalance and diversify their portfolios, with a focus on quality investments. While penny stocks may sound like a term from a bygone era, they continue to offer potential value for those interested in smaller or newer companies with strong financial foundations. In this article, we will explore three penny stocks that exhibit financial strength and potential for long-term growth.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Rewards & Risks |

| Westbridge Renewable Energy (TSXV:WEB) | CA$2.70 | CA$71.54M | ✅ 3 ⚠️ 4 View Analysis > |

| Zoomd Technologies (TSXV:ZOMD) | CA$2.62 | CA$246.84M | ✅ 3 ⚠️ 2 View Analysis > |

| Montero Mining and Exploration (TSXV:MON) | CA$0.425 | CA$3.34M | ✅ 2 ⚠️ 4 View Analysis > |

| CEMATRIX (TSX:CEMX) | CA$0.37 | CA$52.57M | ✅ 2 ⚠️ 1 View Analysis > |

| Thor Explorations (TSXV:THX) | CA$1.21 | CA$785.05M | ✅ 3 ⚠️ 2 View Analysis > |

| Automotive Finco (TSXV:AFCC.H) | CA$1.04 | CA$18.23M | ✅ 2 ⚠️ 3 View Analysis > |

| Amerigo Resources (TSX:ARG) | CA$2.73 | CA$431.18M | ✅ 3 ⚠️ 2 View Analysis > |

| Pulse Seismic (TSX:PSD) | CA$3.40 | CA$172.57M | ✅ 2 ⚠️ 1 View Analysis > |

| Hemisphere Energy (TSXV:HME) | CA$2.07 | CA$194.14M | ✅ 3 ⚠️ 2 View Analysis > |

| Matachewan Consolidated Mines (TSXV:MCM.A) | CA$0.79 | CA$9.83M | ✅ 2 ⚠️ 4 View Analysis > |

Click here to see the full list of 410 stocks from our TSX Penny Stocks screener.

Let's review some notable picks from our screened stocks.

Pulse Seismic (TSX:PSD)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Pulse Seismic Inc. acquires, markets, and licenses 2D and 3D seismic data for the energy sector in Canada, with a market cap of CA$172.57 million.

Operations: The company's revenue is primarily generated from its Oil Well Equipment & Services segment, amounting to CA$49.38 million.

Market Cap: CA$172.57M

Pulse Seismic Inc. demonstrates strong financial health, with a market cap of CA$172.57 million and no debt, indicating stability in the volatile penny stock sector. The company has shown impressive earnings growth, with profits increasing by 75.4% over the past year and a return on equity of 76.5%, which is considered outstanding. Its experienced management team and board add to its credibility, while stable weekly volatility suggests reduced risk for investors. Despite an unstable dividend track record, Pulse Seismic's high-quality earnings and undervaluation relative to fair value provide potential upside for cautious investors seeking opportunities in energy services.

- Get an in-depth perspective on Pulse Seismic's performance by reading our balance sheet health report here.

- Understand Pulse Seismic's track record by examining our performance history report.

Covalon Technologies (TSXV:COV)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Covalon Technologies Ltd. focuses on the research, development, manufacturing, and marketing of medical products in infection management, advanced wound care, and surgical procedure areas across various international markets with a market cap of CA$57.85 million.

Operations: The company generates CA$32.99 million in revenue from its Biotechnology (Startups) segment.

Market Cap: CA$57.85M

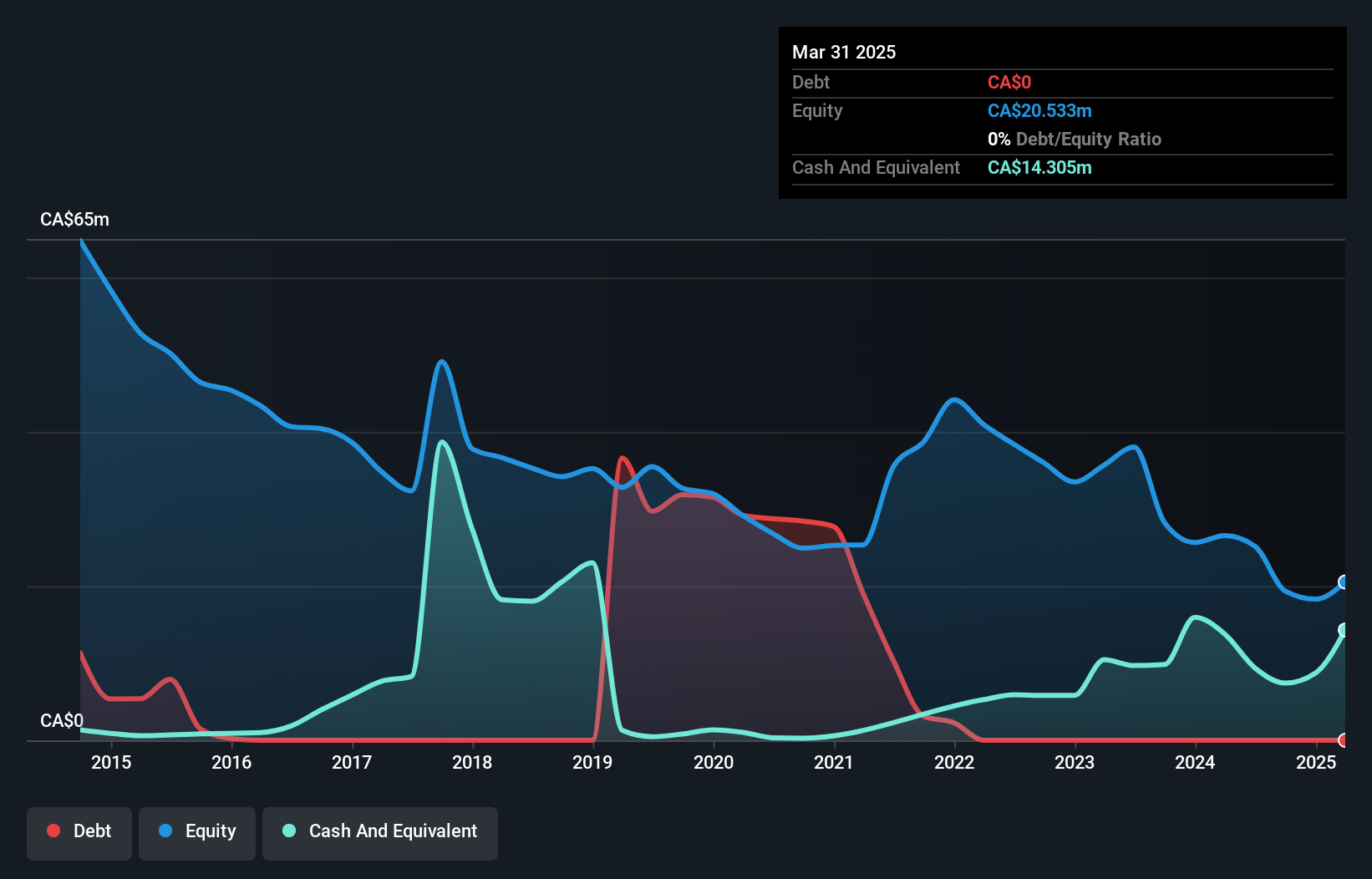

Covalon Technologies Ltd., with a market cap of CA$57.85 million, recently declared a special cash dividend, highlighting its commitment to shareholder returns. The company has transitioned to profitability over the past year, supported by high-quality earnings and no debt burden. Its short-term assets significantly exceed liabilities, indicating strong financial health in the penny stock domain. Recent peer-reviewed studies validate the effectiveness of Covalon's products in infection management, potentially enhancing its market position. Despite an inexperienced management team and low return on equity at 7.8%, Covalon's stable weekly volatility and forecasted revenue growth present a balanced investment opportunity.

- Unlock comprehensive insights into our analysis of Covalon Technologies stock in this financial health report.

- Understand Covalon Technologies' earnings outlook by examining our growth report.

PharmaCorp Rx (TSXV:PCRX)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: PharmaCorp Rx Inc. operates retail pharmacies under the PharmaChoice name in Canada and has a market cap of CA$56.30 million.

Operations: The company's revenue is derived from non-wholly owned pharmacies, amounting to CA$5.85 million.

Market Cap: CA$56.3M

PharmaCorp Rx Inc., with a market cap of CA$56.30 million, is navigating the penny stock landscape with a focus on expansion through strategic acquisitions, supported by recent credit facilities totaling CA$20.5 million from CIBC. Despite being unprofitable and having a negative return on equity, the company reported significant revenue growth in its latest earnings—CA$8.4 million for six months ended June 2025 compared to CA$0.29 million previously—indicating potential operational improvements. Its short-term assets surpass liabilities, providing some financial stability amidst management and board inexperience challenges as they seek to leverage their shelf registration for further capital raising.

- Click here to discover the nuances of PharmaCorp Rx with our detailed analytical financial health report.

- Review our historical performance report to gain insights into PharmaCorp Rx's track record.

Where To Now?

- Gain an insight into the universe of 410 TSX Penny Stocks by clicking here.

- Contemplating Other Strategies? Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:COV

Covalon Technologies

Engages in the research, development, manufacturing, and marketing of medical products in infection management, advanced wound care, and surgical procedure areas in the United States, the Middle East, Canada, Latin America, Asia, and internationally.

Flawless balance sheet with moderate growth potential.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Butler National (Buks) outperforms.

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)